The Hillsborough Florida Nonemployee Directors Nonqualified Stock Option Plan is a compensation program offered by Cocos, Inc., a company based in Hillsborough County, Florida. This plan is specifically designed for nonemployee directors of Cocos, Inc. and provides them with the opportunity to purchase company stock at a predetermined price. The purpose of this plan is to incentivize nonemployee directors by aligning their interests with those of the company's shareholders. By providing stock options, Cocos, Inc. aims to motivate nonemployee directors to actively contribute to the company's growth and success. The Hillsborough Florida Nonemployee Directors Nonqualified Stock Option Plan offers various types of stock options to eligible nonemployee directors. Some common types include: 1. Standard Nonqualified Stock Options: Nonemployee directors are granted the right to purchase a specified number of company shares at a predetermined price, called the exercise price. The exercise price is typically set at the fair market value of the company's stock on the date of grant. 2. Performance-Based Stock Options: In addition to the standard stock options, Cocos, Inc. may offer performance-based stock options to nonemployee directors. These options are granted based on predetermined performance criteria, such as achieving specific financial targets or milestones. 3. Restricted Stock Units (RSS): Instead of stock options, Cocos, Inc. may choose to grant RSS to nonemployee directors. RSS represents a promise to deliver company shares in the future, subject to certain vesting conditions. Once the RSS vest, nonemployee directors are entitled to receive the equivalent number of company shares. It's important for nonemployee directors to understand the specific terms and conditions of their stock options or RSS under the Hillsborough Florida Nonemployee Directors Nonqualified Stock Option Plan. These may include the vesting schedule, expiration dates, and any limitations on the sale or transfer of the purchased shares. Overall, the Hillsborough Florida Nonemployee Directors Nonqualified Stock Option Plan serves as a valuable tool for Cocos, Inc. to attract and retain qualified individuals as nonemployee directors. By offering stock-based compensation, the company can foster a sense of ownership and alignment among its board members, ultimately contributing to its long-term success.

Hillsborough Florida Nonemployee Directors Nonqualified Stock Option Plan of Cucos, Inc.

Description

How to fill out Hillsborough Florida Nonemployee Directors Nonqualified Stock Option Plan Of Cucos, Inc.?

How much time does it typically take you to draw up a legal document? Given that every state has its laws and regulations for every life situation, finding a Hillsborough Nonemployee Directors Nonqualified Stock Option Plan of Cucos, Inc. meeting all local requirements can be exhausting, and ordering it from a professional attorney is often expensive. Many web services offer the most popular state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive web collection of templates, grouped by states and areas of use. Aside from the Hillsborough Nonemployee Directors Nonqualified Stock Option Plan of Cucos, Inc., here you can find any specific form to run your business or personal affairs, complying with your regional requirements. Specialists check all samples for their validity, so you can be sure to prepare your documentation correctly.

Using the service is pretty easy. If you already have an account on the platform and your subscription is valid, you only need to log in, select the required sample, and download it. You can get the document in your profile anytime later on. Otherwise, if you are new to the website, there will be some extra steps to complete before you obtain your Hillsborough Nonemployee Directors Nonqualified Stock Option Plan of Cucos, Inc.:

- Check the content of the page you’re on.

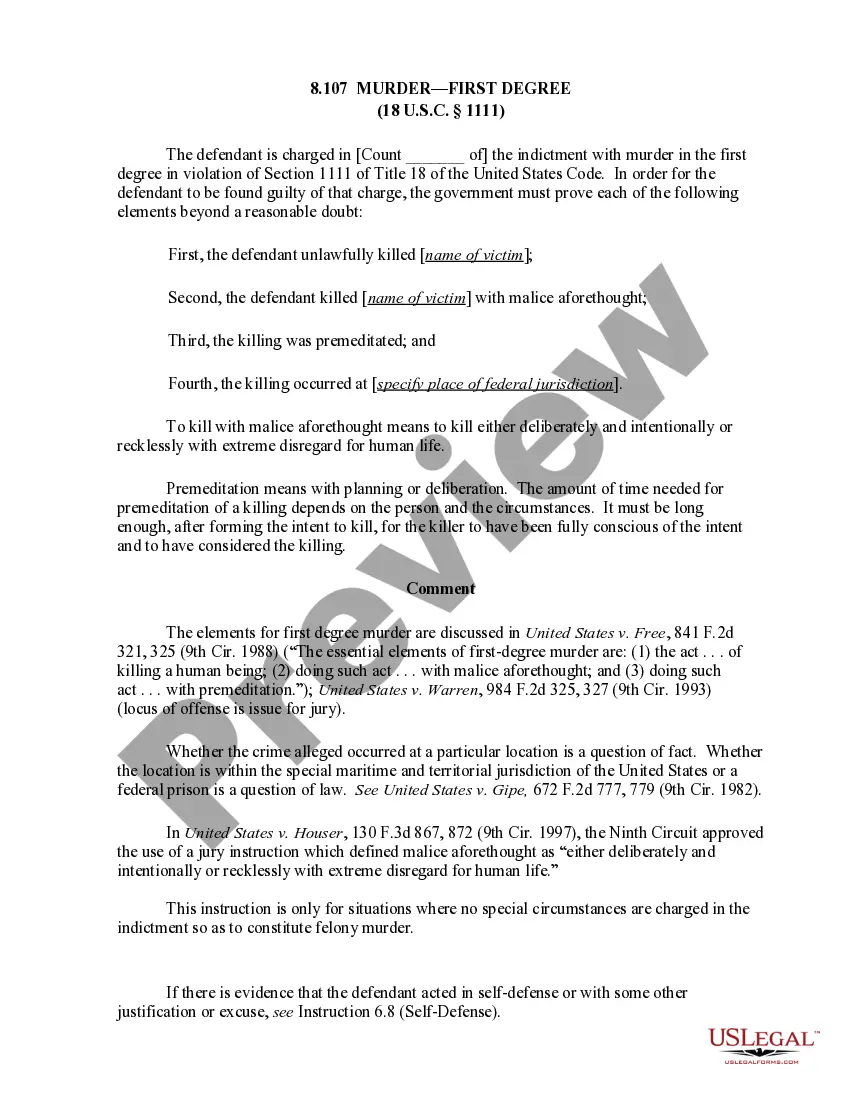

- Read the description of the sample or Preview it (if available).

- Look for another form using the corresponding option in the header.

- Click Buy Now once you’re certain in the chosen document.

- Select the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Hillsborough Nonemployee Directors Nonqualified Stock Option Plan of Cucos, Inc..

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased template, you can find all the samples you’ve ever saved in your profile by opening the My Forms tab. Give it a try!