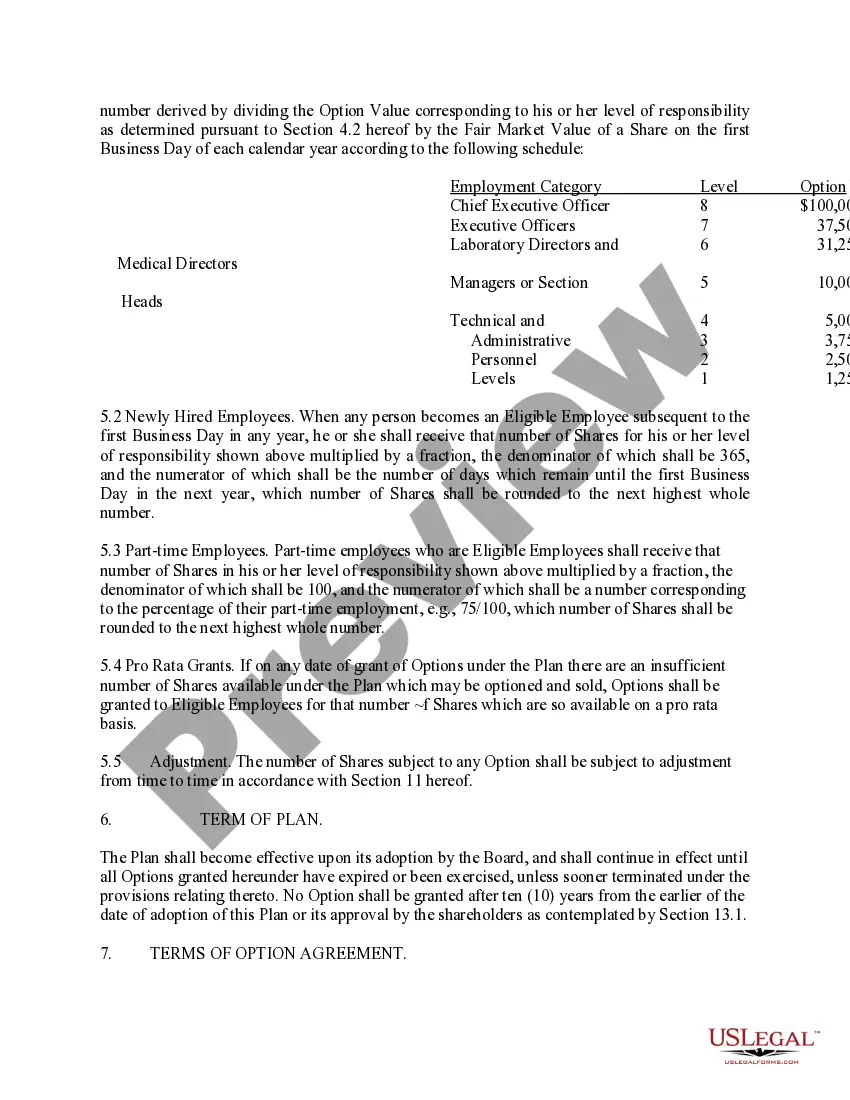

The Phoenix Arizona Employee Stock Option Plan (ESOP) is an attractive offering from Vivien, Inc., a leading company in Phoenix, Arizona. An ESOP is a beneficial program provided by many companies that afford their employees the opportunity to become shareholders in the company. It serves as a valuable incentive, encouraging employees to work harder, enhancing their loyalty, and aligning their interests with those of the company. The Phoenix Arizona Employee Stock Option Plan offers various types of stock options that cater to the diverse needs and circumstances of Vivien, Inc.'s employees. Here are a few types of Sops available: 1. Standard Stock Options: This type of ESOP grants employees the right to purchase a specific number of company shares at a predetermined price, known as the exercise price. Over time, the employees can exercise these options, acquiring ownership in the company and enjoying the potential growth in share value. 2. Incentive Stock Options (SOS): SOS provide additional tax benefits for employees. Under this plan, if certain conditions are met, employees can exercise their options without being subject to immediate tax liabilities. SOS typically come with specific holding periods and requirements that must be met to fully benefit from the tax advantages. 3. Non-Qualified Stock Options (Nests): Nests differ from SOS in terms of the taxes owed upon exercise. With Nests, employees need to pay taxes on the difference between the market price and the exercise price at the time of exercising the options. Although not as tax-favorable as SOS, Nests still provide the opportunity for employees to acquire company shares. 4. Restricted Stock Units (RSS): RSS represent a commitment to provide employees with a specific number of company shares at a predetermined future date. Once the RSS vest, employees are entitled to the shares and any appreciation in their value. RSS are often subject to specific performance or tenure-based criteria. By offering these different types of Sops, Vivien, Inc., ensures flexibility and suitability for its employees' diverse needs and circumstances. This program not only helps attract and retain top talent but also instills a sense of ownership and loyalty, driving the company's growth and success.

