Title: Sacramento California Proposal to Approve Adoption of Employees' Stock Option Plan Keywords: Sacramento California, Proposal, Adoption, Employees' Stock Option Plan Description: The Sacramento California Proposal to Approve Adoption of Employees' Stock Option Plan is a strategic proposal aimed at enhancing employee compensation and engagement within organizations based in the Sacramento area. This proposal seeks to empower employees by offering them an additional form of compensation through the provision of stock options. The main objective of this proposal is to gain approval from key stakeholders, such as company management and shareholders, to establish an Employees' Stock Option Plan (ESOP) within relevant Sacramento-based organizations. By implementing this plan, employees will have the ability to acquire company stocks at a predetermined price within a specified time period. Types of Sacramento California Proposal to Approve Adoption of Employees' Stock Option Plan: 1. Standard Stock Option Plan: — This type of stock option plan offers employees the opportunity to purchase company stocks at a fixed price over a period of time, typically resulting in potential financial gains if the stock's value increases. 2. Incentive Stock Option Plan: — Designed to motivate and retain high-performing employees, this type of stock option plan offers tax advantages to employees by allowing them to purchase company stocks at a discounted price, fostering loyalty and commitment. 3. Restricted Stock Option Plan: — Under this type of plan, employees are granted company stocks subject to specific conditions, such as limitations on selling or transfer. These conditions promote employee retention and align their interests with the long-term success and growth of the organization. 4. Performance Stock Option Plan: — This plan links the acquisition of stock options to predefined performance goals or milestones, encouraging employees to strive for higher levels of performance and rewarding them with the opportunity to purchase company stocks upon reaching these targets. Successful adoption of the Employees' Stock Option Plan in Sacramento, California can bring several advantages to organizations, such as enhanced employee motivation, improved retention rates, and the alignment of employee interests with those of the organization. By providing employees with a sense of ownership and potential financial gain, the proposal aims to foster a more engaging work environment and boost overall business performance.

Sacramento California Proposal to Approve Adoption of Employees' Stock Option Plan

