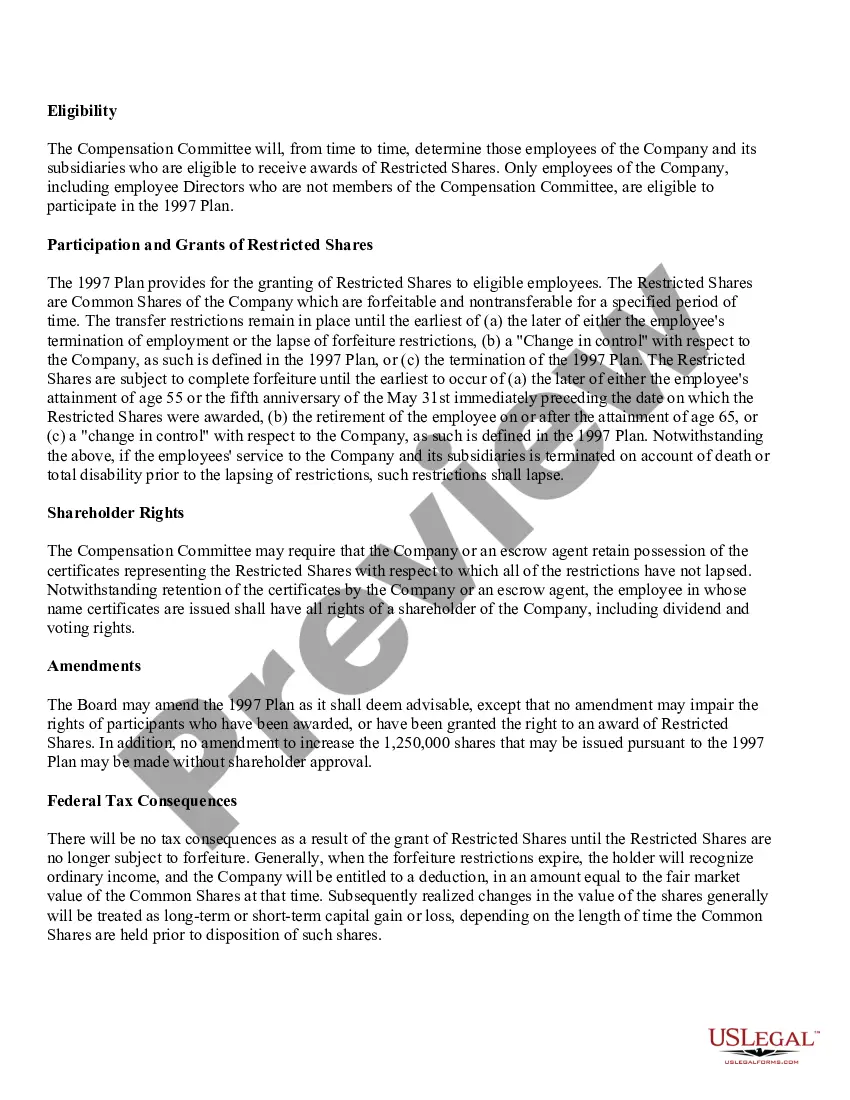

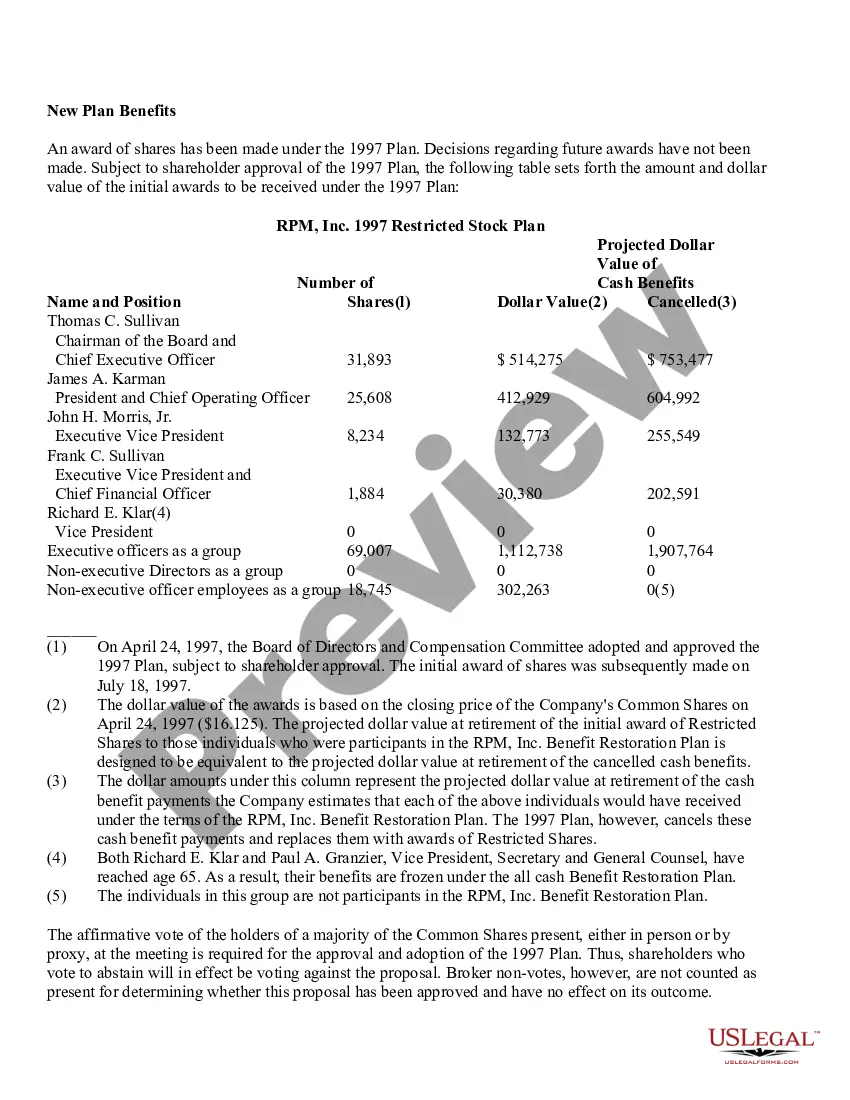

Title: Understanding the Maricopa Arizona Adoption of Restricted Stock Plan of RPM, Inc. Introduction: The Maricopa Arizona Adoption of Restricted Stock Plan serves as a comprehensive framework for RPM, Inc. to grant restricted stock awards to eligible employees in Maricopa, Arizona. This detailed plan aims to motivate and retain key personnel by offering them a unique compensation opportunity tied to the company's performance. In this article, we will explore the specifics of the Maricopa Arizona Adoption of Restricted Stock Plan, its benefits, and potential variations. I. Key Components: 1. Vesting Schedule: The Maricopa Arizona Adoption of Restricted Stock Plan outlines the vesting schedule, specifying the timeframe during which employees have to meet specific requirements to gain ownership of the granted restricted stock. 2. Performance Criteria: RPM, Inc. sets performance targets that employees must achieve to qualify for the restricted stock grant. These criteria are established to align employee efforts with the company's strategic goals and overall success. 3. Eligibility and Allocation: The plan details the eligibility criteria for participation in the Maricopa Arizona Adoption of Restricted Stock Plan. It also explains the allocation process, ensuring fairness and transparency in awarding restricted stock to deserving employees. 4. Transferability Restrictions: The plan establishes restrictions on the transferability of the awarded restricted stock, preventing employees from selling or transferring shares until specific conditions or timelines are met. II. Benefits and Advantages: 1. Retention and Motivation: By offering restricted stock awards, RPM, Inc. can motivate employees to stay with the company for the long term, as stock ownership creates a sense of ownership and alignment with its success. 