The Oakland Michigan Stock Option Plan is a comprehensive program that offers executive officers of companies based in Oakland, Michigan, the opportunity to receive both Incentive Stock Options (SOS) and Nonqualified Stock Options (SOS) as part of their compensation package. This plan allows executives to purchase company stock at a specified price, commonly known as the "strike price," within a predetermined time frame. SOS, also referred to as statutory stock options, are one type of stock option available under the Oakland Michigan Stock Option Plan. These options provide certain tax advantages to the executives who hold them. When exercising SOS, executives can potentially qualify for long-term capital gains tax rates on the profit made from selling the shares, if specific holding requirements are met. On the other hand, SOS, also known as nonstatutory stock options or nonqualified options, represent another category within the Oakland Michigan Stock Option Plan. SOS do not have the same tax advantages as SOS, as the profit made from their exercise is subject to ordinary income tax rates. However, SOS provide greater flexibility in terms of eligibility and can be offered to a broader range of employees, including executives. Executives participating in the Oakland Michigan Stock Option Plan must carefully consider the terms and conditions outlined in the plan document, including the vesting period, exercise price, and expiration date of the options. The plan typically sets specific guidelines regarding when and how executives can exercise their options. The purpose of the Stock Option Plan is to align the interests of executives with the performance and success of the company. By offering stock options, companies provide an incentive for executives to drive long-term value and profitability, as the value of their options increases if the company's stock price rises. In summary, the Oakland Michigan Stock Option Plan is designed to reward executive officers by granting them Incentive Stock Options (SOS) and Nonqualified Stock Options (SOS). SOS provide potential tax advantages, while SOS offer more flexibility in eligibility. The plan aims to align executive interests with company performance, fostering long-term value creation.

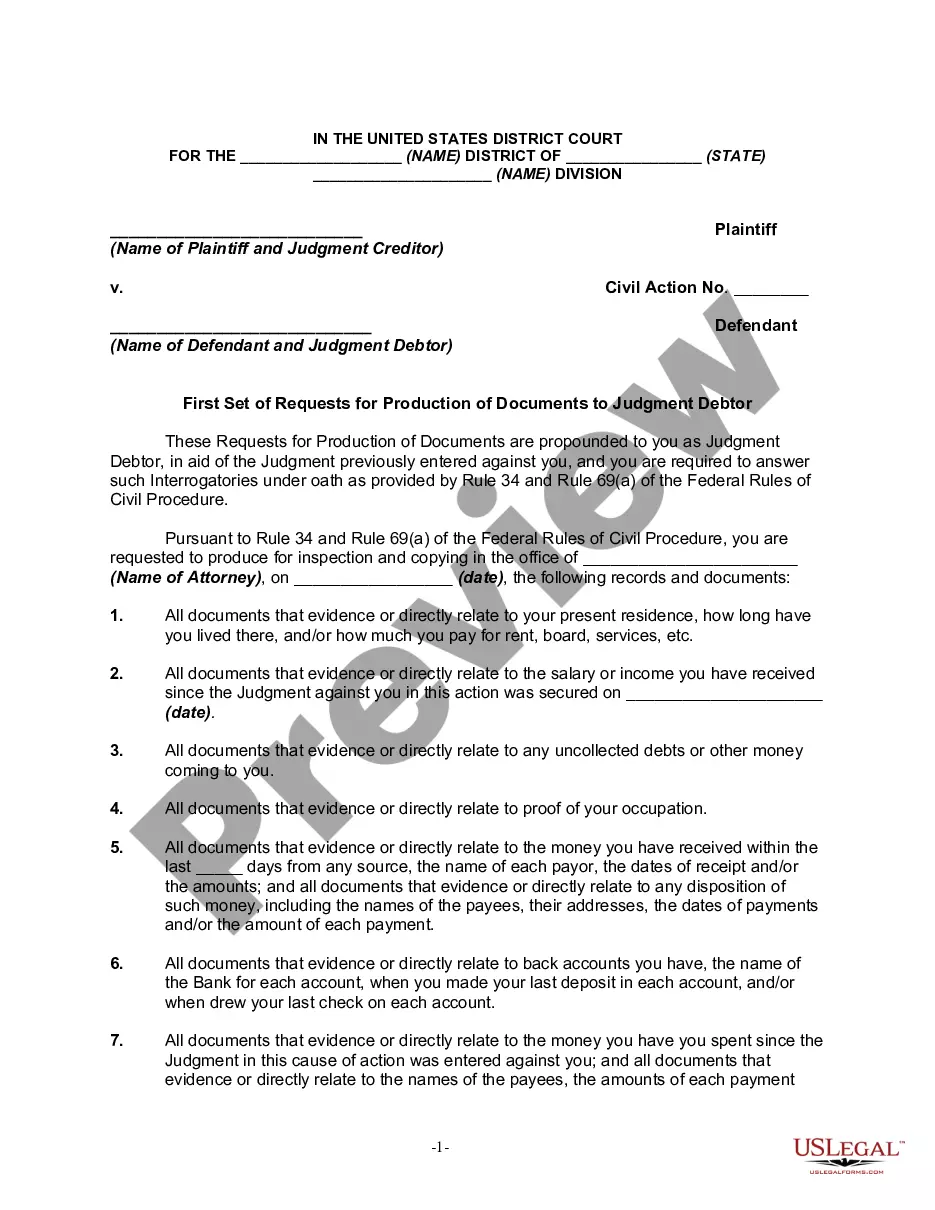

Oakland Michigan Stock Option Plan which provides for grant of Incentive Stock Options and Nonqualified Stock Options to executive officers

Description

How to fill out Oakland Michigan Stock Option Plan Which Provides For Grant Of Incentive Stock Options And Nonqualified Stock Options To Executive Officers?

