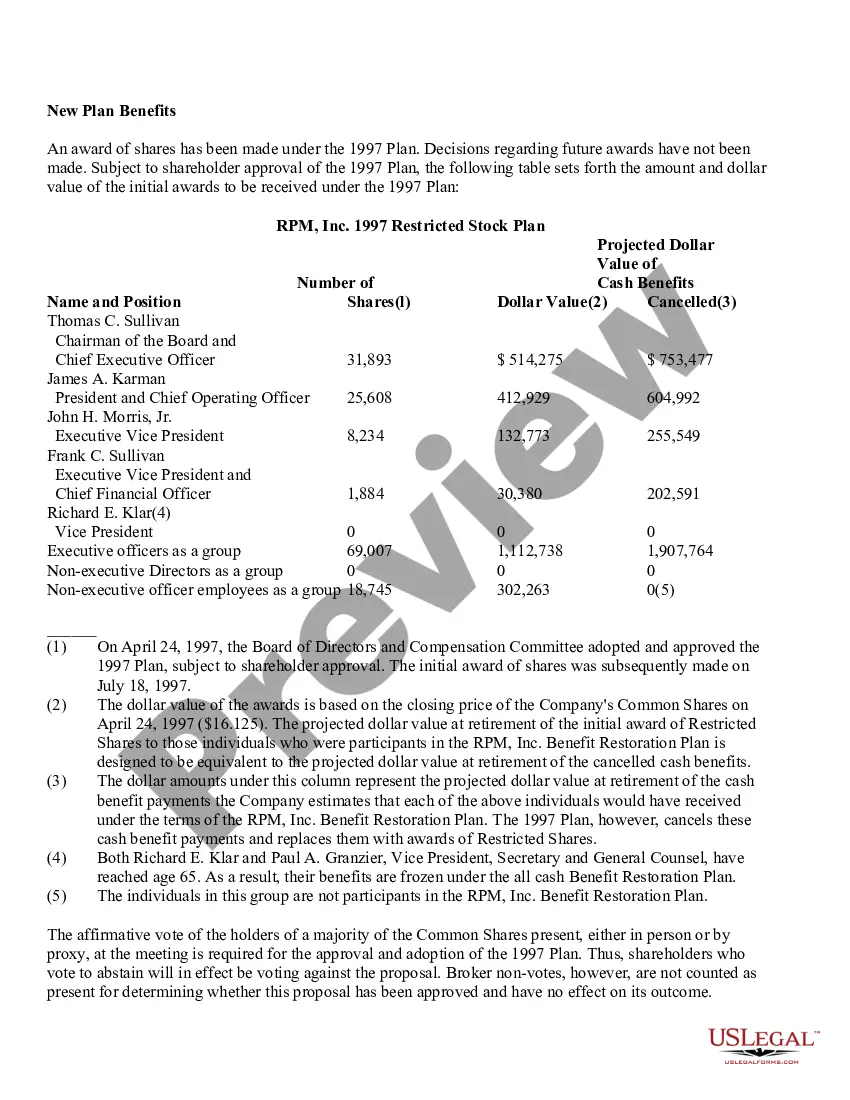

The Contra Costa California Adoption of Restricted Stock Plan of RPM, Inc. is a comprehensive employee benefit program designed to incentivize and reward employees by granting them restricted stock units (RSS) within the company. This plan is specifically tailored for RPM, Inc., a company operating in Contra Costa County, California. Under the Contra Costa California Adoption of Restricted Stock Plan, eligible employees are granted a certain number of RSS as a form of compensation. RSS represents a promise to deliver a specific number of shares of company stock to the employee at a future date, subject to certain conditions and restrictions. The plan aims to align employee interests with overall company performance, as RSS often vest over a set period of time or upon the attainment of predetermined performance targets. By doing so, it encourages employees to contribute to the growth and success of RPM, Inc. while fostering a sense of ownership and motivation. The Contra Costa California Adoption of Restricted Stock Plan also ensures that key employees remain with the company for a certain period by implementing a vesting schedule. This means that employees typically do not have immediate access to the granted RSS, but rather receive them gradually over a specified timeframe, with certain portions vesting each year. While the specific details of the Contra Costa California Adoption of Restricted Stock Plan may vary, including the vesting schedule and eligibility criteria, it generally encompasses provisions such as: 1. Eligibility: The plan sets forth the criteria for employees who are eligible to participate, often focusing on key employees, executives, or those who have met specific performance benchmarks. 2. Granting RSS: The plan outlines how RSS are granted, including the number or percentage of RSS awarded to eligible employees. It may also clarify the method of determining the fair market value of the RSS at the time of the grant. 3. Vesting Schedule: The plan defines the vesting schedule, which specifies when and how the RSS will become available to the employee. Vesting can be time-based, performance-based, or a combination of both. 4. Forfeiture: The plan may include conditions under which RSS can be forfeited by the employee, such as termination of employment or violation of certain company policies. 5. Change of Control Provisions: In the case of a change of control, such as a merger or acquisition, the plan might include provisions that address the treatment of RSS and the impact on the employees. It is important to note that the Contra Costa California Adoption of Restricted Stock Plan may have different variations or may be customized based on the specific needs and objectives of RPM, Inc. Hence, the plan's details may vary from one company to another, and its implementation is subject to legal and regulatory requirements.

Contra Costa California Adoption of Restricted Stock Plan of RPM, Inc.

Description

How to fill out Contra Costa California Adoption Of Restricted Stock Plan Of RPM, Inc.?

Drafting papers for the business or personal needs is always a huge responsibility. When drawing up a contract, a public service request, or a power of attorney, it's important to take into account all federal and state regulations of the specific region. However, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it burdensome and time-consuming to draft Contra Costa Adoption of Restricted Stock Plan of RPM, Inc. without expert assistance.

It's easy to avoid wasting money on lawyers drafting your documentation and create a legally valid Contra Costa Adoption of Restricted Stock Plan of RPM, Inc. by yourself, using the US Legal Forms online library. It is the greatest online catalog of state-specific legal documents that are professionally verified, so you can be certain of their validity when picking a sample for your county. Previously subscribed users only need to log in to their accounts to download the necessary form.

If you still don't have a subscription, follow the step-by-step guide below to obtain the Contra Costa Adoption of Restricted Stock Plan of RPM, Inc.:

- Look through the page you've opened and verify if it has the document you require.

- To achieve this, use the form description and preview if these options are presented.

- To find the one that fits your needs, utilize the search tab in the page header.

- Recheck that the template complies with juridical criteria and click Buy Now.

- Pick the subscription plan, then sign in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever obtained never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and quickly obtain verified legal templates for any situation with just a few clicks!