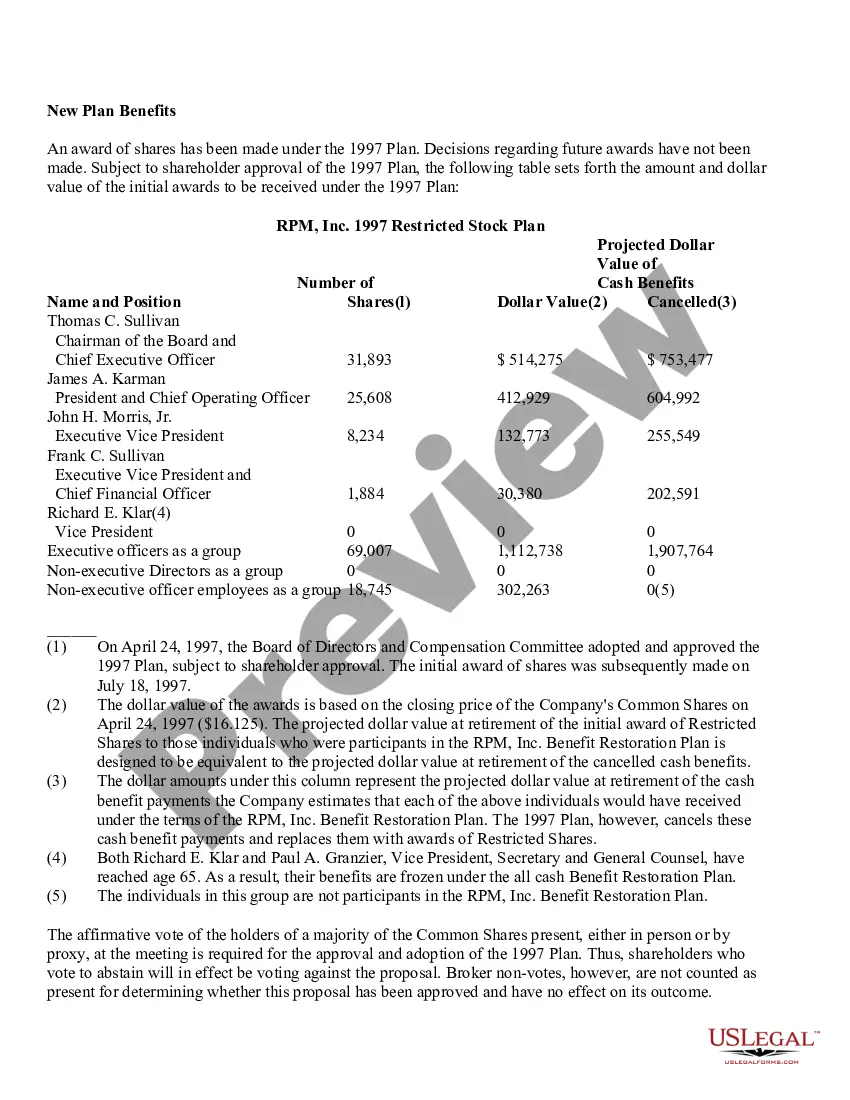

The Wake North Carolina Adoption of Restricted Stock Plan of RPM, Inc. is a comprehensive employee benefit program aimed at incentivizing and rewarding employees of RPM, Inc., a leading company in the XYZ industry. This plan allows employees to acquire restricted stock units (RSS) as a form of compensation, providing them with a vested interest in the company's success. Under the Wake North Carolina Adoption of Restricted Stock Plan, eligible employees have the opportunity to receive a grant of RSS, which represent a right to receive RPM, Inc.'s common stock at a predetermined future date. These grants are subject to certain restrictions and vesting schedules, ensuring that employees remain with the company in order to fully benefit from their RSS. The plan offers several variations of the Wake North Carolina Adoption of Restricted Stock Plan, tailored to different employee groups within the company, including executives, management-level employees, and general employees. Each variant of the plan has unique provisions and guidelines, which determine the number of RSS granted, vesting periods, and any performance-based criteria that may apply. The Wake North Carolina Adoption of Restricted Stock Plan also focuses on aligning the interests of RPM, Inc. employees with the company's overall performance and long-term objectives. By providing employees with a stake in the company's success, the plan encourages them to actively contribute to its growth, profitability, and shareholder value. RSS granted through the plan may have certain performance-based conditions, allowing employees to earn additional shares based on specific financial or operational targets achieved by the company. Furthermore, the plan incorporates provisions relating to the treatment of RSS in the event of a change in control or termination of employment. In such cases, employees may be entitled to accelerated vesting or other benefits, depending on the circumstances of their departure from the company. In summary, the Wake North Carolina Adoption of Restricted Stock Plan of RPM, Inc. is a comprehensive employee incentive program that grants RSS to eligible employees, providing them with an ownership interest in the company. The plan is designed to motivate employees, align their interests with the company's goals, and promote long-term commitment and loyalty. It offers various plan variants catering to different employee groups and incorporates provisions for change in control or termination situations.

