Travis Texas Restricted Stock Plan of RPM, Inc. is a comprehensive employee benefit program offered by RPM, Inc., a reputed company based in Travis, Texas. This plan is designed to incentivize and reward employees by granting them ownership rights in the form of restricted stock units (RSS). The Travis Texas Restricted Stock Plan is structured to align the interests of employees with those of the company, motivating them to contribute to the long-term success of RPM, Inc. By offering RSS, this plan provides employees with an opportunity to acquire stocks in the company at a predetermined price, ensuring they share in the financial growth and achievements of RPM, Inc. Under this plan, employees are granted a specific number of RSS, which are subject to a vesting schedule. The vesting period is typically determined by the company's policy and acts as an incentive for employees to remain with RPM, Inc. for a certain period, promoting loyalty and dedication. Once the RSS vest, employees gain ownership rights to the corresponding number of company stocks. The compensation received through these stocks often offers a long-term financial benefit as employees leverage the growth potential of RPM, Inc. As a result, this plan not only serves as a means to increase employee engagement and retention but also acts as a powerful tool to attract top talent in the industry. It is important to note that while the Travis Texas Restricted Stock Plan benefits all eligible employees, there might be variants of the plan based on factors such as job level, tenure, or performance. Some potential types of the Travis Texas Restricted Stock Plan of RPM, Inc. may include: 1. Executive Restricted Stock Plan: Created specifically for top-level executives, this variant of the plan is designed to provide higher incentives and rewards to drive the company's strategic vision and goals. 2. Performance-based Restricted Stock Plan: This type of plan is tied to individual or team performance metrics, allowing employees to earn additional RSS based on meeting or exceeding specific targets and objectives. 3. Long-Term Incentive Restricted Stock Plan: Meant to encourage employee retention, this plan provides RSS to employees after a significant period, motivating them to stay with RPM, Inc. and contribute to its long-term success. 4. Equity Sharing Restricted Stock Plan: This variant focuses on sharing the company's equity with a broader employee base, allowing them to benefit from the company's growth and success. Overall, the Travis Texas Restricted Stock Plan of RPM, Inc. serves as a powerful tool to attract, motivate, and retain talented employees. It not only aligns their interests with the company's but also fosters a sense of ownership and commitment towards achieving RPM, Inc.'s strategic objectives.

Travis Texas Restricted Stock Plan of RPM, Inc.

