The San Diego California Employee Stock Option Plan is a program offered by Texas American Ranchers, Inc. that provides employees with the opportunity to purchase company stocks at a predetermined price, usually below the market value. This plan serves as an incentive for employees to remain with the company and perform well, as they can benefit from potential stock price appreciation. Under the San Diego California Employee Stock Option Plan, employees are granted stock options based on their employment terms and performance. These stock options have a specific exercise price, which is the predetermined price at which employees can purchase the company's stocks. Typically, there is a vesting period before the employees can exercise their stock options, ensuring that they remain committed to the company and contribute to its long-term success. Employee Stock Option Plans (Sops) provide a variety of benefits to both employees and employers. For employees, Sops are seen as an additional form of compensation, allowing them to participate in the company's growth and share in its success. By becoming shareholders, employees have a vested interest in the company's performance, leading to increased motivation and loyalty. Additionally, Sops can also serve as a long-term savings mechanism, as employees hold onto the stocks, potentially benefiting from capital appreciation over time. Texas American Ranchers, Inc. offers various types of San Diego California Employee Stock Option Plans tailored to different employee levels or groups within the company. These may include: 1. Executive Stock Option Plan: This plan is typically designed for top-level executives within the company, providing them with more significant stock option grants and potentially additional benefits. 2. Employee Stock Purchase Plan (ESPN): Unlike traditional stock option plans, an ESPN allows employees to purchase company stocks at a discounted price, usually through regular payroll deductions. This type of plan encourages broad-based employee participation, providing them with an accessible way to become shareholders. 3. Restricted Stock Unit (RSU) Plan: RSS are different from traditional stock options, as they do not require employees to purchase stocks. Instead, RSS are granted to employees, often subject to a vesting schedule or specific performance conditions, and convert into company stocks upon vesting. 4. Stock Appreciation Rights (SARS) Plan: SARS entitle employees to receive the appreciation in the company's stock value over a specified period, without requiring them to purchase actual shares. Once vested, employees can receive the value difference between the stock's grant price and the current market price in cash or company stock. It is important for employees to thoroughly understand the San Diego California Employee Stock Option Plan they are offered, its terms, and any potential risks or tax implications associated with exercising or selling the stock options. Employees should consult with financial advisors or tax professionals to make informed decisions regarding their participation in the plan.

San Diego California Employee Stock Option Plan of Texas American Bancshares, Inc.

Description

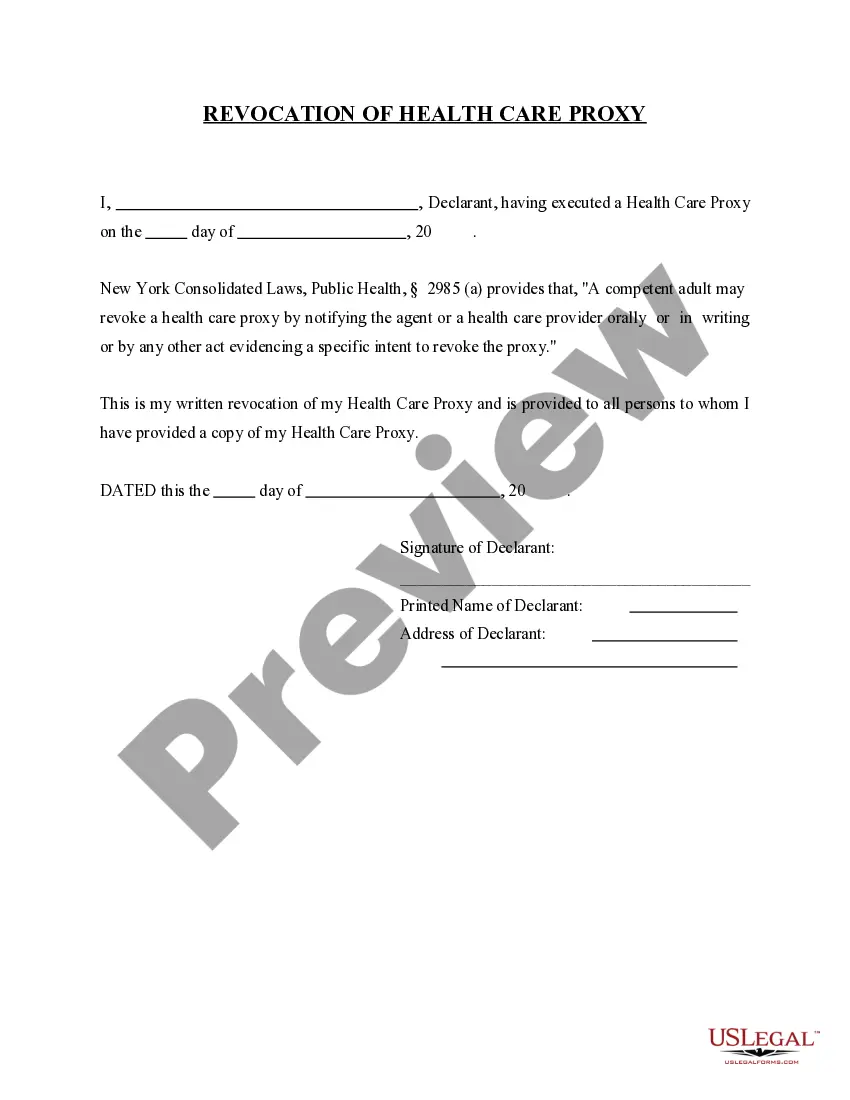

How to fill out San Diego California Employee Stock Option Plan Of Texas American Bancshares, Inc.?

Dealing with legal forms is a necessity in today's world. Nevertheless, you don't always need to look for qualified assistance to create some of them from the ground up, including San Diego Employee Stock Option Plan of Texas American Bancshares, Inc., with a platform like US Legal Forms.

US Legal Forms has more than 85,000 forms to pick from in different types ranging from living wills to real estate papers to divorce documents. All forms are organized according to their valid state, making the searching process less frustrating. You can also find detailed resources and guides on the website to make any activities associated with paperwork completion simple.

Here's how you can purchase and download San Diego Employee Stock Option Plan of Texas American Bancshares, Inc..

- Take a look at the document's preview and outline (if available) to get a basic information on what you’ll get after getting the document.

- Ensure that the document of your choice is adapted to your state/county/area since state regulations can impact the legality of some documents.

- Examine the similar document templates or start the search over to locate the correct document.

- Hit Buy now and create your account. If you already have an existing one, choose to log in.

- Choose the option, then a suitable payment method, and buy San Diego Employee Stock Option Plan of Texas American Bancshares, Inc..

- Select to save the form template in any available format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the needed San Diego Employee Stock Option Plan of Texas American Bancshares, Inc., log in to your account, and download it. Needless to say, our website can’t replace a legal professional entirely. If you need to deal with an exceptionally challenging case, we advise using the services of an attorney to check your document before executing and submitting it.

With more than 25 years on the market, US Legal Forms became a go-to provider for many different legal forms for millions of customers. Become one of them today and get your state-compliant paperwork effortlessly!