The San Antonio Texas Stock Option Plan is a comprehensive incentive program offered by many companies located in the San Antonio area. This plan allows employers to grant various types of stock options and stock appreciation rights to their employees. These options are designed to incentivize and reward employees for their hard work, dedication, and contribution towards the company's success. 1. Incentive Stock Options (SOS): This type of stock option is typically granted to key employees and provides them with the opportunity to purchase company stock at a discounted price in the future. SOS offer potential tax advantages, as they may qualify for favorable tax treatment upon exercise and sale of the stock. 2. Nonqualified Stock Options (SOS): Nonqualified stock options are an alternative to SOS and are usually granted to a broader range of employees, including executives, consultants, and non-executive employees. SOS do not qualify for the same tax advantages as SOS but are still an attractive option for employees seeking to participate in the company's growth. 3. Stock Appreciation Rights (SARS): In addition to stock options, some companies may also grant Stock Appreciation Rights as part of their stock option plan. SARS provide employees with the right to receive cash or stock bonuses equivalent to the increase in the company's stock price over a predetermined period. They do not require employees to purchase actual stock, making them an attractive option for employees who prefer the flexibility of cash-based incentives. The San Antonio Texas Stock Option Plan recognizes the importance of attracting and retaining top talent in a competitive market. By offering a combination of SOS, SOS, and SARS, companies can tailor their stock option plans to meet the needs and goals of their employees. These plans not only provide employees with a sense of ownership and engagement but also align their interests with the long-term success of the company.

San Antonio Texas Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options and Stock Appreciation Rights

Description

How to fill out San Antonio Texas Stock Option Plan Which Provides For Grant Of Incentive Stock Options, Nonqualified Stock Options And Stock Appreciation Rights?

Drafting paperwork for the business or individual needs is always a huge responsibility. When creating an agreement, a public service request, or a power of attorney, it's important to consider all federal and state regulations of the particular area. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it tense and time-consuming to draft San Antonio Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options and Stock Appreciation Rights without professional help.

It's easy to avoid spending money on lawyers drafting your paperwork and create a legally valid San Antonio Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options and Stock Appreciation Rights by yourself, using the US Legal Forms online library. It is the most extensive online catalog of state-specific legal templates that are professionally verified, so you can be certain of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to download the required form.

In case you still don't have a subscription, adhere to the step-by-step instruction below to get the San Antonio Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options and Stock Appreciation Rights:

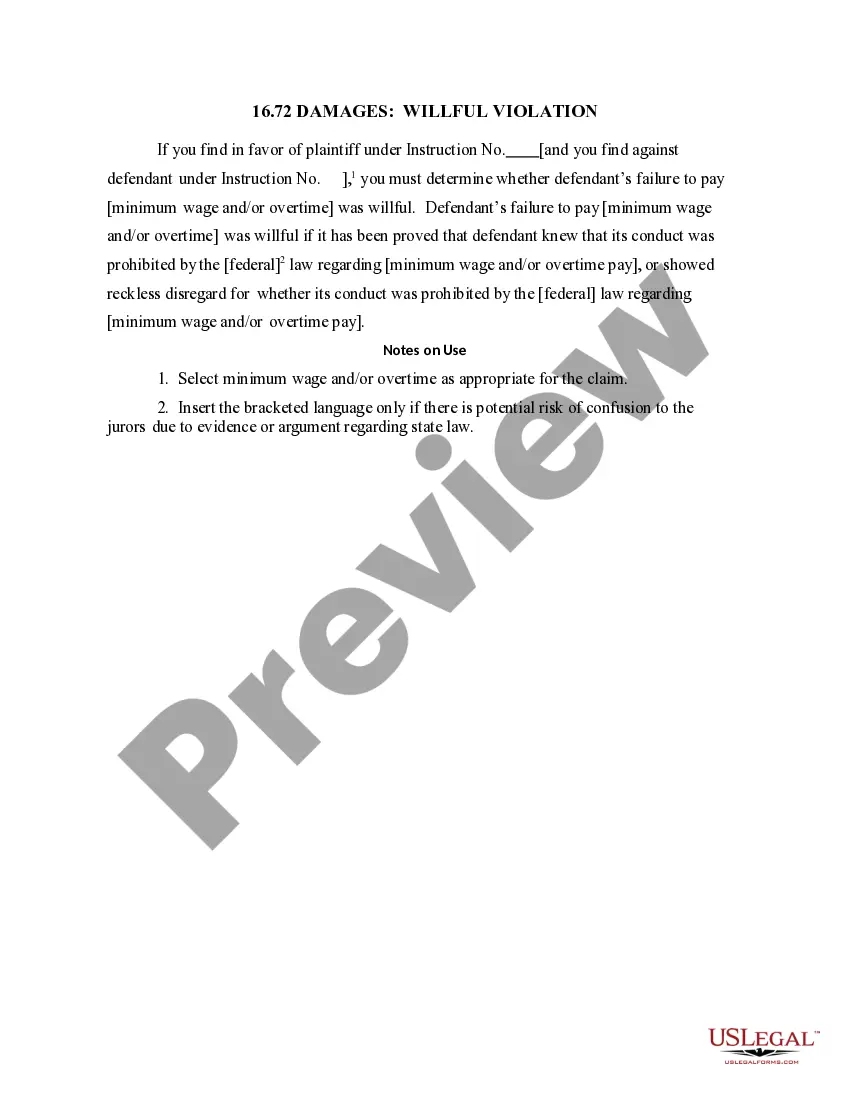

- Look through the page you've opened and verify if it has the document you require.

- To accomplish this, use the form description and preview if these options are available.

- To find the one that meets your requirements, use the search tab in the page header.

- Double-check that the sample complies with juridical criteria and click Buy Now.

- Select the subscription plan, then sign in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever acquired never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and easily get verified legal templates for any situation with just a couple of clicks!