The Lima Arizona Stock Option Plan of Sunrise Assisted Living, Inc. is a comprehensive program designed to provide incentives to employees, consultants, and advisers through the grant of stock options. These options can be categorized into two types: Incentive Stock Options (SOS) and Nonqualified Stock Options (SOS), each offering different benefits and characteristics. Incentive Stock Options (SOS) are a type of stock option plan that offers favorable tax treatment to the option holder. These options are typically granted to employees and are subject to specific requirements outlined by the Internal Revenue Service (IRS). SOS provide the opportunity for employees to purchase company stock at a predetermined price, usually referred to as the exercise price or strike price. They also offer the potential for long-term capital gains tax treatment if certain holding requirements are met. Nonqualified Stock Options (SOS), on the other hand, do not offer the same tax advantages as SOS. These options are generally granted to employees, consultants, or advisers who may not meet the eligibility criteria for SOS or when the company decides not to comply with ISO requirements. SOS allow the option holder to purchase company stock at a predetermined price, similar to SOS. However, SOS are subject to ordinary income tax rates upon exercise, and any subsequent appreciation in the stock may be subject to capital gains tax. The Lima Arizona Stock Option Plan serves as a valuable tool for Sunrise Assisted Living, Inc. to attract and retain talented individuals by offering them the opportunity to share in the company's success. It provides employees with a sense of ownership and aligns their interests with those of the company. Consultants and advisers may also be granted stock options as a means of compensating them for their expertise and contributions to the company's growth. By implementing the Lima Arizona Stock Option Plan, Sunrise Assisted Living, Inc. aims to create a mutually beneficial relationship between the company and its employees, consultants, and advisers. Through the grant of both Incentive Stock Options (SOS) and Nonqualified Stock Options (SOS), the company can tailor the program to meet the needs and preferences of various individuals within its organization. This robust stock option plan encourages excellence, fosters loyalty, and incentivizes participants to contribute significantly to the company's long-term success.

Pima Arizona Stock Option Plan of Sunrise Assisted Living, Inc., for grant of Incentive Stock Options and Nonqualified Stock Options to employees, consultants and advisers

