The Dallas Texas Nonemployee Directors Stock Option Plan of National Surgery Centers, Inc. is a compensation plan designed to incentivize nonemployee directors of the company. This plan aims to provide these directors with the opportunity to acquire stock in the company, thereby aligning their interests with those of the shareholders and promoting long-term growth. Under the Dallas Texas Nonemployee Directors Stock Option Plan of National Surgery Centers, Inc., eligible nonemployee directors are granted stock options, which allow them to purchase a specified number of shares of the company's common stock at a predetermined price. These options typically have a vesting period, during which the options cannot be exercised, encouraging continuity in the director's service. Once the options are vested, directors can exercise them and acquire shares of the company's stock at the predetermined price. The plan may include different types of stock options, such as: 1. Nonqualified Stock Options (Nests): These are stock options that do not qualify for special tax treatment. When the nonemployee directors exercise Nests, the difference between the exercise price and the fair market value of the stock becomes taxable as ordinary income. 2. Incentive Stock Options (SOS): These stock options may qualify for special tax treatment under the Internal Revenue Code. If certain conditions are met, nonemployee directors may be able to exercise SOS without incurring immediate tax liability. However, when the acquired shares are eventually sold, capital gain or loss taxes may apply. 3. Performance-based Stock Options: These stock options have additional performance criteria that need to be met before the options can be exercised. These criteria are typically tied to the company's financial performance, stock price, or other predetermined goals. Performance-based stock options aim to motivate and reward nonemployee directors for achieving specific targets. The Dallas Texas Nonemployee Directors Stock Option Plan of National Surgery Centers, Inc. demonstrates the company's commitment to attracting and retaining exceptional directors. By offering stock options, the plan aligns the interests of the nonemployee directors with the long-term success of the company and fosters a sense of ownership among the board members.

Dallas Texas Nonemployee Directors Stock Option Plan of National Surgery Centers, Inc.

