Collin Texas Insurance Agents Stock Option Plan is a comprehensive compensation program designed to reward and motivate insurance agents operating in the Collin, Texas area. It offers a unique opportunity for insurance agents to purchase company stock at a predetermined price within a specified timeframe, granting them the right to buy or sell shares in the future. This stock option plan serves as an effective tool for attracting and retaining top-performing insurance agents, providing them with an added incentive to drive business growth and success. By incorporating stock options into their compensation package, insurance agents in Collin, Texas can align their personal financial goals with the overall success of the company, fostering a sense of ownership and loyalty. Different types of stock option plans exist within the Collin Texas Insurance Agents program, catering to the diverse needs and preferences of agents. Some notable types include: 1. Non-Qualified Stock Options (SOS): These options grant insurance agents the right to purchase company stock at a predetermined price, usually at a discount to the market value. SOS are more flexible, as they can be offered to both employees and outside contractors. 2. Incentive Stock Options (SOS): SOS are typically reserved for key employees and offer certain tax advantages. If certain requirements are met, the gains from exercising SOS can be taxed at a lower rate than ordinary income. 3. Employee Stock Purchase Plans (ESPN): Unlike traditional stock options, ESPN allow insurance agents to purchase company stock through payroll deductions. These plans often offer a discounted purchase price, making it an affordable and accessible option for agents. 4. Restricted Stock Units (RSS): Rather than offering the right to purchase shares, RSS grant insurance agents the actual stock units, typically subject to a vesting schedule. RSS provides a tangible ownership interest in the company's stock while deferring actual ownership until the vesting period ends. Collin Texas Insurance Agents Stock Option Plan is designed to incentivize agents, foster a sense of loyalty, and pave the way for a mutually beneficial relationship between agents and the company. It offers agents the unique opportunity to invest in the company's success, resulting in long-term growth and financial stability for both parties involved.

Collin Texas Insurance Agents Stock option plan

Description

How to fill out Collin Texas Insurance Agents Stock Option Plan?

