The Los Angeles California Nonemployee Directors Nonqualified Stock Option Plan of Cocos, Inc. is a comprehensive compensation plan designed specifically for the non-employee directors of the company who reside in the city of Los Angeles, California. This plan provides eligible directors with the opportunity to acquire stock options, offering them the chance to participate in the future growth and success of Cocos, Inc. Under this plan, non-employee directors are granted nonqualified stock options, which are a type of stock option that does not meet the requirements to be qualified under the Internal Revenue Code. Nonqualified stock options offer flexibility in terms of granting and exercising options, while also providing potential tax advantages for the recipients. The Los Angeles California Nonemployee Directors Nonqualified Stock Option Plan of Cocos, Inc. aims to align the interests of the non-employee directors with those of the company's shareholders. By allowing directors to acquire stock options, they have a vested interest in the overall performance and profitability of Cocos, Inc., thus motivating them to make decisions that benefit the company and its stakeholders. It is worth mentioning that there may be different types or variations of the Los Angeles California Nonemployee Directors Nonqualified Stock Option Plan of Cocos, Inc. These variations could be based on factors such as the number of options granted, the exercise price, the vesting schedule, or any other terms and conditions specified by the plan. In summary, the Los Angeles California Nonemployee Directors Nonqualified Stock Option Plan of Cocos, Inc. is a specialized compensation plan designed for non-employee directors residing in Los Angeles, California. By granting nonqualified stock options, this plan not only rewards directors but also aligns their interests with the company's long-term growth and success.

Los Angeles California Nonemployee Directors Nonqualified Stock Option Plan of Cucos, Inc.

Description

How to fill out Los Angeles California Nonemployee Directors Nonqualified Stock Option Plan Of Cucos, Inc.?

Creating legal forms is a necessity in today's world. However, you don't always need to look for professional help to create some of them from scratch, including Los Angeles Nonemployee Directors Nonqualified Stock Option Plan of Cucos, Inc., with a service like US Legal Forms.

US Legal Forms has over 85,000 forms to choose from in different types ranging from living wills to real estate paperwork to divorce papers. All forms are organized according to their valid state, making the searching process less frustrating. You can also find detailed materials and tutorials on the website to make any activities associated with paperwork execution straightforward.

Here's how you can locate and download Los Angeles Nonemployee Directors Nonqualified Stock Option Plan of Cucos, Inc..

