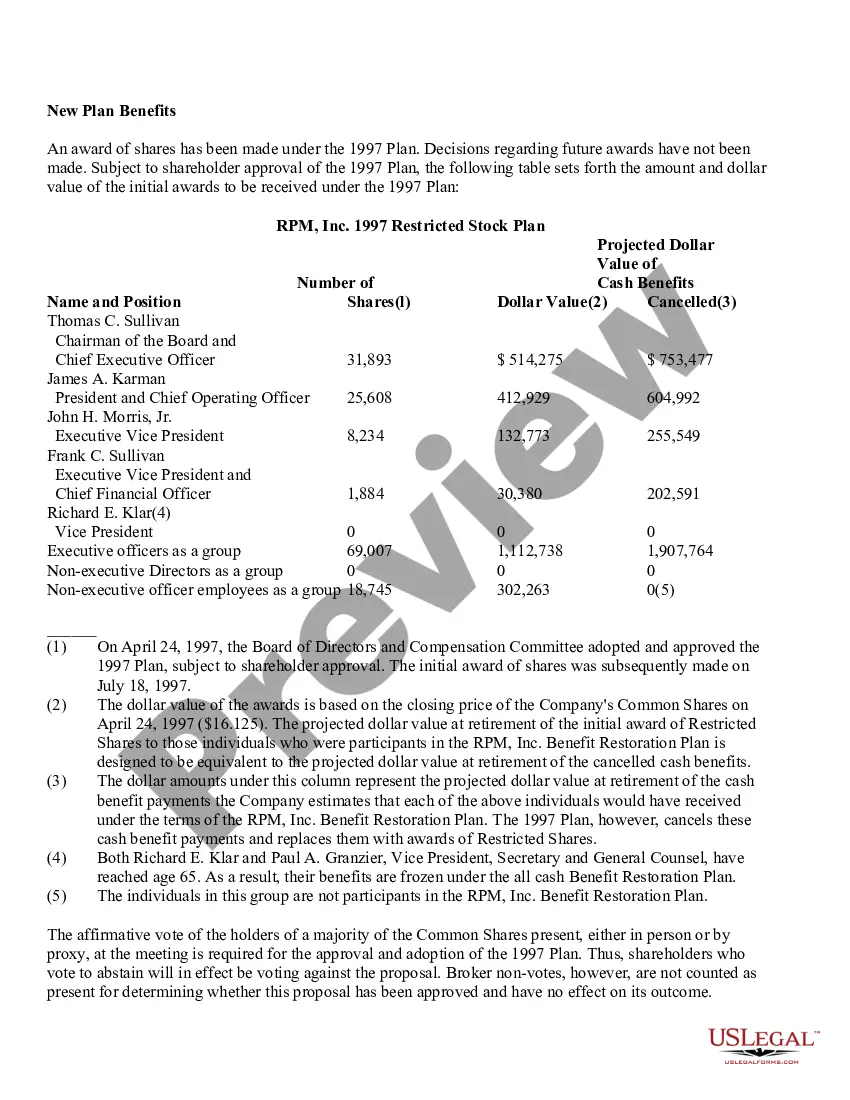

The Houston Texas Adoption of Restricted Stock Plan of RPM, Inc. is a comprehensive program designed to incentivize and reward employees of RPM, Inc., a prominent company based in Houston, Texas. This restricted stock plan is tailored to provide eligible employees with an opportunity to acquire and hold company stock, thus aligning their interests with the company's long-term growth objectives. The Houston Texas Adoption of Restricted Stock Plan offers various types of stock grants and awards to eligible employees, enhancing their motivation, commitment, and retention within the organization. These types of grants may include restricted stock units (RSS), performance-based restricted stock units (Versus), stock options, or stock appreciation rights (SARS), among others. Restricted stock units (RSS) are the most commonly offered type of stock grants under this plan. When an employee is granted RSS, they receive virtual stock units that convert into actual shares of RPM, Inc. stock after a predetermined vesting period. The vesting period ensures that employees remain dedicated to the company and its success. Upon vesting, employees gain full ownership of the shares and can sell them or keep them as they see fit. Performance-based restricted stock units (Versus) are another variant of stock grants available under the Houston Texas Adoption of Restricted Stock Plan. Versus are granted based on certain performance metrics and goals, which are agreed upon by the employee and the company. The employee's eligibility to receive the shares is tied to their individual or team performance, encouraging exceptional contributions and aligning rewards with achievements. Stock options represent another type of incentive provided under the plan. Employees who receive stock options are given the right to purchase a specified number of company shares at a predetermined price, known as the exercise price. These options typically have a set expiration date, and employees can exercise them (purchase the shares) after a specific vesting period. Stock options offer employees the potential for future gains as the company's stock price increases, motivating them to contribute to the company's success. Similarly, stock appreciation rights (SARS) are granted to employees and entitle them to receive the appreciation in the company's stock value over a specified period. SARS are typically granted without requiring the employee to purchase the shares and are settled in cash or additional stock after the vesting period. SARS provides an opportunity for employees to benefit from the company's stock price growth without assuming any financial risk. The Houston Texas Adoption of Restricted Stock Plan of RPM, Inc. aims to attract, retain, and reward talented employees who drive the company's performance and growth. This comprehensive plan offers various types of stock grants, including RSS, Versus, stock options, and SARS, providing employees with diverse avenues to participate in the company's equity while aligning their interests with long-term value creation.

Houston Texas Adoption of Restricted Stock Plan of RPM, Inc.

Description

How to fill out Houston Texas Adoption Of Restricted Stock Plan Of RPM, Inc.?

Drafting documents for the business or personal demands is always a big responsibility. When creating a contract, a public service request, or a power of attorney, it's essential to consider all federal and state regulations of the particular area. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it stressful and time-consuming to draft Houston Adoption of Restricted Stock Plan of RPM, Inc. without expert assistance.

It's easy to avoid spending money on lawyers drafting your documentation and create a legally valid Houston Adoption of Restricted Stock Plan of RPM, Inc. on your own, using the US Legal Forms online library. It is the greatest online catalog of state-specific legal templates that are professionally verified, so you can be certain of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to save the needed document.

If you still don't have a subscription, adhere to the step-by-step instruction below to get the Houston Adoption of Restricted Stock Plan of RPM, Inc.:

- Examine the page you've opened and verify if it has the sample you need.

- To do so, use the form description and preview if these options are presented.

- To find the one that meets your requirements, utilize the search tab in the page header.

- Recheck that the template complies with juridical standards and click Buy Now.

- Choose the subscription plan, then sign in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever obtained never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and easily obtain verified legal forms for any scenario with just a few clicks!