Description

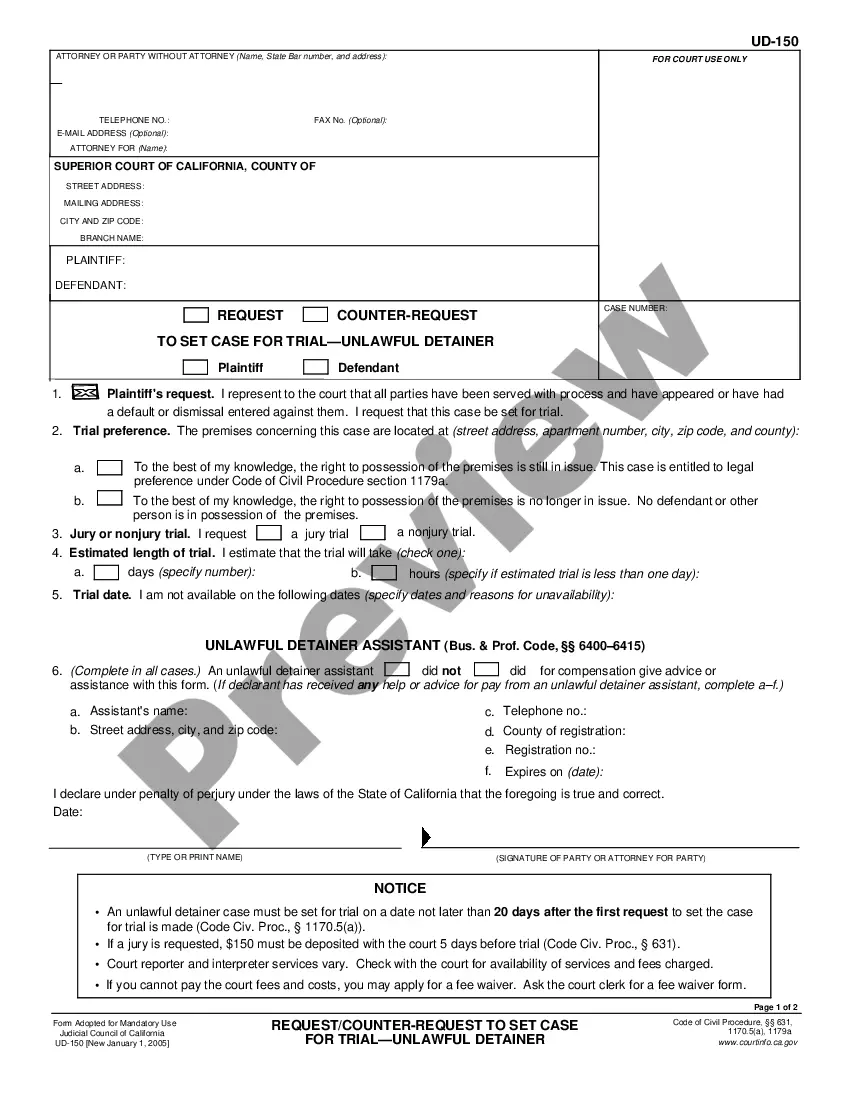

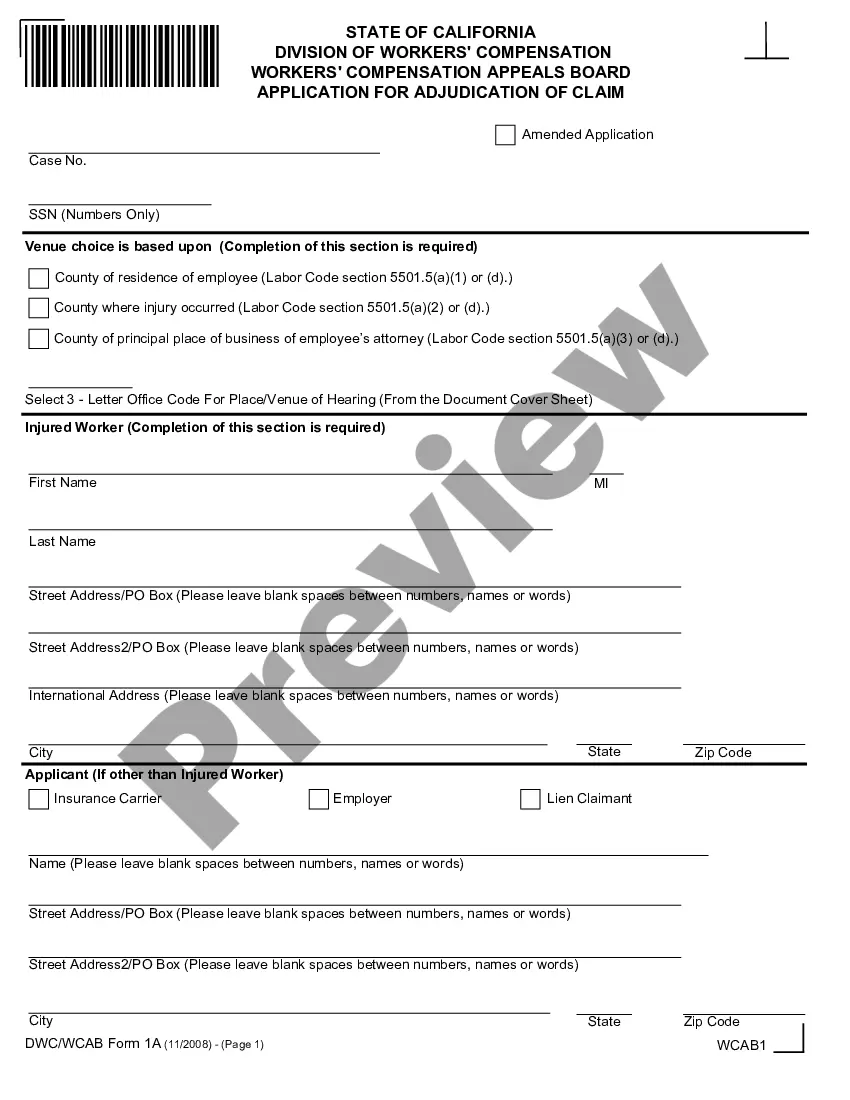

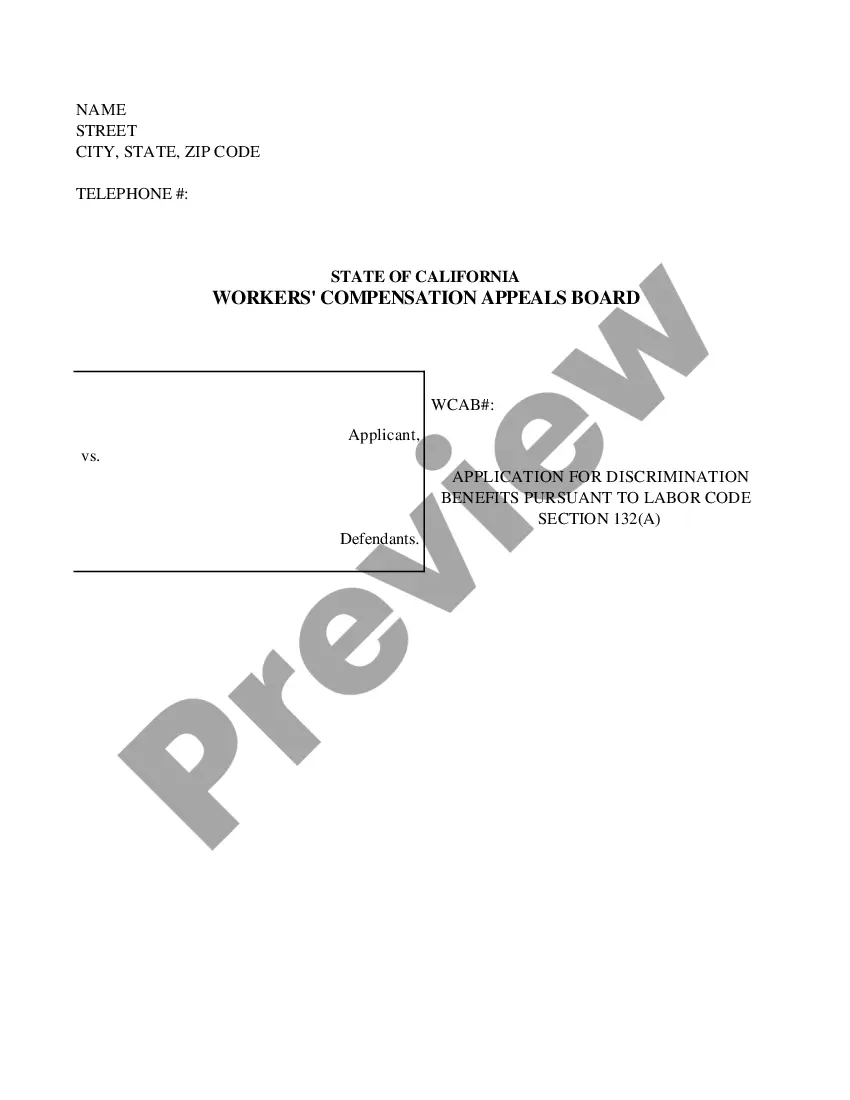

How to fill out Dallas Texas Nonemployee Directors Stock Option Plan Of National Surgery Centers, Inc.?

Do you need to quickly create a legally-binding Dallas Nonemployee Directors Stock Option Plan of National Surgery Centers, Inc. or maybe any other form to take control of your personal or corporate matters? You can go with two options: hire a legal advisor to draft a legal document for you or create it completely on your own. Luckily, there's a third solution - US Legal Forms. It will help you get neatly written legal documents without paying unreasonable fees for legal services.

US Legal Forms provides a huge collection of more than 85,000 state-specific form templates, including Dallas Nonemployee Directors Stock Option Plan of National Surgery Centers, Inc. and form packages. We provide documents for a myriad of use cases: from divorce paperwork to real estate documents. We've been on the market for more than 25 years and gained a rock-solid reputation among our customers. Here's how you can become one of them and obtain the necessary document without extra troubles.

- To start with, double-check if the Dallas Nonemployee Directors Stock Option Plan of National Surgery Centers, Inc. is adapted to your state's or county's laws.

- In case the document comes with a desciption, make sure to check what it's intended for.

- Start the searching process again if the document isn’t what you were hoping to find by utilizing the search box in the header.

- Choose the plan that is best suited for your needs and proceed to the payment.

- Select the format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, locate the Dallas Nonemployee Directors Stock Option Plan of National Surgery Centers, Inc. template, and download it. To re-download the form, just head to the My Forms tab.

It's effortless to find and download legal forms if you use our catalog. In addition, the documents we offer are reviewed by law professionals, which gives you greater confidence when dealing with legal matters. Try US Legal Forms now and see for yourself!