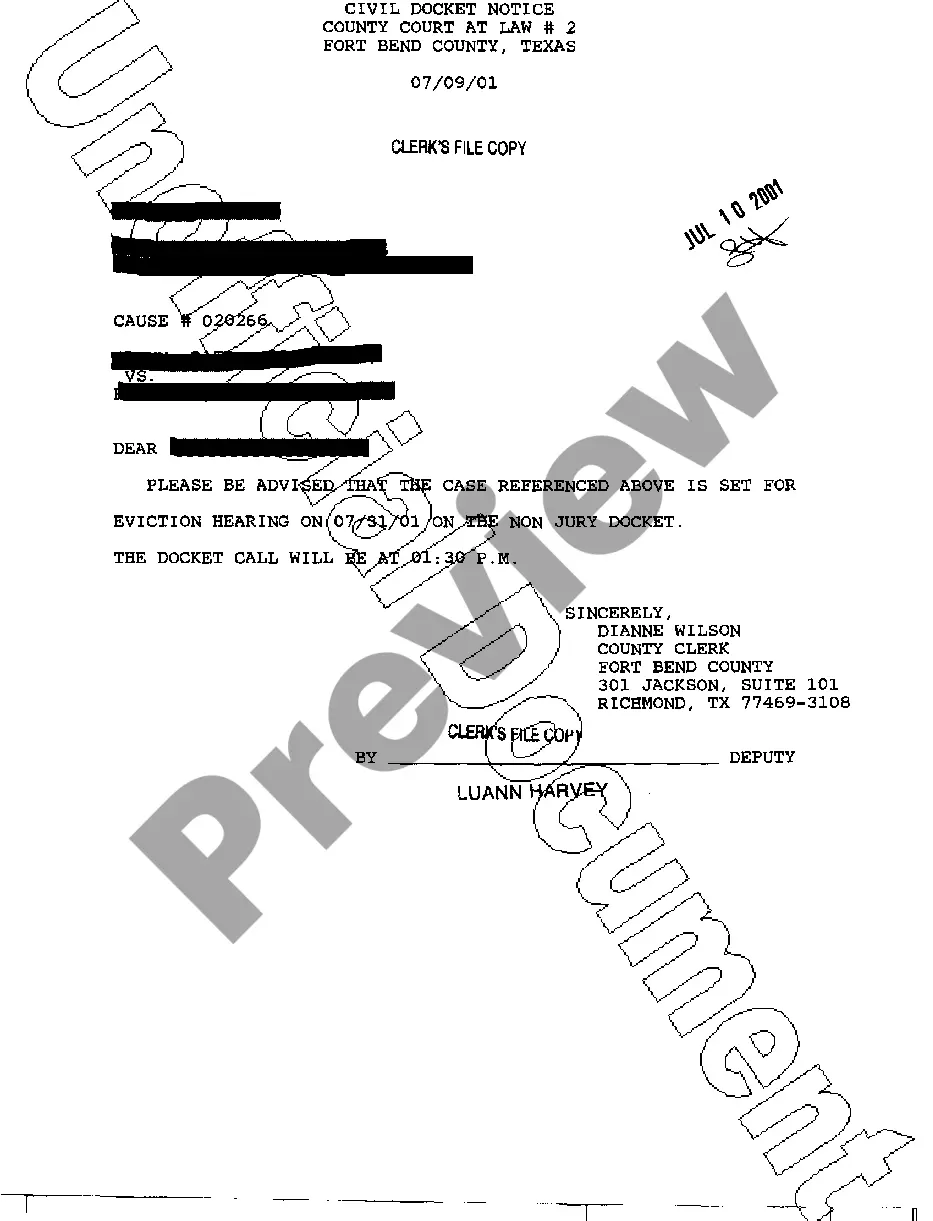

- Take a look at the document's preview and outline (if available) to get a basic idea of what you’ll get after getting the form.

- Ensure that the template of your choice is adapted to your state/county/area since state regulations can affect the legality of some documents.

- Check the similar forms or start the search over to locate the right document.

- Hit Buy now and register your account. If you already have an existing one, select to log in.

- Pick the option, then a needed payment method, and purchase Los Angeles Nonemployee Directors Nonqualified Stock Option Plan of Cucos, Inc..

- Choose to save the form template in any available file format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the needed Los Angeles Nonemployee Directors Nonqualified Stock Option Plan of Cucos, Inc., log in to your account, and download it. Needless to say, our website can’t take the place of a legal professional entirely. If you have to deal with an extremely difficult situation, we recommend getting a lawyer to check your document before signing and filing it.

With over 25 years on the market, US Legal Forms proved to be a go-to provider for various legal forms for millions of customers. Join them today and purchase your state-specific documents with ease!

Form popularity

FAQ

The new regulations have also expanded its coverage to include employees of associate companies (those in which the issuing company has significant influence or is engaged with in a joint venture). Earlier regulations allowed only employees of holding and subsidiary companies to be issued Esops.

Non-qualified stock options (NSOs) are a type of stock option that does not qualify for favorable tax treatment for the employee. Unlike with incentive stock options (ISOs), where you don't pay taxes upon exercise, with NSOs you pay taxes both when you exercise the option (purchase shares) and sell those shares.

The most common expiration of NSOs is 10 years, but this does vary from company to company. Since time is often your friend when it comes to stock options, you can simply sit out the first couple of years to allow for growth and start to exercise your NSOs in a systematic way when you are nearing expiration.

However incentive stock options (ISOs) are generally only available to employees. For non-employees, such as directors and consultants, non-qualified stock options (NSO) are available. Can foreigners receive ISOs? Yes, as long as the individual is an employee of the qualifying US company.

So how exactly are NSOs taxed? NSOs are taxed at ordinary income tax rates (the highest possible rate, just like your salary) twice: When you exercise them. Then again when you make money with them after your company exits.

Non-qualified stock options (NSOs) are a type of stock option that does not qualify for favorable tax treatment for the employee. Unlike with incentive stock options (ISOs), where you don't pay taxes upon exercise, with NSOs you pay taxes both when you exercise the option (purchase shares) and sell those shares.

Qualified stock options, also known as incentive stock options, can only be granted to employees. Non-qualified stock options can be granted to employees, directors, contractors and others. This gives you greater flexibility to recognize the contributions of non-employees.

qualified stock option (NSO) is a form of equity compensation that can be provided to employees and other stakeholders. An NSO gives recipients the choice to purchase a company's stock at a predetermined price, which can be profitable if the stock price rises above that level.

Stock options are a form of compensation. Companies can grant them to employees, contractors, consultants and investors.

Non-qualified stock options (NSOs) are a type of stock option that does not qualify for favorable tax treatment for the employee. Unlike with incentive stock options (ISOs), where you don't pay taxes upon exercise, with NSOs you pay taxes both when you exercise the option (purchase shares) and sell those shares.