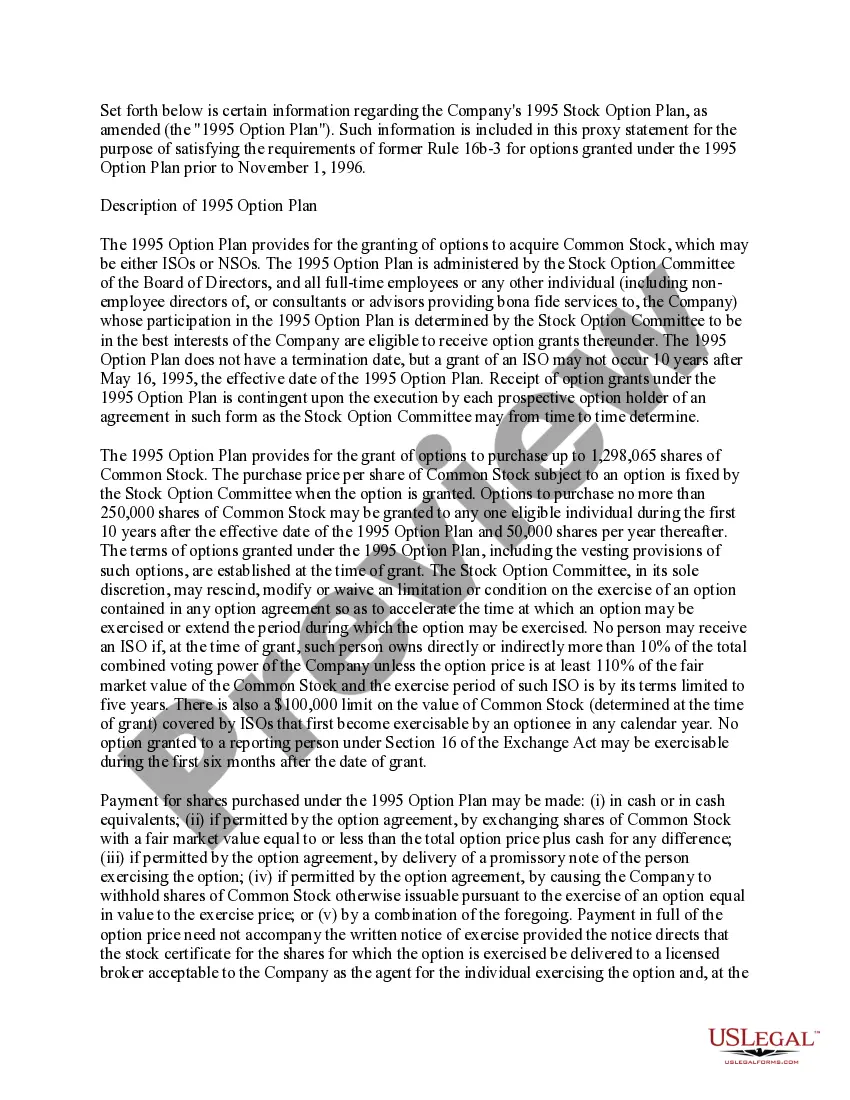

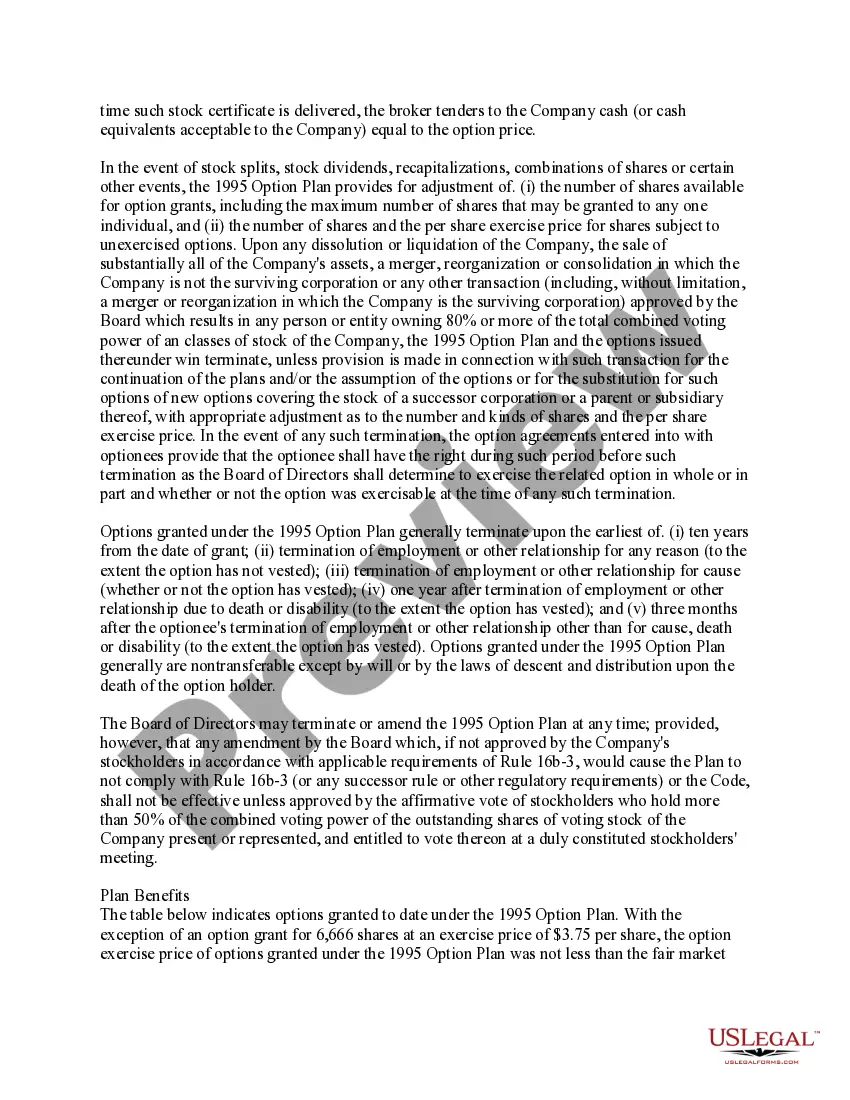

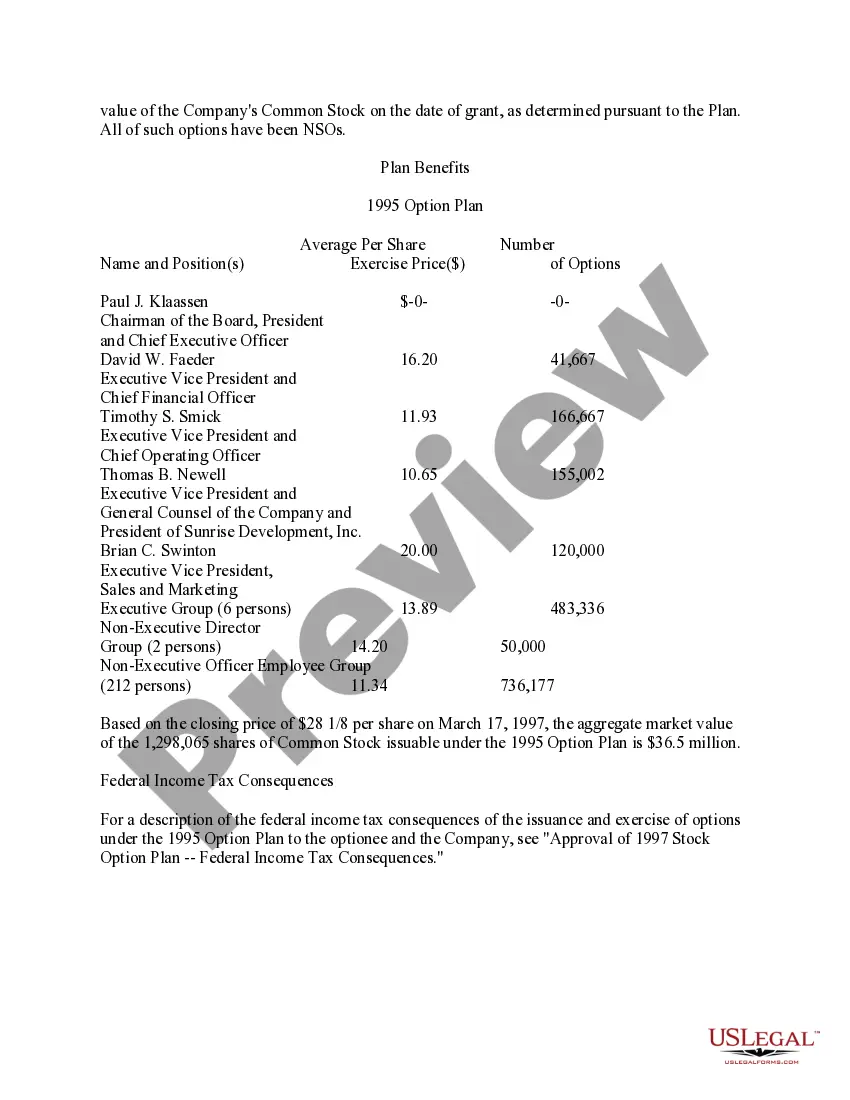

Kings New York Approval of Stock Option Plan is a comprehensive and legally binding document that outlines the guidelines and parameters for granting stock options to employees of the company. This plan serves as an effective tool for incentivizing employees and aligning their interests with the success of Kings New York. The Approval of Stock Option Plan provides detailed information on the various types of stock options available to employees. These options may include incentive stock options (SOS), non-qualified stock options (SOS), and restricted stock units (RSS). Each type of option has its own set of rules and regulations that govern the exercise, vesting, and taxation. SOS, one of the most common types of stock options, offer employees favorable tax treatment if certain conditions are met. These options typically require a specified holding period before they can be exercised and may be subject to limitations on the amount and timing of exercise. SOS, on the other hand, do not have the same tax advantages as SOS but offer greater flexibility in terms of eligibility and exercise. SOS can be granted to employees, directors, and even consultants, and they can often be exercised immediately or during a predetermined period. In addition to stock options, the Approval of Stock Option Plan may also include provisions for RSS. RSS are grants of stock units that vest over a specific period of time. Unlike stock options, RSS do not grant the holder the right to purchase or sell the stock, but instead provide them with the actual shares at a future date. The Approval of Stock Option Plan outlines the eligibility criteria for employees to qualify for these stock options, such as employment duration, position, and performance. It also includes details regarding the exercise price, vesting schedule, and expiration date for each type of option. Furthermore, the plan ensures compliance with regulatory requirements, such as those set by the Securities and Exchange Commission (SEC) and Internal Revenue Service (IRS), and addresses potential issues such as change of control provisions and stock option repricing. The Kings New York Approval of Stock Option Plan serves as an essential tool for attracting and retaining top talent, motivating employees, and fostering a sense of ownership and commitment among the workforce. By providing employees with the opportunity to share in the company's success, the approval of this plan can play a pivotal role in driving the growth and prosperity of Kings New York.

Kings New York Approval of Stock Option Plan

Description

How to fill out Kings New York Approval Of Stock Option Plan?