Wake North Carolina Adoption of Restricted Stock Plan of RPM, Inc.

Description

How to fill out Wake North Carolina Adoption Of Restricted Stock Plan Of RPM, Inc.?

Are you looking to quickly create a legally-binding Wake Adoption of Restricted Stock Plan of RPM, Inc. or probably any other document to manage your personal or business affairs? You can go with two options: hire a legal advisor to draft a valid document for you or create it entirely on your own. The good news is, there's an alternative option - US Legal Forms. It will help you get neatly written legal documents without paying unreasonable fees for legal services.

US Legal Forms offers a rich collection of over 85,000 state-compliant document templates, including Wake Adoption of Restricted Stock Plan of RPM, Inc. and form packages. We offer templates for a myriad of use cases: from divorce papers to real estate document templates. We've been out there for more than 25 years and gained a rock-solid reputation among our customers. Here's how you can become one of them and obtain the needed template without extra troubles.

- To start with, double-check if the Wake Adoption of Restricted Stock Plan of RPM, Inc. is tailored to your state's or county's regulations.

- If the document includes a desciption, make sure to check what it's suitable for.

- Start the search again if the form isn’t what you were seeking by using the search box in the header.

- Select the subscription that best suits your needs and move forward to the payment.

- Select the file format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can simply log in to it, locate the Wake Adoption of Restricted Stock Plan of RPM, Inc. template, and download it. To re-download the form, simply head to the My Forms tab.

It's effortless to buy and download legal forms if you use our catalog. Moreover, the documents we offer are reviewed by law professionals, which gives you greater peace of mind when dealing with legal matters. Try US Legal Forms now and see for yourself!

Form popularity

FAQ

Restricted stock is an award of company stock, subject to conditions (such as continued service to the company or attainment of performance goals) that must be met before you have the right to sell or transfer the stock. Restricted Stock Units (RSUs) are equivalent to shares, but are converted to stock upon vesting.

Restricted stock is a form of executive compensation where non-transferable shares are issued to employees that come with conditions on the timing of the sale.

RSUs are appealing because if the company performs well and the share price takes off, employees can receive a significant financial benefit. This can motivate employees to take ownership. Since employees need to satisfy vesting requirements, RSUs encourage them to stay for the long term and can improve retention.

How to Sell Restricted Stock Fulfill the SEC holding period requirements.Comply with federal reporting requirements.Check trading volume.Remove the stock legend.Conduct an ordinary brokerage transaction.File required notices with the SEC.

How to Sell Restricted Stock Fulfill the SEC holding period requirements.Comply with federal reporting requirements.Check trading volume.Remove the stock legend.Conduct an ordinary brokerage transaction.File required notices with the SEC.

If you're granted RSUs, you get to essentially own company shares without putting any money down (unlike when you are exercising stock options). So, when is the best time to sell your RSUs? If your company is public, the best thing to do is to cash them out as soon as they vest.

Speaking of selling shares, if your vested RSUs from the old company are sold to buy shares of the new company, this also is a taxable event. Fortunately, it is treated as capital gains. A common event is RSUs are exchanged from the old company to the new one.

Restricted stock units are often offered as part of a compensation package to attract and retain key employees They are restricted in that certain requirements must be met before the employee can obtain full ownership rights to the value of the units.

Restriction Lapse. The term lapse often appears in relation to restricted stock and stock options as a synonym for vesting. Vesting occurs when all restrictions on a stock vanish. For instance, when the shares reserved for you by a restricted stock grant transfer to your possession, this process constitutes vesting.