The Nassau New York Stock Option Plan of Sunrise Assisted Living, Inc. is a comprehensive program designed to grant Incentive Stock Options (SOS) and Nonqualified Stock Options (SOS) to employees, consultants, and advisers. This plan aims to provide a valuable incentive to individuals associated with Sunrise Assisted Living, Inc. by allowing them to purchase company stock at a predetermined price. Under this plan, there are two primary types of stock options available: Incentive Stock Options (SOS) and Nonqualified Stock Options (SOS). Let's delve into each type to understand their distinct features: 1. Incentive Stock Options (SOS): This type of stock option is typically granted to employees of Sunrise Assisted Living, Inc. SOS provide various tax advantages to the employees who exercise the options. One of the key benefits is that the gains from SOS are subject to long-term capital gains tax rates when the stock is held for at least two years from the grant date and one year from the exercise date. SOS typically come with specific vesting requirements and may have restrictions on transferability. 2. Nonqualified Stock Options (SOS): These stock options, also known as Nonstatutory Stock Options or Jonquils, are more flexible than SOS in terms of whom they can be granted to. SOS can be awarded to employees, consultants, and advisers. Unlike SOS, SOS do not come with specific tax advantages and are subject to ordinary income tax rates. They also allow for more flexibility in terms of vesting requirements and transferability. The Nassau New York Stock Option Plan of Sunrise Assisted Living, Inc. ensures that these stock options are offered as a means of encouraging loyalty, motivating performance, and aligning the interests of employees, consultants, and advisers with the company's long-term growth objectives. By granting stock options, Sunrise Assisted Living, Inc. aims to promote a sense of ownership and provide individuals with the opportunity to share in the company's success. Please note that this description is a general overview of the Nassau New York Stock Option Plan. It is always advisable for employees, consultants, and advisers to review the specific terms and conditions of the plan to fully understand the rights, restrictions, and benefits associated with the granted stock options.

Nassau New York Stock Option Plan of Sunrise Assisted Living, Inc., for grant of Incentive Stock Options and Nonqualified Stock Options to employees, consultants and advisers

Description

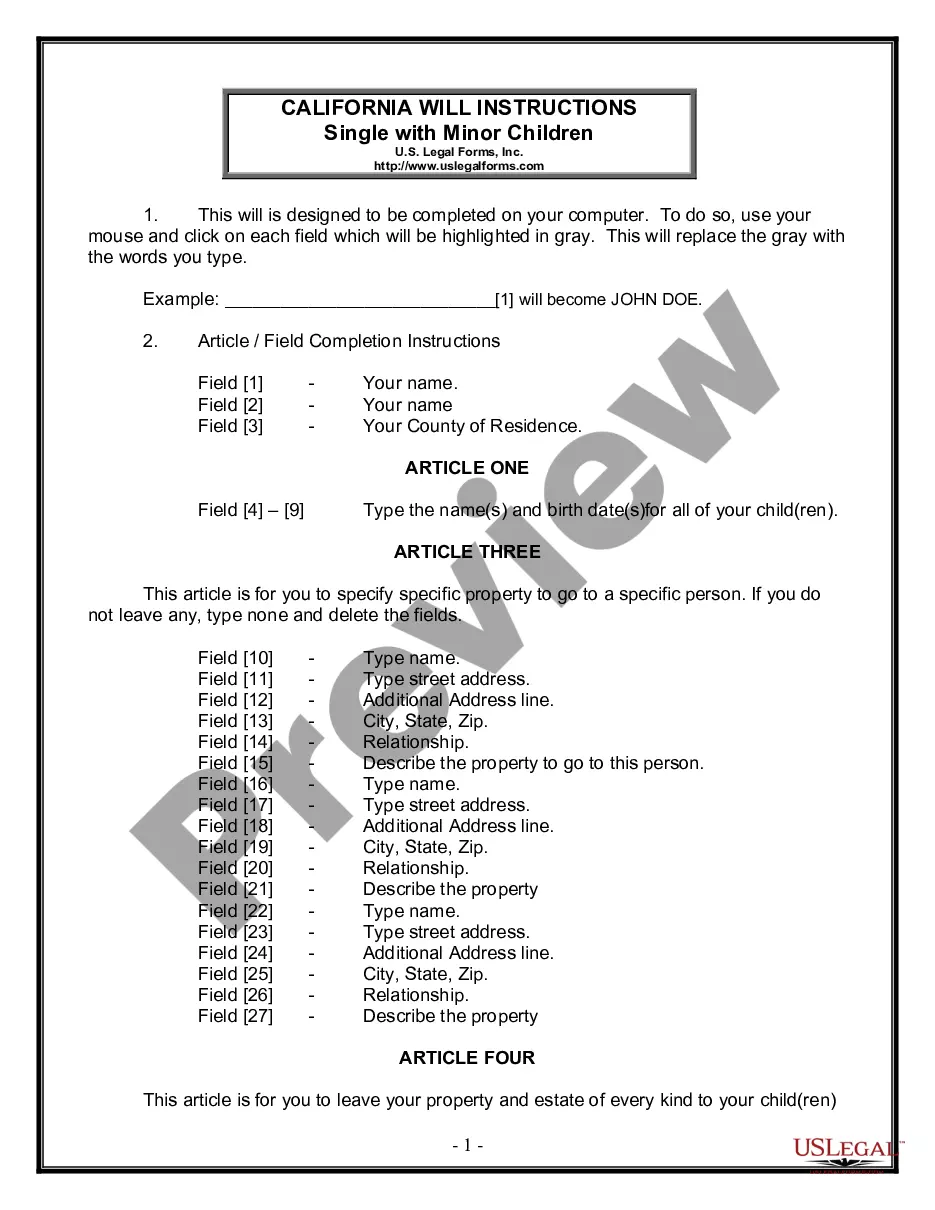

How to fill out Nassau New York Stock Option Plan Of Sunrise Assisted Living, Inc., For Grant Of Incentive Stock Options And Nonqualified Stock Options To Employees, Consultants And Advisers?

