Santa Clara, California is an influential city known for its numerous tech companies, including giants like Intel and Nvidia. Within the region, there are several Director stock programs that offer lucrative opportunities for individuals looking to invest in these successful companies. These programs allow directors of these organizations to purchase company stock at discounted prices, enabling them to build substantial wealth through these investments. One of the notable Director stock programs in Santa Clara is the Intel Director Stock Program. This program is designed specifically for the directors of Intel Corporation. It allows directors to purchase Intel stocks at a discounted rate, providing them with a unique opportunity to benefit from the success and growth of the company. By participating in this program, directors can not only enhance their financial portfolios but also demonstrate their confidence in Intel's long-term prospects. Another Director stock program in Santa Clara is the Nvidia Director Stock Program. Similar to the Intel program, this initiative is exclusively available to directors of Nvidia Corporation. Directors are given the chance to buy Nvidia stocks at a reduced price, giving them a significant advantage in building their personal wealth. These shares present an attractive investment opportunity, especially given Nvidia's position as a leader in the gaming and artificial intelligence industries. Both the Intel and Nvidia Director stock programs offer an insider's perspective to directors, allowing them to align their own financial interests with those of the respective companies. Directors often have a deep understanding of their organizations, and by investing in their company's stock, they demonstrate their belief in its potential for future growth and success. Moreover, these programs typically have policies in place to restrict directors from selling their acquired stock for a specified period, ensuring a long-term commitment to the company's success. Participating in a Director stock program can provide directors with significant financial gains, allowing them to diversify their investment portfolios and potentially accumulate substantial wealth. It also serves as a compensation tool beyond regular director compensation packages, incentivizing directors to contribute their expertise and efforts to drive the company's performance. Overall, the Director stock programs in Santa Clara, such as the Intel Director Stock Program and the Nvidia Director Stock Program, are exclusive opportunities for directors to invest in the success of their respective companies while enjoying the benefits of discounted stock prices. These programs not only enhance the financial well-being of directors but also reinforce their commitment to the organization's long-term success.

