The Franklin Ohio Restricted Stock Plan of RPM, Inc. is a comprehensive employee benefit program offered by RPM, Inc., a leading multinational company headquartered in Franklin, Ohio. This plan aims to reward eligible employees with equity-based compensation in the form of restricted stock units (RSS) tied to the company's stock value. The Franklin Ohio Restricted Stock Plan serves as a vital tool to attract, retain, and motivate talented individuals within RPM, Inc. by providing them with a sense of ownership in the company's success. RSS serve as a unique incentive that aligns employee interests with shareholder value, fostering a collaborative and high-performance work environment. Key features and benefits of the Franklin Ohio Restricted Stock Plan include: 1. Eligibility: Employees meeting specific criteria, such as employment length, position, or performance, are eligible for participation in this program. The plan aims to include employees across various levels and functions. 2. Restricted Stock Units (RSS): Under this plan, eligible employees are granted RSS, which represent a contracted right to receive a specified number of shares of RPM, Inc.'s common stock after a predetermined vesting period. RSS provide employees the opportunity to participate in the company's growth and value appreciation over time. 3. Vesting Schedule: The Franklin Ohio Restricted Stock Plan outlines a vesting schedule, determining when employees gain complete ownership of their RSS. This vesting period, often spanning multiple years, encourages employees to stay with the company, fostering loyalty and commitment. 4. Performance-Based Metrics: To further motivate employees, the plan may incorporate performance-based metrics. These metrics could include individual or company-wide goals, such as achieving revenue targets, market share growth, or other strategic objectives. 5. Tax Implications: The Franklin Ohio Restricted Stock Plan takes into account the tax implications associated with RSS. Employees receive detailed guidance on tax obligations, including the withholding of applicable taxes during the vesting and distribution of shares. It is important to note that there may be multiple variations or types of the Franklin Ohio Restricted Stock Plan, tailored to meet the specific needs of different employee groups or divisions within RPM, Inc. For example, there could be variations based on executives, mid-level managers, or other employee classifications. These variations may include different vesting periods, performance metrics, or other terms and conditions. Overall, the Franklin Ohio Restricted Stock Plan of RPM, Inc. exemplifies the company's commitment to recognizing and rewarding its employees' contributions while fostering a shared sense of ownership in the organization's success.

Franklin Ohio Restricted Stock Plan of RPM, Inc.

Description

How to fill out Franklin Ohio Restricted Stock Plan Of RPM, Inc.?

Preparing paperwork for the business or personal needs is always a big responsibility. When creating an agreement, a public service request, or a power of attorney, it's crucial to take into account all federal and state regulations of the specific area. However, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it tense and time-consuming to generate Franklin Restricted Stock Plan of RPM, Inc. without professional help.

It's easy to avoid spending money on lawyers drafting your paperwork and create a legally valid Franklin Restricted Stock Plan of RPM, Inc. on your own, using the US Legal Forms online library. It is the largest online collection of state-specific legal documents that are professionally cheched, so you can be sure of their validity when picking a sample for your county. Previously subscribed users only need to log in to their accounts to download the necessary document.

If you still don't have a subscription, follow the step-by-step instruction below to get the Franklin Restricted Stock Plan of RPM, Inc.:

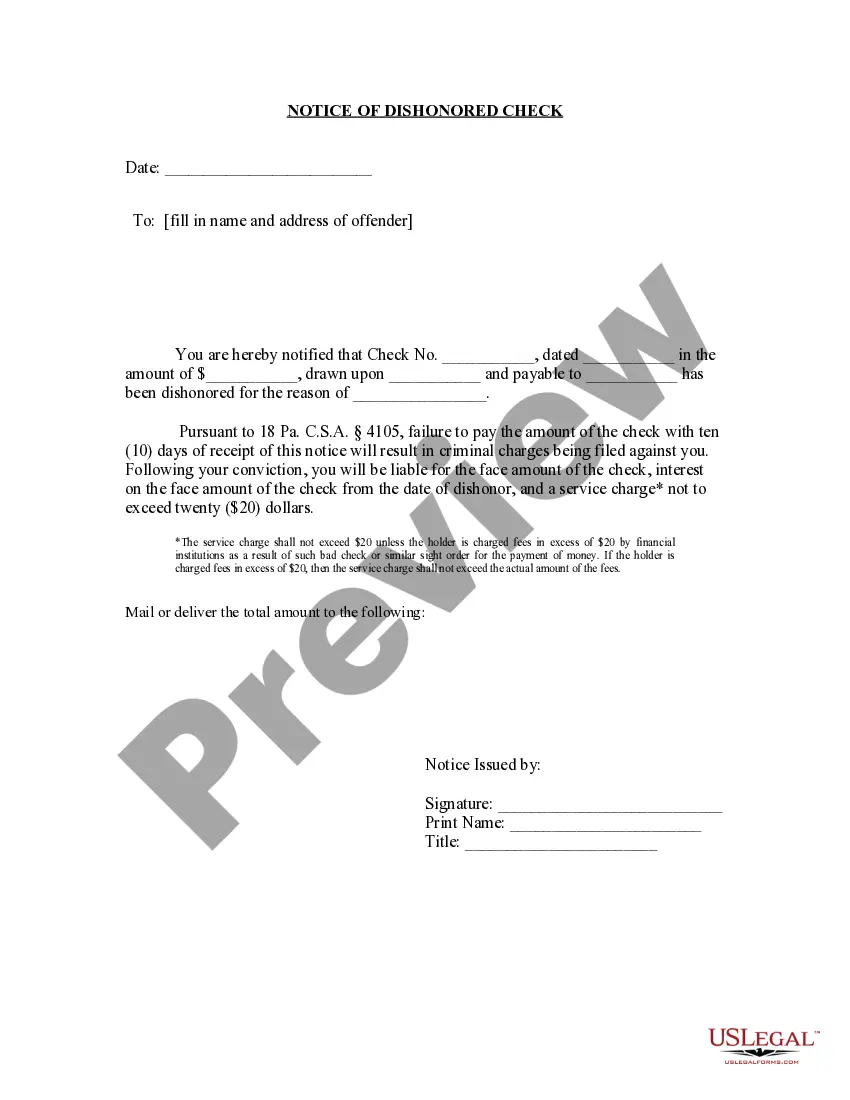

- Look through the page you've opened and verify if it has the sample you need.

- To accomplish this, use the form description and preview if these options are available.

- To find the one that satisfies your needs, utilize the search tab in the page header.

- Double-check that the sample complies with juridical criteria and click Buy Now.

- Choose the subscription plan, then sign in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever purchased never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and quickly obtain verified legal templates for any situation with just a couple of clicks!