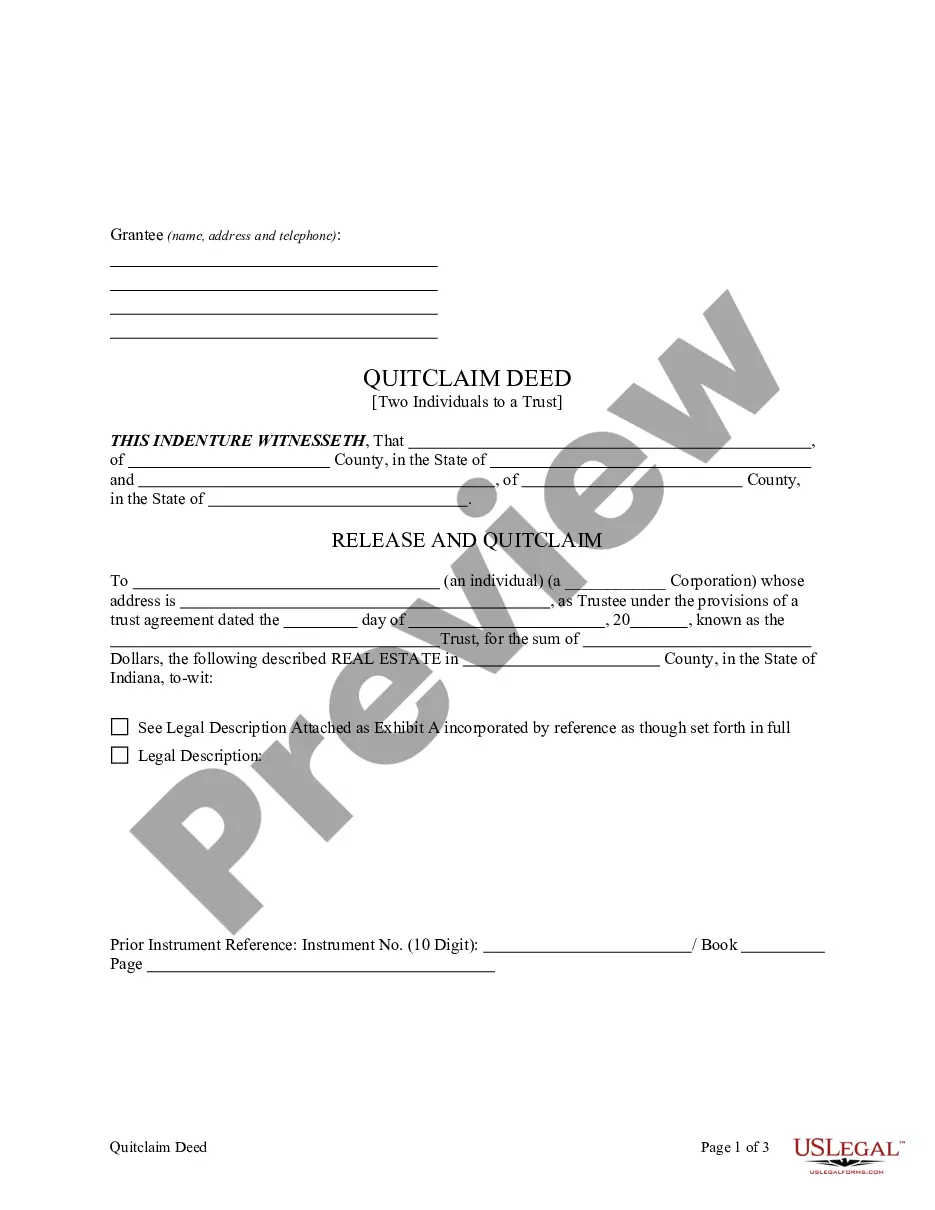

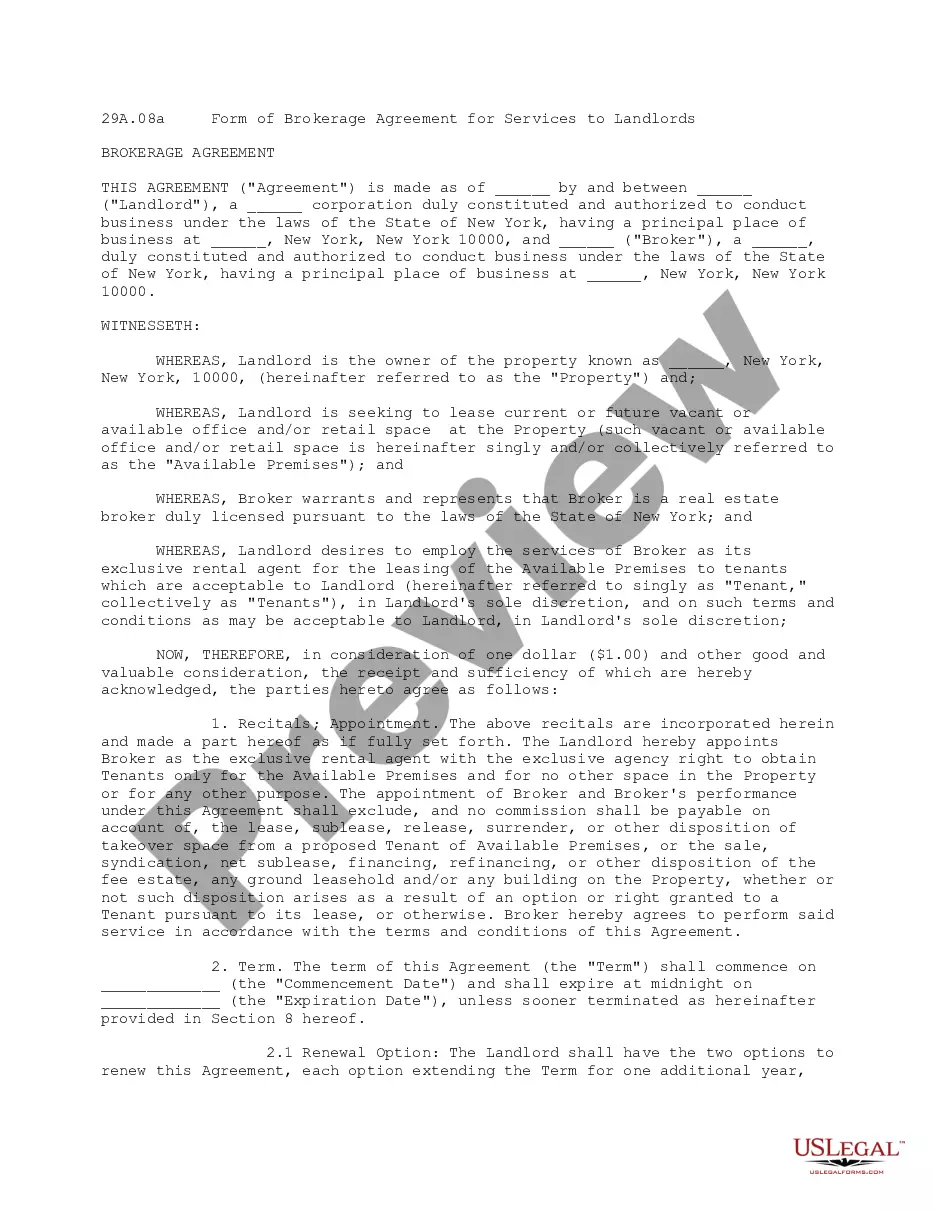

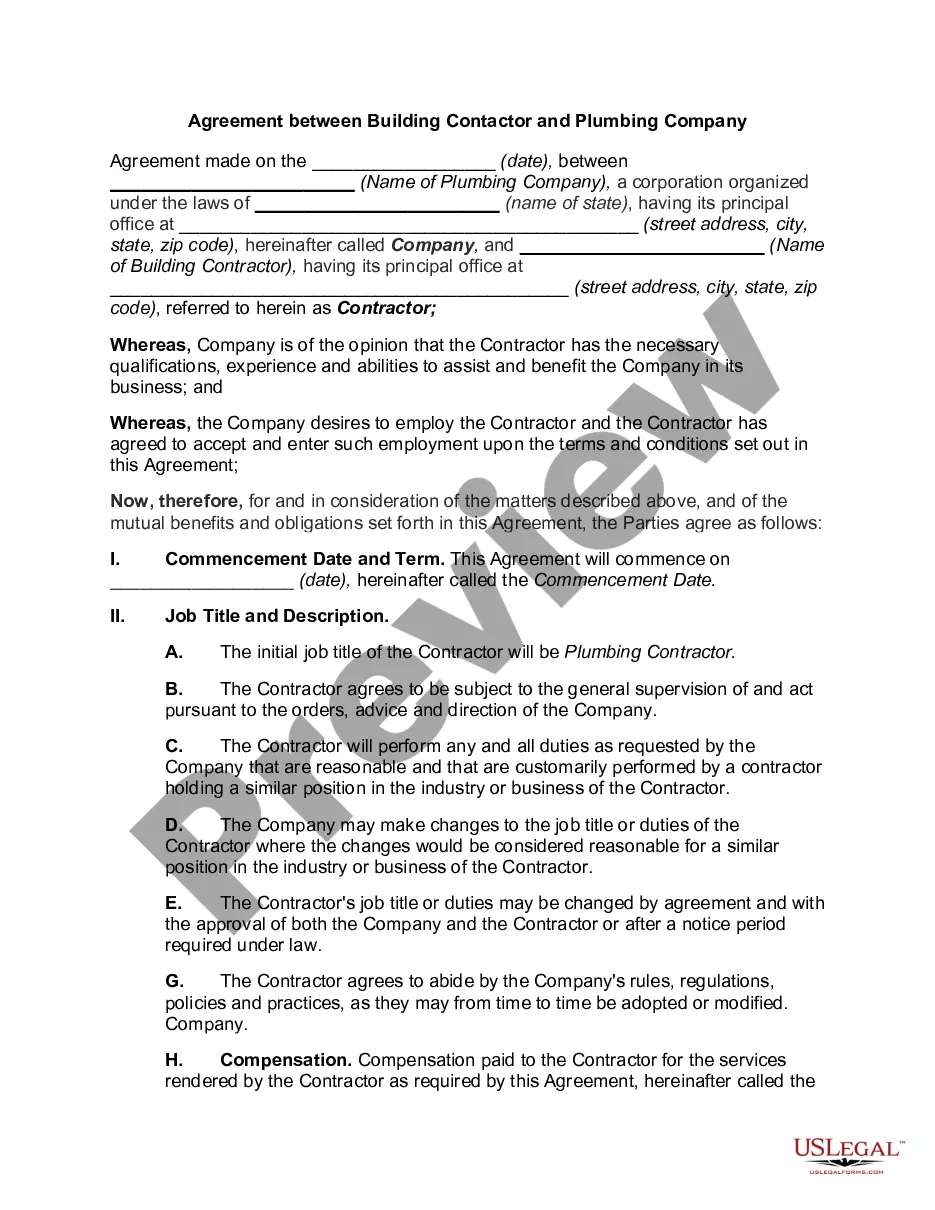

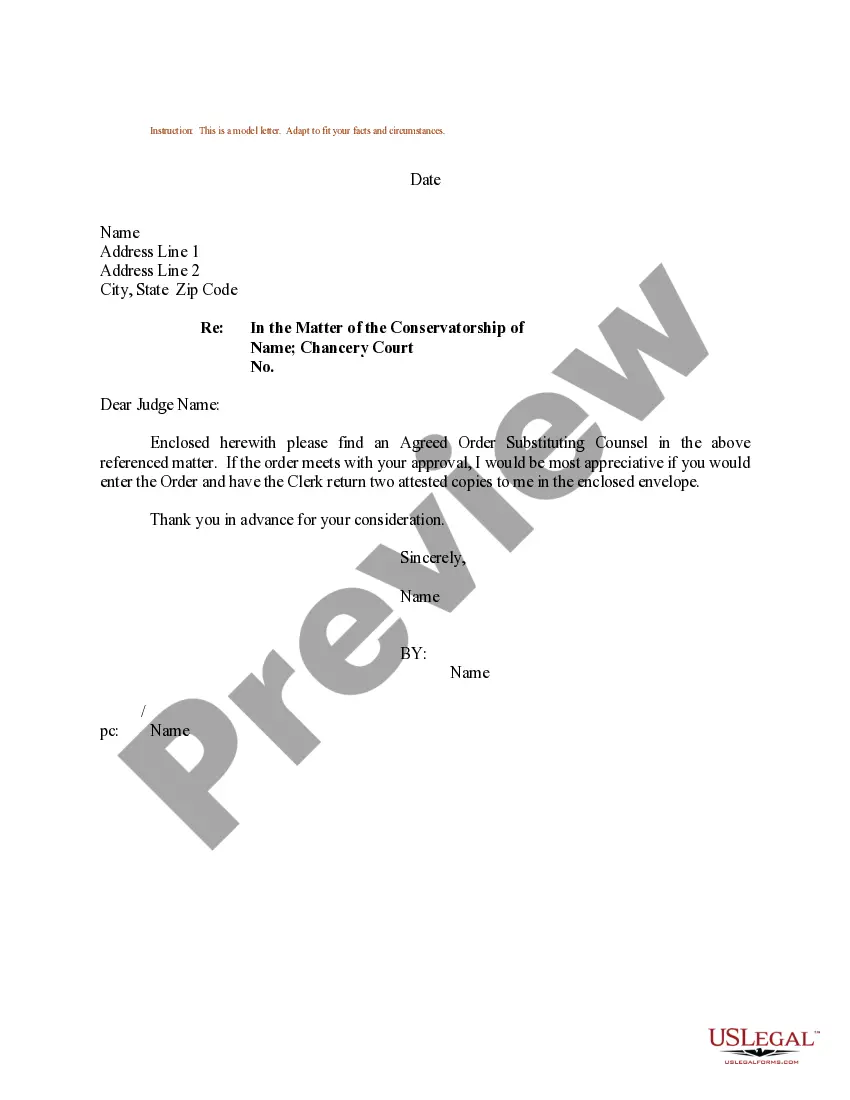

Preparing legal paperwork can be burdensome. In addition, if you decide to ask an attorney to draft a commercial agreement, papers for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Collin Insurance Agents Stock option plan, it may cost you a fortune. So what is the best way to save time and money and draft legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is an excellent solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is biggest online catalog of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any use case gathered all in one place. Consequently, if you need the current version of the Collin Insurance Agents Stock option plan, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample using the Download button. If you haven't subscribed yet, here's how you can get the Collin Insurance Agents Stock option plan:

- Look through the page and verify there is a sample for your region.

- Examine the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - search for the correct one in the header.

- Click Buy Now when you find the required sample and select the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a payment with a credit card or through PayPal.

- Choose the file format for your Collin Insurance Agents Stock option plan and download it.

