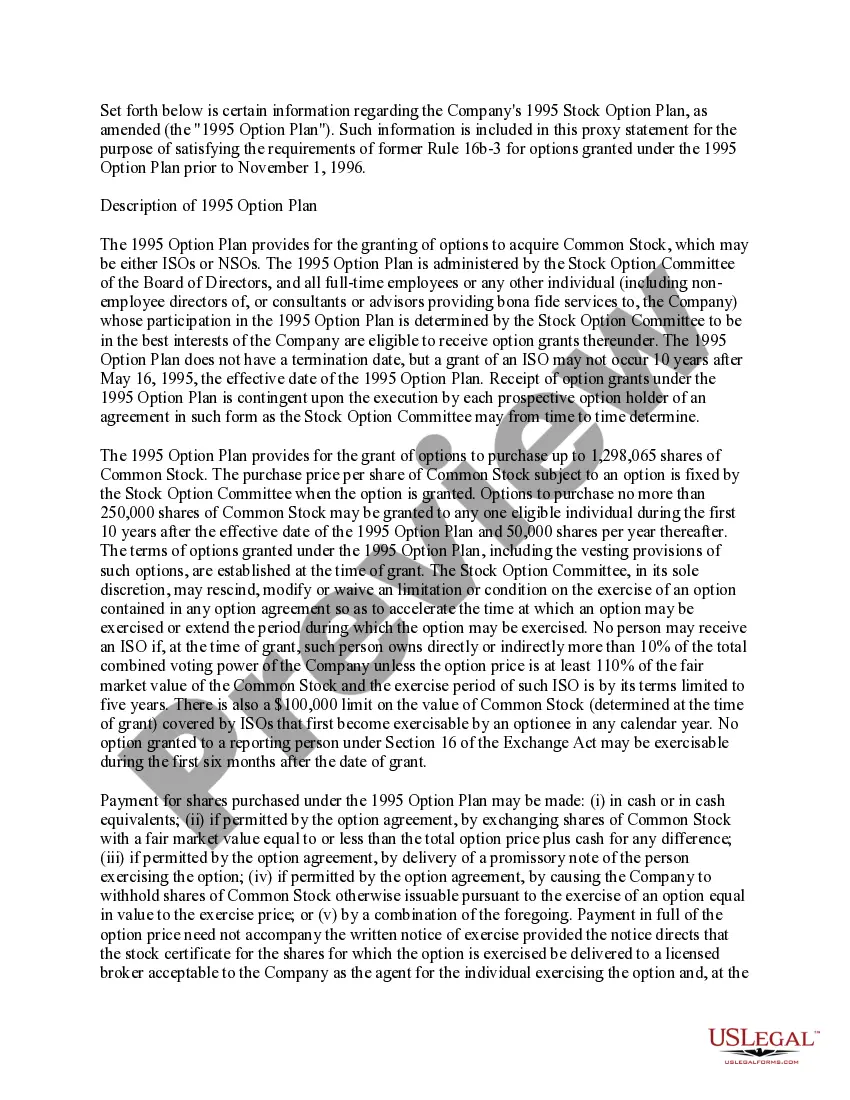

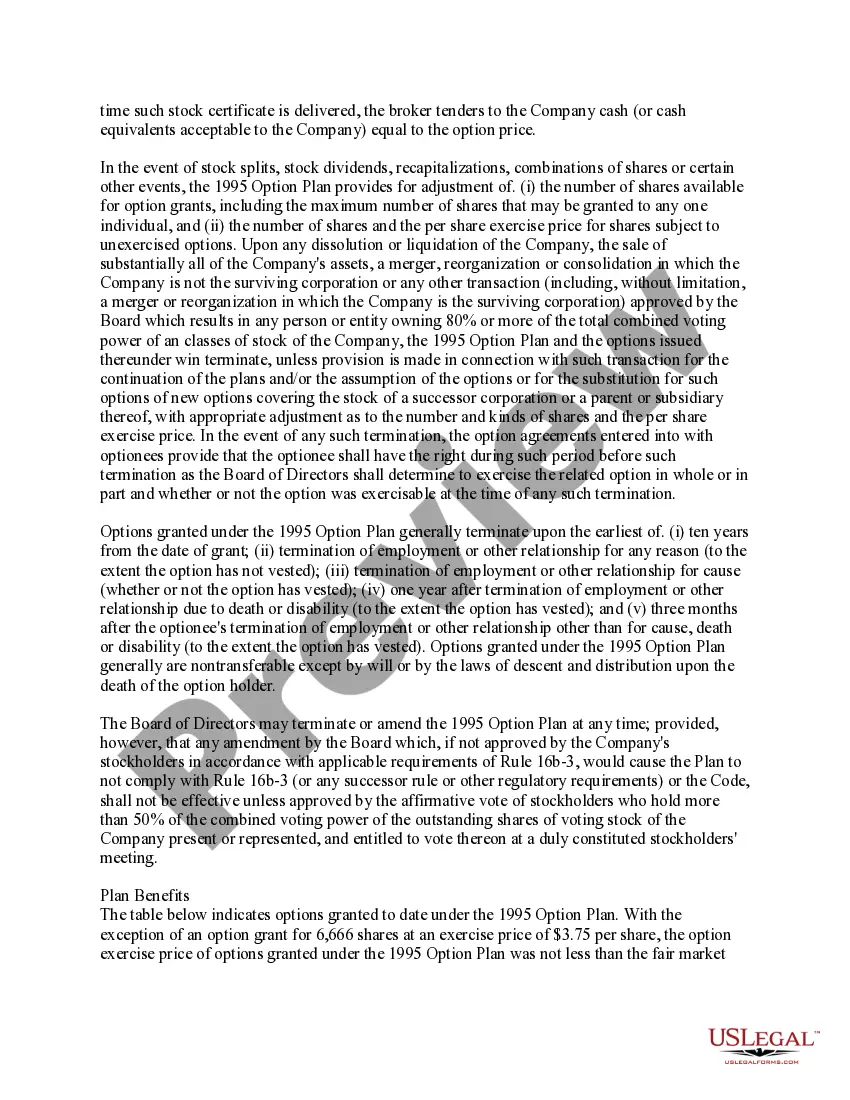

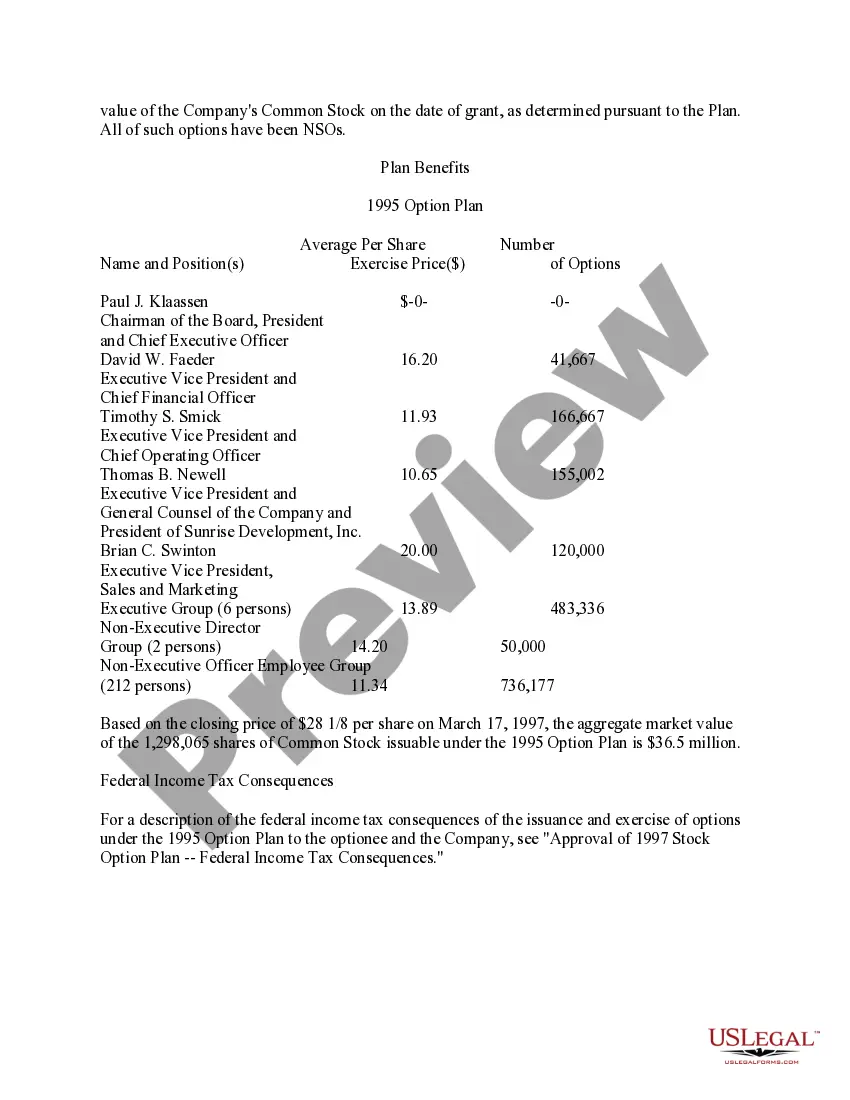

Phoenix Arizona Approval of Stock Option Plan refers to the process of obtaining consent or authorization in Phoenix, Arizona for a stock option plan. This plan is designed to grant employees or key individuals the right to purchase company stock at a predetermined price within a specified period. It offers various benefits for both employees and the company, encouraging employee retention, motivating performance, and aligning interests. There are primarily two types of Phoenix Arizona Approval of Stock Option Plan: 1. Incentive Stock Option Plan (ISO): This plan is primarily aimed at providing favorable tax treatment to employees. It complies with the requirements of Section 422 of the Internal Revenue Code, allowing employees to purchase stock at a discounted price while potentially deferring tax liability until the stock is sold. SOS usually have specific eligibility criteria and may require holding periods before the options can be exercised. 2. Non-Qualified Stock Option Plan (NO): Nests do not comply with the provisions of Section 422 and are, therefore, subject to different tax treatment. Under this plan, the stock options offered to employees are considered ordinary income upon exercise, resulting in immediate tax liabilities. Nests offer more flexibility in terms of eligibility criteria and suitable for companies looking to provide stock-based incentives beyond the limitations of SOS. The Phoenix Arizona Approval of Stock Option Plan typically involves the following steps: 1. Drafting the Plan: The company's legal team or external legal counsel prepares a comprehensive plan document outlining the terms and conditions of the stock option program. It includes provisions related to eligibility, exercise price, stock vesting, exercise periods, and any restrictions or conditions imposed on the options. 