The Phoenix Arizona Nonemployee Directors Nonqualified Stock Option Plan of Cocos, Inc. is a comprehensive compensation package designed specifically for nonemployee directors of the company, residing in Phoenix, Arizona. This tailored plan provides directors with the opportunity to receive stock options as part of their compensation, allowing them to become shareholders of Cocos, Inc. and share in the company's success. Under the Phoenix Arizona Nonemployee Directors Nonqualified Stock Option Plan, directors are granted the right to purchase a certain number of shares of Cocos, Inc. stock at a predetermined exercise price. These stock options are nonqualified, meaning they do not qualify for special tax treatment under the Internal Revenue Code. However, they offer directors the potential for substantial financial gain if the stock price increases over time. This plan serves as a vital tool for attracting and retaining highly experienced and knowledgeable nonemployee directors, providing them with a tangible stake in Cocos, Inc.'s performance and long-term growth. By aligning the interests of directors with those of the company and its shareholders, Cocos, Inc. aims to foster a sense of ownership and active engagement among its board members based in Phoenix, Arizona. While there may not be different types of the Phoenix Arizona Nonemployee Directors Nonqualified Stock Option Plan specifically, it may include certain variations or terms specific to individual directors. These variations could include the number of stock options granted, exercise prices, vesting schedules, and other administrative details. However, the main purpose of the plan remains consistent — to reward nonemployee directors in Phoenix, Arizona, through equity participation and enhance their commitment to advancing Cocos, Inc.'s goals. Overall, the Phoenix Arizona Nonemployee Directors Nonqualified Stock Option Plan of Cocos, Inc. demonstrates the company's commitment to fostering a strong relationship with its nonemployee directors based in Phoenix, Arizona. By offering stock options as a form of compensation, Cocos, Inc. aims to attract talented individuals to its board, incentivize active participation, and align their interests with the long-term success of the company.

Phoenix Arizona Nonemployee Directors Nonqualified Stock Option Plan of Cucos, Inc.

Description

How to fill out Phoenix Arizona Nonemployee Directors Nonqualified Stock Option Plan Of Cucos, Inc.?

Whether you plan to open your business, enter into a deal, apply for your ID update, or resolve family-related legal concerns, you must prepare certain paperwork corresponding to your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and verified legal templates for any individual or business occurrence. All files are collected by state and area of use, so opting for a copy like Phoenix Nonemployee Directors Nonqualified Stock Option Plan of Cucos, Inc. is quick and easy.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you a couple of more steps to obtain the Phoenix Nonemployee Directors Nonqualified Stock Option Plan of Cucos, Inc.. Adhere to the guidelines below:

- Make certain the sample meets your individual needs and state law requirements.