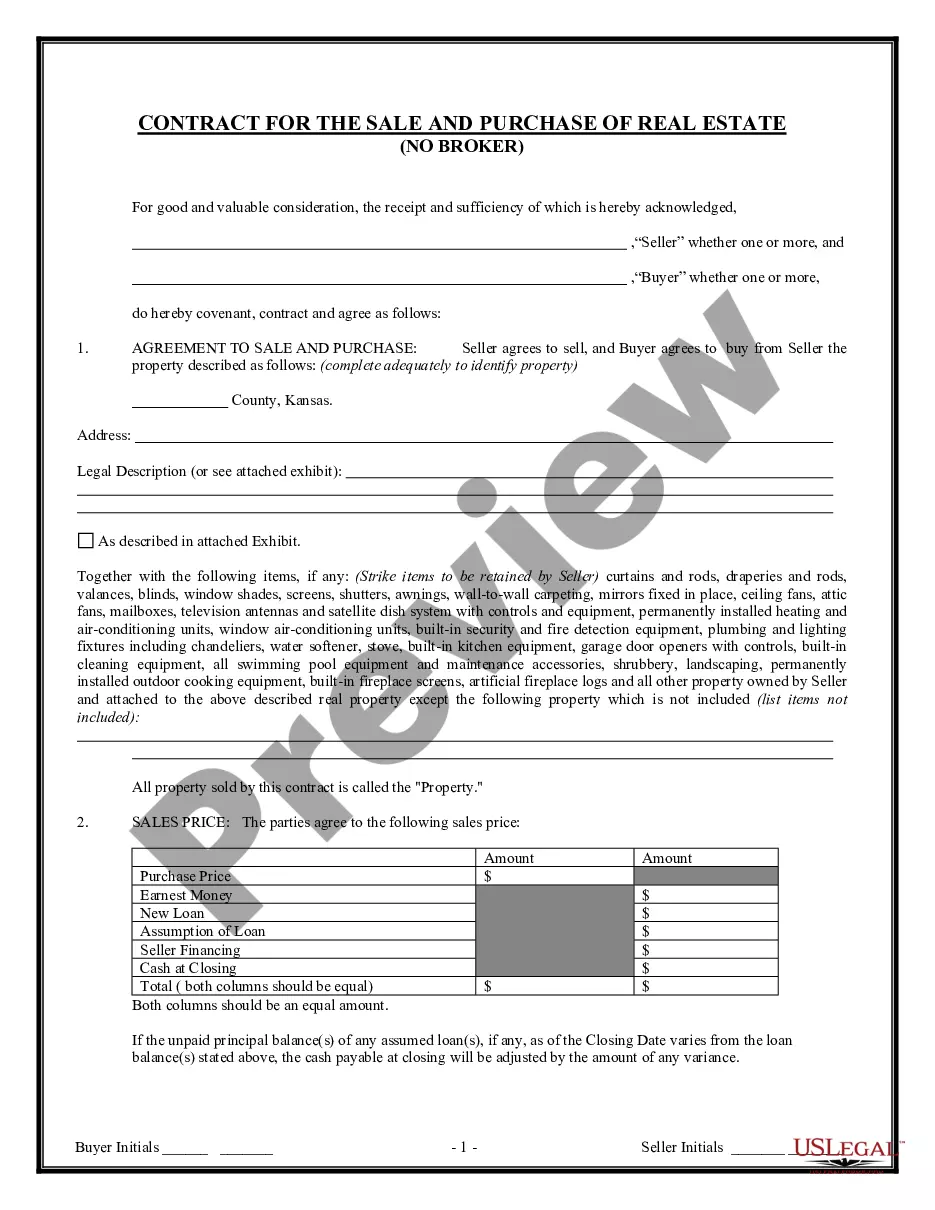

Creating legal forms is a necessity in today's world. However, you don't always need to seek qualified assistance to create some of them from scratch, including Kings Approval of Stock Option Plan, with a service like US Legal Forms.

US Legal Forms has over 85,000 templates to pick from in various categories ranging from living wills to real estate paperwork to divorce papers. All forms are organized based on their valid state, making the searching process less challenging. You can also find detailed materials and guides on the website to make any activities associated with paperwork completion straightforward.

Here's how to locate and download Kings Approval of Stock Option Plan.

- Go over the document's preview and outline (if provided) to get a basic idea of what you’ll get after downloading the document.

- Ensure that the document of your choosing is specific to your state/county/area since state regulations can impact the validity of some documents.

- Check the similar forms or start the search over to find the appropriate file.

- Hit Buy now and create your account. If you already have an existing one, select to log in.

- Choose the option, then a suitable payment method, and buy Kings Approval of Stock Option Plan.

- Choose to save the form template in any available file format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the appropriate Kings Approval of Stock Option Plan, log in to your account, and download it. Needless to say, our website can’t take the place of a lawyer entirely. If you need to deal with an extremely difficult situation, we recommend getting a lawyer to review your form before signing and submitting it.

With more than 25 years on the market, US Legal Forms proved to be a go-to provider for many different legal forms for millions of customers. Join them today and purchase your state-compliant paperwork effortlessly!

Form popularity

FAQ

On June 30, the SEC approved rules requiring shareholder approval of equity compensation plans, including stock option plans. The new rules will also require approval for repricings and material plan changes.

