The Nassau New York Stock Option and Long Term Incentive Plan of Golf Technology Holding, Inc. is a comprehensive compensation program offered by the company to attract and retain top talent in the golf technology industry. This plan provides employees with the opportunity to participate in the company's growth and success through stock options and long-term incentives. Stock options are a key component of the plan, giving employees the right to purchase shares of Golf Technology Holding, Inc. stock at a predetermined price, known as the exercise price. These options can be exercised after a specific vesting period, during which employees must remain with the company to be eligible. By offering stock options, employees have the potential to benefit financially if the company's stock price increases over time. In addition to stock options, the plan also includes long-term incentives to align employee interests with long-term company performance. These incentives are designed to reward employees for achieving specific performance targets or milestones that contribute to the overall success of Golf Technology Holding, Inc. The long-term incentives may consist of cash bonuses, additional stock options, or other forms of equity-based compensation. The Nassau New York Stock Option and Long Term Incentive Plan may have different types based on factors such as employee position, seniority, or performance level. For example, there might be different plans for executives, managers, and general employees. Each plan may have its own specific terms, conditions, and eligibility requirements. It is important to note that the specific details of the Nassau New York Stock Option and Long Term Incentive Plan of Golf Technology Holding, Inc. may vary and are subject to change as determined by the company's board of directors and compensation committee. Employees should refer to the official plan documents and consult with their HR department or plan administrator for the most up-to-date information. Keywords: Nassau New York, Stock Option Plan, Long Term Incentive Plan, Golf Technology Holding, Inc., compensation program, stock options, vesting period, exercise price, long-term incentives, performance targets, equity-based compensation, employee position, eligibility requirements, board of directors, compensation committee.

Nassau New York Stock Option and Long Term Incentive Plan of Golf Technology Holding, Inc.

Description

How to fill out Nassau New York Stock Option And Long Term Incentive Plan Of Golf Technology Holding, Inc.?

If you need to get a trustworthy legal form supplier to obtain the Nassau Stock Option and Long Term Incentive Plan of Golf Technology Holding, Inc., look no further than US Legal Forms. No matter if you need to start your LLC business or take care of your belongings distribution, we got you covered. You don't need to be well-versed in in law to find and download the needed form.

- You can search from more than 85,000 forms categorized by state/county and situation.

- The self-explanatory interface, variety of learning resources, and dedicated support team make it easy to get and execute various papers.

- US Legal Forms is a reliable service offering legal forms to millions of customers since 1997.

Simply select to look for or browse Nassau Stock Option and Long Term Incentive Plan of Golf Technology Holding, Inc., either by a keyword or by the state/county the form is intended for. After finding the needed form, you can log in and download it or retain it in the My Forms tab.

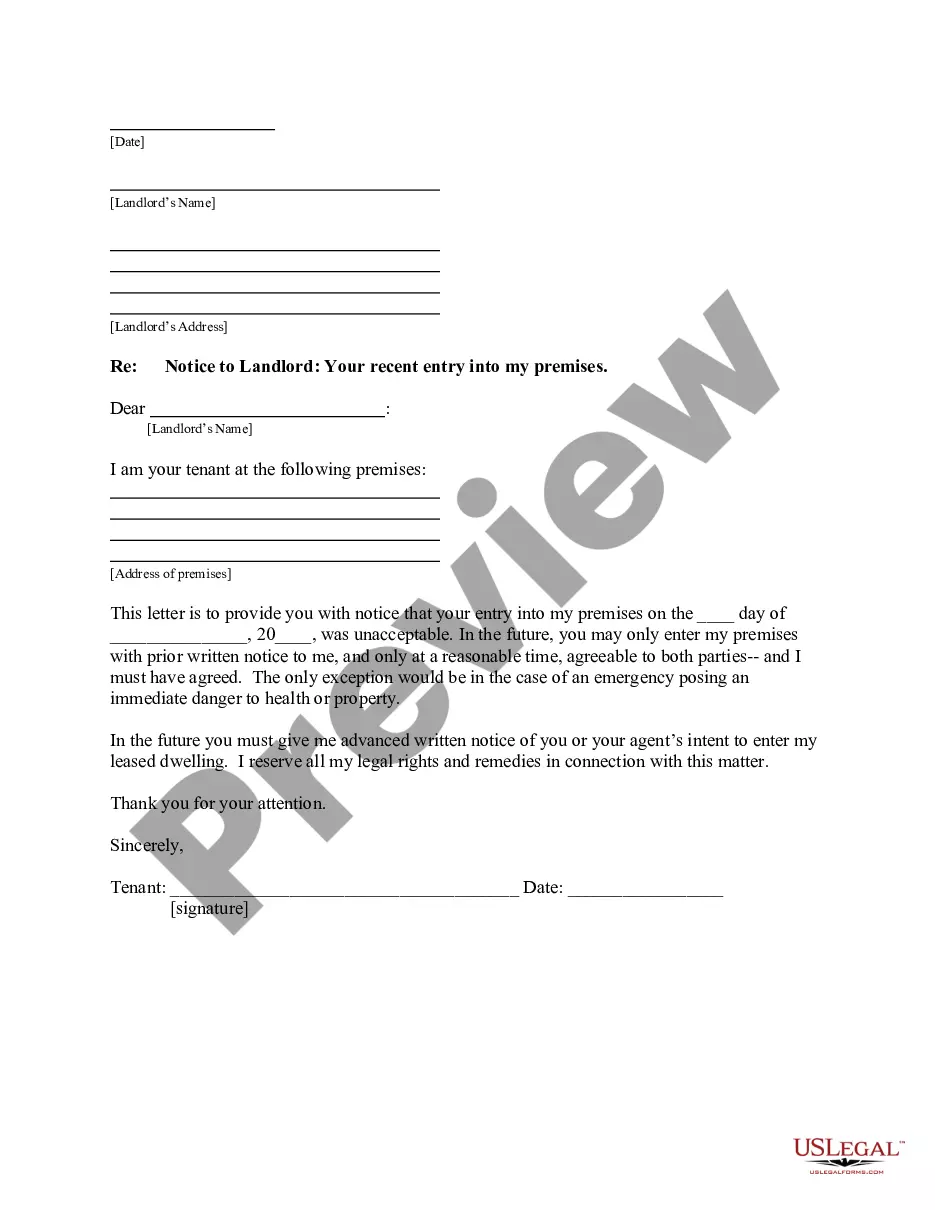

Don't have an account? It's easy to start! Simply find the Nassau Stock Option and Long Term Incentive Plan of Golf Technology Holding, Inc. template and check the form's preview and short introductory information (if available). If you're comfortable with the template’s terminology, go ahead and click Buy now. Create an account and choose a subscription option. The template will be instantly available for download as soon as the payment is completed. Now you can execute the form.

Taking care of your legal affairs doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our rich collection of legal forms makes these tasks less expensive and more affordable. Set up your first company, organize your advance care planning, create a real estate contract, or complete the Nassau Stock Option and Long Term Incentive Plan of Golf Technology Holding, Inc. - all from the convenience of your home.

Sign up for US Legal Forms now!