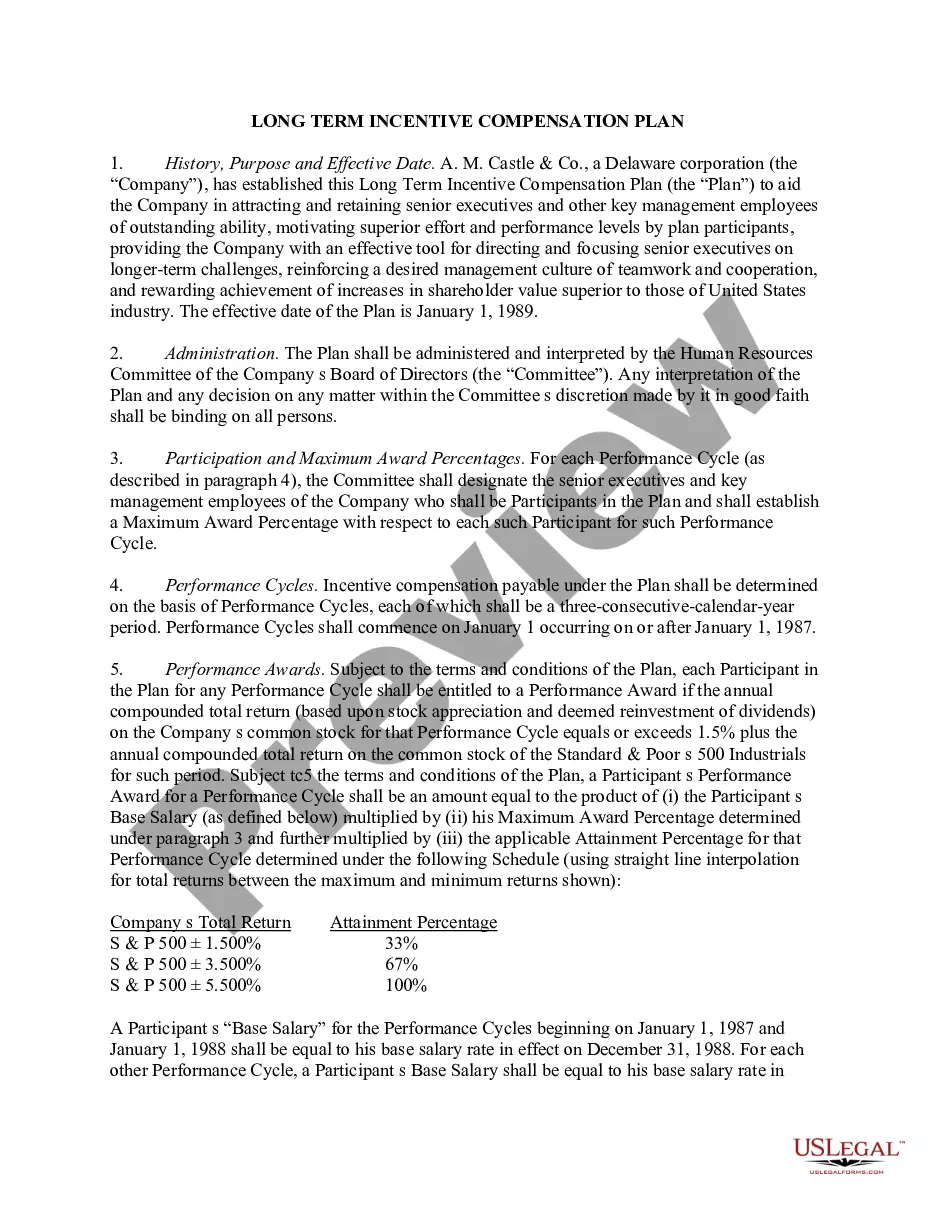

The Hennepin Minnesota Stock Option Plan is a specialized program designed to offer executive officers of companies in Hennepin County, Minnesota, the opportunity to receive stock options as a part of their compensation package. This plan provides two types of stock options to eligible executives, including Incentive Stock Options (SOS) and Nonqualified Stock Options (Nests). Incentive Stock Options (SOS) are stock options granted to executive officers that come with specific tax advantages. These options allow executives to purchase company stock at a predetermined price, known as the exercise price, within a defined period of time. SOS typically come with certain requirements, such as being held for a certain period of time before being eligible for favorable tax treatment upon sale. Nonqualified Stock Options (Nests), on the other hand, are stock options that do not qualify for the same tax advantages as SOS. While Nests still allow executive officers to purchase company stock at a predetermined price within a specified timeframe, they may be subject to ordinary income tax rates upon exercise. However, Nests offer more flexibility in terms of eligibility and vesting criteria compared to SOS. The Hennepin Minnesota Stock Option Plan aims to provide executive officers with a valuable employee benefit that aligns their interests with shareholders. By offering stock options, companies can incentivize their top executives to drive organizational performance and contribute to long-term shareholder value. Through the Hennepin Minnesota Stock Option Plan, executive officers can participate in the company's growth and success, as they only profit from stock options if the company's stock price increases over time. This creates a mutually beneficial relationship where executives have a vested interest in the company's prosperity, directly tying their rewards to the company's financial performance. Overall, the Hennepin Minnesota Stock Option Plan presents an attractive compensation structure for executive officers, incorporating both Incentive Stock Options (SOS) and Nonqualified Stock Options (Nests) to suit varied tax and benefit preferences. This plan serves as an effective tool for attracting, retaining, and motivating talented executives while enhancing the overall performance and value of companies in Hennepin County, Minnesota.