2. Performance-Driven Culture: The plan promotes a performance-driven work culture by tying rewards to predefined performance targets. This encourages employees to strive for excellence and actively contribute to the company's growth. 3. Wealth Accumulation: A successful restricted stock plan allows employees the opportunity to accumulate wealth as the value of the awarded stocks appreciates over time, potentially enhancing their financial security. III. Types of Maricopa Arizona Adoption of Restricted Stock Plan: While the specific variations of the Maricopa Arizona Adoption of Restricted Stock Plan may vary depending on RPM, Inc.'s unique requirements, some common types are: 1. Time-based Vesting Plan: The restricted stock grant becomes fully vested after a predetermined period of time, encouraging employee loyalty and dedication. 2. Performance-based Vesting Plan: Restricted stock vests based on the achievement of specific performance goals, typically aligned with the company's financial, operational, or strategic objectives. 3. Hybrid Vesting Plan: This type combines time-based and performance-based vesting, providing a balanced approach that factors in both employee service duration and individual or team performance. Conclusion: The Maricopa Arizona Adoption of Restricted Stock Plan of RPM, Inc. signifies a strategic initiative to incentivize and reward employees in Maricopa, Arizona, for their dedication and contribution to the company's growth. By carefully establishing eligibility criteria, allocation processes, and vesting schedules, RPM, Inc. aims to foster a motivated and engaged workforce that directly contributes to the organization's long-term success.

