San Diego California Management Long Term Incentive Compensation Plan of Suncorp is a comprehensive and competitive incentive program designed to reward and retain top-performing management personnel within the organization. The plan aims to align the interests of executives and employees with the long-term objectives of Suncorp, a prominent energy company operating in San Diego, California. The San Diego California Management Long Term Incentive Compensation Plan is structured to provide executives with incentives that are linked to the company's financial performance and strategic goals over an extended period, typically spanning several years. This rewards executives for generating sustained growth and shareholder value, thereby motivating them to lead the company efficiently and make decisions that contribute to its overall success. This incentive plan of Suncorp offers various types of compensation mechanisms such as: 1. Stock options: Executives are granted the right to purchase company stock at a predetermined price, known as the exercise price, for a specified period. This allows them to benefit from any increase in the company's stock price, thus aligning their interests with those of shareholders. 2. Restricted stock units (RSS): Executives receive a certain number of RSS, which represent the right to receive company shares at a future date. These units are typically granted subject to certain performance or time-based vesting criteria, ensuring that executives remain committed to the company's long-term success. 3. Performance-based cash incentives: This type of compensation awards executives with cash bonuses based on predetermined performance metrics, such as achieving specific financial targets, increasing market share, or successfully completing strategic initiatives. 4. Performance share units (Plus): Executives are granted Plus, which entitle them to receive a certain number of company shares upon meeting specific performance goals. These goals may include measures like earnings per share growth, return on equity, or operational efficiency improvements. The San Diego California Management Long Term Incentive Compensation Plan of Suncorp takes into account market benchmarks and industry best practices ensuring competitiveness and retain top talent. Compensation packages are designed to attract and motivate executives by offering a combination of short-term and long-term incentives that are tied to company performance and individual achievements. In conclusion, Suncorp's San Diego California Management Long Term Incentive Compensation Plan is a well-structured and comprehensive program that aims to reward and retain top management personnel. Through stock options, RSS, performance-based cash incentives, and Plus, executives are encouraged to drive the company's long-term growth and deliver value to shareholders.

San Diego California Management Long Term Incentive Compensation Plan of of SCEcorp

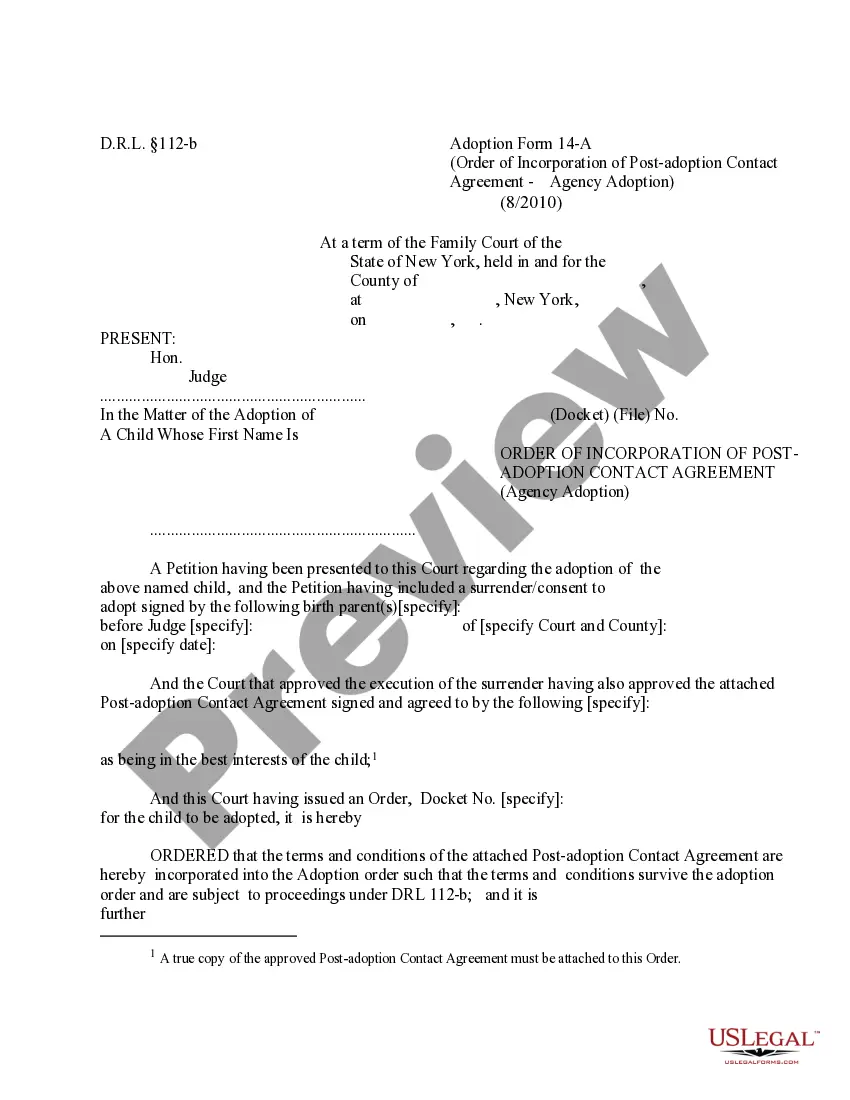

Description

How to fill out San Diego California Management Long Term Incentive Compensation Plan Of Of SCEcorp?

Creating legal forms is a must in today's world. However, you don't always need to look for professional help to draft some of them from scratch, including San Diego Management Long Term Incentive Compensation Plan of of SCEcorp, with a service like US Legal Forms.

US Legal Forms has more than 85,000 forms to choose from in various types ranging from living wills to real estate paperwork to divorce documents. All forms are arranged based on their valid state, making the searching experience less frustrating. You can also find information resources and tutorials on the website to make any activities related to paperwork execution straightforward.

Here's how to find and download San Diego Management Long Term Incentive Compensation Plan of of SCEcorp.

- Go over the document's preview and description (if provided) to get a general idea of what you’ll get after getting the form.

- Ensure that the template of your choosing is adapted to your state/county/area since state regulations can impact the legality of some documents.

- Examine the related forms or start the search over to find the appropriate document.

- Click Buy now and register your account. If you already have an existing one, choose to log in.

- Choose the pricing {plan, then a needed payment gateway, and purchase San Diego Management Long Term Incentive Compensation Plan of of SCEcorp.

- Choose to save the form template in any available file format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the appropriate San Diego Management Long Term Incentive Compensation Plan of of SCEcorp, log in to your account, and download it. Of course, our platform can’t take the place of a legal professional entirely. If you have to cope with an extremely challenging case, we advise getting an attorney to check your document before executing and filing it.

With over 25 years on the market, US Legal Forms proved to be a go-to provider for various legal forms for millions of customers. Become one of them today and get your state-specific documents with ease!