Preparing legal documentation can be burdensome. Besides, if you decide to ask an attorney to draft a commercial contract, documents for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Nassau Stock Option Plan of Sunrise Assisted Living, Inc., for grant of Incentive Stock Options and Nonqualified Stock Options to employees, consultants and advisers, it may cost you a fortune. So what is the most reasonable way to save time and money and draw up legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is a perfect solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is the most extensive online library of state-specific legal documents, providing users with the up-to-date and professionally checked templates for any scenario collected all in one place. Therefore, if you need the latest version of the Nassau Stock Option Plan of Sunrise Assisted Living, Inc., for grant of Incentive Stock Options and Nonqualified Stock Options to employees, consultants and advisers, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample using the Download button. If you haven't subscribed yet, here's how you can get the Nassau Stock Option Plan of Sunrise Assisted Living, Inc., for grant of Incentive Stock Options and Nonqualified Stock Options to employees, consultants and advisers:

- Glance through the page and verify there is a sample for your area.

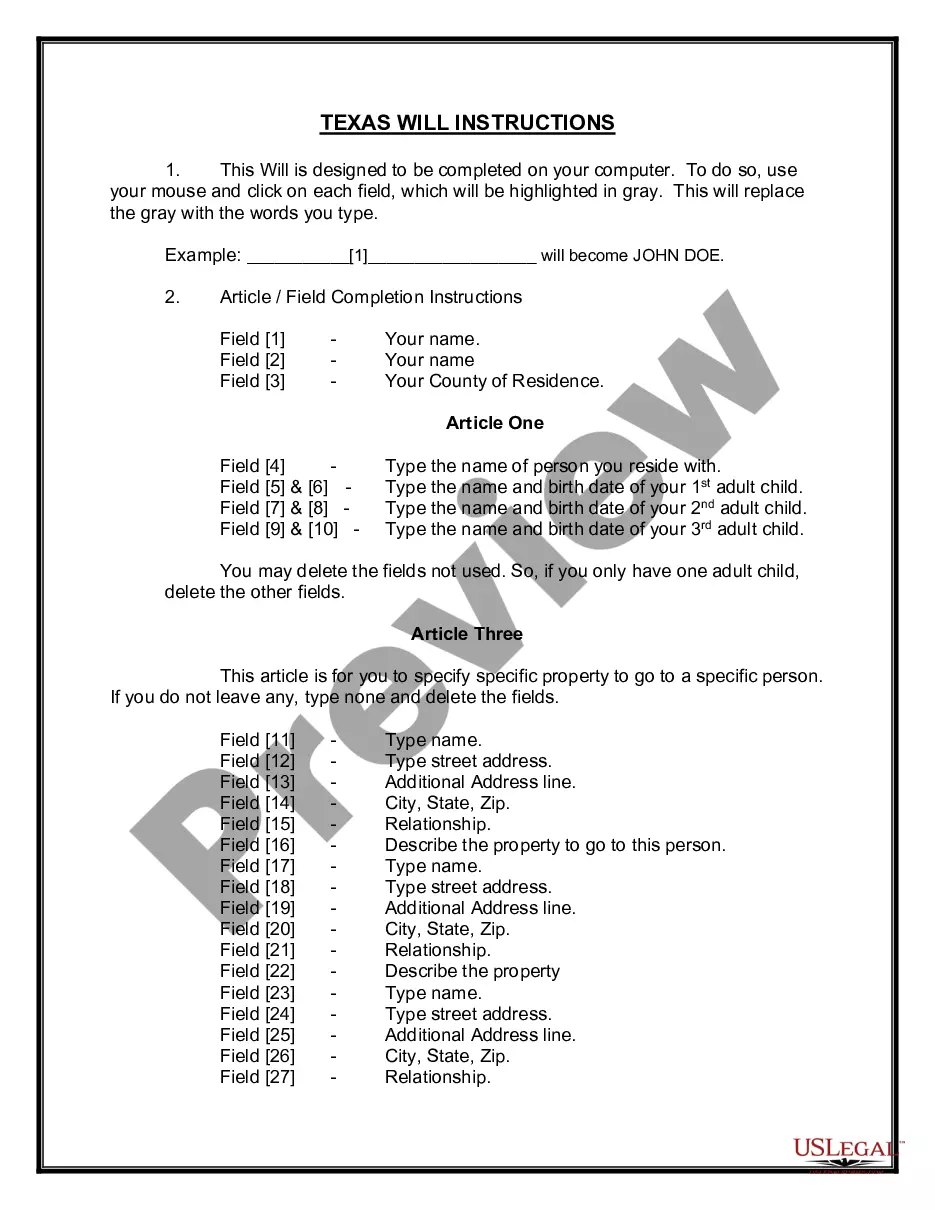

- Check the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - search for the correct one in the header.

- Click Buy Now once you find the needed sample and pick the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a transaction with a credit card or via PayPal.

- Choose the file format for your Nassau Stock Option Plan of Sunrise Assisted Living, Inc., for grant of Incentive Stock Options and Nonqualified Stock Options to employees, consultants and advisers and save it.

When finished, you can print it out and complete it on paper or upload the template to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the paperwork ever acquired many times - you can find your templates in the My Forms tab in your profile. Give it a try now!