Description

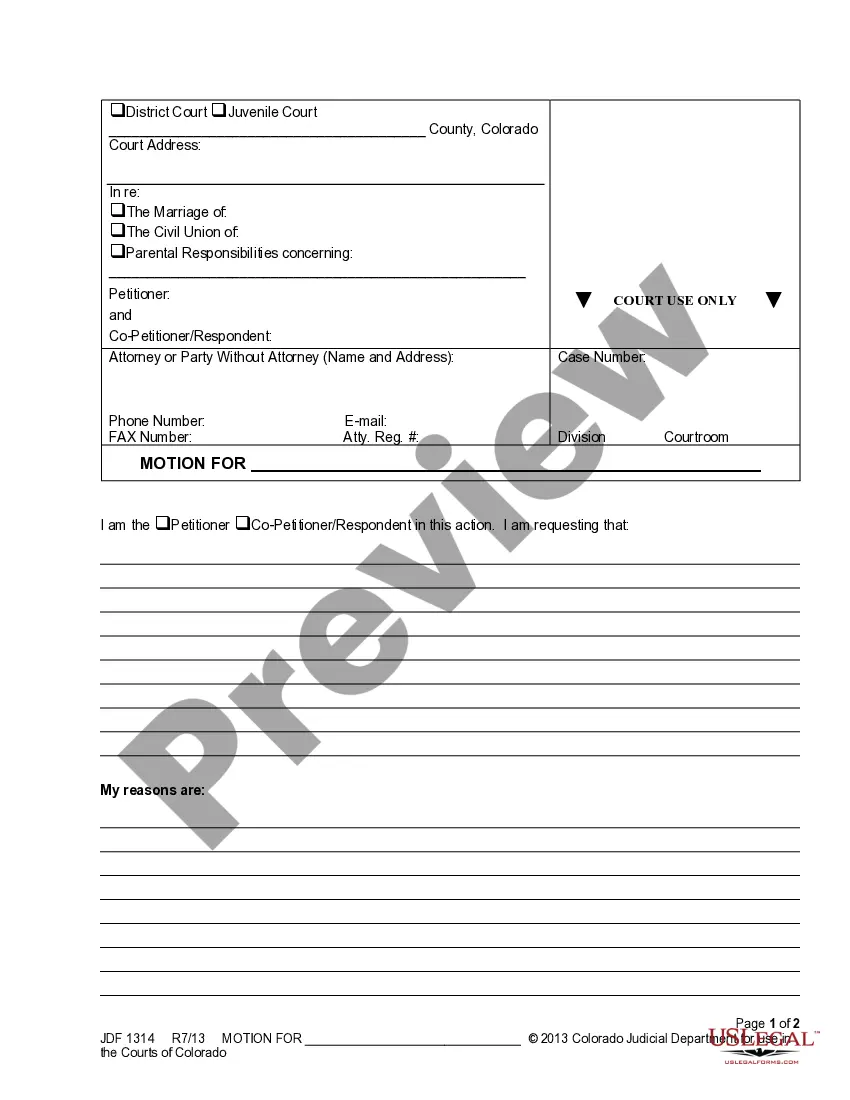

How to fill out Travis Texas Restricted Stock Plan Of RPM, Inc.?

How much time does it typically take you to draft a legal document? Since every state has its laws and regulations for every life sphere, locating a Travis Restricted Stock Plan of RPM, Inc. meeting all regional requirements can be tiring, and ordering it from a professional attorney is often pricey. Many online services offer the most popular state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive online catalog of templates, gathered by states and areas of use. In addition to the Travis Restricted Stock Plan of RPM, Inc., here you can find any specific document to run your business or individual deeds, complying with your regional requirements. Experts check all samples for their actuality, so you can be certain to prepare your paperwork correctly.

Using the service is pretty simple. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the needed form, and download it. You can retain the document in your profile at any time later on. Otherwise, if you are new to the website, there will be a few more actions to complete before you obtain your Travis Restricted Stock Plan of RPM, Inc.:

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another document using the related option in the header.

- Click Buy Now once you’re certain in the selected document.

- Decide on the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Travis Restricted Stock Plan of RPM, Inc..

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired template, you can locate all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!