When done, you can print it out and complete it on paper or import the samples to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the documents ever purchased multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!

Form popularity

FAQ

Stock options are a popular way for companies to build a strong relationship with employees and to motivate them to work hard in the interests of the company. Stock options are also a way to encourage employees to stay and not be tempted to leave and work for a competitor.

A stock option plan is a mechanism for affording selected employees and executives or managers of a company the opportunity to acquire stock in their company at a price determined at the time the options are granted and fixed for the term of the options.

The easiest way to find out which securities have options is to check directly using your broker, which is particularly easy if you use an online broker. Many of these platforms have an options chain or options series function that allows you to look up the options on a stock, if there are any.

Stock options are a form of compensation. Companies can grant them to employees, contractors, consultants and investors. These options, which are contracts, give an employee the right to buy, or exercise, a set number of shares of the company stock at a preset price, also known as the grant price.

Companies grant stock options to motivate employees. A stock option is a type of investment that allows the holder to buy a certain number of shares of a company's stock at a locked-in price.

What are the cons of offering employee stock options? Although stock option plans offer many advantages, the tax implications for employees can be complicated. Dilution can be very costly to shareholder over the long run. Stock options are difficult to value.

What are the cons of offering employee stock options? Although stock option plans offer many advantages, the tax implications for employees can be complicated. Dilution can be very costly to shareholder over the long run. Stock options are difficult to value.

Advantages of Options Trading: Cost Efficient: Options come up with huge leveraging power.High Return Potential: The returns on options trading would be much higher than buying shares on cash.Lower Risk:More Strategy Available:Disadvantages of options:Less Liquidity:High Commissions:Time Decay:

What Is a Stock Option? A stock option gives an investor the right, but not the obligation, to buy or sell a stock at an agreed-upon price and date. There are two types of options: puts, which is a bet that a stock will fall, or calls, which is a bet that a stock will rise.

Options are traded through ASX-accredited brokers. You will need to sign a Client Agreement form before you start trading. If your current broker is not active in options, or accredited to advise on options, it is wise to seek out a specialist broker in this area.