Maricopa Arizona Adoption of Restricted Stock Plan of RPM, Inc.

Description

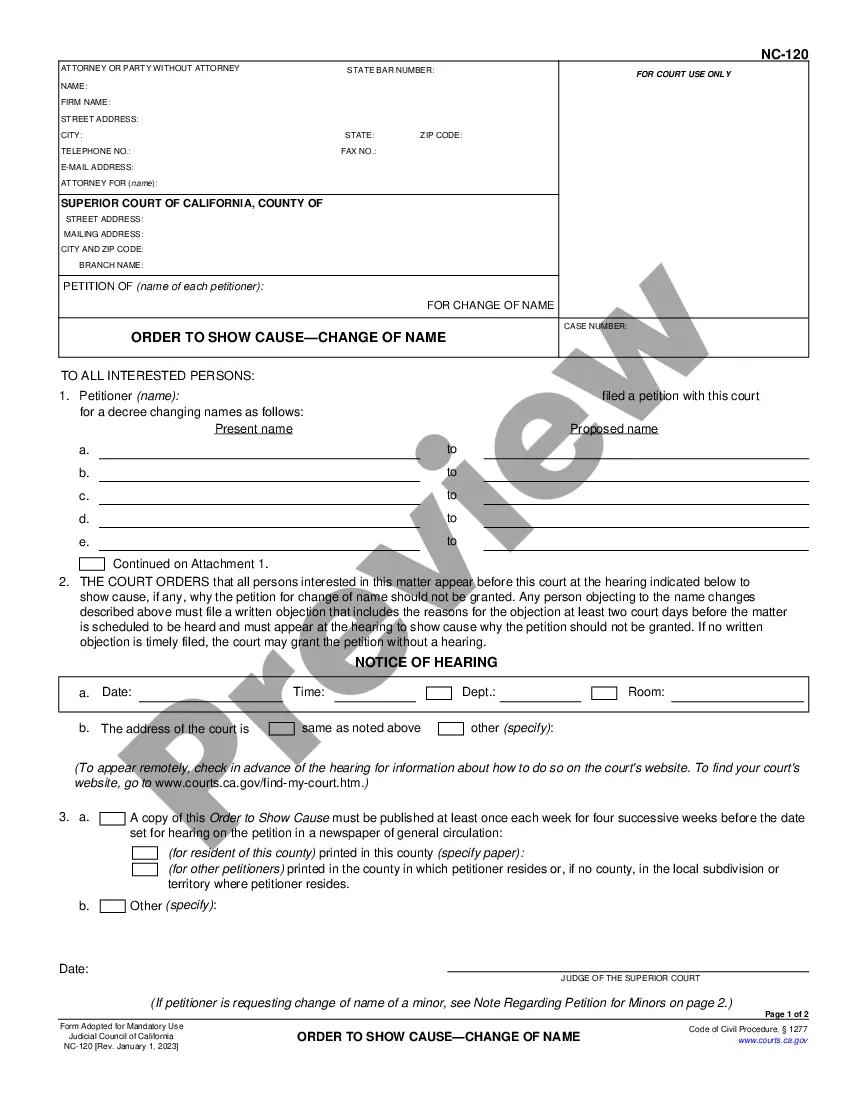

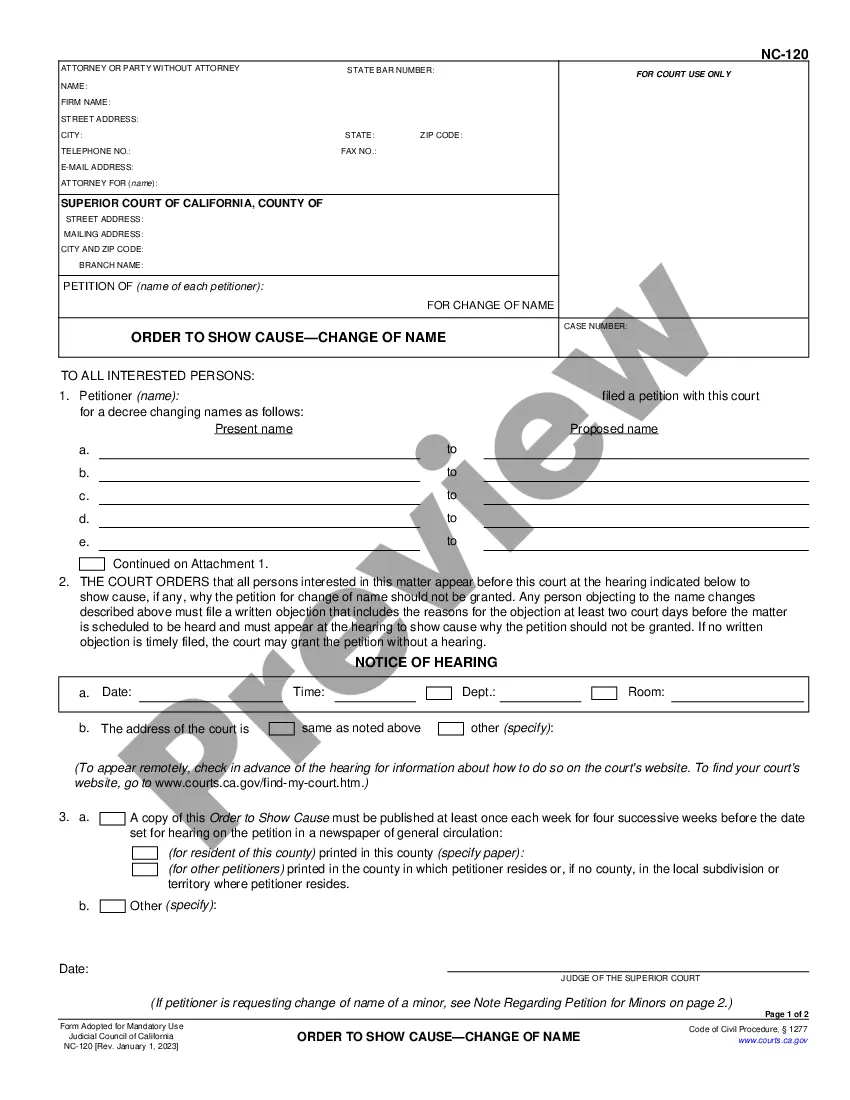

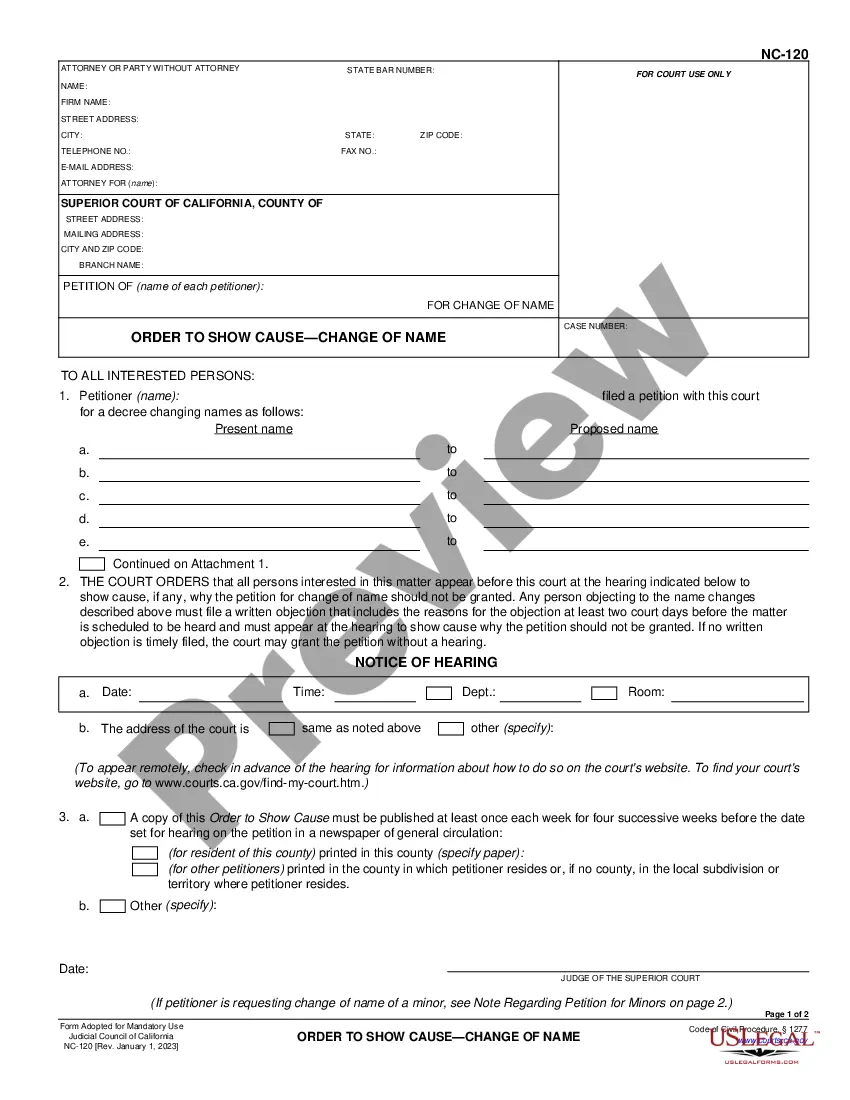

How to fill out Maricopa Arizona Adoption Of Restricted Stock Plan Of RPM, Inc.?

Are you looking to quickly create a legally-binding Maricopa Adoption of Restricted Stock Plan of RPM, Inc. or probably any other form to manage your personal or corporate affairs? You can select one of the two options: contact a professional to draft a valid document for you or draft it completely on your own. Luckily, there's an alternative solution - US Legal Forms. It will help you get neatly written legal documents without paying sky-high fees for legal services.

US Legal Forms provides a rich collection of more than 85,000 state-compliant form templates, including Maricopa Adoption of Restricted Stock Plan of RPM, Inc. and form packages. We offer templates for an array of life circumstances: from divorce papers to real estate documents. We've been out there for more than 25 years and gained a rock-solid reputation among our customers. Here's how you can become one of them and get the needed template without extra hassles.

- First and foremost, carefully verify if the Maricopa Adoption of Restricted Stock Plan of RPM, Inc. is adapted to your state's or county's regulations.

- If the document comes with a desciption, make sure to verify what it's suitable for.

- Start the search again if the template isn’t what you were seeking by utilizing the search box in the header.

