Clark Nevada Employee Stock Option Plan is a compensation program offered by Linguistics Group, Inc. to its employees, allowing them to purchase company stock at a predetermined price within a specified timeframe. This stock option plan is specifically designed for employees located in Clark County, Nevada, where the company operates. The Clark Nevada Employee Stock Option Plan of Linguistics Group, Inc. provides employees with the opportunity to participate in the company's growth and success by becoming shareholders. By granting stock options, Linguistics aims to incentivize and reward its employees, aligning their interests with those of the company. Under this stock option plan, employees are granted a certain number of stock options, the exercise price of which is predetermined. The exercise price is typically set at the market price of the company's stock on the date of the grant, ensuring that employees have a fair opportunity to benefit from potential stock price appreciation. One of the key advantages of the Clark Nevada Employee Stock Option Plan is the ability for employees to purchase company stock at a discount compared to its current market price. This discount, often referred to as the intrinsic value, allows employees to acquire shares below their fair market value, potentially resulting in financial gains. Linguistics Group, Inc. offers different types of stock options within the Clark Nevada Employee Stock Option Plan, including non-qualified stock options (SOS) and incentive stock options (SOS). Non-qualified stock options do not qualify for preferential tax treatment and are subject to ordinary income tax rates upon exercise. In contrast, incentive stock options provide tax advantages but come with specific eligibility criteria and holding periods. Employees participating in the Clark Nevada Employee Stock Option Plan must be aware of the terms and conditions of the program. These may include vesting schedules, which determine when employees can exercise their stock options, as well as any restrictions on trading or selling the acquired shares. It is essential for employees to review the plan document and consult with financial advisors to maximize the benefits and make informed decisions. Overall, the Clark Nevada Employee Stock Option Plan of Linguistics Group, Inc. presents an attractive opportunity for employees to gain ownership in the company and potentially share in its success. By offering stock options, Linguistics aims to foster a sense of loyalty, motivation, and alignment among its workforce, driving increased productivity and long-term commitment.

Clark Nevada Employee Stock Option Plan of Manugistics Group, Inc.

