The Nassau New York Director Incentive Compensation Plan is a comprehensive program designed to provide competitive compensation packages to directors in Nassau County, New York. This plan aims to attract and retain talented individuals who can contribute effectively to the organizational goals and strategic objectives of various businesses and organizations in the region. The plan is structured to incentivize directors and align their interests with the company's success. The Nassau New York Director Incentive Compensation Plan incorporates various components to reward directors for their performance, including base salary, bonuses, stock options, and long-term incentives. These components are tailored to meet the specific needs and goals of the organization while considering market trends and industry standards. Under this plan, directors receive a competitive base salary that reflects their expertise, experience, and responsibilities. Alongside the base salary, directors are eligible for performance-based bonuses that are determined by their individual and/or company-wide achievements. These bonuses can include both short-term and long-term incentives, such as cash rewards, profit-sharing, or equity-based compensation. In addition to monetary incentives, the Nassau New York Director Incentive Compensation Plan may also include stock options or stock grants. These enable directors to partially or fully own company shares, providing them with potential financial gains in line with the company's performance and stock market value. Furthermore, the plan may offer long-term incentives like retirement plans, pension schemes, or deferred compensation plans. These incentives ensure directors' continued commitment to the organization's growth and success over the long run. While the specifics of the Nassau New York Director Incentive Compensation Plan may vary across different organizations and industries, the overarching goal remains the same: to attract top talent, motivate directors to excel, and reward them equitably for their contributions. By implementing an effective director incentive compensation plan, businesses in Nassau County, New York can foster a positive work environment and drive sustainable growth. Please note that the names of specific Nassau New York Director Incentive Compensation Plans might vary depending on the organizations implementing them. Some potential plan names could include: 1. Nassau County Corporate Director Incentive Compensation Plan 2. Nassau County Non-Profit Director Incentive Compensation Plan 3. Nassau County Small Business Director Incentive Compensation Plan 4. Nassau County Public Sector Director Incentive Compensation Plan 5. Nassau County Financial Institution Director Incentive Compensation Plan It is important to consult the respective organization's official documentation or reach out to their human resources department for accurate information on the specific types of Nassau New York Director Incentive Compensation Plans they offer.