Description

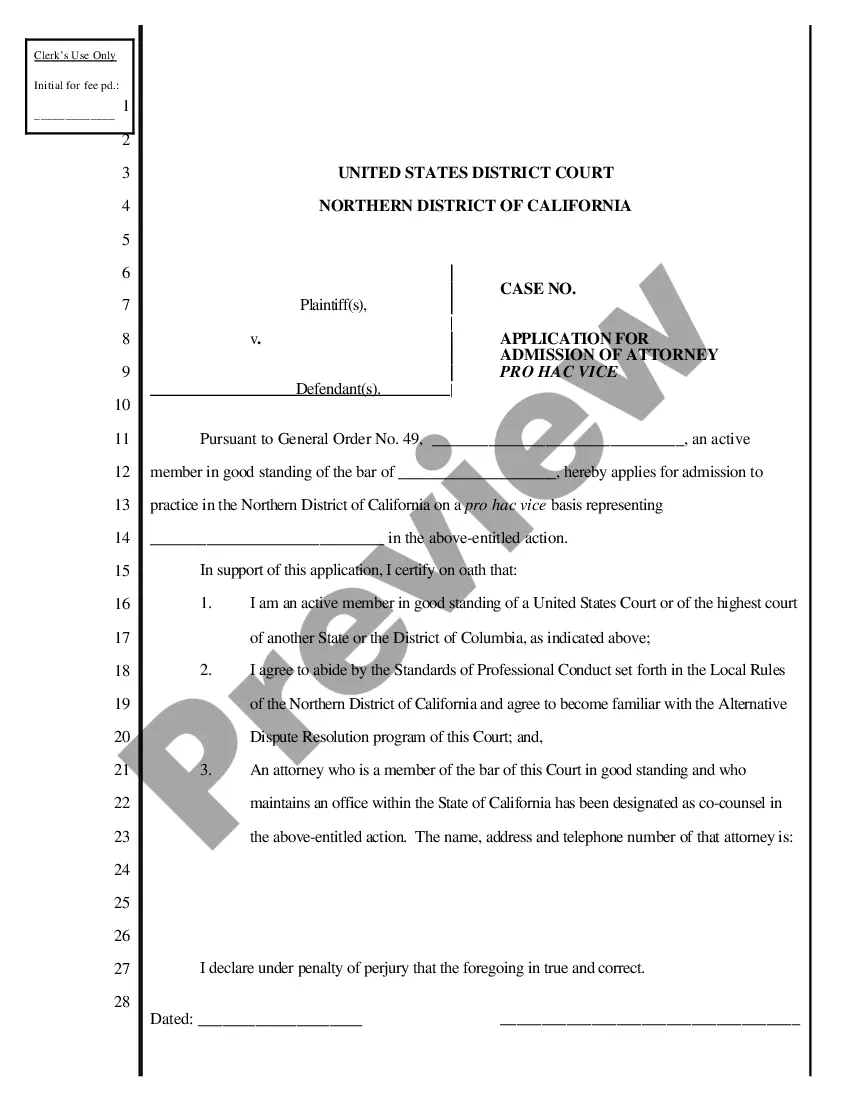

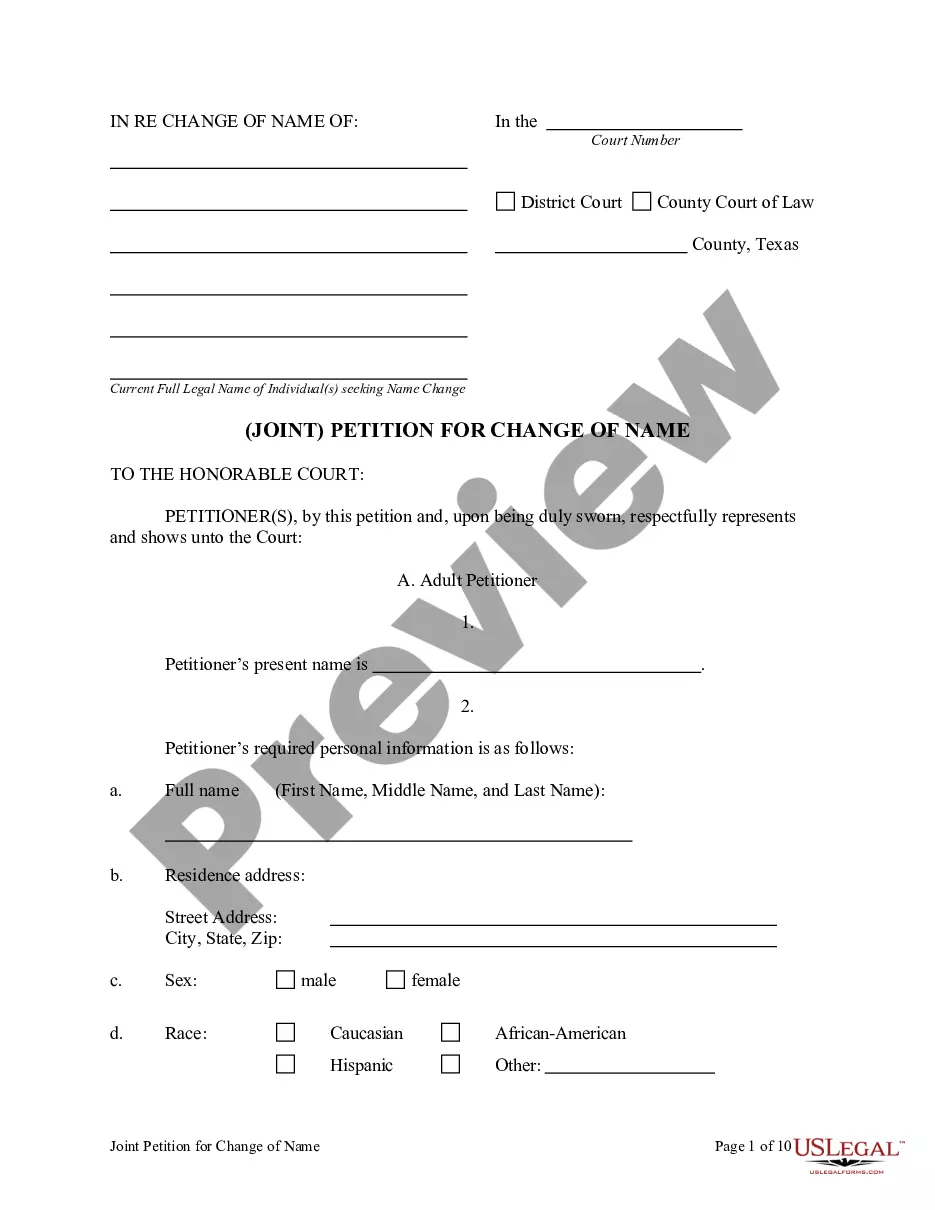

How to fill out Sacramento California Proposal To Approve Adoption Of Employees' Stock Option Plan?

Preparing legal paperwork can be burdensome. In addition, if you decide to ask a lawyer to write a commercial agreement, documents for ownership transfer, pre-marital agreement, divorce paperwork, or the Sacramento Proposal to Approve Adoption of Employees' Stock Option Plan, it may cost you a lot of money. So what is the most reasonable way to save time and money and draw up legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is an excellent solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is biggest online catalog of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any use case accumulated all in one place. Therefore, if you need the recent version of the Sacramento Proposal to Approve Adoption of Employees' Stock Option Plan, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample with the Download button. If you haven't subscribed yet, here's how you can get the Sacramento Proposal to Approve Adoption of Employees' Stock Option Plan:

- Look through the page and verify there is a sample for your region.

- Examine the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - search for the correct one in the header.

- Click Buy Now when you find the needed sample and pick the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a transaction with a credit card or through PayPal.

- Opt for the file format for your Sacramento Proposal to Approve Adoption of Employees' Stock Option Plan and save it.

Once finished, you can print it out and complete it on paper or upload the template to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the documents ever purchased many times - you can find your templates in the My Forms tab in your profile. Try it out now!