Santa Clara California Employee Stock Option Plan of Texas American Ranchers, Inc. is a comprehensive employee benefit plan provided by the company to its employees in Santa Clara, California. This stock option plan allows eligible employees of Texas American Ranchers, Inc. to purchase company stock at a predetermined price within a specified period. The Santa Clara California Employee Stock Option Plan is designed to incentivize employees and align their interests with the success of the company. By offering stock options, employees have the opportunity to share in the company's growth and financial success. This compensation package is an excellent way for the company to reward and retain its talented workforce. This employee stock option plan comes with various features and benefits. It provides employees the right to purchase company stock at a specific exercise price, usually lower than the market price, known as the grant price. The exercise price remains fixed for a predetermined period, typically referred to as the vesting period. One of the primary benefits of the Santa Clara California Employee Stock Option Plan is that it offers potential tax advantages. If employees hold onto the purchased stock for a specific period, known as the qualifying period, they may qualify for favorable tax treatment, such as a lower capital gains tax rate when selling the shares. The plan has different types of stock options within it, such as: 1. Non-Qualified Stock Options (SOS): These are the most common types of stock options in employee stock option plans. SOS provide employees with the right to purchase company stock at a predetermined price, which may be at the current market price or slightly discounted. 2. Incentive Stock Options (SOS): SOS are another type of stock option granted to employees, but they come with specific tax advantages. To qualify for favorable tax treatment, employees must satisfy certain requirements, such as holding the options for a specific period and not exceeding the annual limit on the value of options granted. The Santa Clara California Employee Stock Option Plan is carefully administered by Texas American Ranchers, Inc., following regulatory guidelines and internal policies. Eligible employees are provided with detailed information about the plan, including the terms, conditions, vesting schedule, and tax implications. It is crucial for employees to thoroughly understand the Santa Clara California Employee Stock Option Plan and consult with financial professionals to make well-informed decisions regarding exercising the options. Additionally, employees should be aware of any restrictions on selling the acquired stock, any blackout periods during which they cannot exercise the options, and any limitations on transferability. Texas American Ranchers, Inc. is committed to providing competitive employee benefit packages, and the Santa Clara California Employee Stock Option Plan is an integral part of attracting, motivating, and retaining talent in Santa Clara, California.

Santa Clara California Employee Stock Option Plan of Texas American Bancshares, Inc.

Description

How to fill out Santa Clara California Employee Stock Option Plan Of Texas American Bancshares, Inc.?

Creating legal forms is a must in today's world. Nevertheless, you don't always need to seek professional help to create some of them from the ground up, including Santa Clara Employee Stock Option Plan of Texas American Bancshares, Inc., with a service like US Legal Forms.

US Legal Forms has over 85,000 templates to pick from in different types varying from living wills to real estate papers to divorce papers. All forms are arranged according to their valid state, making the searching experience less frustrating. You can also find information materials and tutorials on the website to make any activities related to paperwork execution simple.

Here's how to locate and download Santa Clara Employee Stock Option Plan of Texas American Bancshares, Inc..

