Montgomery Maryland Stock Option Plan For Federal Savings Association

Description

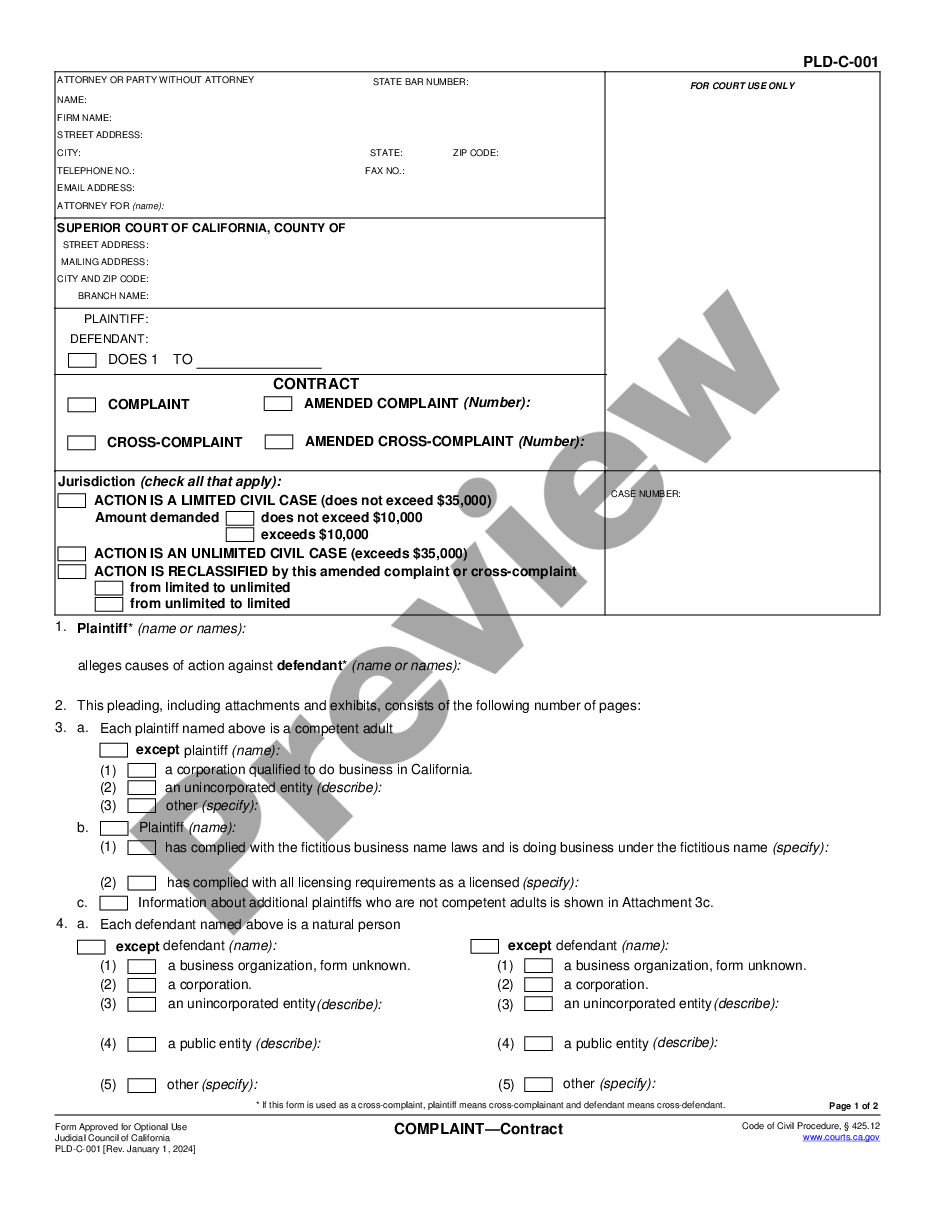

How to fill out Montgomery Maryland Stock Option Plan For Federal Savings Association?

Dealing with legal forms is a must in today's world. However, you don't always need to seek qualified assistance to draft some of them from scratch, including Montgomery Stock Option Plan For Federal Savings Association, with a service like US Legal Forms.

US Legal Forms has more than 85,000 forms to select from in different types ranging from living wills to real estate papers to divorce documents. All forms are organized based on their valid state, making the searching process less challenging. You can also find detailed resources and tutorials on the website to make any tasks associated with paperwork execution simple.

Here's how to find and download Montgomery Stock Option Plan For Federal Savings Association.

- Take a look at the document's preview and outline (if provided) to get a basic information on what you’ll get after downloading the form.

- Ensure that the template of your choice is specific to your state/county/area since state laws can affect the validity of some documents.

- Examine the similar document templates or start the search over to locate the correct document.

- Click Buy now and create your account. If you already have an existing one, select to log in.

- Pick the option, then a suitable payment gateway, and purchase Montgomery Stock Option Plan For Federal Savings Association.

- Choose to save the form template in any offered format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the needed Montgomery Stock Option Plan For Federal Savings Association, log in to your account, and download it. Of course, our website can’t take the place of a lawyer completely. If you have to cope with an exceptionally difficult case, we recommend using the services of a lawyer to examine your form before executing and filing it.

With over 25 years on the market, US Legal Forms became a go-to provider for various legal forms for millions of users. Become one of them today and get your state-compliant paperwork with ease!

Form popularity

FAQ

Activities undertaken by banks include personal banking, corporate banking, investment banking, private banking, transaction banking, insurance, consumer finance, trade finance and other related.

Share This Page: The Office of the Comptroller of the Currency (OCC) is an independent bureau of the U.S. Department of the Treasury. The OCC charters, regulates, and supervises all national banks, federal savings associations, and federal branches and agencies of foreign banks.

A covered savings association has the same rights and privileges as a national bank and is subject to the same duties, restrictions, penalties, liabilities, conditions, and limitations as a national bank. A covered savings association retains its Federal savings association charter and existing governance framework.

The OCC charters, regulates, and supervises all national banks and federal savings associations as well as federal branches and agencies of foreign banks. The OCC is an independent bureau of the U.S. Department of the Treasury.

Non-bank subsidiaries, are firms owned by bank holding companies which offer non-bank products and services, such as insurance and investment advice, and do not offer Federal Deposit Insurance Corporation insured banking products, such as checking and savings accounts.

Permissible non-bank activities are a set of functions that financial holding companies can engage in, but which traditional banks cannot. These include activities like insurance underwriting, securities dealing, and investment advisory or brokerage services.

The Office of the Comptroller of the Currency (OCC) is the primary regulator of banks chartered under the National Bank Act (12 USC 1 et seq.) and federal savings associations chartered under the Home Owners Loan Act of 1933 (12 USC 1461 et seq.).

(b) Purpose This part prescribes standards under which national banks may purchase, sell, deal in, underwrite, and hold securities, consistent with the authority contained in 12 U.S.C. 24 (Seventh) and safe and sound banking practices.

The Code of Federal Regulations Title 12 contains the codified Federal laws and regulations that are in effect as of the date of the publication pertaining to banks, banking, credit unions, farm credit, mortgages, consumer financial protection and other related financial matters.