Phoenix Arizona Employee Stock Option Plan of Vivigen, Inc.

Description

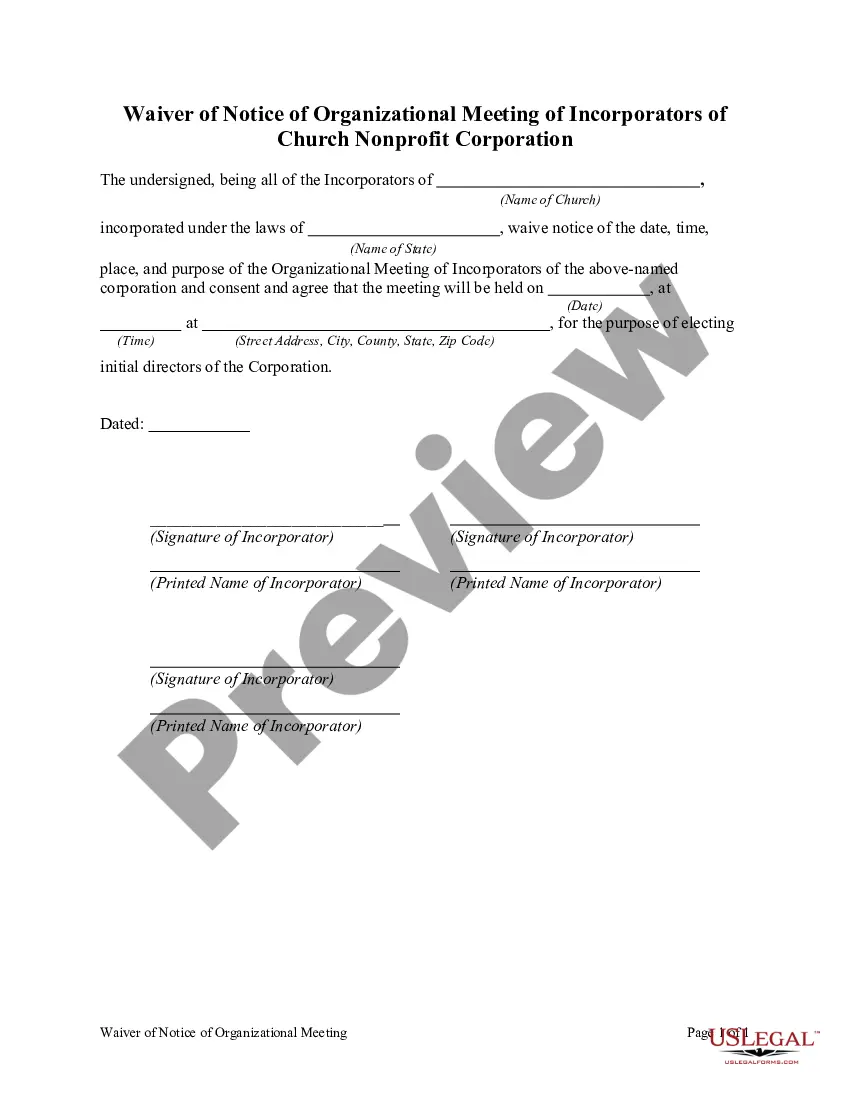

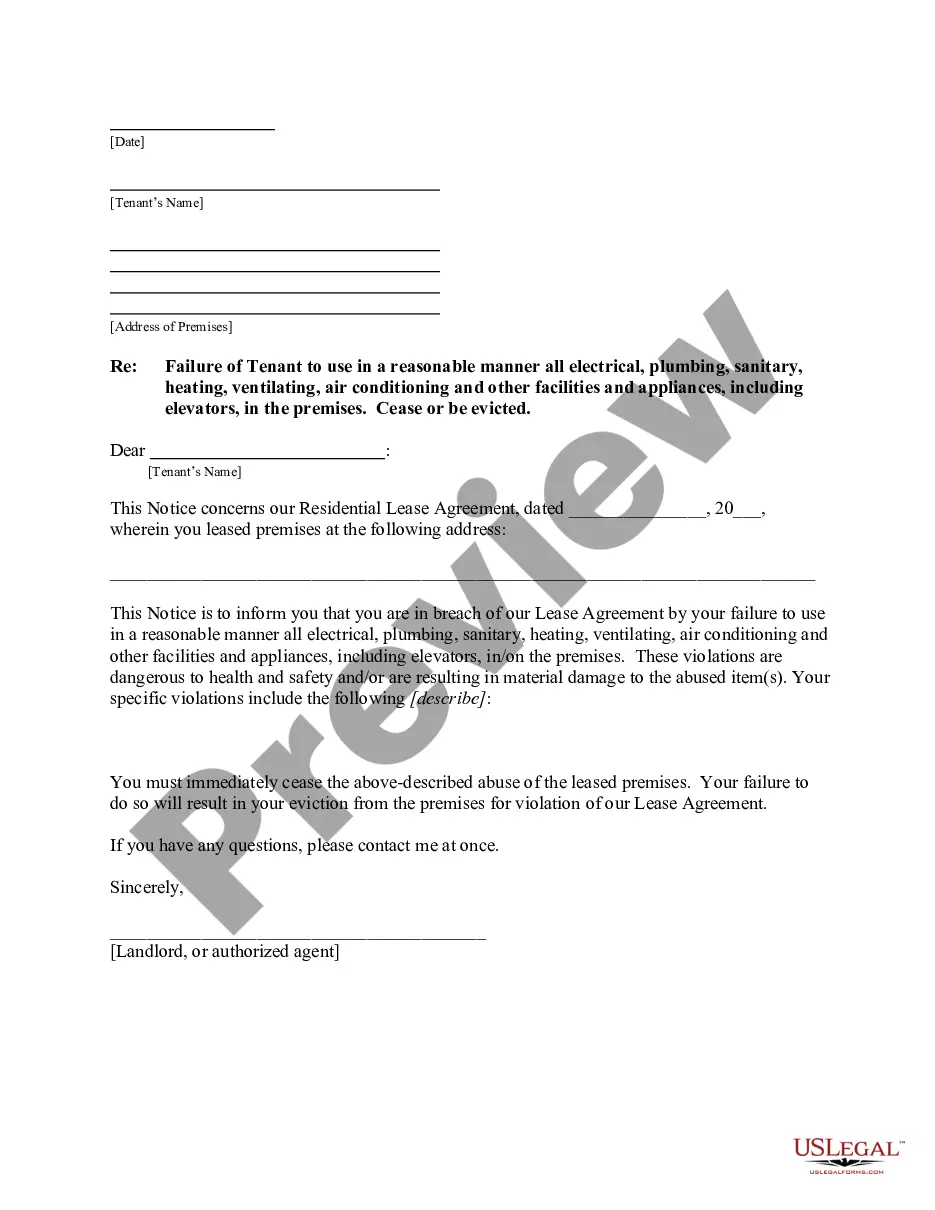

How to fill out Phoenix Arizona Employee Stock Option Plan Of Vivigen, Inc.?

Laws and regulations in every area vary around the country. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal documents. To avoid costly legal assistance when preparing the Phoenix Employee Stock Option Plan of Vivigen, Inc., you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal templates. It's an excellent solution for professionals and individuals looking for do-it-yourself templates for different life and business situations. All the forms can be used multiple times: once you pick a sample, it remains available in your profile for further use. Thus, when you have an account with a valid subscription, you can just log in and re-download the Phoenix Employee Stock Option Plan of Vivigen, Inc. from the My Forms tab.

For new users, it's necessary to make several more steps to obtain the Phoenix Employee Stock Option Plan of Vivigen, Inc.:

- Analyze the page content to ensure you found the appropriate sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Utilize the Buy Now button to obtain the template when you find the correct one.

- Choose one of the subscription plans and log in or sign up for an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Complete and sign the template in writing after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

FAQ

ESOPs offer serious tax and investment benefits. Since ESOPs are tax-exempt trusts, profits earned by the company stay with the employees ? and that's only the beginning. An S-corporation that is 100% employee-owned doesn't pay taxes, which instantly translates to higher profit.

Are ESPPs good investments? These plans can be great investments if used correctly. Purchasing stock at a discount is certainly a valuable tool for accumulating wealth, but comes with investment risks you should consider. An ESPP plan with a 15% discount effectively yields an immediate 17.6% return on investment.