Description

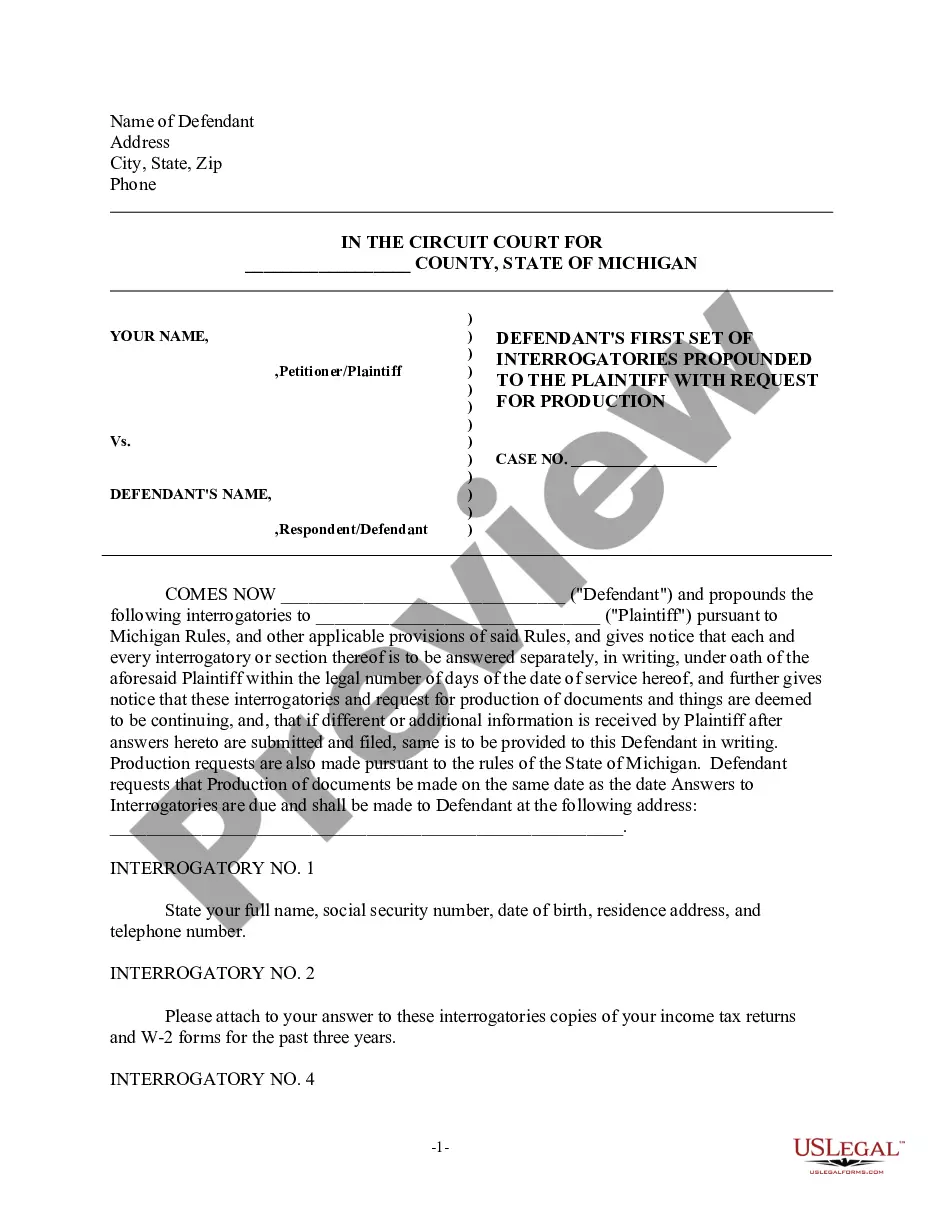

How to fill out Clark Nevada Employee Stock Option Plan Of Manugistics Group, Inc.?

Laws and regulations in every sphere vary throughout the country. If you're not a lawyer, it's easy to get lost in a variety of norms when it comes to drafting legal documentation. To avoid costly legal assistance when preparing the Clark Employee Stock Option Plan of Manugistics Group, Inc., you need a verified template valid for your region. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web catalog of more than 85,000 state-specific legal templates. It's an excellent solution for professionals and individuals searching for do-it-yourself templates for different life and business occasions. All the forms can be used multiple times: once you pick a sample, it remains accessible in your profile for subsequent use. Thus, if you have an account with a valid subscription, you can simply log in and re-download the Clark Employee Stock Option Plan of Manugistics Group, Inc. from the My Forms tab.

For new users, it's necessary to make some more steps to obtain the Clark Employee Stock Option Plan of Manugistics Group, Inc.:

- Take a look at the page content to make sure you found the right sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Click on the Buy Now button to get the template when you find the correct one.

- Opt for one of the subscription plans and log in or create an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Fill out and sign the template on paper after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal reasons. Locate them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

FAQ

Stock options offer employees an opportunity to have ownership in the company they work for and feel more connected to the business. Employees can reap some of the financial benefits of a successful business. This can result in employees making far more money above and beyond their annual salaries.

An employee stock ownership plan (ESOP) is an employee benefit plan that gives workers ownership interest in the company; this interest takes the form of shares of stock. ESOPs give the sponsoring companythe selling shareholderand participants various tax benefits, making them qualified plans.

Stock options aren't shares of actual stock. An employee stock option is a contract that gives employees the right to buy a specific number of shares of company stock at a specified price called the strike price, within a particular time frame known as the exercise window.

An employee stock ownership plan (ESOP) is an employee benefit plan that gives workers ownership interest in the company; this interest takes the form of shares of stock. ESOPs give the sponsoring companythe selling shareholderand participants various tax benefits, making them qualified plans.

There are two key types of employee stock options: incentive stock options, or ISOs, and nonqualified stock options, called NSOs. That distinction has a big impact on the tax treatment, which in turn may affect the strategy you employ with the options.

Research by the Department of Labor shows that ESOPs not only have higher rates of return than 401(k) plans and are also less volatile. ESOPs lay people off less often than non-ESOP companies. ESOPs cover more employees, especially younger and lower income employees, than 401(k) plans.

Exercising share options is when the employee buys the shares at the agreed strike price. Employees only pay tax when they then sell the shares. This is normally when there's an IPO (Initial Public Offering) or the company is sold.

The core elements of an Employee Stock Option Plan include: Definitions, Option Commitment Certificate, Grant of Options, Conditions of Options, Vesting, and Exercise of Option, Termination of Participation, Payment.

An ESOP is a qualified defined contribution retirement plan, so employees don't purchase shares with their own money. An ESPP, on the other hand, is a plan that allows employees to use their own money to buy company shares at a discount.

Overview of Three Types of ESOPs Nonleveraged ESOP. This first type of ESOP (Diagram 1) does not involve borrowed funds to acquire the sponsoring employer's stock.Leveraged Buyout ESOP.Issuance ESOP.