2. Approval by the Board of Directors or Shareholders: The plan must be approved either by the company's board of directors or shareholders, depending on the corporate structure and applicable legal requirements. The approval affirms the company's commitment to implement the stock option plan. 3. Compliance with Applicable Laws: The plan is reviewed to ensure compliance with federal and state securities laws, as well as any specific regulations applicable in Phoenix, Arizona. Legal counsel can assist in navigating through the complex regulatory landscape and ensuring adherence to necessary processes. 4. Participant Education and Communication: Once the plan is approved, the company's HR or compensation team communicates the details of the stock option plan to eligible employees. This involves educating them about the benefits, exercise procedures, and any associated risks or obligations. 5. Option Grants and Administration: Upon enrollment, eligible employees receive option grants specifying the number of shares, exercise price, and vesting schedule. The company maintains accurate records of option grants, exercises, and any changes in employment status to manage the plan effectively. It is essential to consult with legal professionals specializing in stock option plans to ensure compliance with local regulations and maximize the plan's benefits. By implementing a well-designed Phoenix Arizona Approval of Stock Option Plan, companies can attract and retain talented individuals, promote employee ownership, and potentially enhance overall company performance.

Phoenix Arizona Approval of Stock Option Plan

Description

How to fill out Phoenix Arizona Approval Of Stock Option Plan?

Drafting documents for the business or personal needs is always a big responsibility. When creating an agreement, a public service request, or a power of attorney, it's essential to consider all federal and state laws and regulations of the specific region. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these details make it tense and time-consuming to create Phoenix Approval of Stock Option Plan without expert help.

It's possible to avoid spending money on lawyers drafting your paperwork and create a legally valid Phoenix Approval of Stock Option Plan by yourself, using the US Legal Forms web library. It is the biggest online collection of state-specific legal documents that are professionally cheched, so you can be certain of their validity when choosing a sample for your county. Earlier subscribed users only need to log in to their accounts to download the needed form.

If you still don't have a subscription, adhere to the step-by-step instruction below to obtain the Phoenix Approval of Stock Option Plan:

- Look through the page you've opened and verify if it has the document you need.

- To accomplish this, use the form description and preview if these options are presented.

- To find the one that suits your needs, utilize the search tab in the page header.

- Recheck that the template complies with juridical standards and click Buy Now.

- Choose the subscription plan, then sign in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and quickly get verified legal templates for any scenario with just a couple of clicks!