The Contra Costa California Stock Option Plan is a comprehensive program that aims to incentivize employees by granting them various types of stock options and stock appreciation rights. This plan caters to the specific needs of companies operating in Contra Costa, California, and can greatly benefit both employees and employers alike. The plan offers three main types of stock options: Incentive Stock Options (ISO), Nonqualified Stock Options (NO), and Stock Appreciation Rights (SAR). Each type has its own unique features and eligibility criteria, providing flexibility for employers to customize their incentive plans according to their business objectives and employee requirements. 1. Incentive Stock Options (ISO): These stock options are governed by the rules outlined in Section 422 of the Internal Revenue Code. SOS are typically granted to employees as a long-term incentive to retain and motivate them. Employees who receive SOS can enjoy certain tax advantages if they meet specific holding periods and other qualifying criteria. SOS can only be granted to employees and must adhere to strict limitations on their exercise price and value. 2. Nonqualified Stock Options (NO): Unlike SOS, SOS do not fall under the regulations set forth in Section 422 of the Internal Revenue Code. This offers more flexibility to employers as SOS can be granted to both employees and non-employees, such as consultants or contractors. SOS do not have the same tax advantages as SOS but can still serve as a valuable compensation tool. Employers have more freedom in determining exercise prices and can customize SOS to suit their specific needs. 3. Stock Appreciation Rights (SAR): Stock Appreciation Rights provide employees with the opportunity to share in the increase in the company's stock price over a specific period. Unlike stock options, SARS do not grant employees the right to purchase stock at a predetermined price. Instead, employees are entitled to receive the appreciation in the stock's value in cash or stock, aligning their interests with the company's performance. SARS are often granted in conjunction with other stock options to diversify the range of benefits provided. By offering these different types of stock options and stock appreciation rights, the Contra Costa California Stock Option Plan allows businesses in the region to effectively reward and retain their employees. With proper consideration of eligibility criteria, tax implications, and alignment with corporate goals, this plan can be an invaluable tool in attracting top talent, fostering loyalty, and promoting long-term growth and success.

Contra Costa California Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options and Stock Appreciation Rights

Description

How to fill out Contra Costa California Stock Option Plan Which Provides For Grant Of Incentive Stock Options, Nonqualified Stock Options And Stock Appreciation Rights?