Form popularity

FAQ

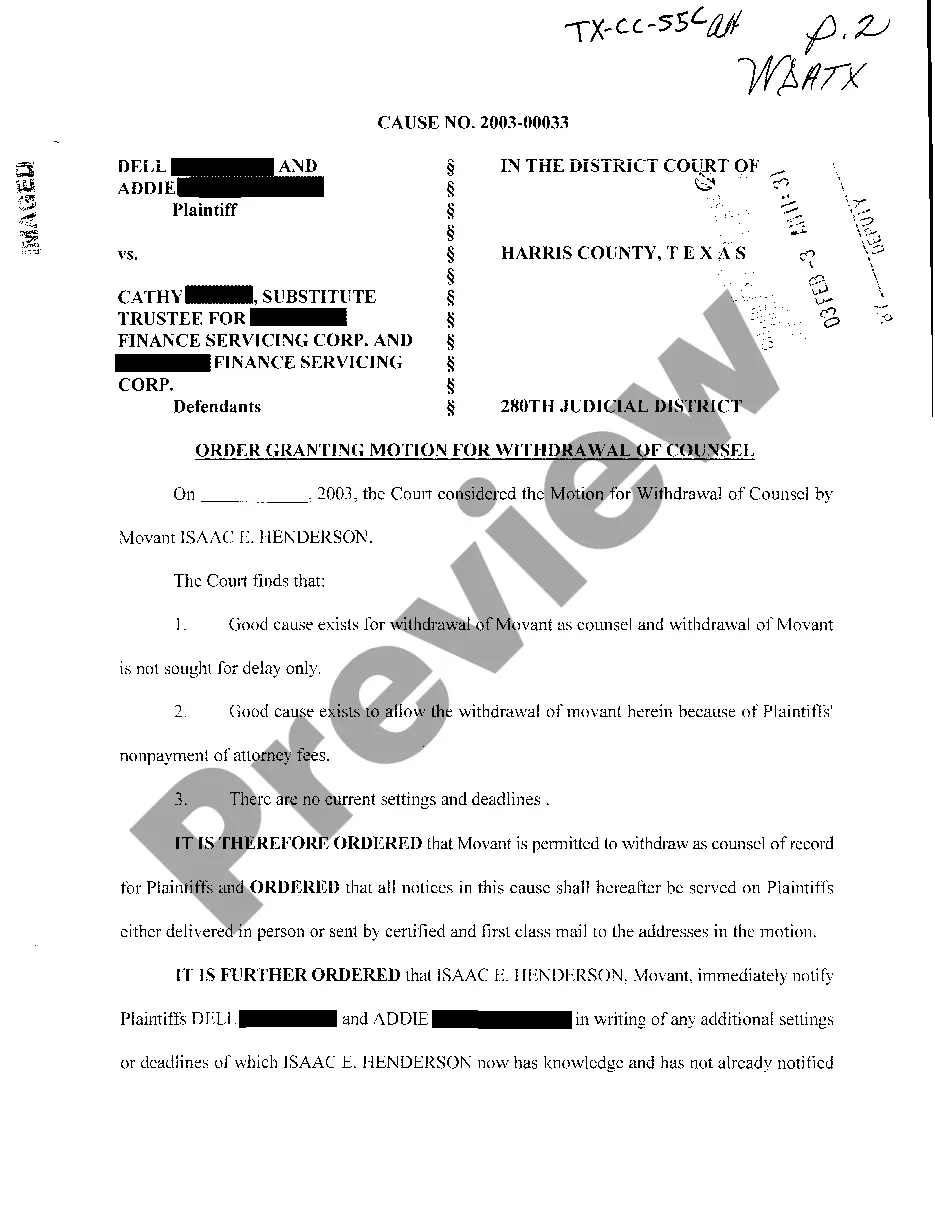

Under Rule 144, persons may not sell restricted stock until the shares have been fully paid for and held for at least six months.

Restricted shares may also be restricted by a double-trigger provision. That means that an employee's shares become unrestricted if the company is acquired by another and the employee is fired in the restructuring that follows. Insiders are often awarded restricted shares after a merger or other major corporate event.

Holding period begins at vesting date, when the compensation element of restricted stock is included in income. Holding period begins at grant date, when the compensation element of restricted stock is included in income.

Restricted stock units are issued to employees through a vesting plan and distribution schedule after they achieve required performance milestones or upon remaining with their employer for a particular length of time. RSUs give employees interest in company stock but no tangible value until vesting is complete.

A Restricted Stock Plan is a common way to share stock with employees in public companies. The shareholder approved plan simply allows for the issuance of stock to selected employees. Unlike stock options, employees receive the full starting value of the shares.

"Market standoff provision", stating that holders of restricted stock may not sell for a certain period of time (usually 180 days) after an initial public offering. This is intended to stabilize the stock price of the company after the IPO by preventing a large sale of stock on the market by the founders.

How to Sell Restricted Stock Fulfill the SEC holding period requirements.Comply with federal reporting requirements.Check trading volume.Remove the stock legend.Conduct an ordinary brokerage transaction.File required notices with the SEC.

Restricted stock units are a way an employer can grant company shares to employees. The grant is "restricted" because it is subject to a vesting schedule, which can be based on length of employment or on performance goals, and because it is governed by other limits on transfers or sales that your company can impose.

Restricted stock units are issued to employees through a vesting plan and distribution schedule after they achieve required performance milestones or upon remaining with their employer for a particular length of time. RSUs give employees interest in company stock but no tangible value until vesting is complete.

Most graded-vesting grants have restrictions that lapse over a period of three to five years. In addition to providing for regular vesting, a graded vesting schedule may, alternatively, have varying intervals between vesting dates: Example: You are granted 20,000 RSUs.