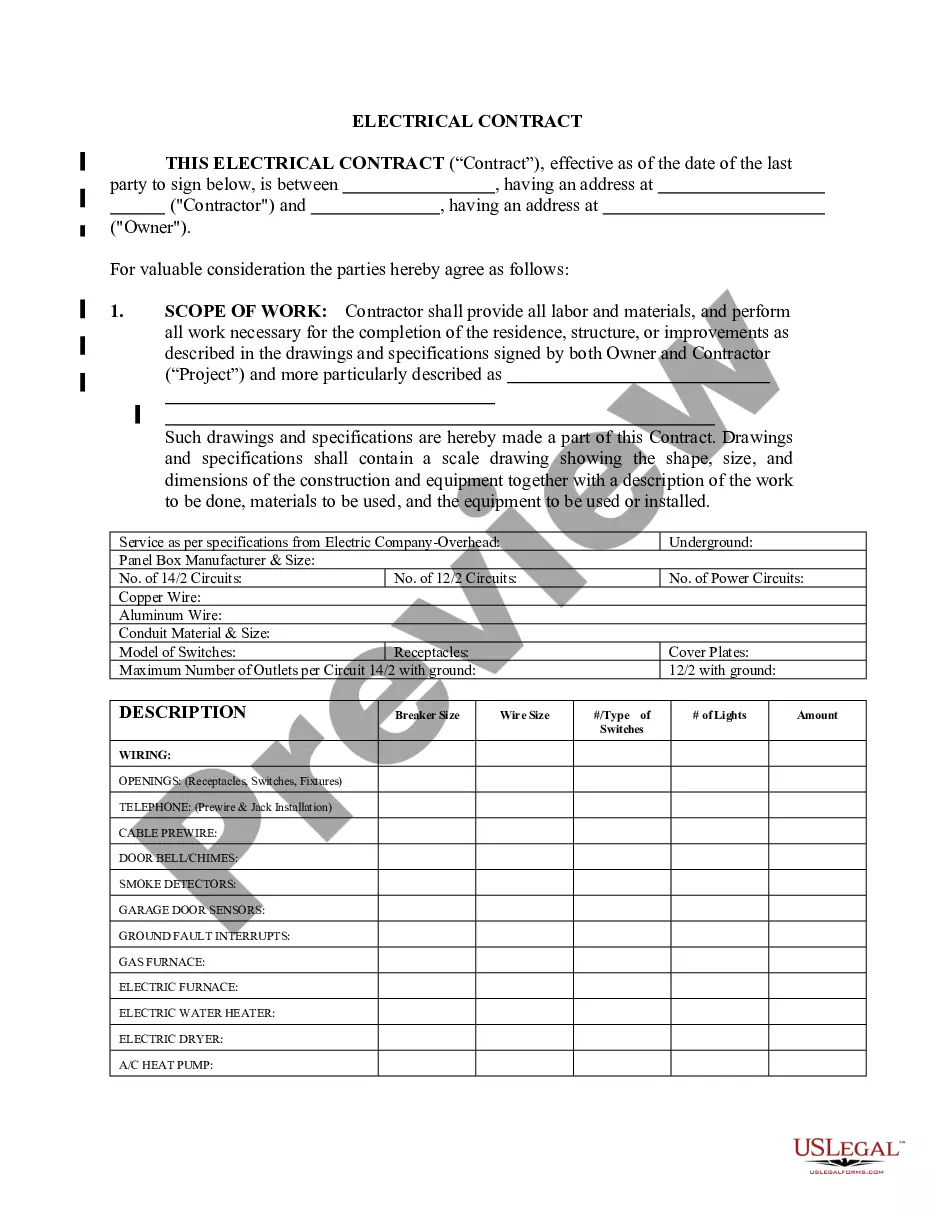

Description

How to fill out Pima Arizona Stock Option Plan Of Sunrise Assisted Living, Inc., For Grant Of Incentive Stock Options And Nonqualified Stock Options To Employees, Consultants And Advisers?

Dealing with legal forms is a necessity in today's world. Nevertheless, you don't always need to look for qualified assistance to create some of them from the ground up, including Pima Stock Option Plan of Sunrise Assisted Living, Inc., for grant of Incentive Stock Options and Nonqualified Stock Options to employees, consultants and advisers, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 forms to pick from in different types ranging from living wills to real estate paperwork to divorce documents. All forms are arranged based on their valid state, making the searching process less frustrating. You can also find detailed resources and tutorials on the website to make any tasks associated with paperwork completion simple.

Here's how you can locate and download Pima Stock Option Plan of Sunrise Assisted Living, Inc., for grant of Incentive Stock Options and Nonqualified Stock Options to employees, consultants and advisers.

- Take a look at the document's preview and description (if provided) to get a general idea of what you’ll get after downloading the form.

- Ensure that the template of your choosing is adapted to your state/county/area since state regulations can affect the legality of some documents.

- Check the related forms or start the search over to locate the right file.

- Hit Buy now and create your account. If you already have an existing one, choose to log in.

- Pick the pricing {plan, then a needed payment gateway, and buy Pima Stock Option Plan of Sunrise Assisted Living, Inc., for grant of Incentive Stock Options and Nonqualified Stock Options to employees, consultants and advisers.

- Select to save the form template in any offered format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the needed Pima Stock Option Plan of Sunrise Assisted Living, Inc., for grant of Incentive Stock Options and Nonqualified Stock Options to employees, consultants and advisers, log in to your account, and download it. Of course, our platform can’t take the place of a legal professional entirely. If you have to cope with an extremely challenging case, we advise using the services of an attorney to check your document before executing and submitting it.

With more than 25 years on the market, US Legal Forms became a go-to platform for many different legal forms for millions of users. Become one of them today and purchase your state-specific documents effortlessly!