The Middlesex Massachusetts Stock Option Plan is a comprehensive stock option plan that allows for the issuance of various types of stock options to employees and key personnel. This plan provides an attractive package of incentives to reward and retain talent within the organization. One of the main types of stock options granted under the Middlesex Massachusetts Stock Option Plan is Incentive Stock Options (SOS). These options are typically given to employees and carry certain tax advantages. SOS allow the holder to purchase company stock at a predetermined price, known as the exercise price, within a specified timeframe. The exercise price is often set at the fair market value of the stock on the date of grant. Another type of stock option available under the plan is Nonqualified Stock Options (SOS). Unlike SOS, SOS do not possess the same tax advantages. However, they offer more flexibility in terms of eligibility and can be granted to any individual, including employees, consultants, and directors. SOS also have an exercise price, and once vested, the holder can use them to purchase company stock at the predetermined price. The Middlesex Massachusetts Stock Option Plan also includes Exchange Options. These options allow the holder to exchange certain previously granted options for new options with revised terms. Exchange options offer an opportunity for the plan participants to modify their existing stock options to align with changing circumstances, such as stock price fluctuations or new company policies. The purpose of the Middlesex Massachusetts Stock Option Plan is to incentivize employees and reward their contributions to the company's growth and success. By granting stock options, the plan aligns the interests of employees with those of shareholders, encouraging long-term commitment and dedication. It also serves as a tool for attracting and retaining top talent in the competitive job market. Overall, the Middlesex Massachusetts Stock Option Plan provides a flexible and comprehensive framework for the issuance of Incentive Stock Options, Nonqualified Stock Options, and Exchange Options. It aims to enhance employee engagement, align interests, and ultimately contribute to the overall success and growth of the organization.

Middlesex Massachusetts Stock Option Plan Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options, and Exchange Options

Description

How to fill out Middlesex Massachusetts Stock Option Plan Stock Option Plan Which Provides For Grant Of Incentive Stock Options, Nonqualified Stock Options, And Exchange Options?

Dealing with legal forms is a must in today's world. Nevertheless, you don't always need to seek qualified assistance to create some of them from scratch, including Middlesex Stock Option Plan Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options, and Exchange Options, with a platform like US Legal Forms.

US Legal Forms has over 85,000 forms to choose from in different types ranging from living wills to real estate paperwork to divorce papers. All forms are organized based on their valid state, making the searching experience less frustrating. You can also find information materials and guides on the website to make any tasks related to paperwork completion straightforward.

Here's how to locate and download Middlesex Stock Option Plan Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options, and Exchange Options.

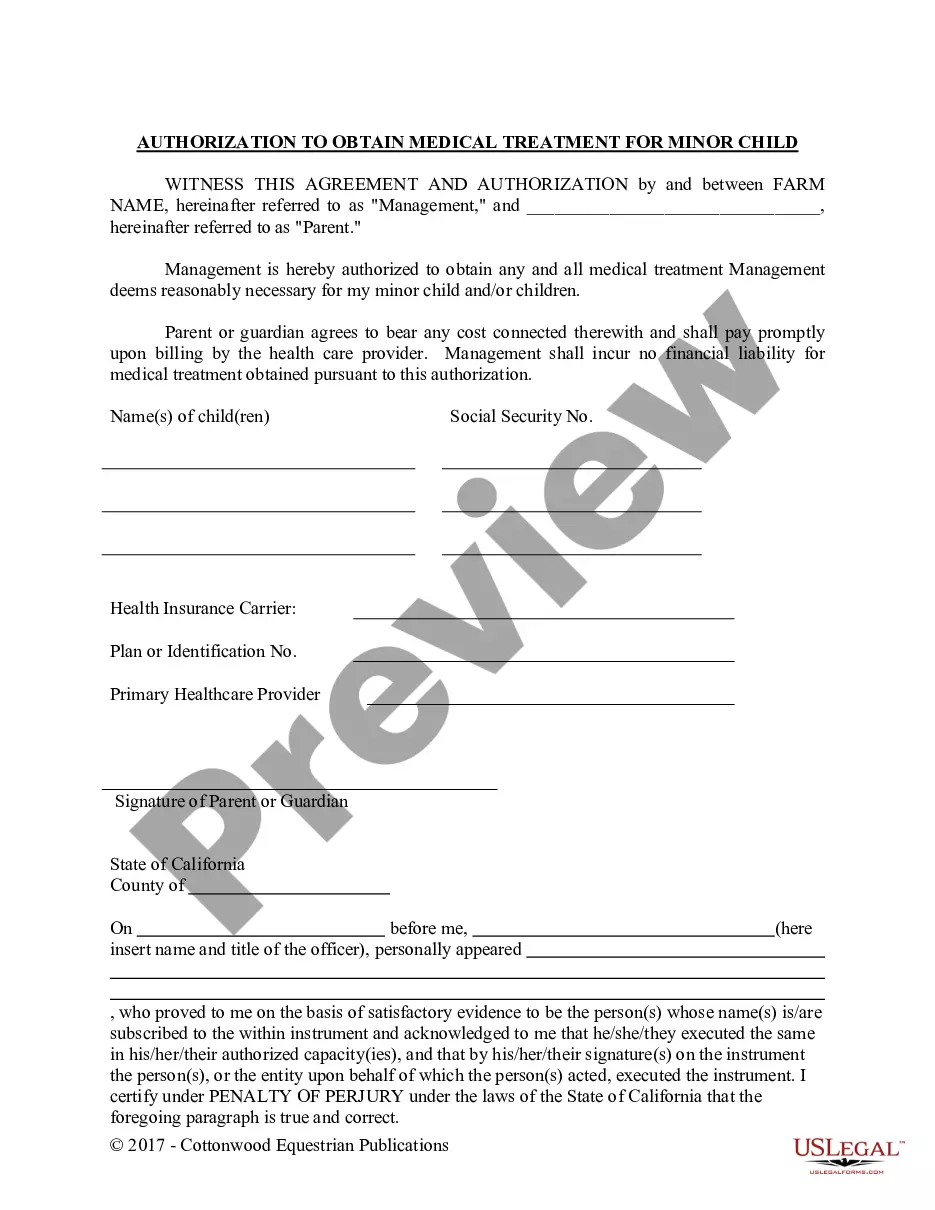

- Go over the document's preview and outline (if available) to get a basic idea of what you’ll get after downloading the form.

- Ensure that the document of your choice is adapted to your state/county/area since state regulations can impact the legality of some records.

- Check the similar forms or start the search over to locate the right file.

- Click Buy now and create your account. If you already have an existing one, select to log in.

- Choose the pricing {plan, then a needed payment method, and buy Middlesex Stock Option Plan Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options, and Exchange Options.

- Select to save the form template in any available format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the needed Middlesex Stock Option Plan Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options, and Exchange Options, log in to your account, and download it. Needless to say, our platform can’t replace an attorney entirely. If you need to cope with an extremely complicated case, we recommend getting a lawyer to review your form before executing and submitting it.

With more than 25 years on the market, US Legal Forms became a go-to provider for various legal forms for millions of customers. Join them today and purchase your state-compliant documents effortlessly!