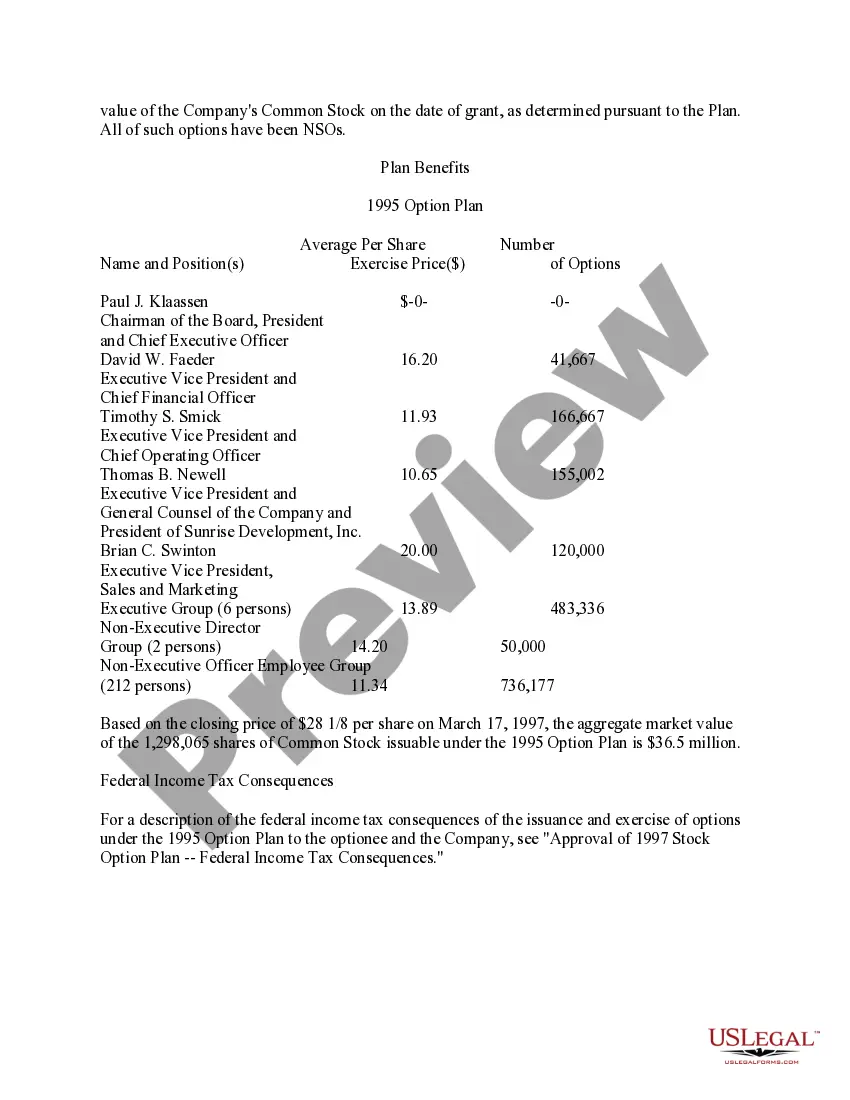

The Bronx, a borough in New York City, is known for its diverse neighborhoods, cultural richness, and economic potential. Bronx New York Approval of Stock Option Plan refers to the authorization process undertaken by companies operating in the Bronx to establish stock option plans for their employees. This strategic move allows businesses to offer ownership opportunities to their workforce, thereby incentivizing and retaining talented individuals within their organizations. A Bronx New York Approval of Stock Option Plan can vary in structure and design, depending on the specific needs and objectives of the company. Some common types include: 1. Employee Stock Ownership Plan (ESOP): An ESOP is a qualified retirement plan that enables employees to acquire ownership interest in the company through employer-provided stock options. This plan can promote employee loyalty, motivate higher performance, and provide retirement benefits. 2. Incentive Stock Options (SOS): SOS are granted exclusively to key employees and provide them with the right to purchase company stock at a specific price within a designated time frame. They often come with tax advantages, as they are subject to capital gains tax rates upon sale. 3. Non-Qualified Stock Options (SOS): SOS are stock options offered to both employees and non-employee directors. Unlike SOS, SOS do not qualify for preferential tax treatment and are subject to ordinary income tax rates upon exercise. 4. Restricted Stock Units (RSS): RSS are another form of stock-based compensation where employees receive units that convert into actual company shares after a vesting period, typically tied to specific performance milestones or tenure. RSS offer employees the opportunity to gain ownership in the company without upfront costs. 5. Performance Stock Options (SOS): SOS are stock options granted based on predetermined performance criteria, such as meeting specific financial targets or achieving company goals. These options align employee and company interests, as they become valuable only if the predetermined objectives are met. 6. Stock Appreciation Rights (SARS): SARS grant employees the right to receive the appreciation in the company's stock value over a specific period. Upon exercise, employees receive a cash payment equal to the difference between the stock price at the grant date and the exercise date, without requiring them to buy actual shares. Bronx New York Approval of Stock Option Plans can assist companies in attracting and retaining talent, fostering a sense of ownership, and aligning the interests of employees with the growth of the organization. Through these programs, businesses in the Bronx can effectively reward employees for their hard work, incentivize innovation and loyalty, and drive long-term success.

Bronx New York Approval of Stock Option Plan

Description

How to fill out Bronx New York Approval Of Stock Option Plan?

Laws and regulations in every sphere vary throughout the country. If you're not a lawyer, it's easy to get lost in various norms when it comes to drafting legal paperwork. To avoid high priced legal assistance when preparing the Bronx Approval of Stock Option Plan, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal forms. It's a great solution for specialists and individuals searching for do-it-yourself templates for various life and business scenarios. All the documents can be used multiple times: once you obtain a sample, it remains accessible in your profile for further use. Therefore, if you have an account with a valid subscription, you can just log in and re-download the Bronx Approval of Stock Option Plan from the My Forms tab.

For new users, it's necessary to make a few more steps to obtain the Bronx Approval of Stock Option Plan:

- Examine the page content to ensure you found the right sample.

- Take advantage of the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Use the Buy Now button to obtain the template when you find the correct one.

- Opt for one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Complete and sign the template on paper after printing it or do it all electronically.

That's the simplest and most cost-effective way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your documentation in order with the US Legal Forms!