Title: Hennepin Minnesota Proposal to Approve Adoption of Employees' Stock Option Plan: Exploring Options for Investment in Employee Equity Keywords: Hennepin Minnesota, Proposal, Adoption, Employees' Stock Option Plan, Investment, Employee Equity Introduction: The Hennepin Minnesota Proposal to Approve Adoption of Employees' Stock Option Plan aims to provide a detailed overview of the proposed initiative to introduce a stock option plan for employees in the Hennepin County of Minnesota. This comprehensive plan not only encourages employee investment but also fosters stronger company loyalty and performance through shared ownership. This article explores the various types and benefits associated with the proposal. 1. Incentivizing Employee Investment: The Hennepin Minnesota Proposal to Approve Adoption of Employees' Stock Option Plan seeks to establish an enticing framework for employees to invest in the growth and success of the organization. By extending stock options to employees, it creates an opportunity for them to become shareholders, aligning their interests with the company's long-term goals. 2. Enhancing Employee Loyalty and Performance: With the Adoption of Employees' Stock Option Plan in Hennepin Minnesota, companies aim to foster an environment where employees feel valued and vested in the organization's success. This, in turn, can lead to increased loyalty, engagement, and productivity, as employees have a personal stake in the company's growth. 3. Flexible Stock Option Structures: The proposal recognizes that different types of employees have varying needs and preferences when it comes to stock options. The plan encompasses diverse stock option structures tailored to suit different employee levels, such as executives, middle management, and entry-level staff. These options may include incentive stock options (SOS), non-qualified stock options (SOS), or restricted stock units (RSS). 4. Tax Benefits for Employees: One of the key advantages of adopting an Employees' Stock Option Plan in Hennepin Minnesota is the potential tax benefits it can offer employees. Depending on the stock option type, employees may gain tax advantages during both the acquisition and sale of the shares, thereby maximizing their return on investment. 5. Long-Term Performance and Wealth Creation: By granting employees the opportunity to accumulate company stock over time through an approved stock option plan, the proposal aims to create a powerful incentive for employees to focus on the company's long-term success. As the company grows, so does the wealth potential for employees, creating a mutually beneficial relationship between employer and employee. Conclusion: The Hennepin Minnesota Proposal to Approve Adoption of Employees' Stock Option Plan is an innovative step towards fostering employee ownership and loyalty within organizations. This proposal, with its different stock option structures, tax benefits, and wealth creation potential, provides a comprehensive framework to align employees' interests with the organization's success. By nurturing a culture of shared ownership, Hennepin County in Minnesota can cultivate a more engaged and productive workforce.

