Maricopa, Arizona is a vibrant city located in Pinal County. The city is known for its scenic beauty, thriving economy, and excellent quality of life. In a proposal for the approval of a Nonqualified Stock Option Plan, Maricopa Arizona aims to provide an incentive for employees and directors to contribute to the growth and success of the company. The Nonqualified Stock Option Plan offers employees the opportunity to purchase company stock at a predetermined price, usually lower than the current market value. This plan is designed to align the interests of employees and shareholders while providing a means for employees to share in the company's overall success. The approval of the Nonqualified Stock Option Plan in Maricopa, Arizona is crucial as it can attract and retain valuable employees and directors. It serves as a strategic tool to motivate employees to drive productivity, innovation, and long-term shareholder value. Various types of Nonqualified Stock Option Plans may exist in Maricopa, Arizona, including: 1. Standard Nonqualified Stock Option Plan: This plan offers employees the right to purchase company stock at a set price over a specific period, with options granted based on factors such as performance, tenure, or position. 2. Performance-Based Nonqualified Stock Option Plan: In this type of plan, the stock options granted are directly linked to achieving specific performance goals or targets. This approach ensures that employees are rewarded based on the company's overall performance. 3. Director Nonqualified Stock Option Plan: This plan is tailored specifically for company directors. It allows directors to acquire company shares through stock options, enhancing their commitment to the organization's success. Approval of the Nonqualified Stock Option Plan in Maricopa, Arizona is a vital step in fostering a positive work environment, attracting top talent, and positioning companies for growth. It not only benefits employees and directors but also aligns the interests of the workforce with the long-term success of the organization. Through this plan, Maricopa, Arizona recognizes the importance of incentivizing employees, promoting loyalty, and ensuring a prosperous future for both individuals and the local economy.

