The Maricopa Arizona Employee Stock Option Plan (ESOP) of Linguistics Group, Inc. is a comprehensive compensation tool offered to employees of the company. The ESOP allows eligible employees to purchase company stocks at a predetermined price within a specified period. Linguistics Group, Inc. is a technology company based in Maricopa, Arizona that specializes in supply chain management and optimization software solutions. The company recognizes the importance of incentivizing and rewarding its employees for their contributions, hence the introduction of the Maricopa Arizona ESOP. Through the Maricopa Arizona ESOP, employees are given the opportunity to acquire company stocks, which can potentially increase in value over time. This allows employees to not only benefit from their hard work but also align their interests with the company's success. The ESOP acts as a motivational tool, encouraging employees to perform at their best and contribute to the company's overall growth. There are different types of Maricopa Arizona Sops available within Linguistics Group, Inc. These include: 1. Standard ESOP: The standard ESOP provides employees with the option to purchase company stocks at a predefined price over a specific period. This type of ESOP typically has a vesting period, ensuring that employees remain with the company for a certain duration before gaining access to their stock options. 2. Performance-based ESOP: The performance-based ESOP is designed to reward employees based on their individual or team’s performance. Employees who meet or exceed predefined targets or milestones might be eligible for additional stock options or benefits under this ESOP. 3. Executive ESOP: The executive ESOP is tailored specifically for high-level executives within Linguistics Group, Inc. These individuals may be granted more substantial stock options or additional benefits as part of their compensation package, in line with their leadership roles and responsibilities. The Maricopa Arizona ESOP empowers employees to become shareholders in the company, fostering a sense of ownership and dedication. It further strengthens the bond between the employees and the organization, encouraging loyalty, commitment, and a long-term perspective towards the company's success. Please note that this content generated by GPT-3 may not provide accurate or up-to-date information about the Maricopa Arizona Employee Stock Option Plan of Linguistics Group, Inc. It is always recommended referring to official sources or contact the company directly for the most accurate information.

Maricopa Arizona Employee Stock Option Plan of Manugistics Group, Inc.

