The Nassau New York Amended and Restated Stock Option Plan of L. Luria and Son, Inc. is a comprehensive document that outlines the terms and conditions of stock options offered to employees of the company. This plan is designed to provide an attractive incentive for employees, align their interests with the company's success, and promote long-term commitment and dedication. The Nassau New York Amended and Restated Stock Option Plan provides various types of stock options to eligible employees based on their roles, responsibilities, and tenure within the organization. Some key types of stock options available in this plan are: 1. Incentive Stock Options (SOS): SOSOs are granted with favorable tax treatment and are intended to encourage employees to remain with the company for an extended period. SOSOs can only be granted to employees who meet certain eligibility criteria. — They provide the right to purchase company stock at a predetermined exercise price within a specific time frame. 2. Non-Qualified Stock Options (Nests): NestsOs are more flexible than ISOs and do not come with the same tax advantages. — They are available to a broader range of employees, including independent contractors and consultants. NestsOs allow the employees to purchase company stock at a predetermined exercise price for a specific period. 3. Restricted Stock Units (RSS): RSSUs are another type of stock-based compensation offered under this plan. RSSUs are typically granted as a promise to deliver company stock at a future date, subject to certain conditions and vesting periods. — Unlike stock optionsRSSUs do not require any upfront purchase, but the employee receives company stock directly after the vesting period ends. The Nassau New York Amended and Restated Stock Option Plan includes detailed provisions regarding the grant, exercise, transferability, and termination of stock options. It also specifies the conditions under which stock options can be forfeited and the circumstances in which employees may exercise their options. This plan is crucial in attracting and retaining talented individuals, as well as encouraging their long-term commitment to the success of L. Luria and Son, Inc. It ensures a fair and transparent structure for stock-based compensation, aligning the interests of employees with those of the company and its shareholders.

Nassau New York Amended and Restated Stock Option Plan of L. Luria and Son, Inc.

Description

How to fill out Nassau New York Amended And Restated Stock Option Plan Of L. Luria And Son, Inc.?

Preparing paperwork for the business or personal needs is always a huge responsibility. When creating an agreement, a public service request, or a power of attorney, it's essential to take into account all federal and state laws and regulations of the specific region. However, small counties and even cities also have legislative procedures that you need to consider. All these details make it burdensome and time-consuming to draft Nassau Amended and Restated Stock Option Plan of L. Luria and Son, Inc. without professional assistance.

It's easy to avoid spending money on attorneys drafting your paperwork and create a legally valid Nassau Amended and Restated Stock Option Plan of L. Luria and Son, Inc. by yourself, using the US Legal Forms online library. It is the greatest online collection of state-specific legal templates that are professionally verified, so you can be certain of their validity when picking a sample for your county. Earlier subscribed users only need to log in to their accounts to download the needed document.

If you still don't have a subscription, adhere to the step-by-step instruction below to get the Nassau Amended and Restated Stock Option Plan of L. Luria and Son, Inc.:

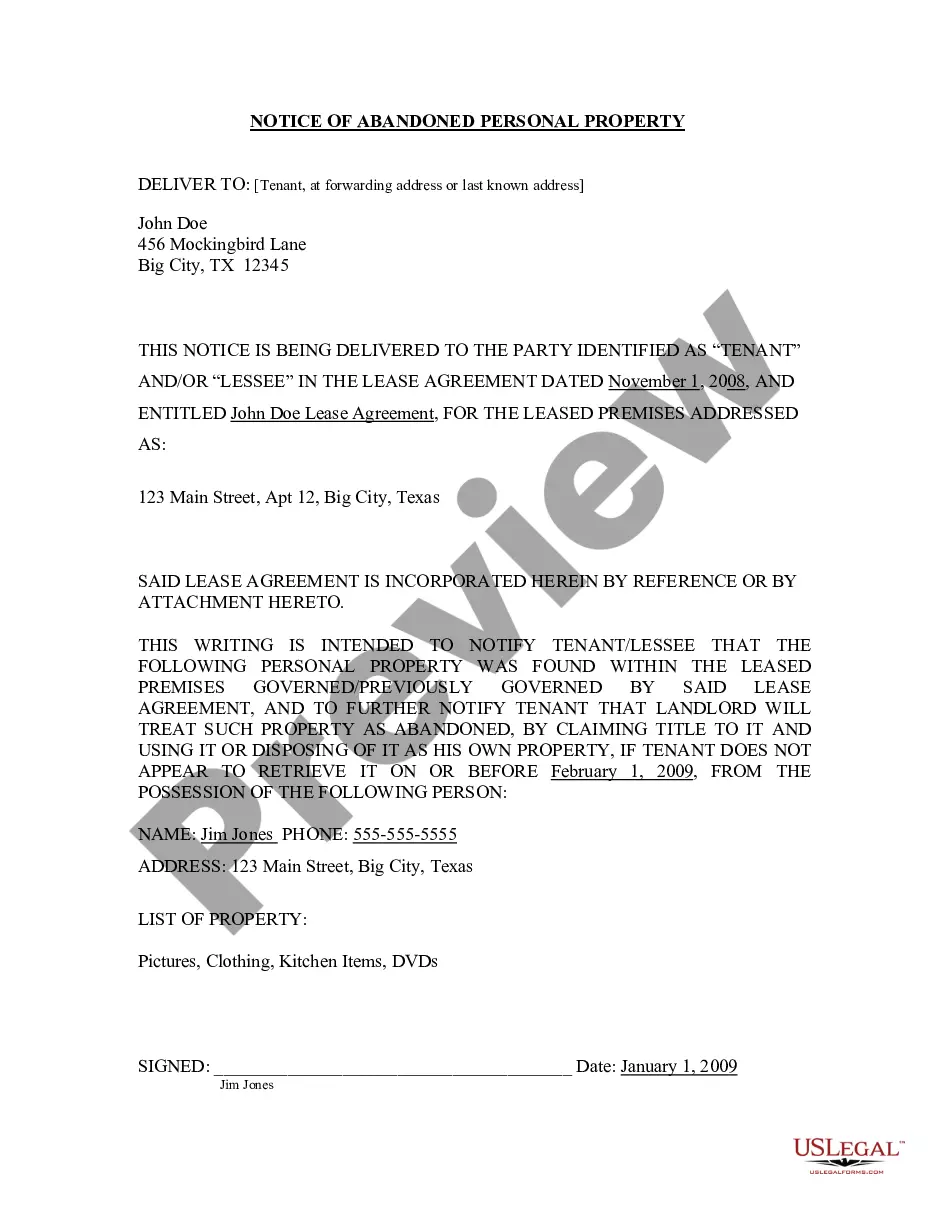

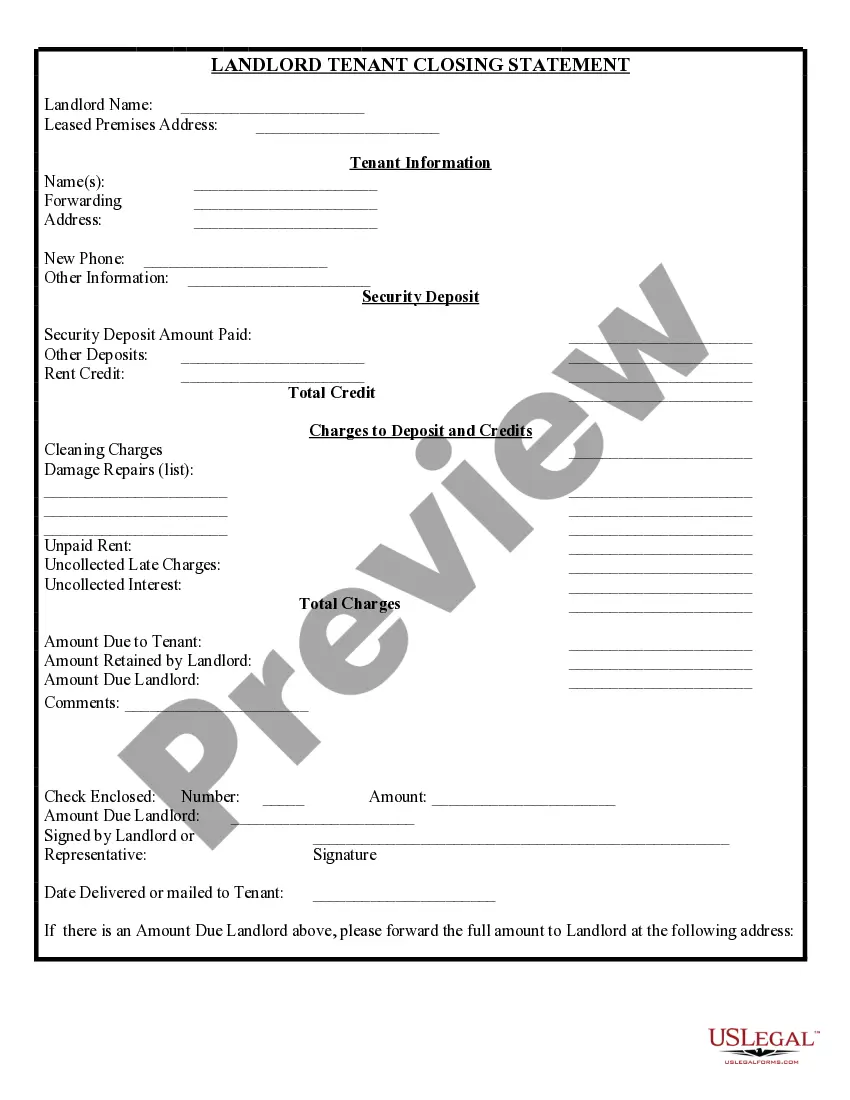

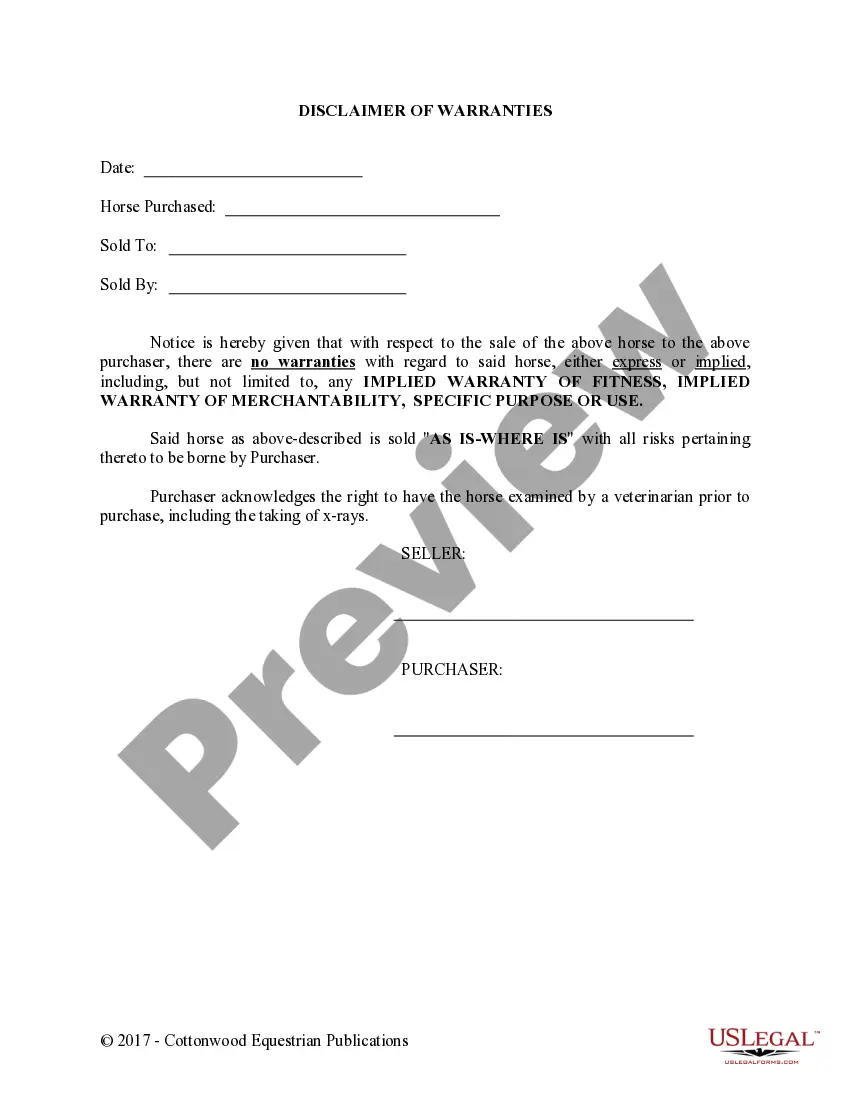

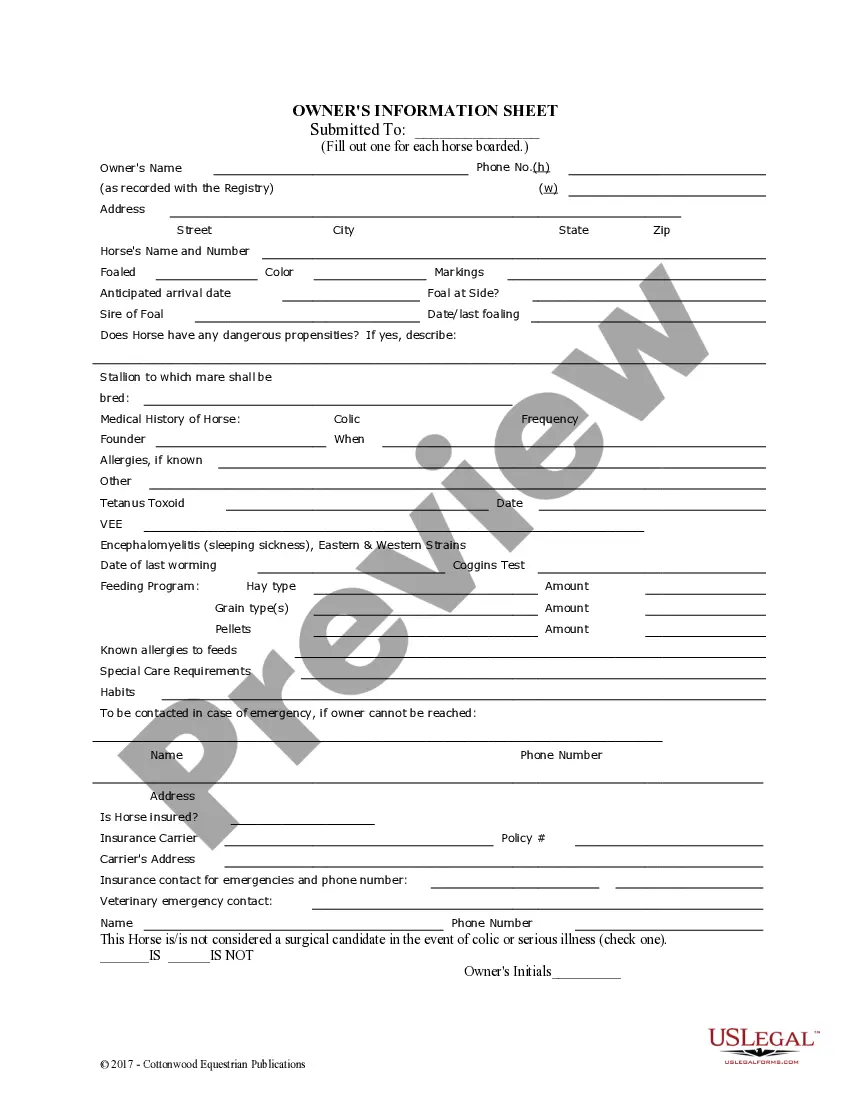

- Look through the page you've opened and check if it has the document you require.

- To achieve this, use the form description and preview if these options are presented.

- To locate the one that meets your requirements, use the search tab in the page header.

- Recheck that the sample complies with juridical criteria and click Buy Now.

- Choose the subscription plan, then log in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever purchased never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and easily get verified legal forms for any scenario with just a few clicks!