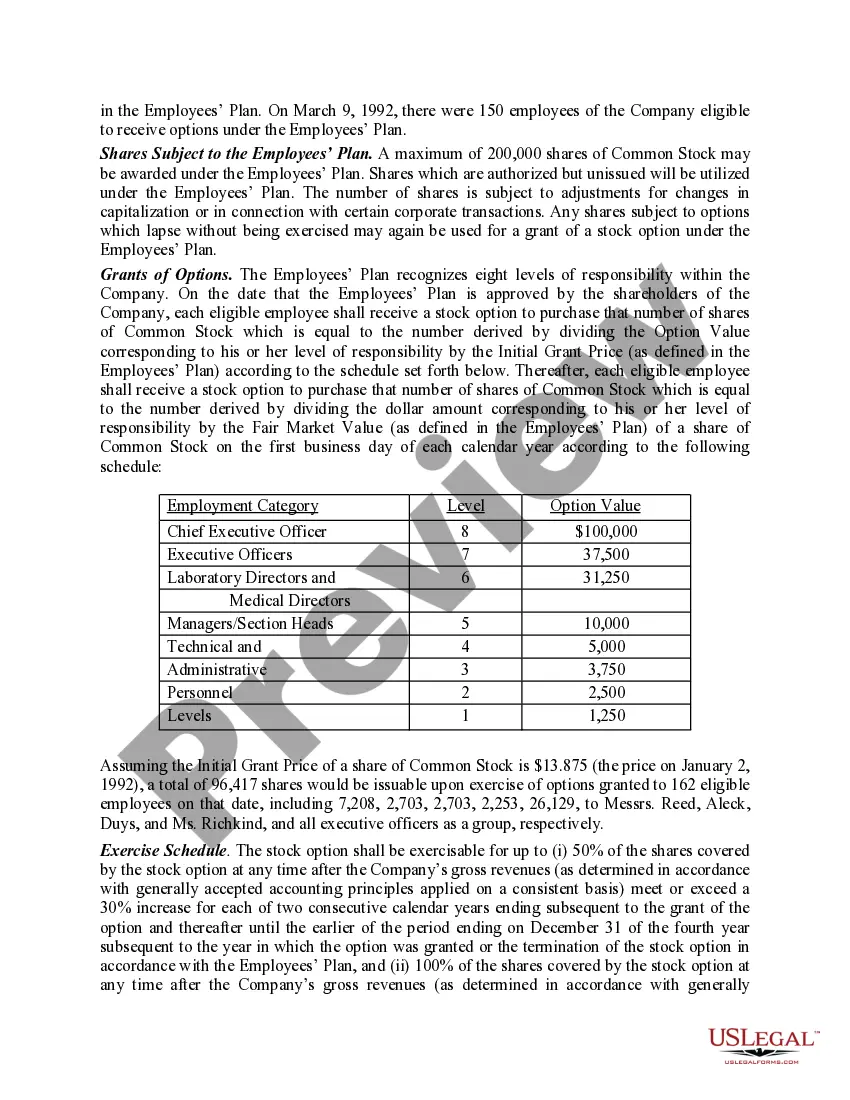

The Cook Illinois Proposal to Approve Adoption of Employees' Stock Option Plan is a comprehensive plan designed to provide employees with an opportunity to acquire ownership in the company. This proposal aims to strengthen employee engagement and retention by offering stock options as a form of compensation. By granting employees the ability to purchase company stock at a predetermined price within a specified time frame, the plan aligns their interests with those of the company, encouraging long-term commitment and dedication. The Employees' Stock Option Plan (ESOP) introduced by Cook Illinois involves providing eligible employees with the opportunity to acquire shares of company stock at a discounted price. This plan is structured to offer various benefits to both the employee and the company. Employees are granted the right to purchase a specific number of shares within a designated time period, typically at a price lower than the current market value. This allows employees to take advantage of potential future increases in stock price as the company grows and succeeds. Under the Cook Illinois Proposal, implementation of the Employees' Stock Option Plan would require the approval of the company's shareholders. The plan typically outlines eligibility criteria, including minimum service requirements and employment status, ensuring that only eligible employees can participate. Additionally, the proposal specifies the number of stock options available, the vesting schedule, and any limitations or restrictions on the purchase or sale of shares. The primary objectives of the Cook Illinois Proposal to Approve Adoption of Employees' Stock Option Plan include: 1. Employee Incentives: By offering stock options, Cook Illinois aims to motivate employees to excel in their roles, foster a sense of ownership, and align their interests with the overall success of the company. This can result in increased productivity, improved job satisfaction, and reduced turnover. 2. Attraction and Retention: The implementation of an Employees' Stock Option Plan can make Cook Illinois a more attractive employer, especially for high-performing individuals seeking long-term employment prospects. It serves as a valuable recruitment tool, particularly in highly competitive industries, by highlighting the potential for financial gains tied to the company's growth. 3. Retaining Talent: By granting stock options, Cook Illinois seeks to retain key talent within the organization. As employees acquire ownership and become invested in the company's success, they are more likely to stay committed to their roles and contribute to the overall growth and profitability of the business. 4. Performance-Based Compensation: The Employees' Stock Option Plan incentivizes employees to perform at their best. As the value of the company's stock rises, employees have the opportunity to reap financial rewards, providing a direct correlation between individual efforts and personal wealth accumulation. Overall, the Cook Illinois Proposal to Approve Adoption of Employees' Stock Option Plan is a strategic move aimed at attracting, retaining, and motivating employees through a performance-based compensation structure. By aligning employee interests with long-term company success, this plan can drive employee engagement, boost productivity, and ultimately contribute to the sustainable growth of Cook Illinois.

Cook Illinois Proposal to Approve Adoption of Employees' Stock Option Plan

Description

How to fill out Cook Illinois Proposal To Approve Adoption Of Employees' Stock Option Plan?

If you need to find a trustworthy legal form supplier to get the Cook Proposal to Approve Adoption of Employees' Stock Option Plan, consider US Legal Forms. Whether you need to launch your LLC business or manage your belongings distribution, we got you covered. You don't need to be knowledgeable about in law to find and download the appropriate template.

- You can select from more than 85,000 forms arranged by state/county and situation.

- The self-explanatory interface, variety of supporting resources, and dedicated support team make it simple to get and complete different paperwork.

- US Legal Forms is a trusted service offering legal forms to millions of users since 1997.

You can simply type to search or browse Cook Proposal to Approve Adoption of Employees' Stock Option Plan, either by a keyword or by the state/county the form is intended for. After locating necessary template, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's effortless to get started! Simply locate the Cook Proposal to Approve Adoption of Employees' Stock Option Plan template and take a look at the form's preview and description (if available). If you're comfortable with the template’s terminology, go ahead and click Buy now. Register an account and select a subscription plan. The template will be instantly ready for download as soon as the payment is processed. Now you can complete the form.

Handling your law-related matters doesn’t have to be expensive or time-consuming. US Legal Forms is here to demonstrate it. Our rich variety of legal forms makes these tasks less pricey and more affordable. Set up your first company, arrange your advance care planning, draft a real estate contract, or execute the Cook Proposal to Approve Adoption of Employees' Stock Option Plan - all from the comfort of your home.

Sign up for US Legal Forms now!