Hennepin Minnesota Proposal to Approve Adoption of Employees' Stock Option Plan

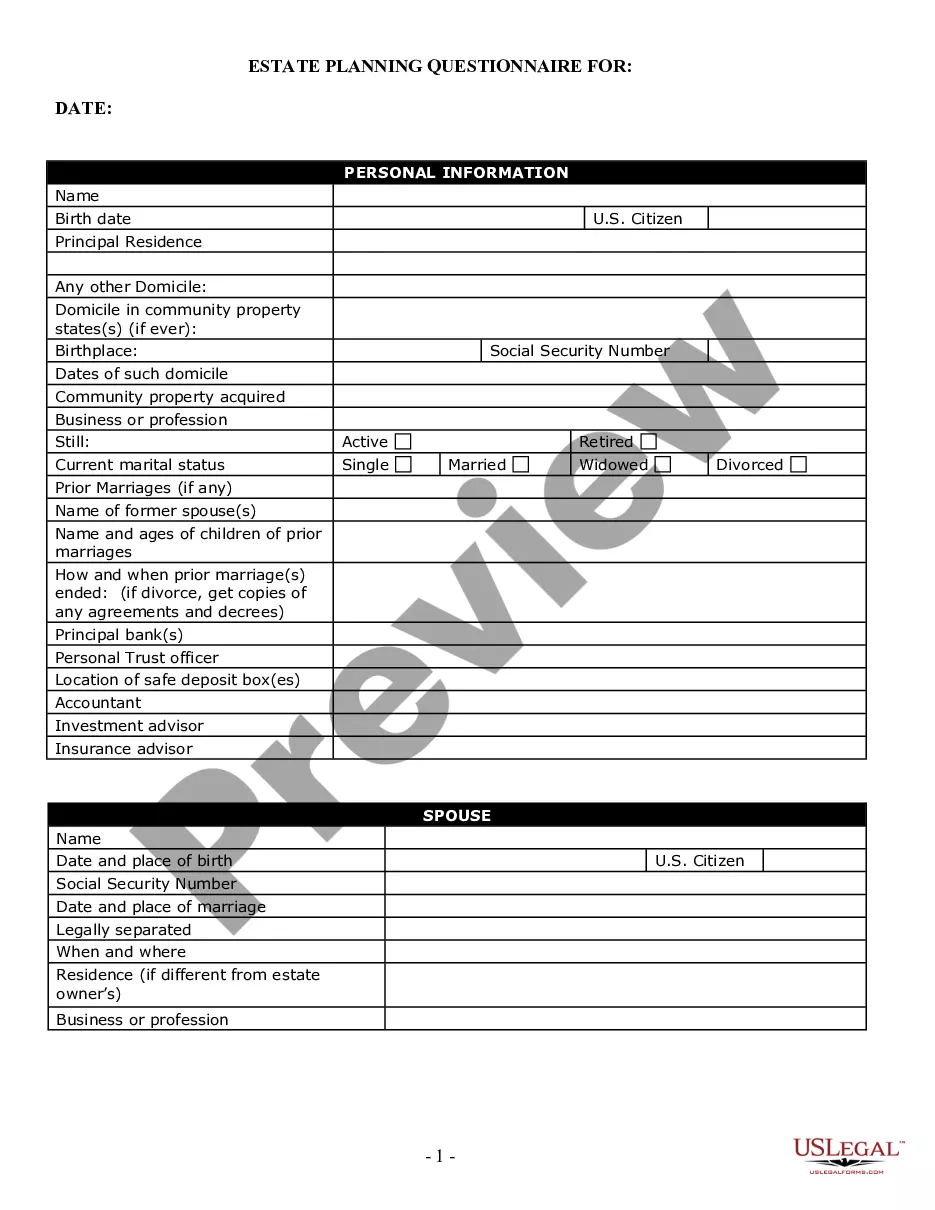

Description

How to fill out Hennepin Minnesota Proposal To Approve Adoption Of Employees' Stock Option Plan?

If you need to get a reliable legal form supplier to find the Hennepin Proposal to Approve Adoption of Employees' Stock Option Plan, consider US Legal Forms. Whether you need to start your LLC business or manage your asset distribution, we got you covered. You don't need to be well-versed in in law to find and download the needed template.

- You can browse from over 85,000 forms arranged by state/county and situation.

- The self-explanatory interface, number of learning materials, and dedicated support make it easy to locate and complete different paperwork.

- US Legal Forms is a trusted service offering legal forms to millions of users since 1997.

Simply type to look for or browse Hennepin Proposal to Approve Adoption of Employees' Stock Option Plan, either by a keyword or by the state/county the document is intended for. After finding the necessary template, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's simple to start! Simply find the Hennepin Proposal to Approve Adoption of Employees' Stock Option Plan template and check the form's preview and description (if available). If you're comfortable with the template’s terminology, go ahead and hit Buy now. Register an account and choose a subscription plan. The template will be immediately ready for download as soon as the payment is completed. Now you can complete the form.

Handling your law-related affairs doesn’t have to be expensive or time-consuming. US Legal Forms is here to demonstrate it. Our extensive variety of legal forms makes these tasks less costly and more reasonably priced. Create your first business, organize your advance care planning, draft a real estate contract, or execute the Hennepin Proposal to Approve Adoption of Employees' Stock Option Plan - all from the convenience of your home.

Join US Legal Forms now!