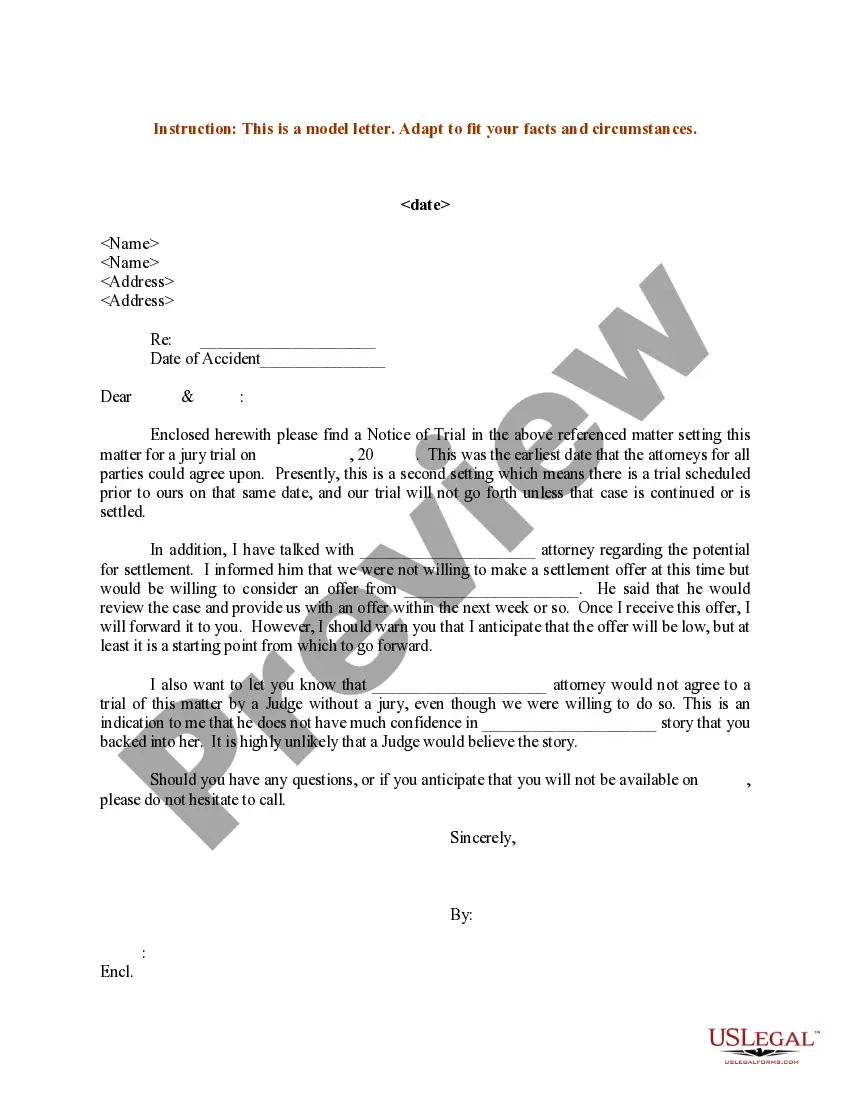

Laws and regulations in every sphere vary around the country. If you're not an attorney, it's easy to get lost in countless norms when it comes to drafting legal documents. To avoid high priced legal assistance when preparing the Contra Costa Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options and Stock Appreciation Rights, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal templates. It's a perfect solution for specialists and individuals looking for do-it-yourself templates for different life and business situations. All the documents can be used many times: once you obtain a sample, it remains available in your profile for further use. Therefore, when you have an account with a valid subscription, you can simply log in and re-download the Contra Costa Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options and Stock Appreciation Rights from the My Forms tab.

For new users, it's necessary to make a few more steps to get the Contra Costa Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options and Stock Appreciation Rights:

- Examine the page content to make sure you found the appropriate sample.

- Utilize the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to obtain the template when you find the proper one.

- Choose one of the subscription plans and log in or create an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Complete and sign the template on paper after printing it or do it all electronically.

That's the simplest and most cost-effective way to get up-to-date templates for any legal scenarios. Find them all in clicks and keep your paperwork in order with the US Legal Forms!

Form popularity

FAQ

A nonqualified stock option, also known as an NSO, is a form of employee compensation offered by employers wherein the option holder pays ordinary income tax on the profit made when they exercise the shares.

When you exercise Incentive Stock Options, you buy the stock at a pre-established price, which could be well below actual market value. The advantage of an ISO is you do not have to report income when you receive a stock option grant or when you exercise that option.

What Is a Non-Qualified Stock Option (NSO)? A non-qualified stock option (NSO) is a type of employee stock option wherein you pay ordinary income tax on the difference between the grant price and the price at which you exercise the option.

Incentive stock options are one type of deferred compensation used to motivate and retain key employees. Since you need to hold on to your ISOs for a period of time, the only way to capitalize on these benefits is to stay with your firm for the long haul.

Incentive stock options (ISOs), are a type of employee stock option that can be granted only to employees and confer a U.S. tax benefit. ISOs are also sometimes referred to as statutory stock options by the IRS. ISOs have a strike price, which is the price a holder must pay to purchase one share of the stock.

Incentive stock options, or ISOs, are options that are entitled to potentially favorable federal tax treatment. Stock options that are not ISOs are usually referred to as nonqualified stock options or NQOs. The acronym NSO is also used. These do not qualify for special tax treatment.

Incentive stock options (ISOs) are popular measures of employee compensation received as rights to company stock. These are a particular type of employee stock purchase plan intended to retain key employees or managers. ISOs often have more favorable tax treatment than other types of employee stock purchase plan.

Qualified stock options, also known as incentive stock options, can only be granted to employees. Non-qualified stock options can be granted to employees, directors, contractors and others. This gives you greater flexibility to recognize the contributions of non-employees.

However, there is another type of stock option, known as an incentive stock option, which is usually only offered to key employees and top-tier management. These options are also commonly known as statutory or qualified options, and they can receive preferential tax treatment in many cases.

An incentive stock option (ISO) is a corporate benefit that gives an employee the right to buy shares of company stock at a discounted price with the added benefit of possible tax breaks on the profit.

Interesting Questions

More info

Options issued in connection with a corporate action or with the exercise or sale of shares are not eligible for the deferred tax asset allocation method. A determination by an outside tax advisor regarding the appropriateness of the financial instrument for the deferred tax asset allocation method is based on its particular facts. For financial instruments that are not included in any of our current valuation models, we record an exclusion (or valuation exception) based on the financial instrument's fair value at the date of the transaction. Financial instruments that are included in our current valuation models generally will be characterized as Level 2 and the exclusion will result in an income tax benefit. However, where an entity files income tax returns on an annual basis, there could be differing amounts of such financial instruments that would be excluded and an additional valuation exception that would result in a potential incremental tax benefit.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.