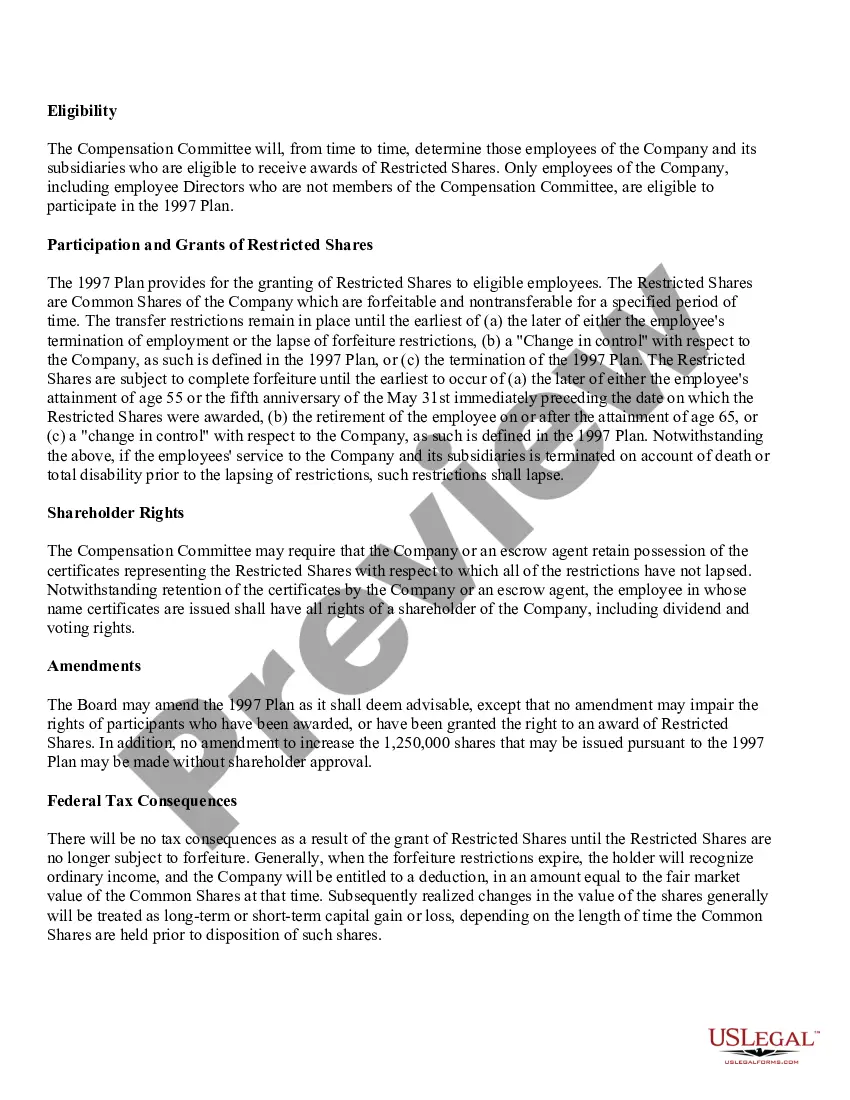

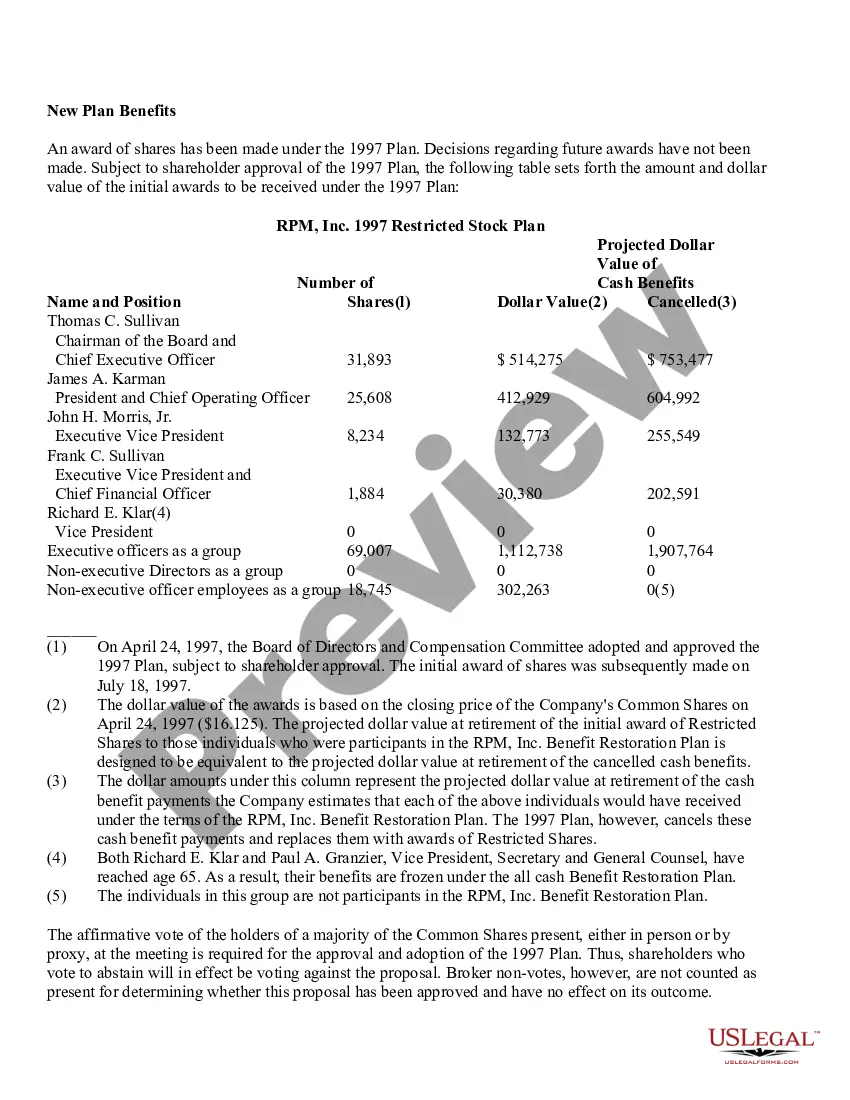

Title: A Comprehensive Overview of Cook Illinois Adoption of Restricted Stock Plan by RPM, Inc. Introduction: Cook Illinois Adoption of Restricted Stock Plan of RPM, Inc., is a key aspect of the company's compensation structure aimed at motivating and retaining top talent. This detailed description highlights the purpose, features, benefits, and types of Cook Illinois Adoption of Restricted Stock Plan(s) offered by RPM, Inc. Keywords: Cook Illinois Adoption, Restricted Stock Plan, RPM, Inc., types, description, purpose, features, benefits 1. Purpose of Cook Illinois Adoption of Restricted Stock Plan: The primary purpose of Cook Illinois Adoption of Restricted Stock Plan is to provide eligible employees of RPM, Inc. with a performance-based incentive through the granting of restricted stock units or shares. It serves as a powerful tool to align employee interests with the long-term success of the company while attracting, rewarding, and retaining skilled professionals. 2. Features of Cook Illinois Adoption of Restricted Stock Plan: — Granting Restricted Stock Units/Shares: Cook Illinois Adoption of Restricted Stock Plan offers eligible employees the opportunity to receive restricted stock units or shares. — Vesting Period: The plan typically includes a vesting period during which employees must fulfill certain conditions or meet specific performance metrics to gain ownership rights. — Stock Price Determination: Stock prices for restricted stock units/shares may be determined based on the market price at the grant date or a pre-determined formula. — Transferability and Sale Restrictions: The plan may impose restrictions on the transfer or sale of restricted stock units/shares, ensuring their retention by employees within the organization. — Dividend Equivalent Rights: Eligible participants may receive dividend equivalent rights on their restricted stock units/shares, allowing them to earn dividends during the restricted period. 3. Benefits of Cook Illinois Adoption of Restricted Stock Plan: — Motivational Tool: The plan serves as a powerful motivator as it ties employee's financial rewards to overall company performance and long-term growth. — Retention of Top Talent: By offering restricted stock units/shares, RPM, Inc. can attract, retain, and incentivize key employees, thereby reducing turnover rates and maintaining a highly skilled workforce. — Alignment of Interests: The plan aligns the interests of employees with shareholders, ensuring everyone works towards achieving the company's strategic objectives. — Financial Reward: Successful completion of the vesting period can result in substantial financial rewards, allowing employees to directly benefit from the company's growth. Types of Cook Illinois Adoption of Restricted Stock Plan of RPM, Inc.: 1. Performance-Based Restricted Stock Plan: Focuses on specific performance criteria, such as meeting revenue targets or achieving specific milestones, to determine stock grants and vesting schedules. 