Queens New York Incentive Stock Option Plan of the Bankers Note, Inc.

Description

How to fill out Queens New York Incentive Stock Option Plan Of The Bankers Note, Inc.?

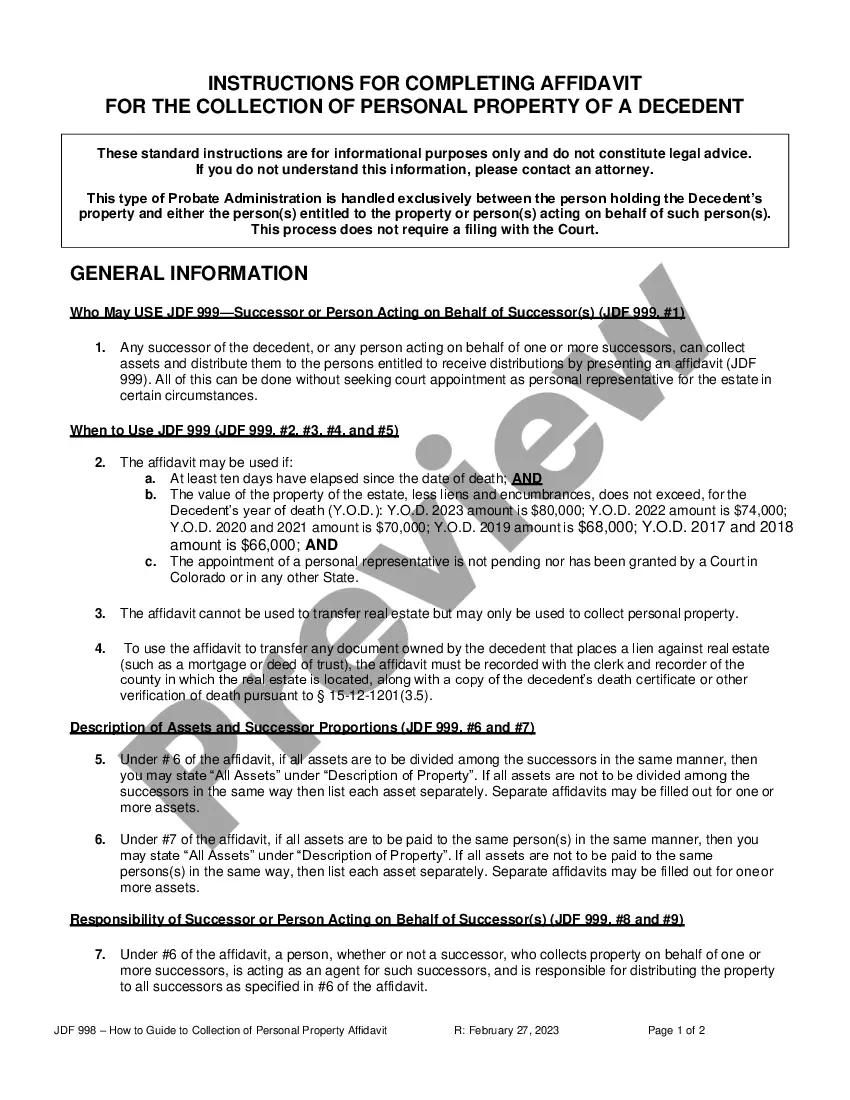

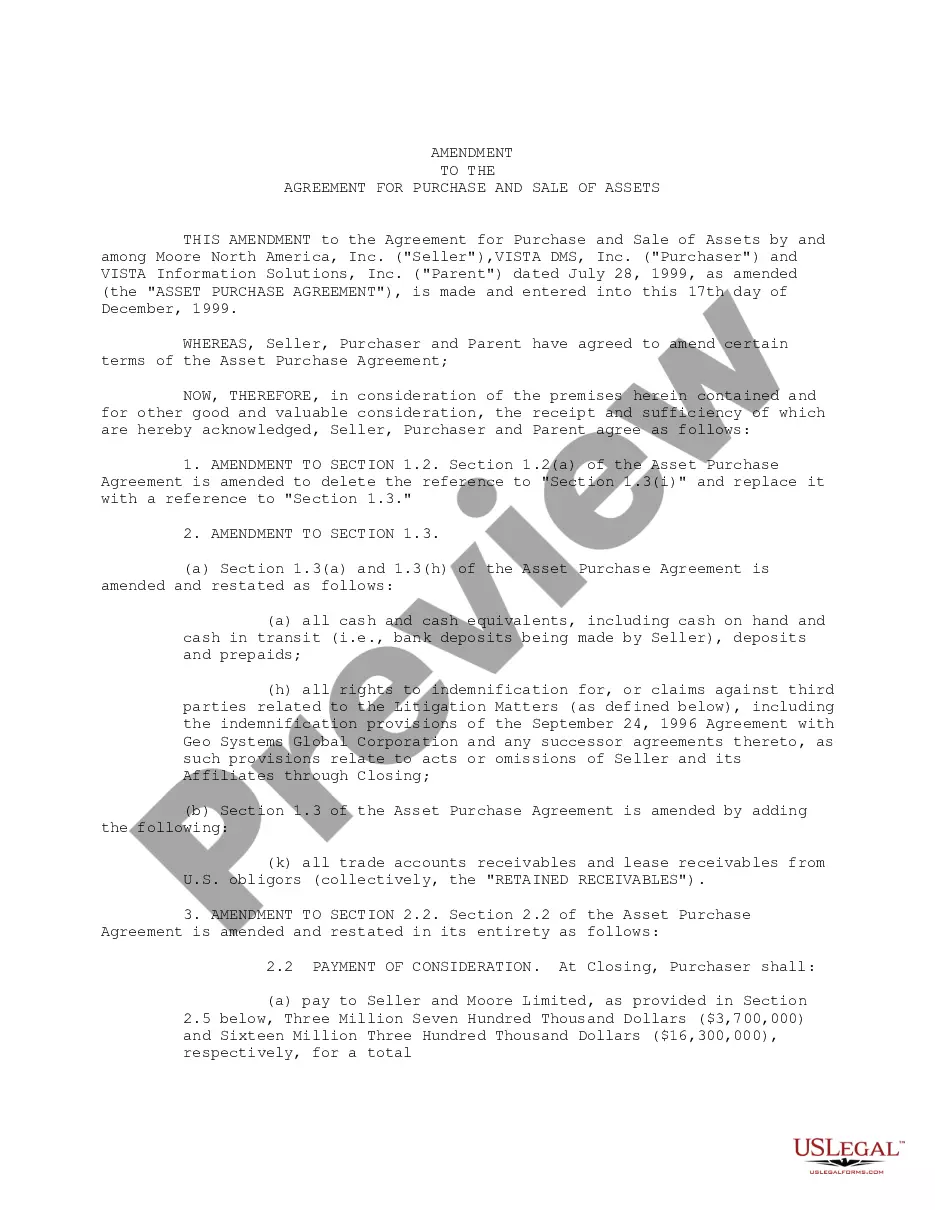

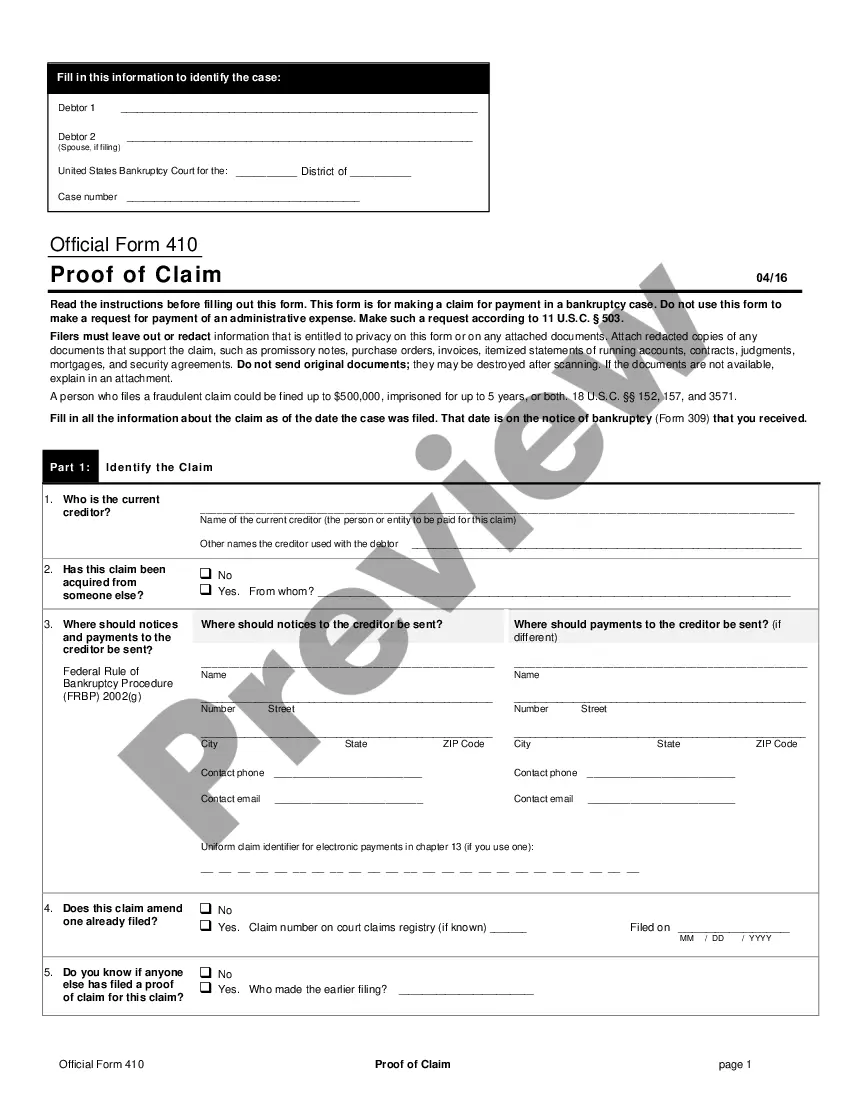

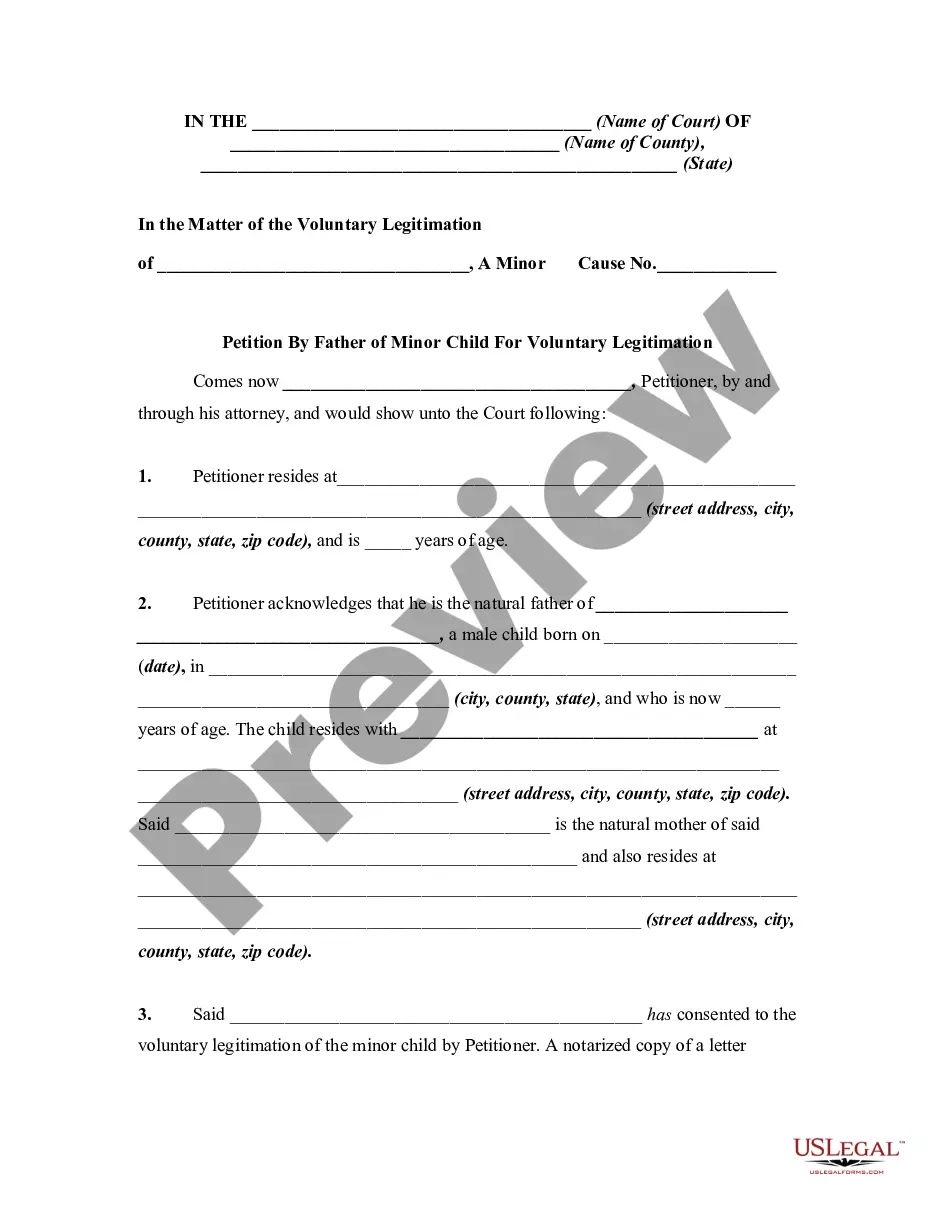

Laws and regulations in every sphere vary around the country. If you're not a lawyer, it's easy to get lost in various norms when it comes to drafting legal paperwork. To avoid pricey legal assistance when preparing the Queens Incentive Stock Option Plan of the Bankers Note, Inc., you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal templates. It's an excellent solution for professionals and individuals looking for do-it-yourself templates for various life and business occasions. All the documents can be used multiple times: once you purchase a sample, it remains available in your profile for subsequent use. Thus, when you have an account with a valid subscription, you can just log in and re-download the Queens Incentive Stock Option Plan of the Bankers Note, Inc. from the My Forms tab.

For new users, it's necessary to make a couple of more steps to get the Queens Incentive Stock Option Plan of the Bankers Note, Inc.:

