The Phoenix Arizona Stock Option Plan is a comprehensive program designed to provide employees and key executives with the opportunity to acquire ownership in the company through the granting of various types of stock options. This plan caters to the needs of both employees and employers by offering different types of stock options, namely Incentive Stock Options, Nonqualified Stock Options, and Exchange Options. Incentive Stock Options (SOS) are a type of stock option that provides favorable tax treatment to the recipient. These options are typically granted to employees and allow them to purchase company stock at a predetermined price, known as the exercise price or strike price. SOS come with specific eligibility criteria, including the requirement that the option holder must be an employee of the company granting the options and must hold the options for at least one year before selling the shares to qualify for certain tax benefits. Nonqualified Stock Options (SOS) are another type of stock option included in the Phoenix Arizona Stock Option Plan. Unlike SOS, SOS do not come with the same tax advantages. However, they offer more flexibility in terms of eligibility requirements and can be granted to employees, directors, consultants, and other service providers. SOS allow the option holder the right to purchase company stock at a predetermined price, and taxes are generally paid on the difference between the exercise price and the fair market value of the stock at the time of exercise. Exchange Options are a unique feature of the Phoenix Arizona Stock Option Plan. This type of stock option allows employees or option holders to exchange their existing stock options for different types of stock options, providing them with greater flexibility and customization. This exchange option feature allows employees to adjust their stock option holdings to align with their changing financial goals and circumstances. The Phoenix Arizona Stock Option Plan is designed to attract and retain talented individuals by offering them ownership opportunities in the company. It provides flexibility in terms of eligibility criteria and tax treatment, ensuring that employees and key executives are incentivized to contribute to the company's long-term success. By granting Incentive Stock Options, Nonqualified Stock Options, and Exchange Options, this stock option plan promotes employee engagement, loyalty, and a sense of shared ownership in Phoenix, Arizona.

Phoenix Arizona Stock Option Plan Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options, and Exchange Options

Description

How to fill out Phoenix Arizona Stock Option Plan Stock Option Plan Which Provides For Grant Of Incentive Stock Options, Nonqualified Stock Options, And Exchange Options?

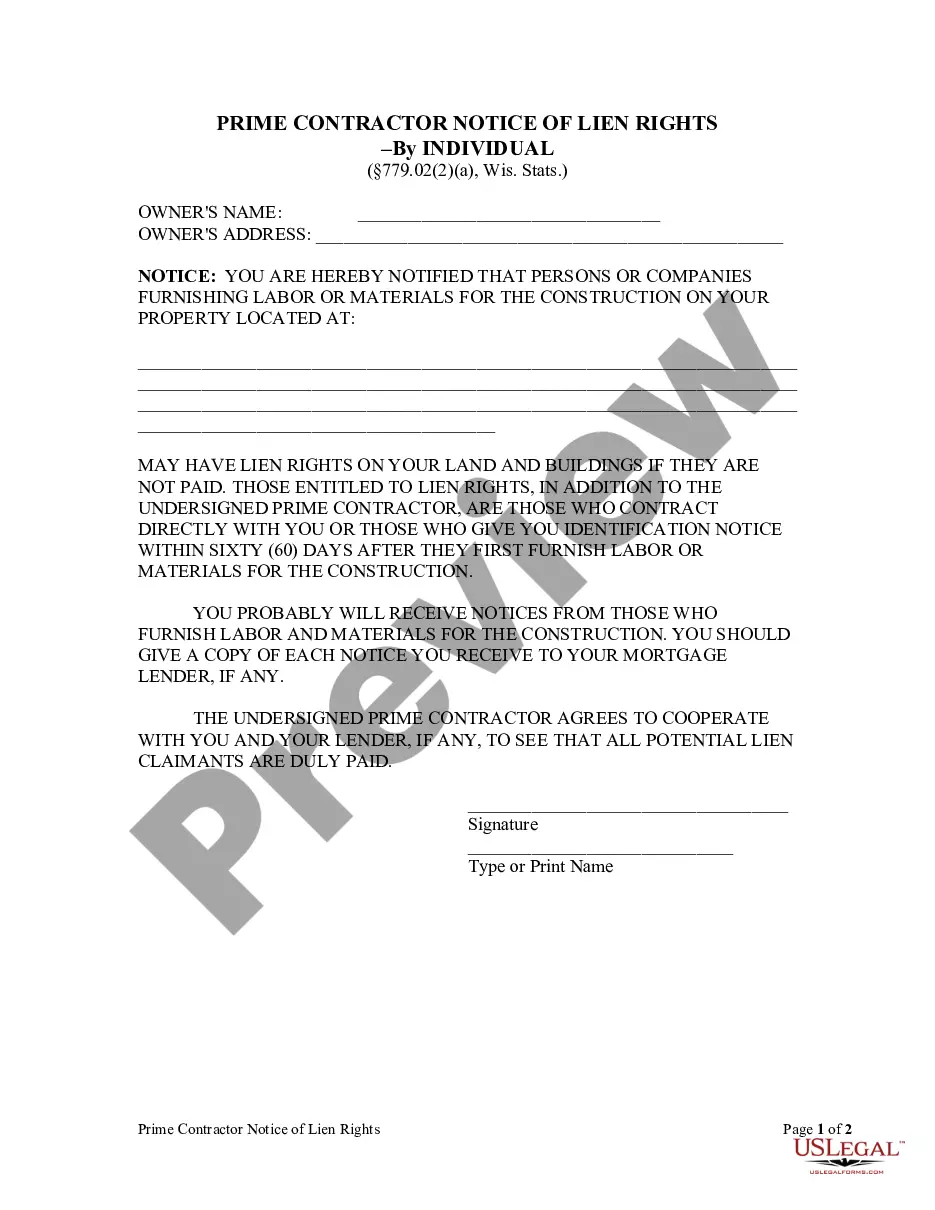

Are you looking to quickly draft a legally-binding Phoenix Stock Option Plan Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options, and Exchange Options or maybe any other form to take control of your personal or business matters? You can select one of the two options: contact a professional to draft a legal paper for you or draft it completely on your own. Luckily, there's an alternative option - US Legal Forms. It will help you get neatly written legal paperwork without paying sky-high fees for legal services.

US Legal Forms provides a rich collection of more than 85,000 state-compliant form templates, including Phoenix Stock Option Plan Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options, and Exchange Options and form packages. We offer templates for a myriad of use cases: from divorce paperwork to real estate document templates. We've been on the market for over 25 years and gained a rock-solid reputation among our clients. Here's how you can become one of them and obtain the needed template without extra troubles.

- First and foremost, double-check if the Phoenix Stock Option Plan Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options, and Exchange Options is adapted to your state's or county's regulations.

- If the form comes with a desciption, make sure to verify what it's intended for.

- Start the search again if the form isn’t what you were looking for by utilizing the search bar in the header.

- Select the plan that best suits your needs and proceed to the payment.

- Choose the format you would like to get your form in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can easily log in to it, find the Phoenix Stock Option Plan Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options, and Exchange Options template, and download it. To re-download the form, simply go to the My Forms tab.

It's effortless to buy and download legal forms if you use our catalog. Moreover, the paperwork we offer are updated by industry experts, which gives you greater confidence when dealing with legal matters. Try US Legal Forms now and see for yourself!