Shareholder approval will only be required for issuances to a related party, and will not be required for issuances to 1) a subsidiary, affiliate, or other closely related person of a related party, or 2) any company or entity in which a related party has a substantial direct or indirect interest.

Incentive stock options (ISOs), are a type of employee stock option that can be granted only to employees and confer a U.S. tax benefit. ISOs are also sometimes referred to as statutory stock options by the IRS. ISOs have a strike price, which is the price a holder must pay to purchase one share of the stock.

On June 30, the SEC approved rules requiring shareholder approval of equity compensation plans, including stock option plans. The new rules will also require approval for repricings and material plan changes.

An incentive stock option (ISO) is a corporate benefit that gives an employee the right to buy shares of company stock at a discounted price with the added benefit of possible tax breaks on the profit.

A stock option should be granted under a written stock plan that is approved by shareholders within 12 months of the date it is adopted by the company's board of directors. There are 2 types of stock options: incentive stock options (ISOs) and non-statutory stock options (NSOs).

Incentive stock options are one type of deferred compensation used to motivate and retain key employees. Since you need to hold on to your ISOs for a period of time, the only way to capitalize on these benefits is to stay with your firm for the long haul.

The board has to approve all stock option grants ahead of time, either at a board meeting or by unanimous written consent. If your board hasn't approved an option grant, no options have actually been granted.

Under both the NYSE and NASDAQ listing standards, a public company must obtain shareholder approval before it can issue shares under an equity incentive plan or make material revisions to an equity incentive plan.