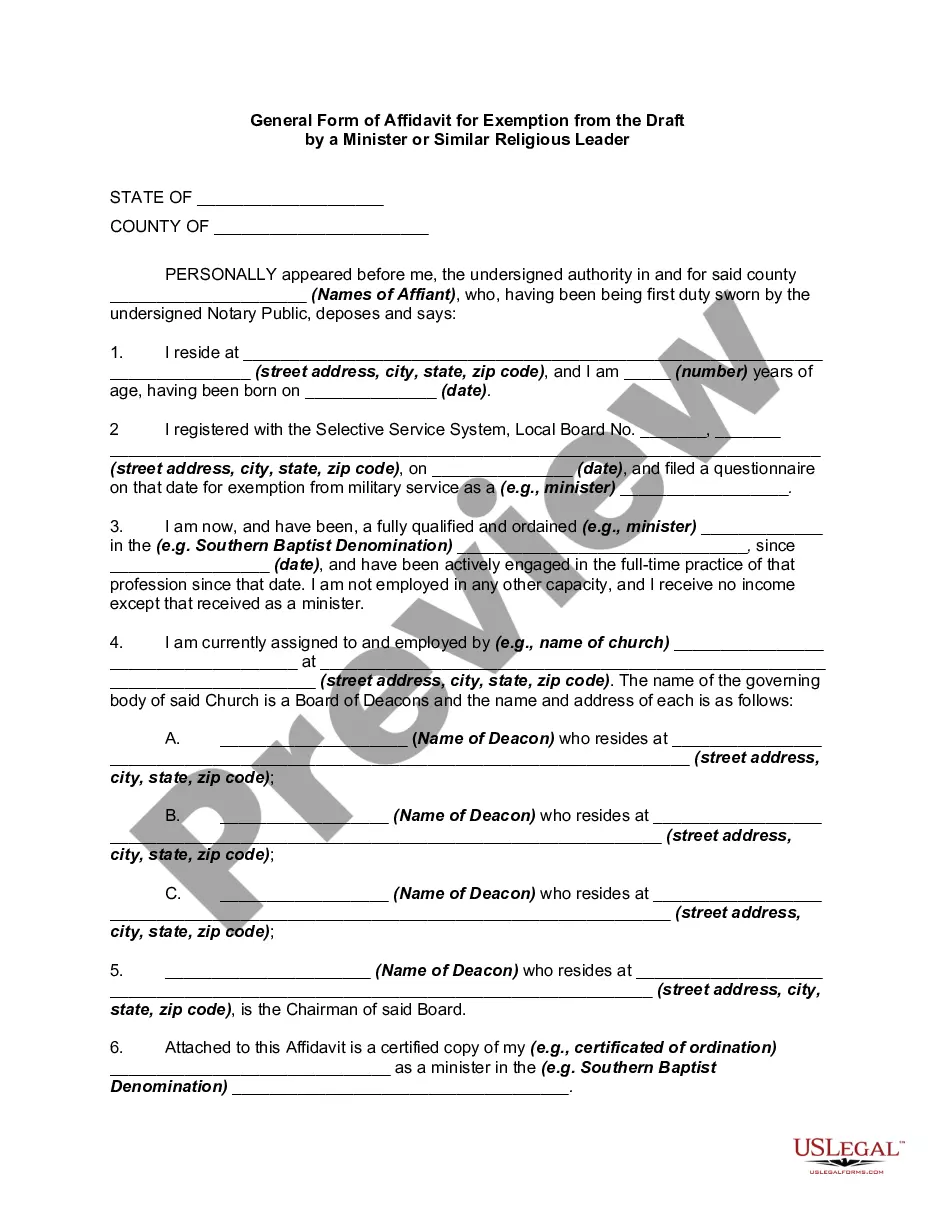

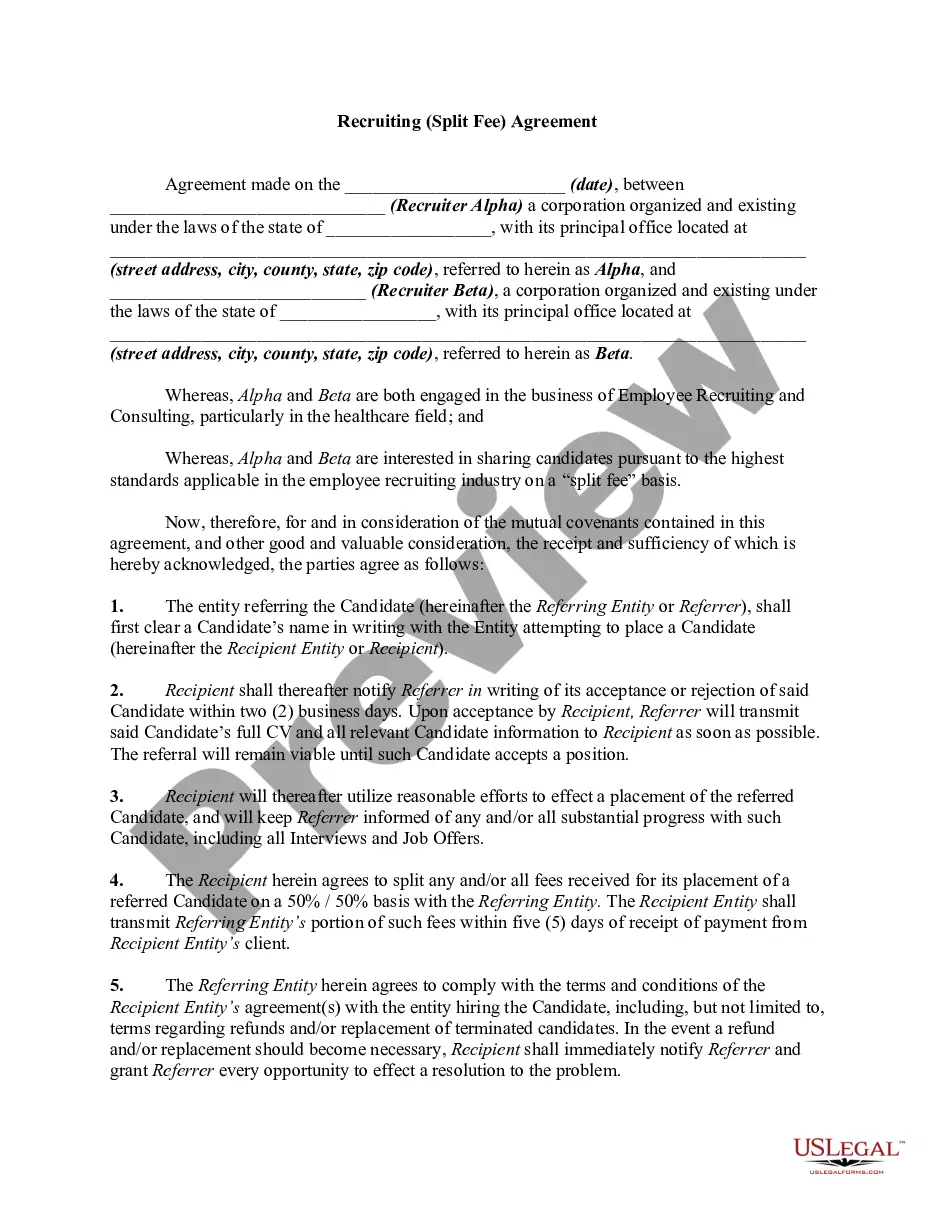

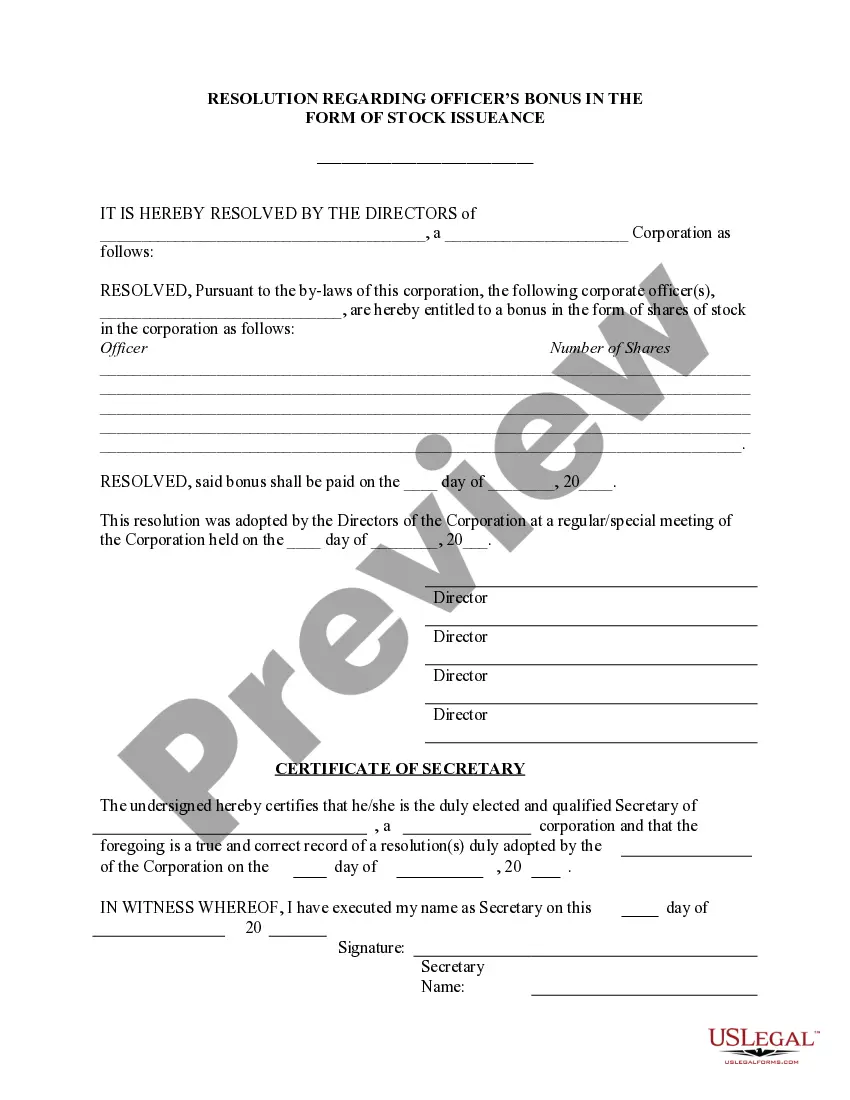

- Examine the page content to make sure you found the appropriate sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Click on the Buy Now button to get the document when you find the right one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Fill out and sign the document in writing after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal purposes. Find them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

FAQ

An incentive stock option (ISO) is a corporate benefit that gives an employee the right to buy shares of company stock at a discounted price with the added benefit of possible tax breaks on the profit.

Incentive stock options (ISOs), are a type of employee stock option that can be granted only to employees and confer a U.S. tax benefit. ISOs are also sometimes referred to as statutory stock options by the IRS. ISOs have a strike price, which is the price a holder must pay to purchase one share of the stock.