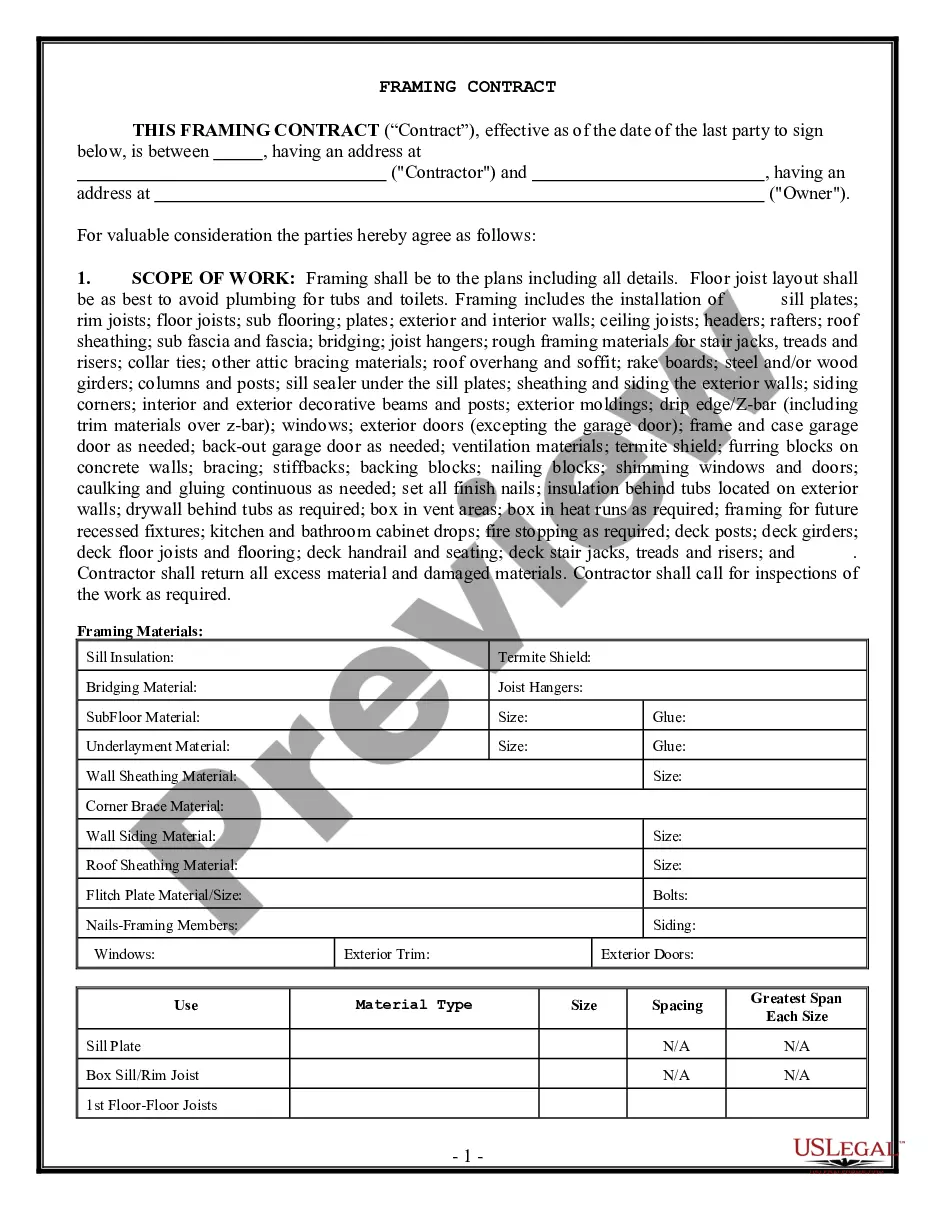

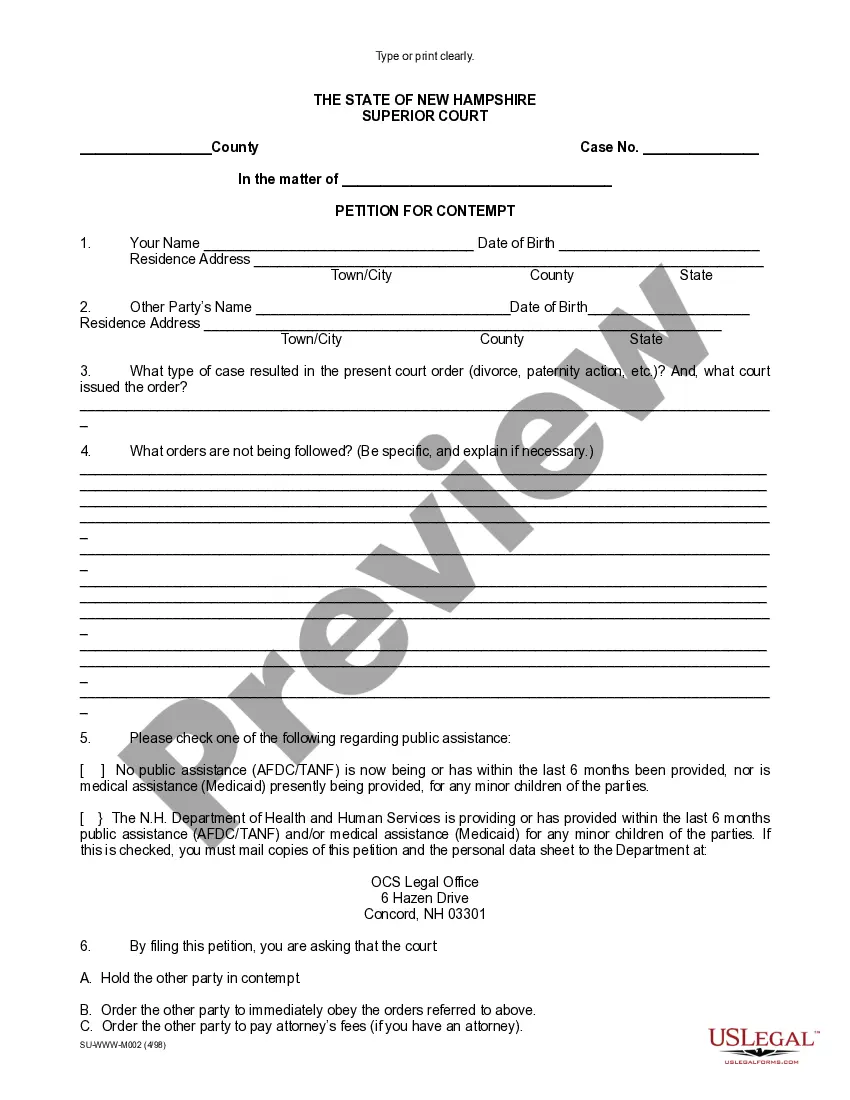

- Take a look at the document's preview and description (if available) to get a basic idea of what you’ll get after downloading the form.

- Ensure that the template of your choice is adapted to your state/county/area since state laws can affect the validity of some documents.

- Check the related forms or start the search over to find the appropriate file.

- Hit Buy now and create your account. If you already have an existing one, choose to log in.

- Choose the option, then a needed payment gateway, and buy Santa Clara Employee Stock Option Plan of Texas American Bancshares, Inc..

- Select to save the form template in any available format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the appropriate Santa Clara Employee Stock Option Plan of Texas American Bancshares, Inc., log in to your account, and download it. Of course, our website can’t replace a legal professional completely. If you need to deal with an extremely challenging case, we advise using the services of a lawyer to examine your form before executing and submitting it.

With over 25 years on the market, US Legal Forms became a go-to platform for various legal forms for millions of customers. Become one of them today and get your state-specific paperwork with ease!