The Kings New York Employee Stock Option Plan (ESOP) is a comprehensive compensation program offered by the Linguistics Group, Inc. to its eligible employees in New York. This plan grants employees the opportunity to purchase company shares at a predetermined price within a specific time frame. The objective of the Kings New York ESOP is to motivate and retain talented employees by aligning their interests with the company's success. Through the Kings New York ESOP, employees receive stock options as part of their compensation package. These stock options provide employees with the right to purchase a certain number of company shares at a predetermined exercise price, known as the strike price. The strike price is typically set at the fair market value of the company's stock at the time of grant. There are two main types of stock options offered under the Kings New York ESOP: 1. Non-Qualified Stock Options (Nests): These options provide employees with flexibility in terms of exercise timing. Nests are subject to ordinary income tax rates upon exercise, and the gain is taxable as ordinary income. However, the company receives a tax deduction for the same amount. 2. Incentive Stock Options (SOS): SOS offer tax advantages to employees. If certain requirements are met, including holding the shares for a specified period, employees may be eligible for favorable long-term capital gains tax rates on the difference between the exercise price and the eventual selling price. SOS can provide employees with potential tax savings compared to Nests. The Kings New York ESOP of Linguistics Group, Inc. also includes various provisions, such as vesting schedules, which determine when employees can exercise their options, and a maximum term within which the options must be exercised. The plan may also include provisions related to stock ownership guidelines, transfer restrictions, and change of control provisions. It is important for employees to carefully review the terms and conditions of the Kings New York ESOP, seeking advice from financial advisors or professionals, to fully understand the potential benefits and risks associated with stock option plans. By participating in the ESOP, employees have the opportunity to become shareholders and share in the company's growth and success.

Kings New York Employee Stock Option Plan of Manugistics Group, Inc.