2. Time-Based Restricted Stock Plan: Relies on a predetermined vesting schedule, typically spanning multiple years, ensuring employee loyalty and retention through tenure-based ownership. 3. Hybrid Restricted Stock Plan: A combination of performance-based and time-based elements, providing both short-term performance incentives and long-term retention benefits. Conclusion: Cook Illinois Adoption of Restricted Stock Plan is an integral part of RPM, Inc.'s compensation strategy, prioritizing employee motivation, retention, and alignment with shareholder interests. By offering attractive benefits and incentives, RPM, Inc. ensures it can attract and reward top talent, fostering continuous growth and success.

Cook Illinois Adoption of Restricted Stock Plan of RPM, Inc.

Description

How to fill out Cook Illinois Adoption Of Restricted Stock Plan Of RPM, Inc.?

If you need to find a reliable legal document supplier to find the Cook Adoption of Restricted Stock Plan of RPM, Inc., look no further than US Legal Forms. No matter if you need to launch your LLC business or manage your belongings distribution, we got you covered. You don't need to be well-versed in in law to locate and download the needed form.

- You can search from more than 85,000 forms arranged by state/county and situation.

- The intuitive interface, variety of supporting resources, and dedicated support make it easy to locate and execute different paperwork.

- US Legal Forms is a reliable service providing legal forms to millions of users since 1997.

You can simply select to look for or browse Cook Adoption of Restricted Stock Plan of RPM, Inc., either by a keyword or by the state/county the form is intended for. After locating required form, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's easy to get started! Simply locate the Cook Adoption of Restricted Stock Plan of RPM, Inc. template and check the form's preview and short introductory information (if available). If you're comfortable with the template’s language, go ahead and click Buy now. Create an account and choose a subscription option. The template will be immediately ready for download as soon as the payment is completed. Now you can execute the form.

Taking care of your legal affairs doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our comprehensive variety of legal forms makes this experience less expensive and more reasonably priced. Create your first business, organize your advance care planning, draft a real estate contract, or execute the Cook Adoption of Restricted Stock Plan of RPM, Inc. - all from the convenience of your sofa.

Join US Legal Forms now!