The Broward Florida Stock Option Plan is a comprehensive program designed to provide executive officers with various stock options, both in the form of Incentive Stock Options (SOS) and Nonqualified Stock Options (SOS). This plan offers attractive opportunities for executives to purchase company stock at a predetermined price within specified periods. Incentive Stock Options (SOS) provided under the Broward Florida Stock Option Plan are designed to incentivize executives and promote long-term commitment to the organization. SOS are typically granted at a discounted exercise price, allowing executives to potentially profit from the stock's appreciation over time. Additionally, SOS offer potential tax advantages, as gains may be subject to capital gains tax rates instead of ordinary income tax rates. Nonqualified Stock Options (SOS), also available under the Broward Florida Stock Option Plan, provide executives with more flexibility and immediate benefits. SOS do not possess the same tax advantages as SOS since they are typically subject to ordinary income tax rates upon exercise. However, SOS can be granted at market value or a premium, presenting executives with an immediate financial gain. The Broward Florida Stock Option Plan recognizes the importance of tailoring stock options to the specific needs and preferences of executive officers. The plan allows for customization within the ISO and NO frameworks, taking into account individual circumstances, risk tolerance, and financial goals. This flexibility ensures that the stock options offered align with the varied needs and aspirations of the executive team. Overall, the Broward Florida Stock Option Plan provides executive officers with a powerful tool to align their interests with the success of the company. By granting SOS and SOS, executives are given the opportunity to share in the company's growth and value creation, fostering long-term commitment and motivation. These stock options also serve as a vital element of executive compensation packages, attracting top talent and promoting retention within the organization. In summary, the Broward Florida Stock Option Plan encompasses both Incentive Stock Options (SOS) and Nonqualified Stock Options (SOS) and offers flexibility in their implementation. This plan serves as an essential component of executive compensation, empowering executives to benefit from the company's growth and aligning their interests with the success of the organization.

Broward Florida Stock Option Plan which provides for grant of Incentive Stock Options and Nonqualified Stock Options to executive officers

Description

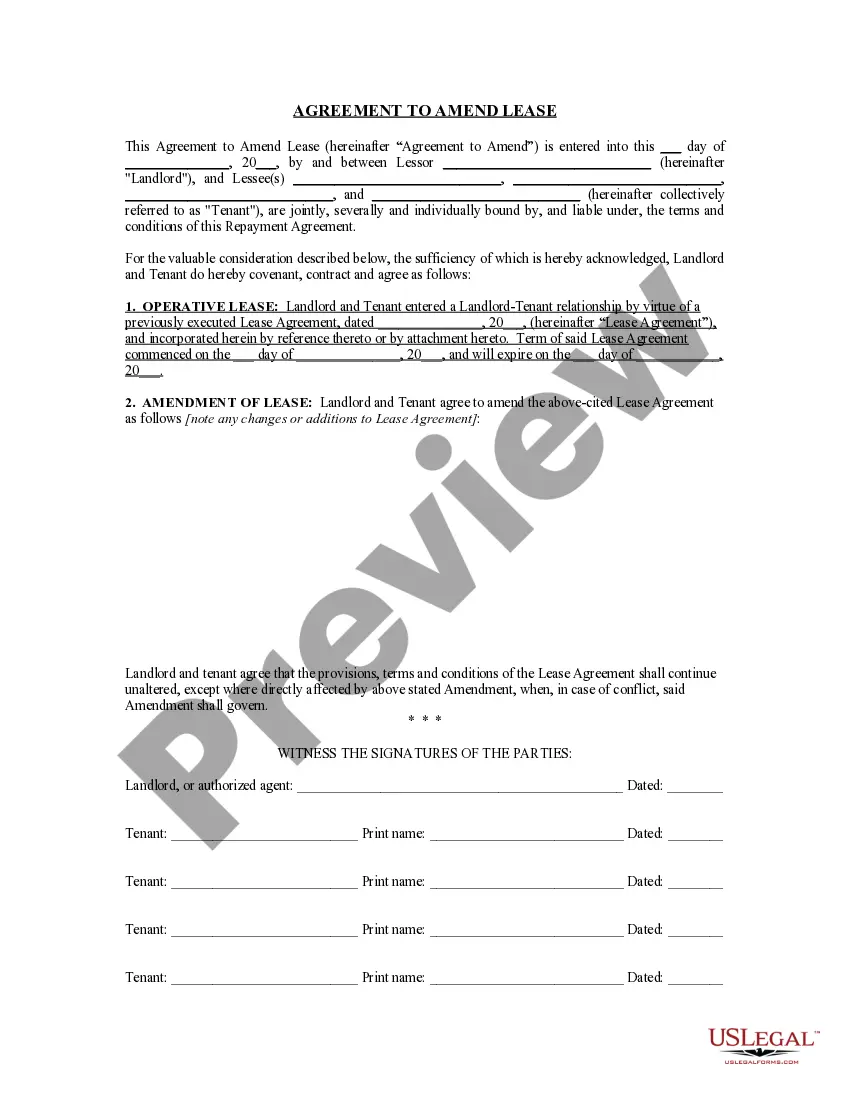

How to fill out Broward Florida Stock Option Plan Which Provides For Grant Of Incentive Stock Options And Nonqualified Stock Options To Executive Officers?

If you need to find a trustworthy legal document provider to find the Broward Stock Option Plan which provides for grant of Incentive Stock Options and Nonqualified Stock Options to executive officers, consider US Legal Forms. No matter if you need to start your LLC business or take care of your belongings distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the needed template.

- You can select from over 85,000 forms arranged by state/county and situation.

- The intuitive interface, number of supporting resources, and dedicated support team make it easy to find and execute different paperwork.

- US Legal Forms is a trusted service providing legal forms to millions of users since 1997.

Simply type to look for or browse Broward Stock Option Plan which provides for grant of Incentive Stock Options and Nonqualified Stock Options to executive officers, either by a keyword or by the state/county the document is intended for. After finding the required template, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's simple to get started! Simply find the Broward Stock Option Plan which provides for grant of Incentive Stock Options and Nonqualified Stock Options to executive officers template and check the form's preview and short introductory information (if available). If you're confident about the template’s legalese, go ahead and hit Buy now. Create an account and choose a subscription option. The template will be instantly ready for download once the payment is completed. Now you can execute the form.

Taking care of your legal matters doesn’t have to be expensive or time-consuming. US Legal Forms is here to demonstrate it. Our rich variety of legal forms makes these tasks less pricey and more reasonably priced. Create your first business, organize your advance care planning, create a real estate contract, or execute the Broward Stock Option Plan which provides for grant of Incentive Stock Options and Nonqualified Stock Options to executive officers - all from the comfort of your sofa.

Sign up for US Legal Forms now!