- Choose the plan that best suits your needs and move forward to the payment.

- Select the file format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, find the Maricopa Adoption of Restricted Stock Plan of RPM, Inc. template, and download it. To re-download the form, simply go to the My Forms tab.

It's effortless to buy and download legal forms if you use our catalog. Moreover, the paperwork we provide are updated by industry experts, which gives you greater peace of mind when writing legal affairs. Try US Legal Forms now and see for yourself!

Form popularity

FAQ

Restricted stock units are issued to employees through a vesting plan and distribution schedule after they achieve required performance milestones or upon remaining with their employer for a particular length of time. RSUs give employees interest in company stock but no tangible value until vesting is complete.

Restricted stocks come in two formsone giving the holder voting rights immediately, and the other holding back these rights based on a vesting schedule. Controlled stock, conversely, is a stock that is held by a business affiliatenot necessarily an employee.

Restricted shares may also be restricted by a double-trigger provision. That means that an employee's shares become unrestricted if the company is acquired by another and the employee is fired in the restructuring that follows. Insiders are often awarded restricted shares after a merger or other major corporate event.

Restricted stock entitles you to receive dividends when they are paid to shareholders. Unlike stock options, which rarely carry dividend equivalent rights, restricted stock typically entitles you to receive dividends when they are paid to shareholders.

Generally, leaving the company before the vesting date of restricted stock or RSUs causes the forfeiture of shares that have not vested. Exceptions can occur, depending on the terms of your employment agreement.

How to Sell Restricted Stock Fulfill the SEC holding period requirements.Comply with federal reporting requirements.Check trading volume.Remove the stock legend.Conduct an ordinary brokerage transaction.File required notices with the SEC.

How to Sell Restricted Stock Fulfill the SEC holding period requirements.Comply with federal reporting requirements.Check trading volume.Remove the stock legend.Conduct an ordinary brokerage transaction.File required notices with the SEC.

Usually, it is recommended to sell the RSU immediately after the vesting period is complete to avoid any additional taxes. Insiders and employees that hold the RSU, need a RSU selling strategy. But for investors with a different and more diverse portfolio, holding on to the RSU is the choice to make.

How to Sell Restricted Stock Fulfill the SEC holding period requirements.Comply with federal reporting requirements.Check trading volume.Remove the stock legend.Conduct an ordinary brokerage transaction.File required notices with the SEC.

If you're granted RSUs, you get to essentially own company shares without putting any money down (unlike when you are exercising stock options). So, when is the best time to sell your RSUs? If your company is public, the best thing to do is to cash them out as soon as they vest.