Queens New York Stock Option Plan is a comprehensive plan that allows individuals to receive stock options as part of their compensation package. This plan provides for the grant of three different types of stock options: Incentive Stock Options (SOS), Nonqualified Stock Options (Nests), and Exchange Options. Incentive Stock Options (SOS) are a type of stock option granted to employees that offer certain tax advantages. These options can only be granted to employees, and they must meet specific eligibility requirements. SOS are subject to various conditions, such as holding periods and restrictions on the number of shares that can be granted. Nonqualified Stock Options (Nests) are stock options that do not qualify for the same tax benefits as SOS. These options can be granted to both employees and non-employees, such as consultants or directors. Nests offer more flexibility in their terms and conditions, making them a popular choice for companies looking to provide stock-based compensation to a broader range of individuals. Exchange Options are a unique type of stock option that allows the holder to exchange their existing stock options for new options with revised terms. This type of option is offered to individuals who may have experienced changes in their employment status or other circumstances that warrant a modification of their original stock options. Exchange options allow for more flexibility and can be customized to meet the specific needs of the option holder. Overall, the Queens New York Stock Option Plan provides a comprehensive framework for granting different types of stock options to individuals based on their eligibility and specific circumstances. This plan enables companies to incentivize and compensate their employees and other stakeholders effectively through the use of stock-based compensation.

Queens New York Stock Option Plan Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options, and Exchange Options

Description

How to fill out Queens New York Stock Option Plan Stock Option Plan Which Provides For Grant Of Incentive Stock Options, Nonqualified Stock Options, And Exchange Options?

