The Dallas Texas Stock Option Plan is a comprehensive program designed to provide employees with various stock-based incentives. This plan offers three distinct types of options: Incentive Stock Options (SOS), Nonqualified Stock Options (Nests), and Stock Appreciation Rights (SARS). Let's delve into each type in detail: 1. Incentive Stock Options (SOS): SOS are a type of stock option that offers significant tax advantages to employees. These options are typically granted to key employees and executives. Under this plan, ISO holders have the right to purchase company stock at a predetermined price (exercise price) within a specified timeframe. SOS also come with special tax treatment, allowing employees to defer taxes until they sell the shares acquired through exercising the options. 2. Nonqualified Stock Options (Nests): Nests, also known as non-statutory stock options, are another type of option available under the Dallas Texas Stock Option Plan. Unlike SOS, Nests do not offer preferential tax treatment. Employees who receive Nests have the right to purchase company stock at the exercise price determined by the plan. Upon exercising Nests, ordinary income tax is usually applicable based on the difference between the stock's fair market value and the exercise price. 3. Stock Appreciation Rights (SARS): Stock Appreciation Rights are an alternative form of compensation provided by the Dallas Texas Stock Option Plan. Instead of being granted the right to purchase company stock, employees with SARS are entitled to receive a cash or stock payment equivalent to the increase in the company's stock price over a specific period. SARS can be exercised at a predetermined date and often have vesting schedules linked to performance goals or company milestones. The Dallas Texas Stock Option Plan brings together these three types of options to offer a comprehensive range of incentives suitable for employees at different levels within the organization. This allows companies to customize their compensation packages based on individual employee needs and objectives while aligning their interests with the company's overall growth and success.

Dallas Texas Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options and Stock Appreciation Rights

Description

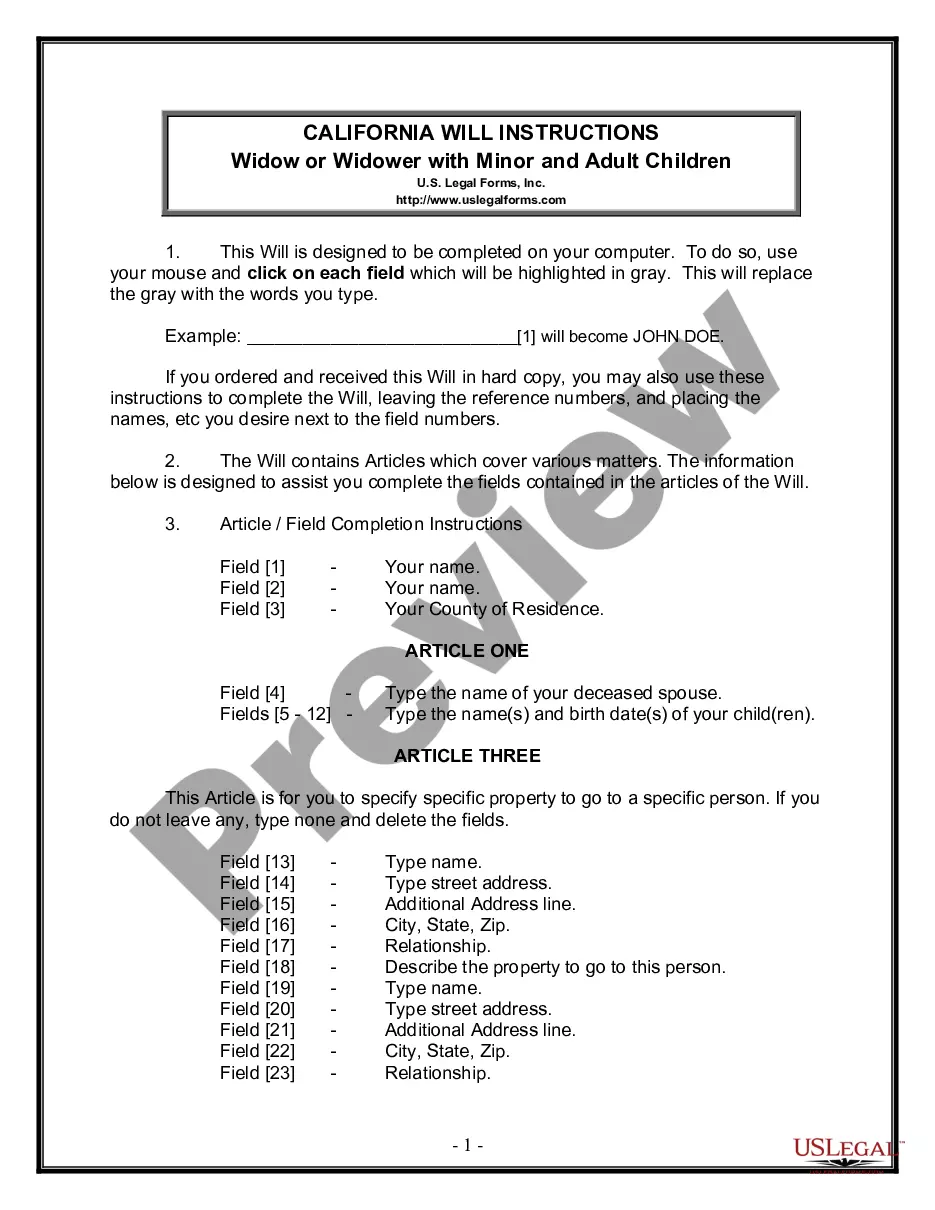

How to fill out Dallas Texas Stock Option Plan Which Provides For Grant Of Incentive Stock Options, Nonqualified Stock Options And Stock Appreciation Rights?

Dealing with legal forms is a must in today's world. Nevertheless, you don't always need to seek professional help to create some of them from scratch, including Dallas Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options and Stock Appreciation Rights, with a platform like US Legal Forms.

US Legal Forms has over 85,000 forms to pick from in different types ranging from living wills to real estate papers to divorce papers. All forms are arranged based on their valid state, making the searching experience less frustrating. You can also find information resources and guides on the website to make any tasks related to paperwork execution simple.

Here's how you can purchase and download Dallas Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options and Stock Appreciation Rights.

- Take a look at the document's preview and description (if available) to get a general information on what you’ll get after getting the form.

- Ensure that the template of your choice is specific to your state/county/area since state laws can impact the validity of some documents.

- Examine the similar document templates or start the search over to find the correct file.

- Click Buy now and create your account. If you already have an existing one, select to log in.

- Pick the option, then a needed payment gateway, and purchase Dallas Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options and Stock Appreciation Rights.

- Select to save the form template in any offered format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the appropriate Dallas Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options and Stock Appreciation Rights, log in to your account, and download it. Of course, our website can’t take the place of an attorney entirely. If you have to cope with an extremely complicated situation, we recommend using the services of a lawyer to examine your document before signing and filing it.

With more than 25 years on the market, US Legal Forms proved to be a go-to provider for various legal forms for millions of customers. Become one of them today and purchase your state-specific paperwork effortlessly!