The Nassau New York Nonemployee Directors Stock Option Plan of National Surgery Centers, Inc. is a comprehensive and rewarding stock option program specifically designed for nonemployee directors of the company. This plan offers various types of stock options to incentivize and motivate these directors who contribute their expertise and guidance to the organization. Under this plan, nonemployee directors of National Surgery Centers, Inc. are granted stock options that allow them to purchase company shares at a pre-determined price, known as the exercise price. These stock options typically have a vesting period, during which the options become exercisable gradually over time or based on specific performance milestones. The nonemployee directors have the opportunity to benefit from the appreciation in the company's stock value, as the exercise price is usually set at the market price on the date of grant. This offers them the chance to gain substantial profits if the stock price increases over time. Moreover, these stock options can also provide a long-term financial incentive, encouraging nonemployee directors to align their interests with the shareholders and promote the company's success. The Nassau New York Nonemployee Directors Stock Option Plan may include various types of stock options, such as nonqualified stock options (Nests) or incentive stock options (SOS). The specific type of stock option granted to a nonemployee director depends on the company's guidelines and applicable regulations. Nonqualified stock options (Nests) are the most common type of stock options granted to nonemployee directors. These options offer flexibility in terms of exercise price and timing, allowing directors to maximize their financial gains by choosing the most advantageous time to exercise the options. On the other hand, incentive stock options (SOS) provide potential tax benefits for nonemployee directors. If certain conditions are met, the profits from exercising the SOS may qualify for preferential tax treatment. This type of stock option is subject to specific rules and limitations imposed by the Internal Revenue Service (IRS). Overall, the Nassau New York Nonemployee Directors Stock Option Plan of National Surgery Centers, Inc. is a valuable program that aims to attract and retain top-tier talent in the boardroom. By offering stock options, the company can align the interests of nonemployee directors with shareholders, fostering a sense of ownership and long-term commitment. This plan serves as a powerful tool to reward the invaluable contributions of these directors and drive the company towards sustainable growth and success.

Nassau New York Nonemployee Directors Stock Option Plan of National Surgery Centers, Inc.

Description

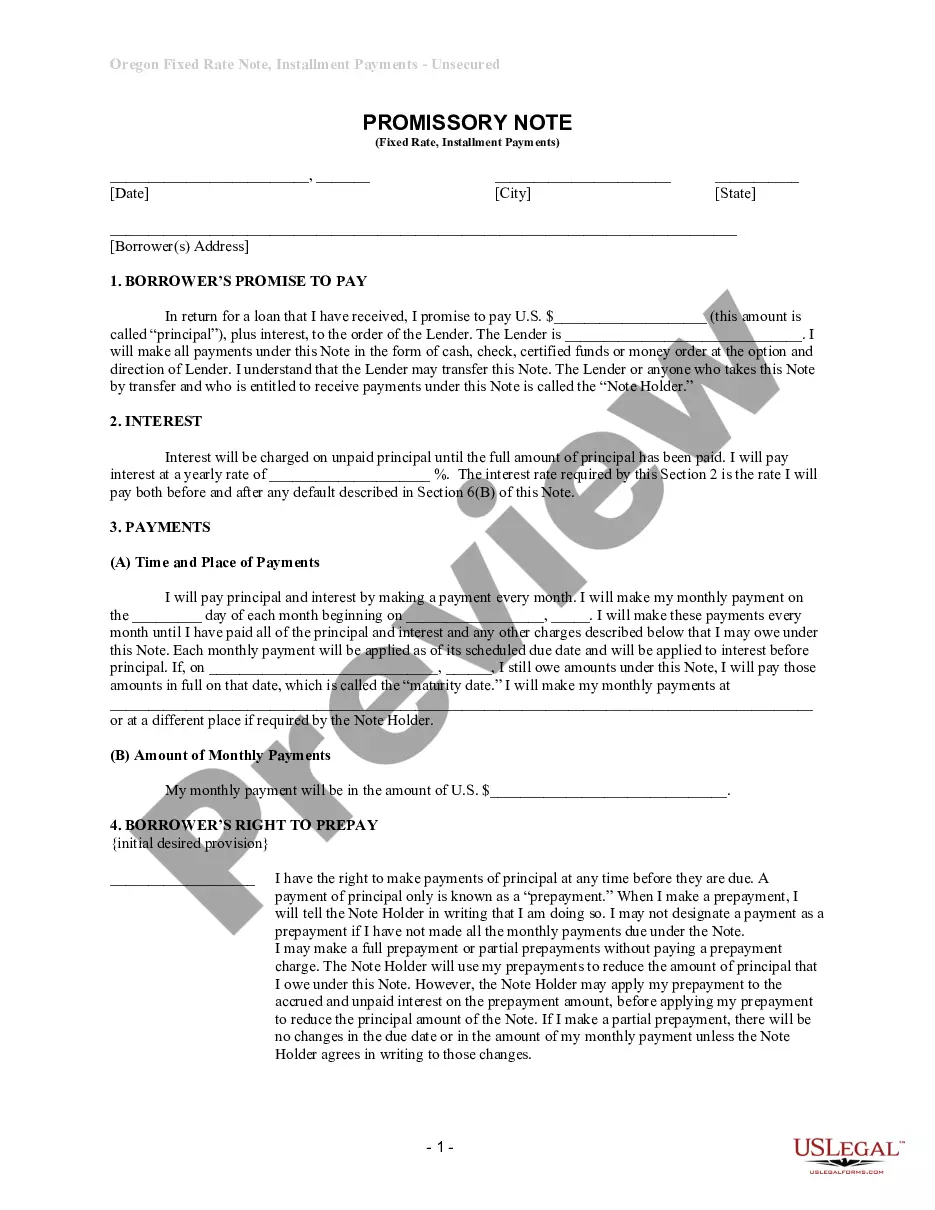

How to fill out Nassau New York Nonemployee Directors Stock Option Plan Of National Surgery Centers, Inc.?

If you need to find a reliable legal paperwork supplier to get the Nassau Nonemployee Directors Stock Option Plan of National Surgery Centers, Inc., consider US Legal Forms. Whether you need to start your LLC business or manage your asset distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the appropriate template.

- You can search from over 85,000 forms arranged by state/county and case.

- The intuitive interface, number of learning resources, and dedicated support make it simple to get and complete different paperwork.

- US Legal Forms is a reliable service providing legal forms to millions of users since 1997.

You can simply select to search or browse Nassau Nonemployee Directors Stock Option Plan of National Surgery Centers, Inc., either by a keyword or by the state/county the document is created for. After locating required template, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's effortless to get started! Simply find the Nassau Nonemployee Directors Stock Option Plan of National Surgery Centers, Inc. template and take a look at the form's preview and short introductory information (if available). If you're comfortable with the template’s language, go ahead and click Buy now. Register an account and choose a subscription option. The template will be instantly ready for download as soon as the payment is completed. Now you can complete the form.

Handling your legal matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our rich collection of legal forms makes this experience less expensive and more affordable. Create your first business, organize your advance care planning, create a real estate contract, or complete the Nassau Nonemployee Directors Stock Option Plan of National Surgery Centers, Inc. - all from the convenience of your home.

Join US Legal Forms now!