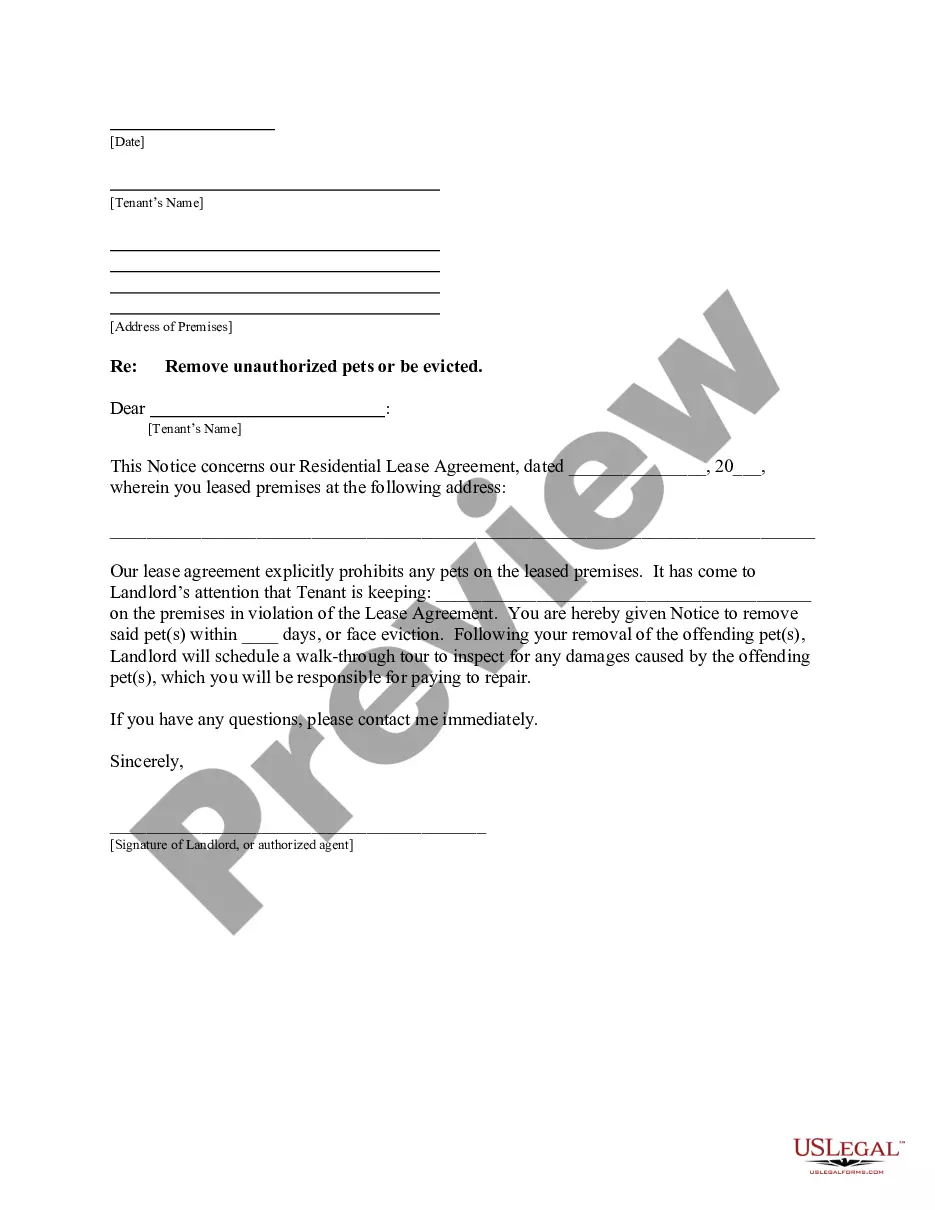

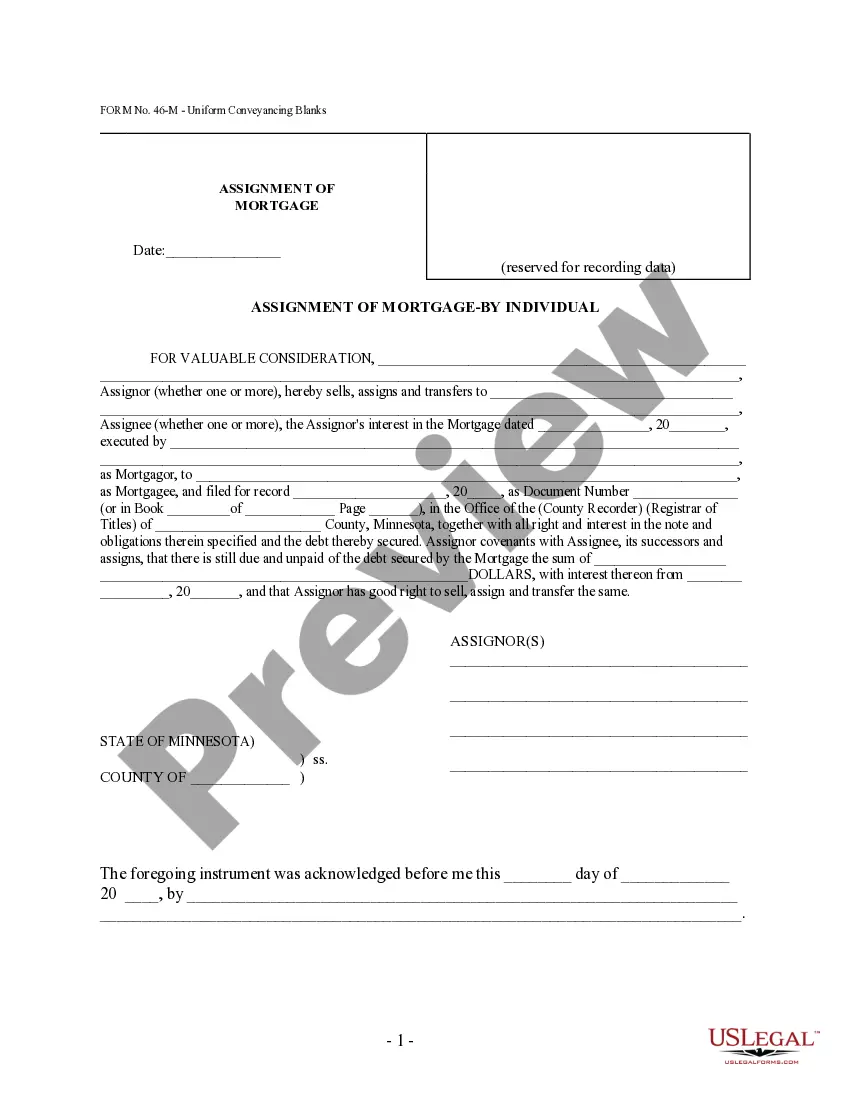

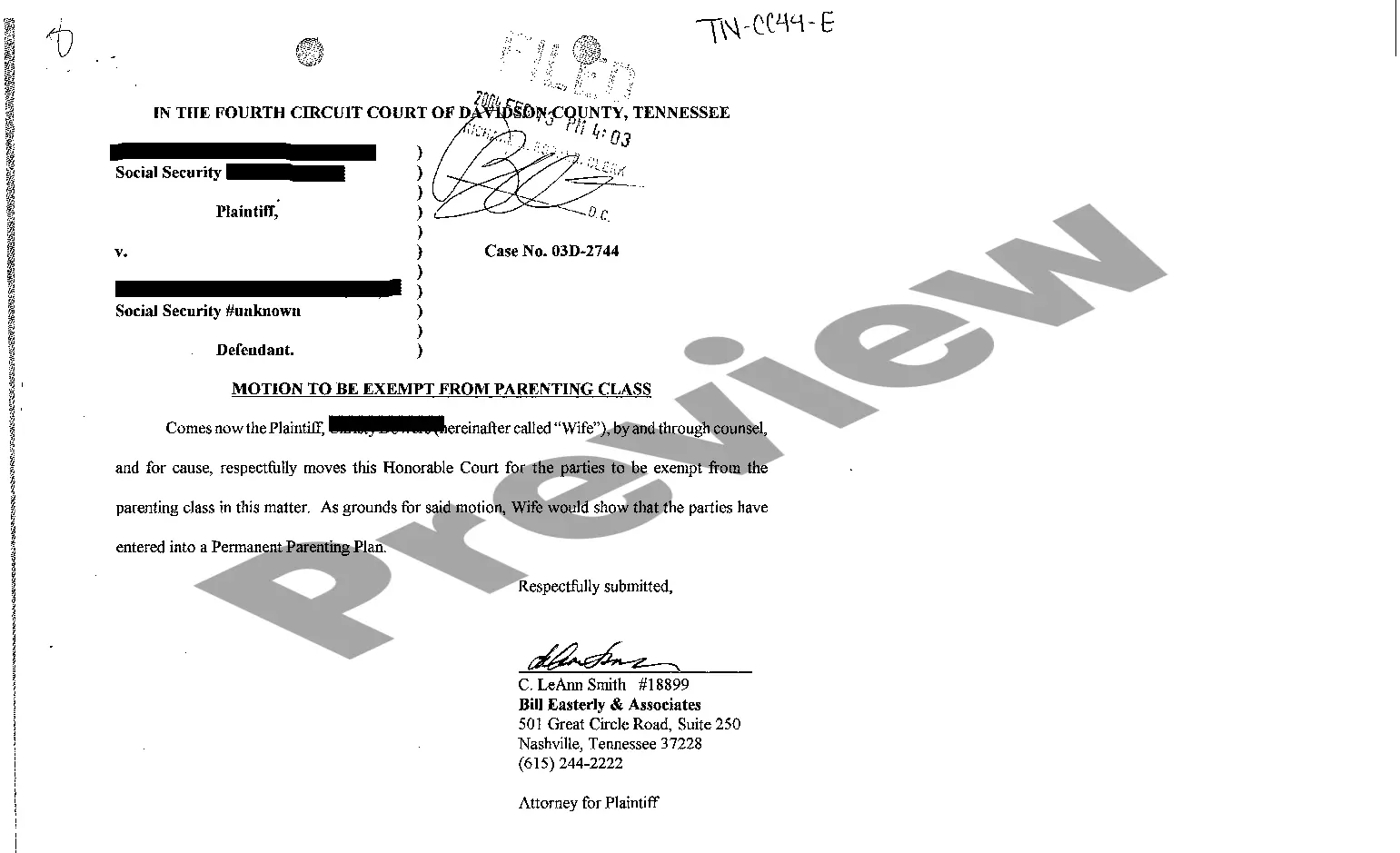

Draftwing paperwork, like Queens Stock Option Plan Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options, and Exchange Options, to take care of your legal affairs is a challenging and time-consumming process. Many cases require an attorney’s involvement, which also makes this task expensive. However, you can get your legal matters into your own hands and deal with them yourself. US Legal Forms is here to the rescue. Our website comes with over 85,000 legal documents created for various scenarios and life situations. We ensure each document is in adherence with the regulations of each state, so you don’t have to be concerned about potential legal pitfalls compliance-wise.

If you're already aware of our website and have a subscription with US, you know how easy it is to get the Queens Stock Option Plan Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options, and Exchange Options template. Go ahead and log in to your account, download the form, and personalize it to your needs. Have you lost your document? Don’t worry. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new customers is just as straightforward! Here’s what you need to do before getting Queens Stock Option Plan Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options, and Exchange Options:

- Ensure that your document is compliant with your state/county since the rules for writing legal documents may vary from one state another.

- Learn more about the form by previewing it or reading a brief description. If the Queens Stock Option Plan Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options, and Exchange Options isn’t something you were looking for, then use the header to find another one.

- Log in or create an account to start using our service and get the form.

- Everything looks great on your side? Hit the Buy now button and select the subscription option.

- Select the payment gateway and type in your payment information.

- Your template is all set. You can go ahead and download it.

It’s an easy task to find and buy the needed template with US Legal Forms. Thousands of organizations and individuals are already benefiting from our rich collection. Sign up for it now if you want to check what other perks you can get with US Legal Forms!