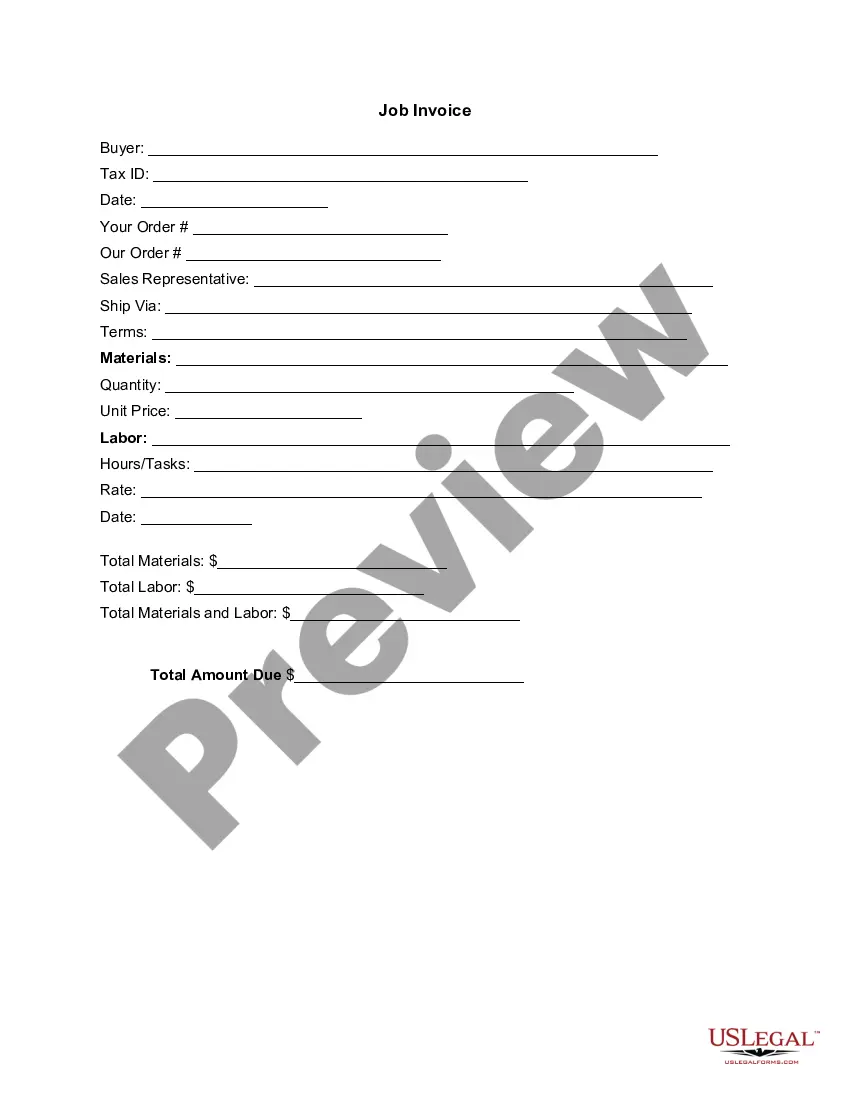

If you need to get a reliable legal form supplier to get the Oakland Stock Option Plan which provides for grant of Incentive Stock Options and Nonqualified Stock Options to executive officers, look no further than US Legal Forms. No matter if you need to start your LLC business or take care of your belongings distribution, we got you covered. You don't need to be knowledgeable about in law to find and download the appropriate form.

- You can search from more than 85,000 forms arranged by state/county and situation.

- The self-explanatory interface, variety of supporting materials, and dedicated support make it easy to find and execute various paperwork.

- US Legal Forms is a trusted service offering legal forms to millions of customers since 1997.

Simply select to look for or browse Oakland Stock Option Plan which provides for grant of Incentive Stock Options and Nonqualified Stock Options to executive officers, either by a keyword or by the state/county the form is intended for. After finding the required form, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's easy to get started! Simply find the Oakland Stock Option Plan which provides for grant of Incentive Stock Options and Nonqualified Stock Options to executive officers template and check the form's preview and short introductory information (if available). If you're comfortable with the template’s language, go ahead and hit Buy now. Register an account and select a subscription option. The template will be immediately available for download once the payment is processed. Now you can execute the form.

Taking care of your legal matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our comprehensive variety of legal forms makes these tasks less pricey and more affordable. Set up your first business, arrange your advance care planning, draft a real estate agreement, or complete the Oakland Stock Option Plan which provides for grant of Incentive Stock Options and Nonqualified Stock Options to executive officers - all from the convenience of your home.

Sign up for US Legal Forms now!