Santa Clara California Director stock program

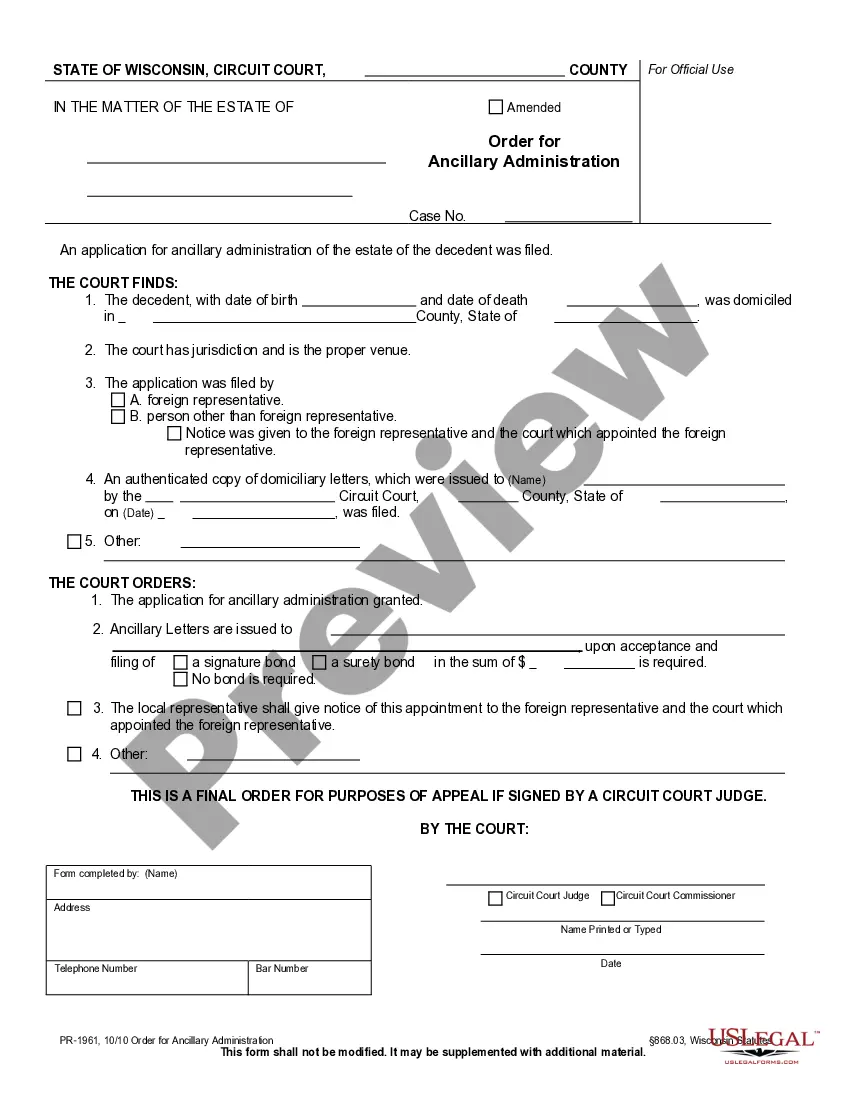

Description

How to fill out Santa Clara California Director Stock Program?

Creating forms, like Santa Clara Director stock program, to manage your legal matters is a challenging and time-consumming task. Many situations require an attorney’s participation, which also makes this task not really affordable. Nevertheless, you can acquire your legal issues into your own hands and handle them yourself. US Legal Forms is here to save the day. Our website features over 85,000 legal forms crafted for a variety of scenarios and life circumstances. We ensure each document is compliant with the laws of each state, so you don’t have to worry about potential legal issues associated with compliance.

If you're already familiar with our website and have a subscription with US, you know how straightforward it is to get the Santa Clara Director stock program form. Go ahead and log in to your account, download the form, and customize it to your needs. Have you lost your document? No worries. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new users is just as easy! Here’s what you need to do before downloading Santa Clara Director stock program:

- Make sure that your form is compliant with your state/county since the regulations for writing legal paperwork may differ from one state another.

- Learn more about the form by previewing it or reading a brief intro. If the Santa Clara Director stock program isn’t something you were looking for, then use the header to find another one.

- Sign in or create an account to start utilizing our service and download the document.

- Everything looks good on your end? Click the Buy now button and choose the subscription option.

- Pick the payment gateway and type in your payment information.

- Your template is good to go. You can try and download it.

It’s an easy task to find and buy the appropriate document with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our extensive library. Sign up for it now if you want to check what other advantages you can get with US Legal Forms!

Form popularity

FAQ

ECA certification is a prerequisite to becoming a CEP. To earn the CEP designation, individuals must pass all three exams, thus demonstrating mastery of equity compensation related issues in all of the core disciplines.

While the 5 hour test can seem daunting and sifting through the endless questions about taxation, accounting and regulations can feel intimidating, there are a few tricks that will put you on the track to acing the exam.

Santa Clara University's Leavey School of Business offers one of the nation's best graduate business programs ranked No. 13 Executive MBA by U.S. News & World Report, No. 20 ranked Evening MBA by U.S. News & World Report, and No. 40 ranked Online MBA by U.S. News & World Report.

To earn the Equity Compensation Associate (ECA) designation, individuals must pass the first exam, thus demonstrating a basic understanding of equity compensation related issues in all of the core disciplines. ECA certification is a prerequisite to becoming a CEP.

The CEPI exam curriculum is challenging and in-depth, covering accounting, corporate and securities laws, taxation, plan design, analysis, and administration, ensuring that CEP designees achieve the required high level of expertise in all of the relevant areas of equity compensation.

While the 5 hour test can seem daunting and sifting through the endless questions about taxation, accounting and regulations can feel intimidating, there are a few tricks that will put you on the track to acing the exam.

Equity Compensation Associate (ECA) is the CEP Institute's new designation for individuals in equity compensation. An ECA is qualified in the fundamentals of equity compensation taxation, plan design, law, and very basic accounting, and can address these topics intelligently with equity plan participants.

The CEPI exam curriculum is challenging and in-depth, covering accounting, corporate and securities laws, taxation, plan design, analysis, and administration, ensuring that CEP designees achieve the required high level of expertise in all of the relevant areas of equity compensation.

Q: How long does it take to receive the Certified Equity Professional designation? A: The exam is offered twice a year, and candidates may only sit for one exam per testing period. So, in order to pass all three levels, a candidate will take at least 13 - 14 months to earn their CEP designation.