Description

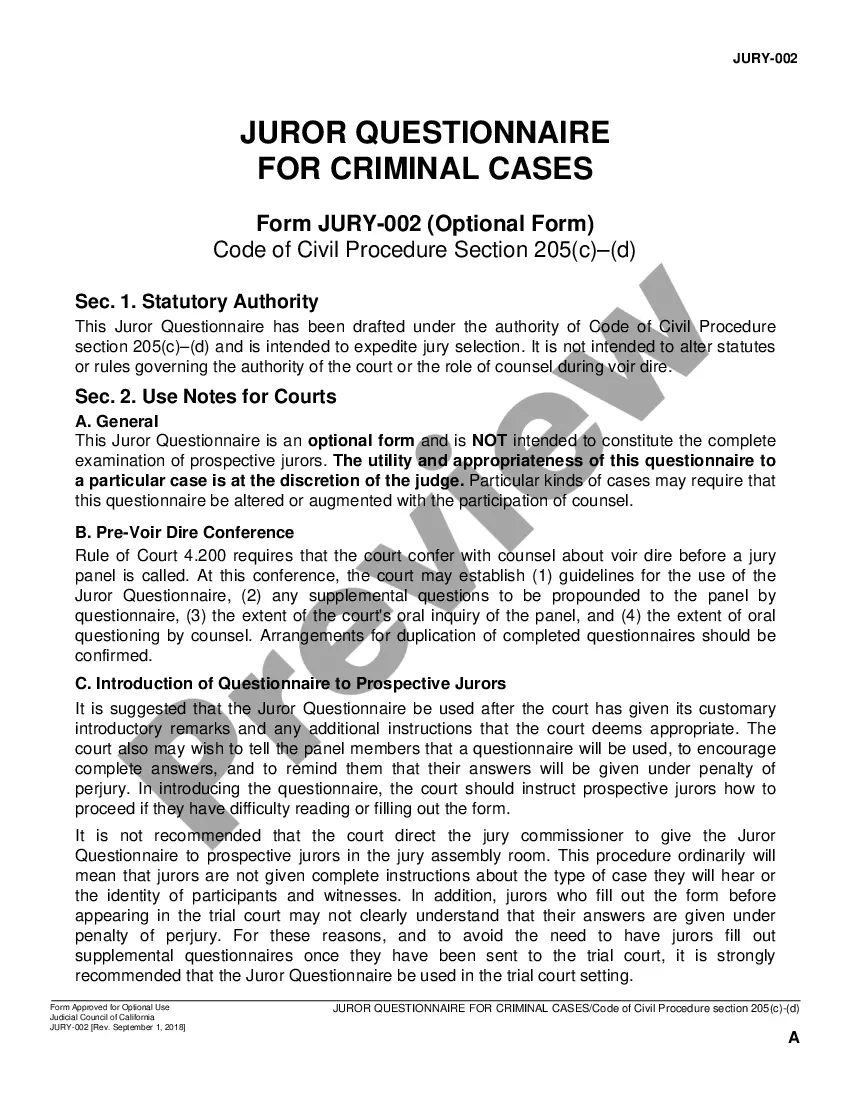

How to fill out Maricopa Arizona Employee Stock Option Plan Of Manugistics Group, Inc.?

A document routine always goes along with any legal activity you make. Opening a business, applying or accepting a job offer, transferring ownership, and lots of other life situations demand you prepare official documentation that varies throughout the country. That's why having it all accumulated in one place is so beneficial.

US Legal Forms is the largest online collection of up-to-date federal and state-specific legal templates. On this platform, you can easily locate and download a document for any personal or business objective utilized in your county, including the Maricopa Employee Stock Option Plan of Manugistics Group, Inc..

Locating samples on the platform is amazingly straightforward. If you already have a subscription to our library, log in to your account, find the sample using the search bar, and click Download to save it on your device. Following that, the Maricopa Employee Stock Option Plan of Manugistics Group, Inc. will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this simple guide to obtain the Maricopa Employee Stock Option Plan of Manugistics Group, Inc.:

- Make sure you have opened the proper page with your localised form.

- Use the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the form satisfies your needs.

- Search for another document via the search option if the sample doesn't fit you.

- Click Buy Now once you find the necessary template.

- Select the suitable subscription plan, then log in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and save the Maricopa Employee Stock Option Plan of Manugistics Group, Inc. on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most reliable way to obtain legal documents. All the samples provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs efficiently with the US Legal Forms!

Form popularity

FAQ

If the acquiring company decides to give you company shares, either you will receive publicly traded shares, and your situation will mimic the IPO outcome, or if acquired by a private company, you will receive private shares and you will be back in the same situation as before: waiting for liquidity.

When a merger is completed the two companies that merged combine into a new entity. At that time, trading in the options of the previous entities will cease and all options on that security that were out-of-the-money will become worthless. Generally, this is determined by the very last closing price on that stock.

Assuming the company closed and is out of business, the options will become worthless just like the stock.

When an employee leaves your company, he is eligible to receive the vested portion of the ESOP retirement plan. The rest is forfeited to the company. A vesting schedule is created for retirement plans to prevent constant employee turnover from draining your plan assets.

You can cash out of your ESOP when you leave, get fired, become disabled or retire. However, the vesting period must be over for you to receive everything due to you. That period is usually about 200bfour years200b after the first year of work, regardless of an employee's position within the company.

Examples of the ESOP Rules The plan must start distributions to you by sometime in 2023. They must be completed no later than 2028. You quit in 2022 at age 40 and the plan year ends December 31. The plan could require that you wait as long as until 2028 before starting distributions.

When Do ESOP Employees Get Paid? Companies typically tie stock distributions to vestingthe proportion of shares earned for each year of service. Full vesting usually takes three or six years depending on the company plan.

Employee stock options are offered by companies to their employees as equity compensation plans. These grants come in the form of regular call options and give an employee the right to buy the company's stock at a specified price for a finite period of time.

When an employee leaves your company, he is eligible to receive the vested portion of the ESOP retirement plan. The rest is forfeited to the company. A vesting schedule is created for retirement plans to prevent constant employee turnover from draining your plan assets.

Like other qualified retirement plans, ESOP distributions received by employees under age 59-½ (or, in the case of terminating employment, under age 55) are considered early withdrawals, so they are subject to normal applicable taxes, plus an additional 10% excise tax.