The Mecklenburg North Carolina Nonqualified Stock Option Plan of Mediocre, Inc. is a compensation program designed specifically for officers, directors, consultants, and key employees of the company. This plan provides an opportunity for these individuals to receive stock options as a form of additional compensation, offering them the right to purchase shares of the company's stock at a predetermined price. Through this plan, Mediocre, Inc. aims to motivate and retain its top talent by providing them with a potential financial incentive tied to the company's success. These stock options allow the participants to benefit from any increase in the company's stock price over time, thus aligning their interests with those of shareholders. There may be different types of Mecklenburg North Carolina Nonqualified Stock Option Plans offered by Mediocre, Inc. for officers, directors, consultants, and key employees. These plans may vary based on eligibility criteria, vesting periods, exercise price, and other key factors. One type of plan could be the "Executive Stock Option Plan," specifically designed for top-level executives such as the CEO, CFO, and other executive officers. This plan may offer more significant stock option grants and include additional performance-based vesting conditions. Another type could be the "Director Stock Option Plan," exclusively for members of the board of directors. This plan may have specific provisions to accommodate the unique nature of their roles and responsibilities. The "Consultant Stock Option Plan" may be tailored for individuals providing professional services to the company on a contractual basis. This plan allows Mediocre, Inc. to reward and motivate consultants crucial to its operations. Lastly, the "Key Employee Stock Option Plan" may be created to target non-executive employees, including managers and high-performing staff members whose contributions significantly impact the company's success. This plan may provide stock option grants to reward and retain these vital team members. It's important to note that the specifics and terms of the Mecklenburg North Carolina Nonqualified Stock Option Plans of Mediocre, Inc. may vary, and interested individuals should refer to the plan's official documentation or consult with the company's human resources or legal department for complete details. In summary, Mediocre, Inc.'s Mecklenburg North Carolina Nonqualified Stock Option Plans are a valuable tool for compensating and incentivizing officers, directors, consultants, and key employees. These plans offer participants the opportunity to purchase company stock at a predetermined price, providing potential financial gain as the stock price appreciates. Different types of plans may exist, such as the Executive, Director, Consultant, and Key Employee Stock Option Plans, each catering to specific groups within the organization.

Mecklenburg North Carolina Nonqualified Stock Option Plan of Medicore, Inc., for officers, directors, consultants, key employees