Tick Tock, the 10-year Expiration of Incentive Stock Options (ISOs) Mandated by US tax rules, unexercised employee stock options expire 10 years from date of grant and are absorbed back into the company.

So how exactly are NSOs taxed? NSOs are taxed at ordinary income tax rates (the highest possible rate, just like your salary) twice: When you exercise them. Then again when you make money with them after your company exits.

Incentive stock options (ISOs) are popular measures of employee compensation received as rights to company stock. These are a particular type of employee stock purchase plan intended to retain key employees or managers. ISOs often have more favorable tax treatment than other types of employee stock purchase plan.

Incentive stock options are one type of deferred compensation used to motivate and retain key employees. Since you need to hold on to your ISOs for a period of time, the only way to capitalize on these benefits is to stay with your firm for the long haul.

When do incentive stock options expire? Theoretically, ISOs expire 10 years from the date you're granted them. However, your company might enforce a post-termination exercise (PTE) period that gives you a shorter amount of time to exercise options after you leave the company.

Reporting an Incentive Stock Option adjustment for the Alternative Minimum Tax. If you buy and hold, you will report the bargain element as income for Alternative Minimum Tax purposes. Report this amount on Form 6251: Alternative Minimum Tax for the year you exercise the ISOs.

Theoretically, ISOs expire 10 years from the date you're granted them. However, your company might enforce a post-termination exercise (PTE) period that gives you a shorter amount of time to exercise options after you leave the company.

When you exercise Incentive Stock Options, you buy the stock at a pre-established price, which could be well below actual market value. The advantage of an ISO is you do not have to report income when you receive a stock option grant or when you exercise that option.