How Do You Start an ESOP? To set up an ESOP, you'll have to establish a trust to buy your stock. Then, each year you'll make tax-deductible contributions of company shares, cash for the ESOP to buy company shares, or both. The ESOP trust will own the stock and allocate shares to individual employee's accounts.

Employee stock options are offered by companies to their employees as equity compensation plans. These grants come in the form of regular call options and give an employee the right to buy the company's stock at a specified price for a finite period of time.

What are the cons of offering employee stock options? Although stock option plans offer many advantages, the tax implications for employees can be complicated. Dilution can be very costly to shareholder over the long run. Stock options are difficult to value.

An ESOP is an employee benefit plan that enables employees to own part or all of the company they work for. at fair market value (unless there's a public market for the shares). So, the employee receives the value of his or her shares from the trust, usually in the form of cash.

Setting Up Your Employee Stock Option Plan Your company's mission and values should be a major factor in your stock option's plan design. Determine how much of the company you plan to share with early employees and employees that will join your company later. Regular stock grants are sold in shares of 100.

Accounting for Stock Options Stock options are valued under the rules of Generally Accepted Accounting Principles (or GAAP) at fair market value. That is easy if the options are traded on an exchange; you can just look up the price.Stock options are compensation expense to the company.

The benefit is equal to the value of the shares, minus the amount paid.

To provide ESOPs, founders must dilute a portion of their stock and carve out the ESOP pool. Employees are given ESOPs or stock options from this pool. If the pool is depleted, founders and investors may dilute further ownership in subsequent fundraising rounds to replace it.