Description

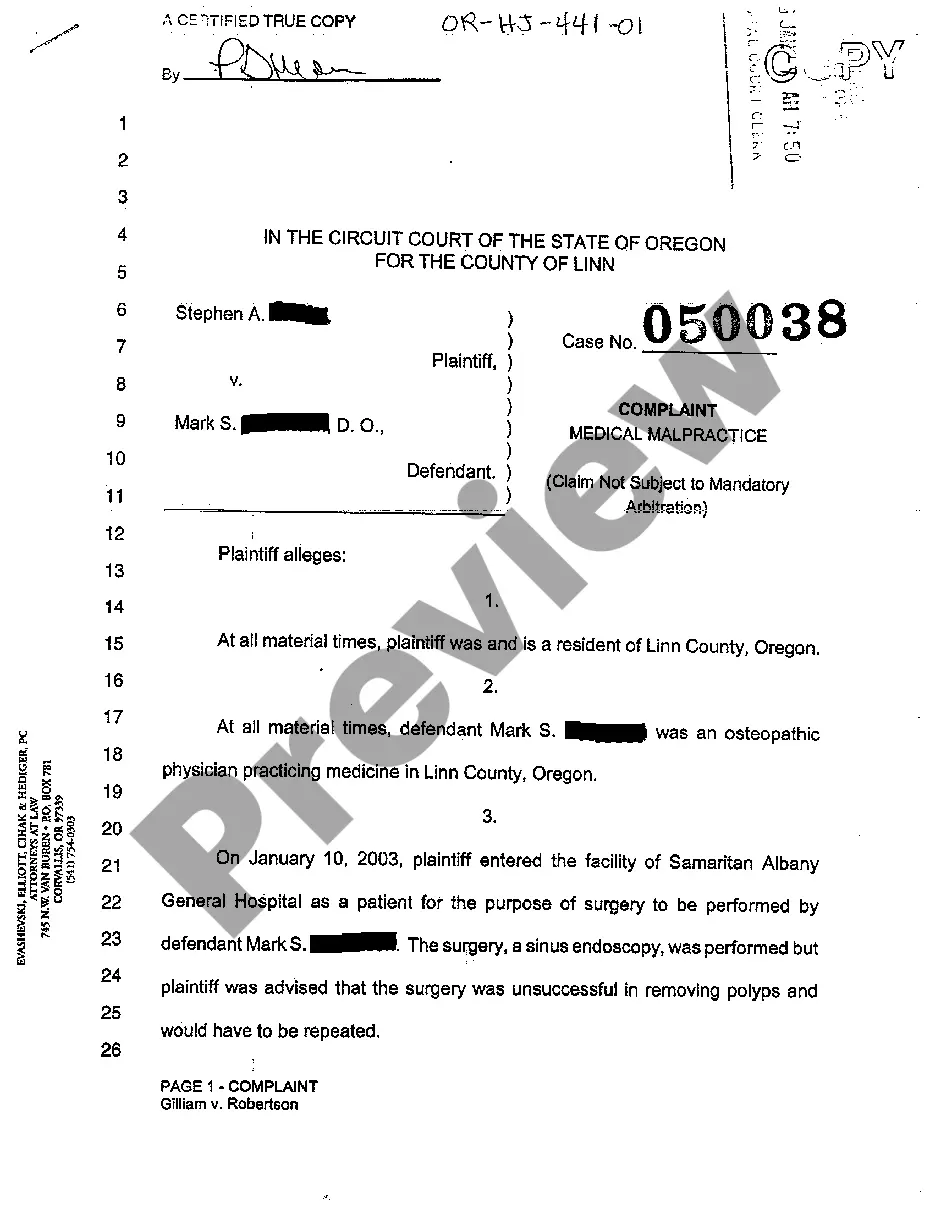

How to fill out Mecklenburg North Carolina Nonqualified Stock Option Plan Of Medicore, Inc., For Officers, Directors, Consultants, Key Employees?

Do you need to quickly draft a legally-binding Mecklenburg Nonqualified Stock Option Plan of Medicore, Inc., for officers, directors, consultants, key employees or probably any other form to handle your own or corporate matters? You can select one of the two options: contact a professional to draft a legal document for you or draft it entirely on your own. Thankfully, there's a third option - US Legal Forms. It will help you receive professionally written legal papers without paying unreasonable prices for legal services.

US Legal Forms offers a huge collection of over 85,000 state-compliant form templates, including Mecklenburg Nonqualified Stock Option Plan of Medicore, Inc., for officers, directors, consultants, key employees and form packages. We offer documents for an array of life circumstances: from divorce paperwork to real estate documents. We've been out there for more than 25 years and got a spotless reputation among our customers. Here's how you can become one of them and get the needed template without extra troubles.

- To start with, double-check if the Mecklenburg Nonqualified Stock Option Plan of Medicore, Inc., for officers, directors, consultants, key employees is adapted to your state's or county's laws.

- In case the form has a desciption, make sure to verify what it's suitable for.

- Start the searching process again if the form isn’t what you were hoping to find by utilizing the search bar in the header.

- Select the subscription that best suits your needs and move forward to the payment.

- Select the file format you would like to get your form in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, find the Mecklenburg Nonqualified Stock Option Plan of Medicore, Inc., for officers, directors, consultants, key employees template, and download it. To re-download the form, simply go to the My Forms tab.

It's stressless to find and download legal forms if you use our services. Additionally, the documents we offer are reviewed by industry experts, which gives you greater peace of mind when dealing with legal matters. Try US Legal Forms now and see for yourself!

Form popularity

FAQ

You exercise your option to purchase the shares and you hold onto the shares. You exercise your option to purchase the shares, and then you sell the shares the same day. You exercise the option to purchase the shares, then you sell them within a year or less after the day you purchased them.

There are two key differences who the stock can be issued to and the tax treatment. Qualified stock options, also known as incentive stock options, can only be granted to employees. Non-qualified stock options can be granted to employees, directors, contractors and others.

Stock acquired from exercising a non-qualified stock option is treated as any other investment property when sold. The employee's basis is the amount paid for the stock, plus any amount included in income upon exercising the option.

Non-qualified stock options are stock options that do not receive favorable tax treatment when exercised but do provide additional flexibility for the issuing company. Gains from non-qualified stock options are taxed as normal income.

A nonqualified stock option, also known as an NSO, is a form of employee compensation offered by employers wherein the option holder pays ordinary income tax on the profit made when they exercise the shares.

Key Takeaways. Non-qualified stock options require payment of income tax of the grant price minus the price of the exercised option. NSOs might be provided as an alternative form of compensation. Prices are often similar to the market value of the shares.

There are two key differences who the stock can be issued to and the tax treatment. Qualified stock options, also known as incentive stock options, can only be granted to employees. Non-qualified stock options can be granted to employees, directors, contractors and others.

Non-qualified stock options are stock options that do not receive favorable tax treatment when exercised but do provide additional flexibility for the issuing company. Gains from non-qualified stock options are taxed as normal income.

The phantom gain is taxed at ordinary income rates. So 45% of $32 is $14, which means you'll pay $17 to exercise each NSO.

Profits made from exercising qualified stock options (QSO) are taxed at the capital gains tax rate (typically 15%), which is lower than the rate at which ordinary income is taxed. Gains from non-qualified stock options (NQSO) are considered ordinary income and are therefore not eligible for the tax break.