Maricopa Arizona Proposal Approval of Nonqualified Stock Option Plan

Description

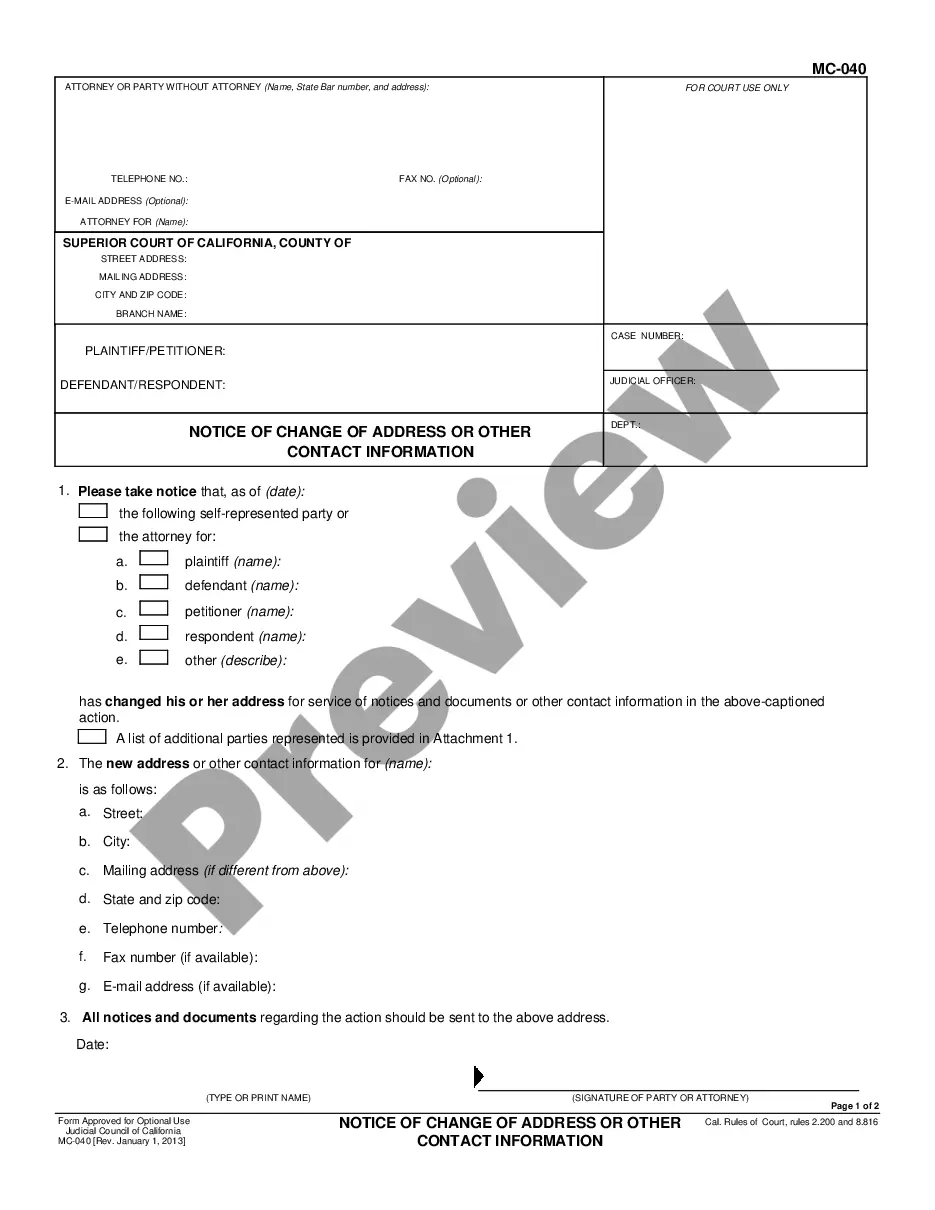

How to fill out Maricopa Arizona Proposal Approval Of Nonqualified Stock Option Plan?

A document routine always goes along with any legal activity you make. Opening a business, applying or accepting a job offer, transferring property, and many other life situations demand you prepare official paperwork that differs from state to state. That's why having it all accumulated in one place is so helpful.

US Legal Forms is the most extensive online collection of up-to-date federal and state-specific legal templates. Here, you can easily locate and get a document for any personal or business purpose utilized in your region, including the Maricopa Proposal Approval of Nonqualified Stock Option Plan.

Locating samples on the platform is amazingly simple. If you already have a subscription to our library, log in to your account, find the sample using the search bar, and click Download to save it on your device. Afterward, the Maricopa Proposal Approval of Nonqualified Stock Option Plan will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this simple guideline to obtain the Maricopa Proposal Approval of Nonqualified Stock Option Plan:

- Ensure you have opened the proper page with your localised form.

- Utilize the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the form satisfies your requirements.

- Look for another document using the search option if the sample doesn't fit you.

- Click Buy Now when you locate the necessary template.

- Select the appropriate subscription plan, then sign in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and download the Maricopa Proposal Approval of Nonqualified Stock Option Plan on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most reliable way to obtain legal documents. All the samples available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs properly with the US Legal Forms!

Form popularity

FAQ

What are non-qualified stock options? Non-qualified stock options are stock options that do not receive favorable tax treatment when exercised but do provide additional flexibility for the issuing company. Gains from non-qualified stock options are taxed as normal income.

A qualified stock option is a type of company share option granted exclusively to employees. It confers an income tax benefit when exercised. Qualified stock options are also referred to as 'incentive stock options' or 'incentive share options. '

Profits made from exercising qualified stock options (QSO) are taxed at the capital gains tax rate (typically 15%), which is lower than the rate at which ordinary income is taxed. Gains from non-qualified stock options (NQSO) are considered ordinary income and are therefore not eligible for the tax break.

Non-statutory Stock Options, or NSOs also known as non-qualified options can be offered to everyone from the everyday employee to 1099 contractors and allow them to participate in the growth and ownership of the company.

There are two key differences who the stock can be issued to and the tax treatment. Qualified stock options, also known as incentive stock options, can only be granted to employees. Non-qualified stock options can be granted to employees, directors, contractors and others.

A qualified stock option confers special tax benefits on the employees of a corporation. This stock option is not reportable as taxable income to the employee at the time of grant, nor when the employee later exercises the option to buy stock.

Non-qualified stock options may be sold at any market price, either higher or lower than the grant price. While non-qualified stock options carry less favorable tax treatment for the holder than qualified stock options, they offer other benefits.

Non-qualified stock options (NSOs) are a type of stock option that does not qualify for favorable tax treatment for the employee. Unlike with incentive stock options (ISOs), where you don't pay taxes upon exercise, with NSOs you pay taxes both when you exercise the option (purchase shares) and sell those shares.

What is the difference between incentive stock options and non-qualified stock options? Incentive stock options, or ISOs, are options that are entitled to potentially favorable federal tax treatment. Stock options that are not ISOs are usually referred to as nonqualified stock options or NQOs.