Description

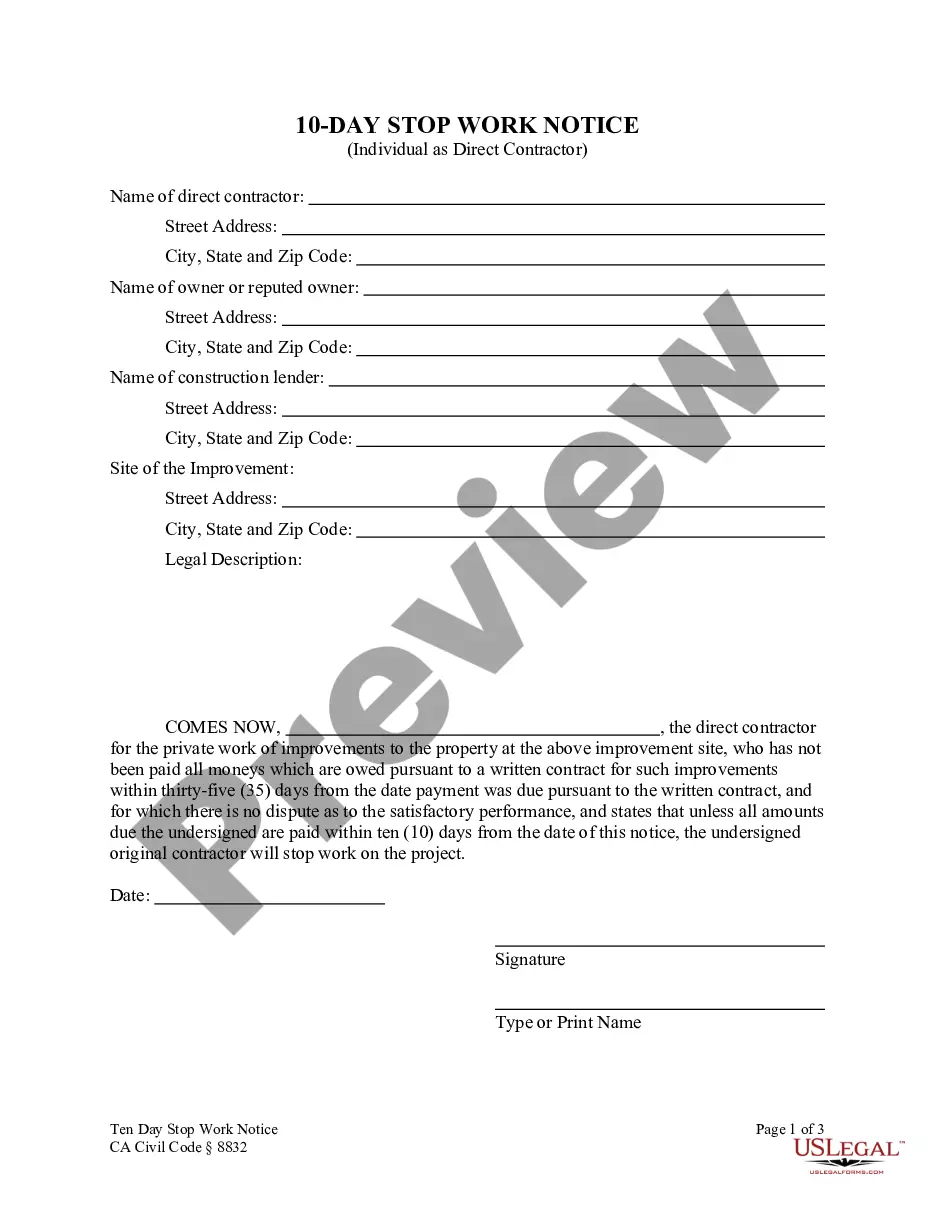

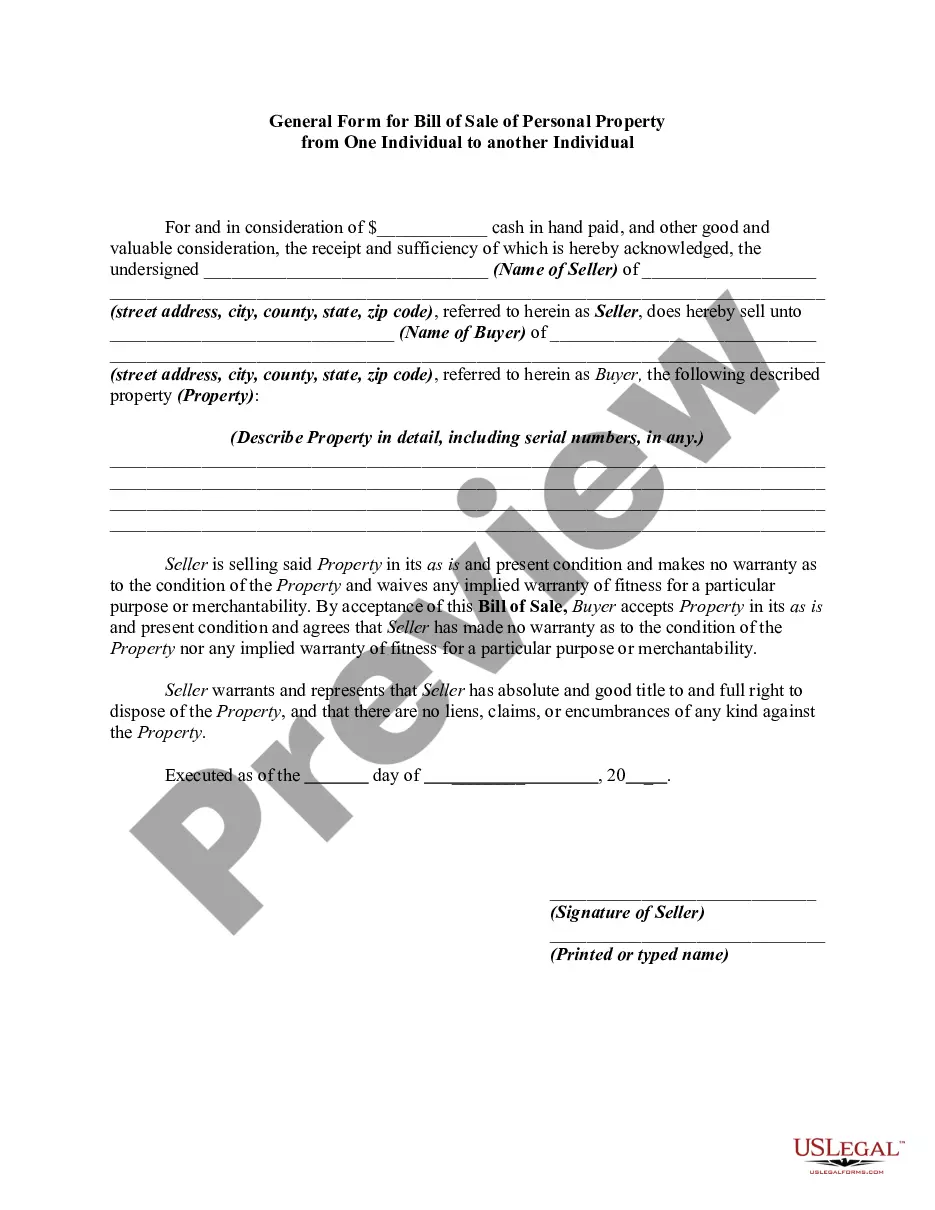

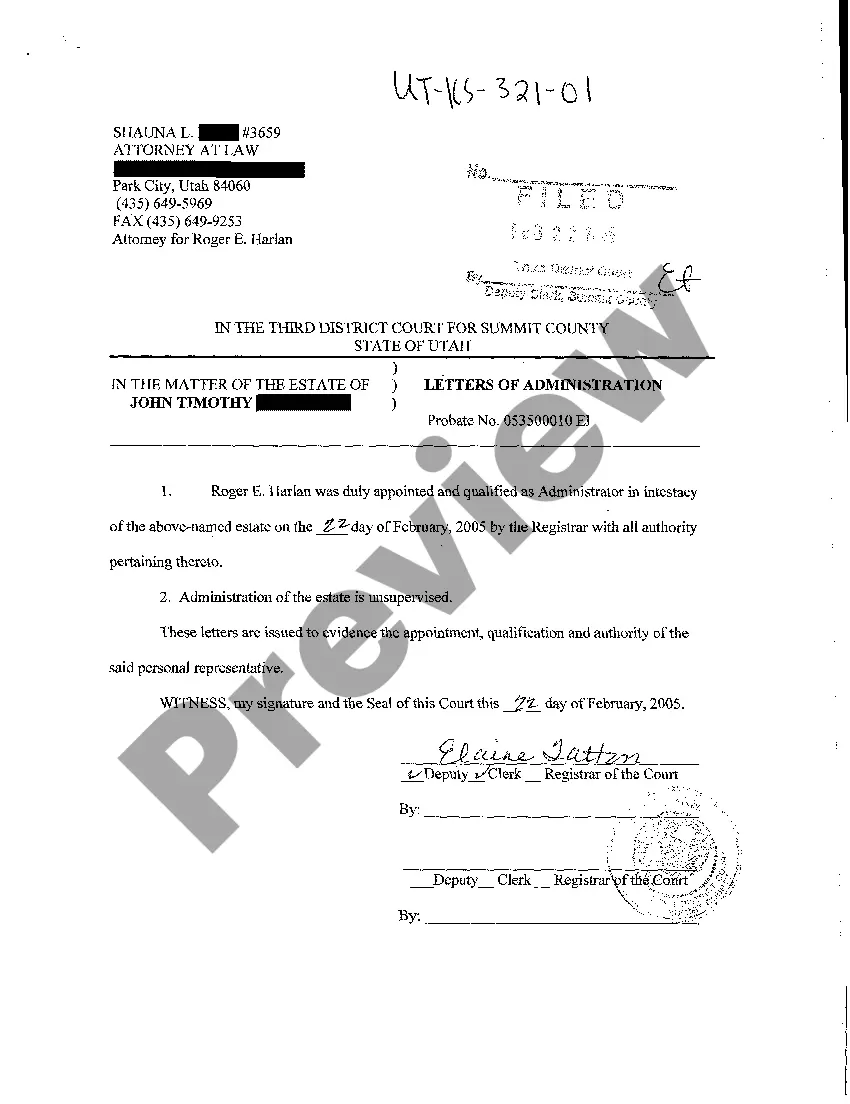

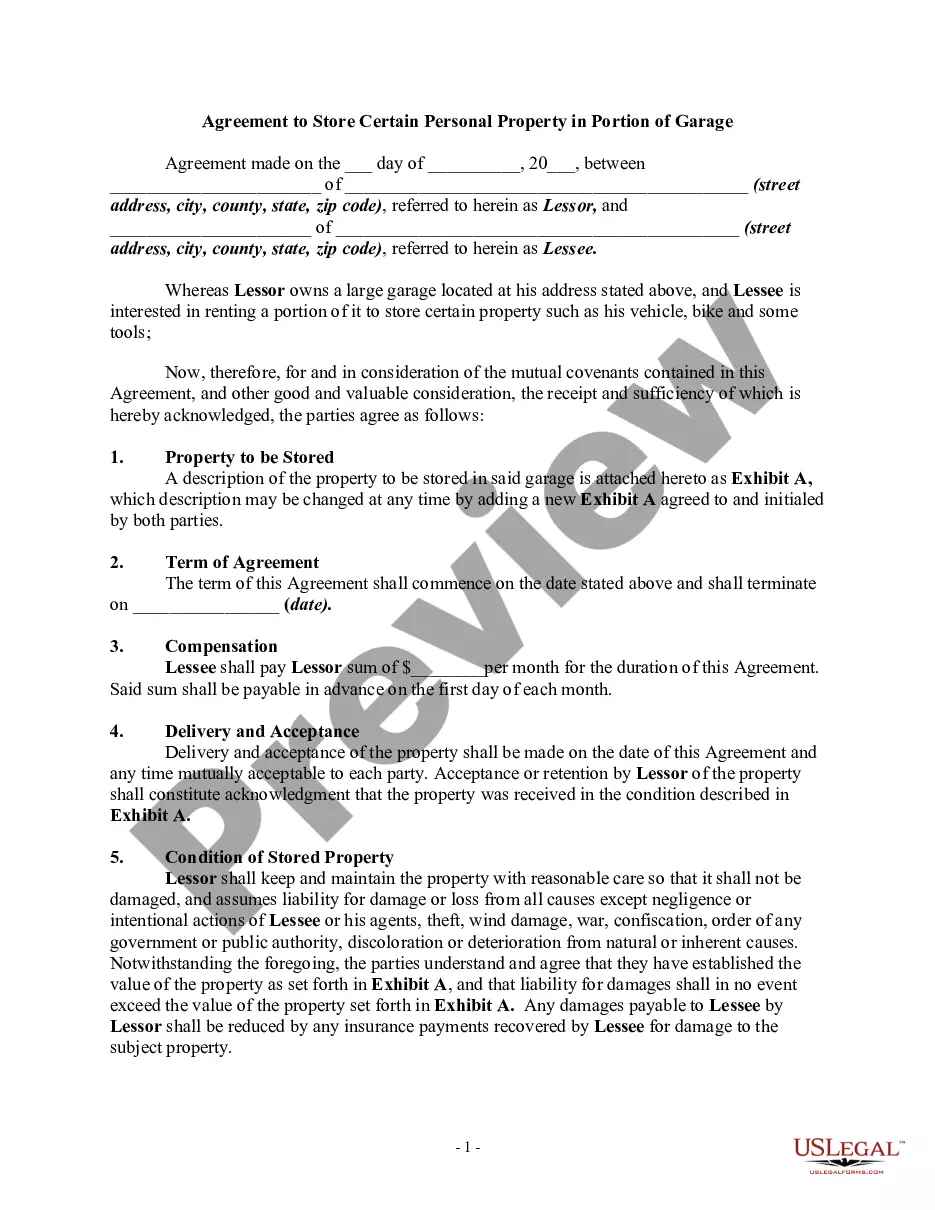

How to fill out Kings New York Employee Stock Option Plan Of Manugistics Group, Inc.?

Preparing legal paperwork can be cumbersome. Besides, if you decide to ask a legal professional to draft a commercial agreement, documents for ownership transfer, pre-marital agreement, divorce paperwork, or the Kings Employee Stock Option Plan of Manugistics Group, Inc., it may cost you a fortune. So what is the best way to save time and money and create legitimate forms in total compliance with your state and local laws? US Legal Forms is an excellent solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is the most extensive online library of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any use case collected all in one place. Therefore, if you need the latest version of the Kings Employee Stock Option Plan of Manugistics Group, Inc., you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample with the Download button. If you haven't subscribed yet, here's how you can get the Kings Employee Stock Option Plan of Manugistics Group, Inc.:

- Look through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - search for the right one in the header.

- Click Buy Now once you find the needed sample and pick the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a payment with a credit card or through PayPal.

- Choose the file format for your Kings Employee Stock Option Plan of Manugistics Group, Inc. and save it.

Once finished, you can print it out and complete it on paper or import the samples to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the documents ever purchased multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!

Form popularity

FAQ

A stock option typically must be granted after the individual's service with the company has started. Options under the stock plan generally can only be granted to service providers of the company and its majority owned subsidiary companies.

Issuing Stock Options: Ten Tips For Entrepreneurs Issue Options ASAP.Comply with Applicable Federal and State Securities Laws.Establish Reasonable Vesting Schedules.Make Sure All of the Paperwork Is in Order.Allocate Reasonable Percentages to Key Employees.

Setting Up Your Employee Stock Option Plan Your company's mission and values should be a major factor in your stock option's plan design. Determine how much of the company you plan to share with early employees and employees that will join your company later. Regular stock grants are sold in shares of 100.

An employee stock option is a plan that means you have the option to buy shares of the company's stock at a certain price for a given period of time. In doing so, it could increase how much money you bring in from your job.

Stock options are a form of compensation. Companies can grant them to employees, contractors, consultants and investors. These options, which are contracts, give an employee the right to buy, or exercise, a set number of shares of the company stock at a preset price, also known as the grant price.

The cost of setting up an ESOP is also substantialperhaps $40,000 for the simplest of plans in small companies and on up from there. Any time new shares are issued, the stock of existing owners is diluted. That dilution must be weighed against the tax and motivation benefits an ESOP can provide.

Setting Up Your Employee Stock Option Plan Your company's mission and values should be a major factor in your stock option's plan design. Determine how much of the company you plan to share with early employees and employees that will join your company later. Regular stock grants are sold in shares of 100.

Steps to Setting Up an ESOP (1) Determine Whether Other Owners Are Amenable.(2) Conduct a Feasibility Study.(3) Conduct a Valuation.(4) Hire an ESOP Attorney.(5) Obtain Funding for the Plan.(6) Establish a Process to Operate the Plan.

Issuing Stock Options: Ten Tips For Entrepreneurs Issue Options ASAP.Comply with Applicable Federal and State Securities Laws.Establish Reasonable Vesting Schedules.Make Sure All of the Paperwork Is in Order.Allocate Reasonable Percentages to Key Employees.

Overview of Three Types of ESOPs Nonleveraged ESOP. This first type of ESOP (Diagram 1) does not involve borrowed funds to acquire the sponsoring employer's stock.Leveraged Buyout ESOP.Issuance ESOP.