Allegheny Pennsylvania Proposal to Approve Adoption of Employees' Stock Option Plan is a significant financial decision for the company. This proposal aims to introduce an employee stock option plan, offering employees the opportunity to purchase company stock at a predetermined price within a specified time frame. This comprehensive plan provides various benefits to both the employees and the organization. The primary objective of the Allegheny Pennsylvania Proposal is to attract and retain talented employees by offering them a stake in the company’s success. By granting stock options, employees become shareholders, aligning their interests with that of the company. This fosters a sense of ownership, motivation, and loyalty, as employees directly benefit from the company's growth and profitability. There are different types of Allegheny Pennsylvania Proposal to Approve Adoption of Employees' Stock Option Plan, including: 1. Standard Stock Option Plan: This involves granting employees the right to purchase company stock at a predetermined price, commonly known as the strike price. The stock options usually come with a vesting period during which employees must fulfill certain conditions, such as a specific tenure with the company, to exercise their options fully. 2. Incentive Stock Option Plan: This type of plan is designed to provide tax advantages to both the company and the employees. If certain requirements are met, the employees may enjoy preferential tax treatment upon exercising their options. 3. Non-Qualified Stock Option Plan: Unlike incentive stock options, non-qualified stock options do not provide the same tax advantages. However, they offer greater flexibility in terms of eligibility criteria, granting options to a wider range of employees, including executives and part-time workers. Implementing an Employees' Stock Option Plan can offer numerous advantages to the company. Firstly, it serves as a powerful tool for attracting skilled professionals, as it provides an additional compensation method beyond salary and benefits packages. This can give the organization a competitive edge in the job market, enabling it to recruit top talent. Secondly, the plan incentivizes employees to work towards the company's long-term goals and share in its success. When employees have a vested interest in the company's performance, they are more likely to dedicate their efforts, contribute innovative ideas, and work collaboratively towards achieving strategic objectives. Furthermore, an Employees' Stock Option Plan can help with employee retention. By allowing employees to purchase company stock, the organization creates a sense of loyalty and commitment. Employees who own company shares tend to develop a stronger attachment to the business, leading to higher job satisfaction and reduced turnover rates. Lastly, this proposal can also serve as a cost-effective way for the company to compensate employees. Rather than allocating large amounts of cash as bonuses, an Employees' Stock Option Plan allows the organization to reward employees based on its overall financial performance, in turn conserving cash flow. In conclusion, Allegheny Pennsylvania's Proposal to Approve Adoption of Employees' Stock Option Plan introduces a mechanism to attract, motivate, and retain employees by granting them the opportunity to purchase company stock. This plan comes in various forms, offering different benefits and eligibility criteria. By implementing such a plan, Allegheny Pennsylvania aims to create a more engaged and dedicated workforce, aligned with the company's long-term objectives.

Allegheny Pennsylvania Proposal to Approve Adoption of Employees' Stock Option Plan

Description

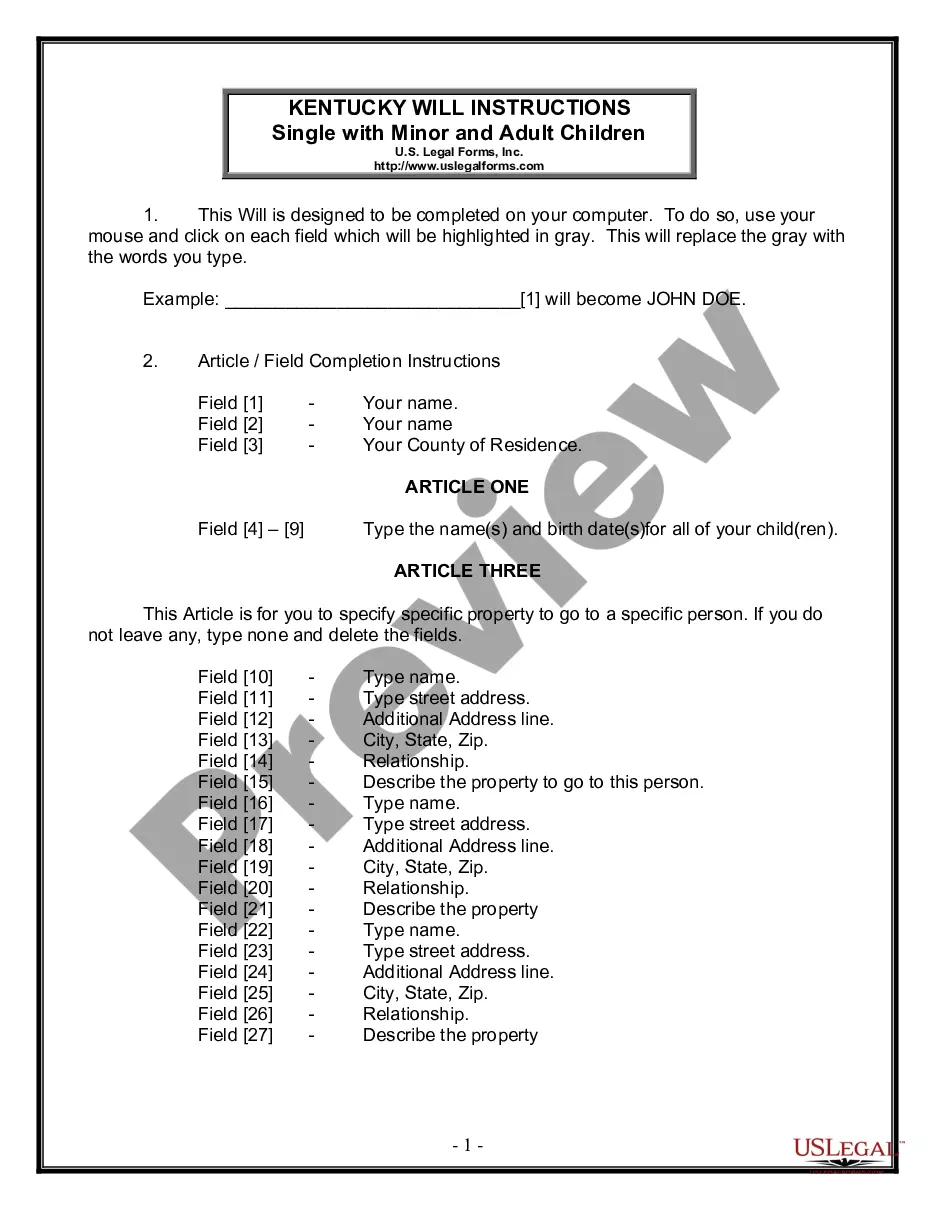

How to fill out Allegheny Pennsylvania Proposal To Approve Adoption Of Employees' Stock Option Plan?

Whether you intend to start your company, enter into a deal, apply for your ID update, or resolve family-related legal issues, you must prepare certain documentation meeting your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and verified legal documents for any personal or business occasion. All files are collected by state and area of use, so opting for a copy like Allegheny Proposal to Approve Adoption of Employees' Stock Option Plan is quick and easy.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you several additional steps to get the Allegheny Proposal to Approve Adoption of Employees' Stock Option Plan. Adhere to the guidelines below:

- Make certain the sample meets your personal needs and state law requirements.

- Look through the form description and check the Preview if available on the page.

- Make use of the search tab providing your state above to find another template.

- Click Buy Now to obtain the file once you find the right one.

- Choose the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Allegheny Proposal to Approve Adoption of Employees' Stock Option Plan in the file format you need.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our library are multi-usable. Having an active subscription, you can access all of your previously acquired paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!