Hennepin Minnesota Stock Option Plan which provides for grant of Incentive Stock Options and Nonqualified Stock Options to executive officers

Description

How to fill out Hennepin Minnesota Stock Option Plan Which Provides For Grant Of Incentive Stock Options And Nonqualified Stock Options To Executive Officers?

Creating paperwork, like Hennepin Stock Option Plan which provides for grant of Incentive Stock Options and Nonqualified Stock Options to executive officers, to manage your legal affairs is a challenging and time-consumming task. Many circumstances require an attorney’s involvement, which also makes this task not really affordable. Nevertheless, you can take your legal matters into your own hands and take care of them yourself. US Legal Forms is here to save the day. Our website comes with more than 85,000 legal documents crafted for different cases and life situations. We make sure each document is in adherence with the regulations of each state, so you don’t have to be concerned about potential legal issues associated with compliance.

If you're already aware of our services and have a subscription with US, you know how easy it is to get the Hennepin Stock Option Plan which provides for grant of Incentive Stock Options and Nonqualified Stock Options to executive officers form. Go ahead and log in to your account, download the template, and customize it to your needs. Have you lost your document? Don’t worry. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new users is fairly easy! Here’s what you need to do before getting Hennepin Stock Option Plan which provides for grant of Incentive Stock Options and Nonqualified Stock Options to executive officers:

- Ensure that your form is compliant with your state/county since the regulations for creating legal paperwork may differ from one state another.

- Discover more information about the form by previewing it or going through a quick intro. If the Hennepin Stock Option Plan which provides for grant of Incentive Stock Options and Nonqualified Stock Options to executive officers isn’t something you were hoping to find, then use the header to find another one.

- Sign in or create an account to begin utilizing our website and download the document.

- Everything looks good on your side? Hit the Buy now button and choose the subscription option.

- Pick the payment gateway and enter your payment information.

- Your template is good to go. You can try and download it.

It’s easy to find and buy the appropriate document with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our rich collection. Subscribe to it now if you want to check what other advantages you can get with US Legal Forms!

Form popularity

FAQ

Incentive stock options, or ISOs, are a type of equity compensation granted only to employees, who can then purchase a set quantity of company shares at a certain price, while receiving favorable tax treatment.

An incentive stock option must be granted within 10 years from the date that the plan under which it is granted is adopted or the date such plan is approved by the stockholders, whichever is earlier. To grant incentive stock options after the expiration of the 10-year period, a new plan must be adopted and approved.

Only income taxes apply to RSUs, meaning the capital gains tax is not a factor. On the other hand, two types of stock options exist. These are non-qualified stock options (NSOs) and incentive stock options (ISOs). For NSOs, you are taxed on the difference between the market price and the grant price.

An incentive stock option (ISO) is a corporate benefit that gives an employee the right to buy shares of company stock at a discounted price with the added benefit of possible tax breaks on the profit. The profit on qualified ISOs is usually taxed at the capital gains rate, not the higher rate for ordinary income.

Under the said Rules, ESOPs can be issued only to the employees of an unlisted private limited company.

Non-qualified stock options are stock options that do not receive favorable tax treatment when exercised but do provide additional flexibility for the issuing company. Gains from non-qualified stock options are taxed as normal income.

Qualified stock options, also known as incentive stock options, can only be granted to employees. Non-qualified stock options can be granted to employees, directors, contractors and others. This gives you greater flexibility to recognize the contributions of non-employees.

Incentive stock options, or ISOs, are options that are entitled to potentially favorable federal tax treatment. Stock options that are not ISOs are usually referred to as nonqualified stock options or NQOs. The acronym NSO is also used. These do not qualify for special tax treatment.

However, there is another type of stock option, known as an incentive stock option, which is usually only offered to key employees and top-tier management. These options are also commonly known as statutory or qualified options, and they can receive preferential tax treatment in many cases.

What Is a Non-Qualified Stock Option (NSO)? A non-qualified stock option (NSO) is a type of employee stock option wherein you pay ordinary income tax on the difference between the grant price and the price at which you exercise the option.