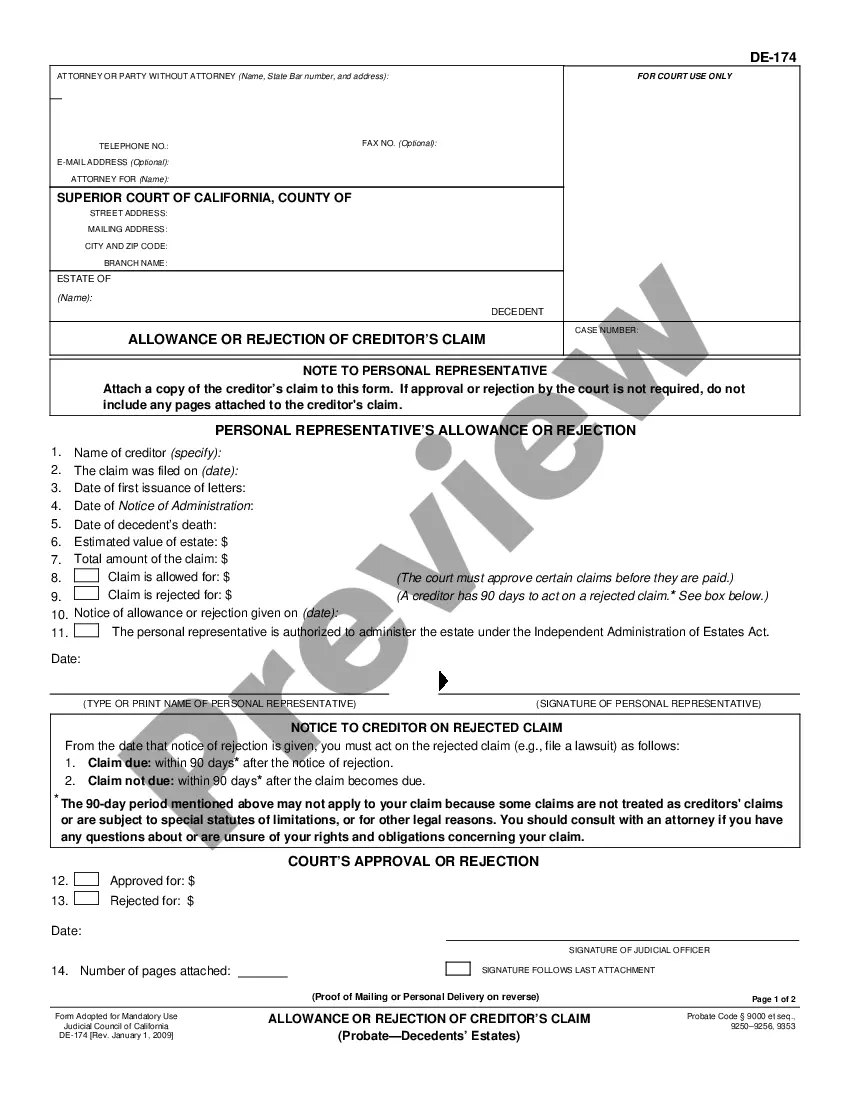

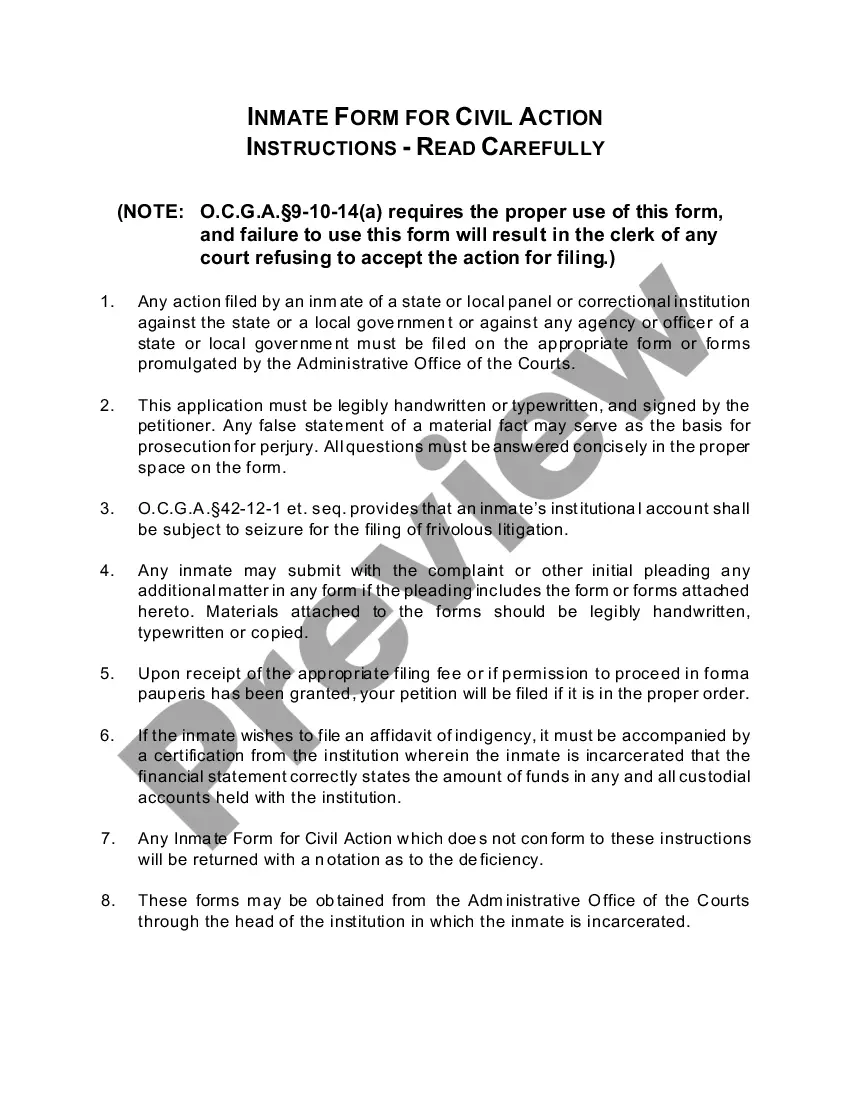

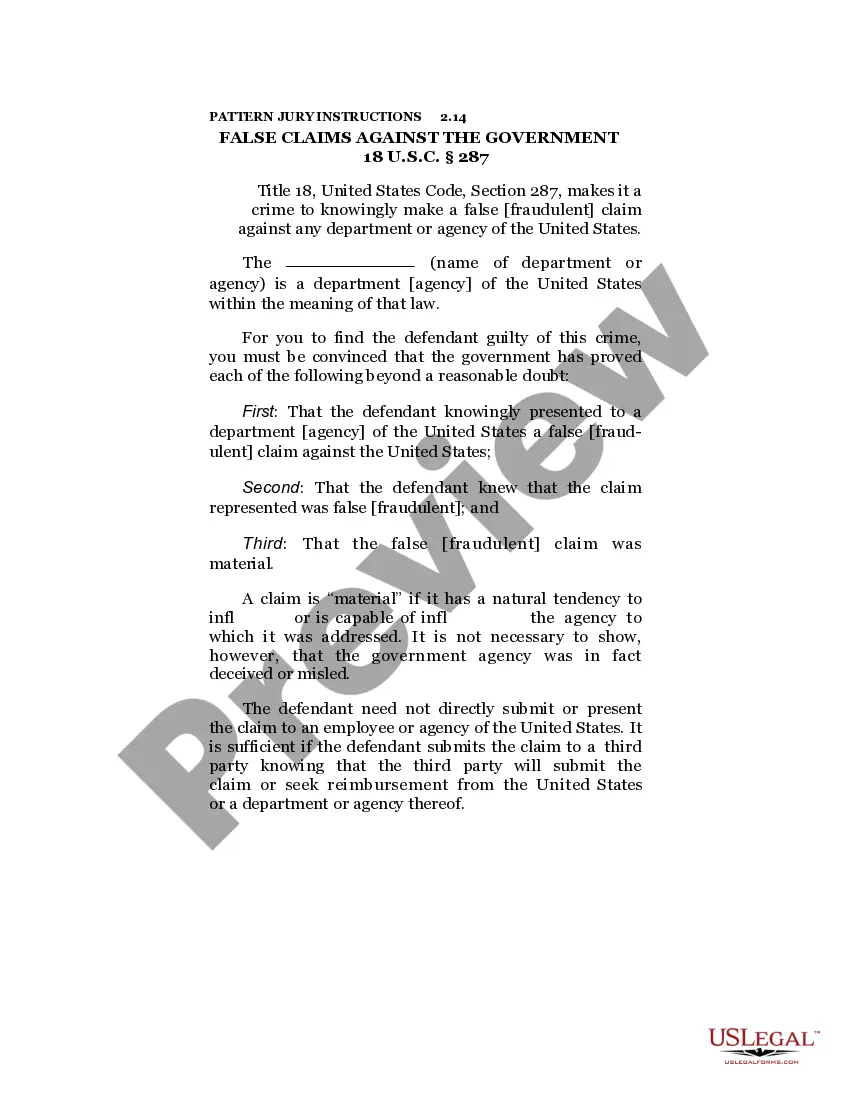

- Read the form description and check the Preview if available on the page.

- Use the search tab providing your state above to find another template.

- Click Buy Now to obtain the sample when you find the right one.

- Opt for the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Phoenix Nonemployee Directors Nonqualified Stock Option Plan of Cucos, Inc. in the file format you need.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our website are reusable. Having an active subscription, you are able to access all of your earlier purchased paperwork at any time in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documentation. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!