Nassau New York Director Incentive Compensation Plan

Description

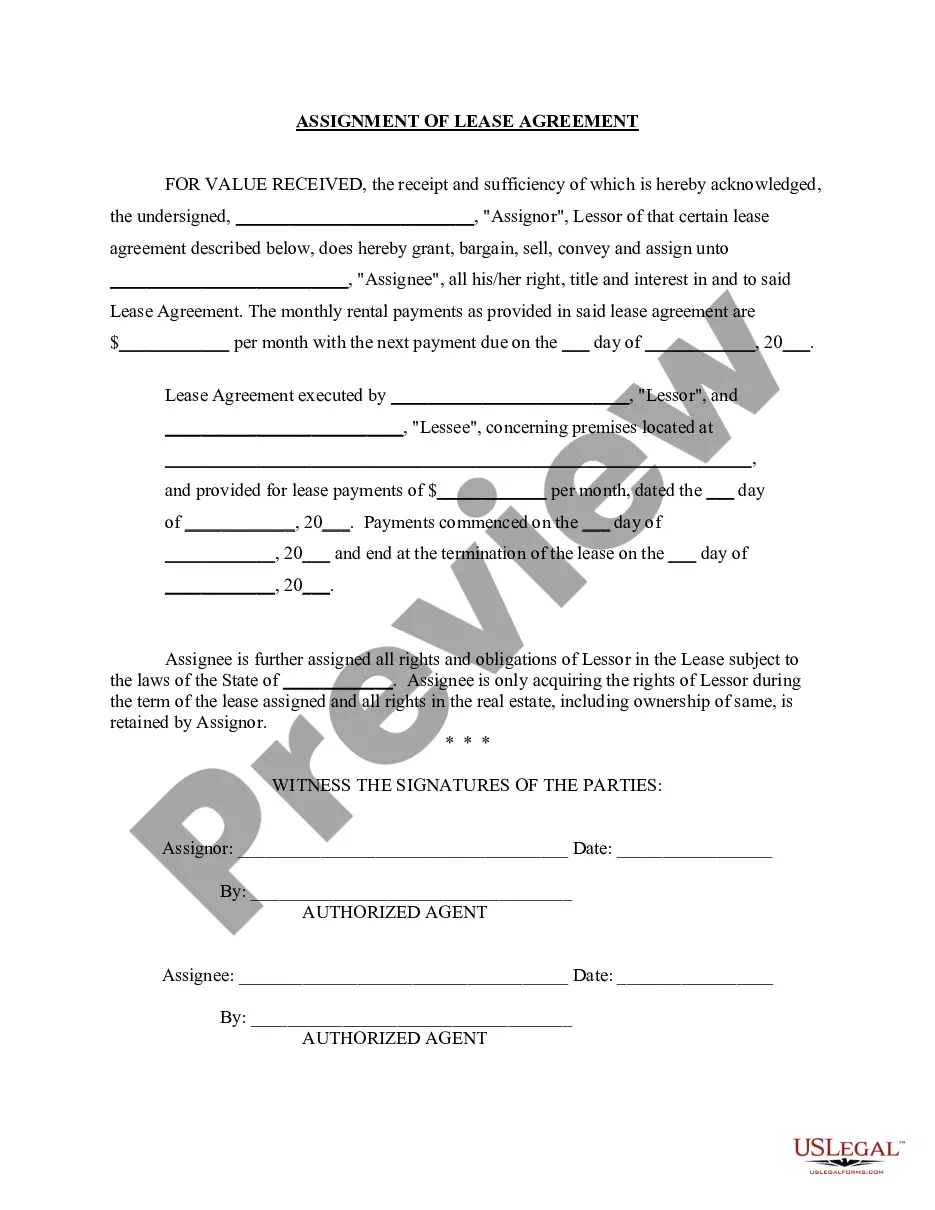

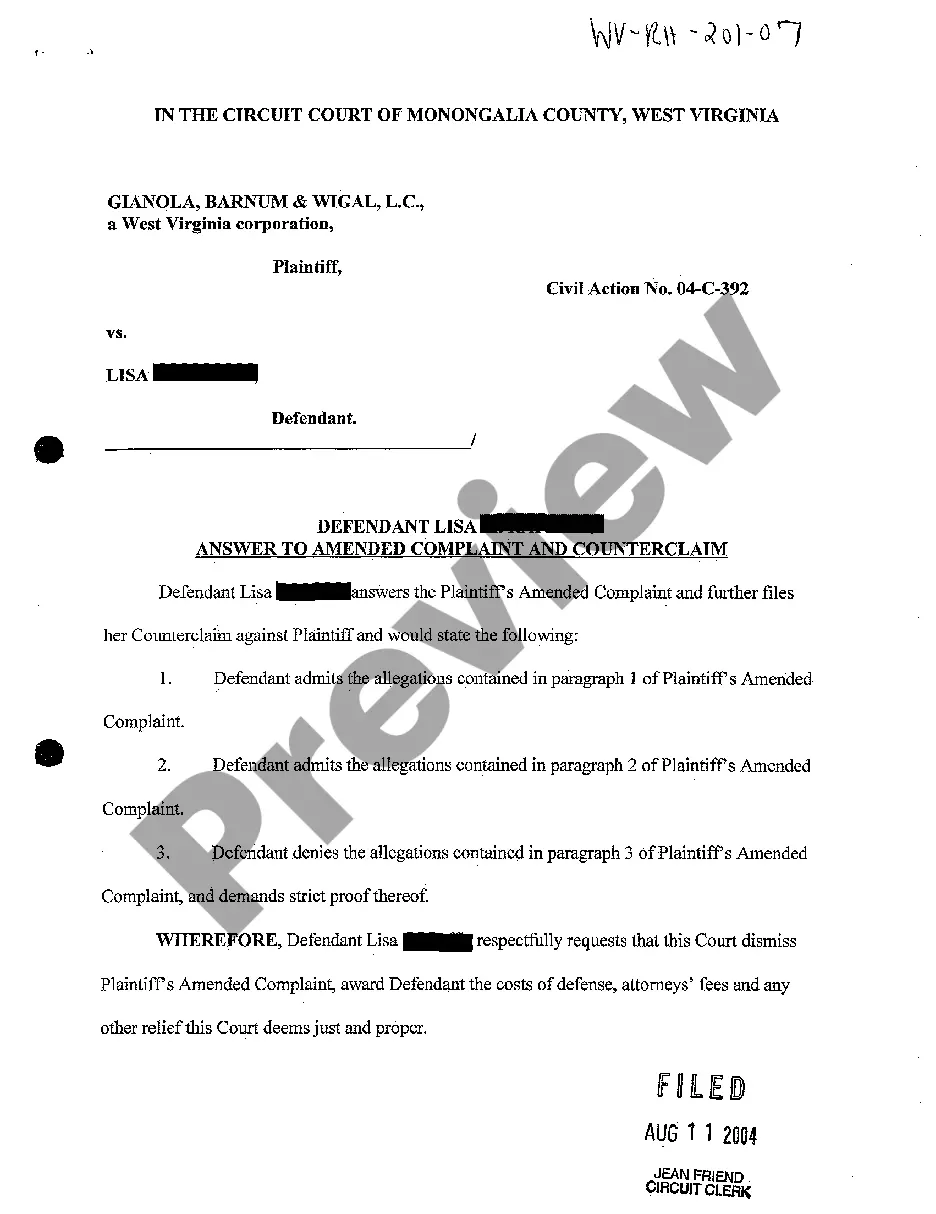

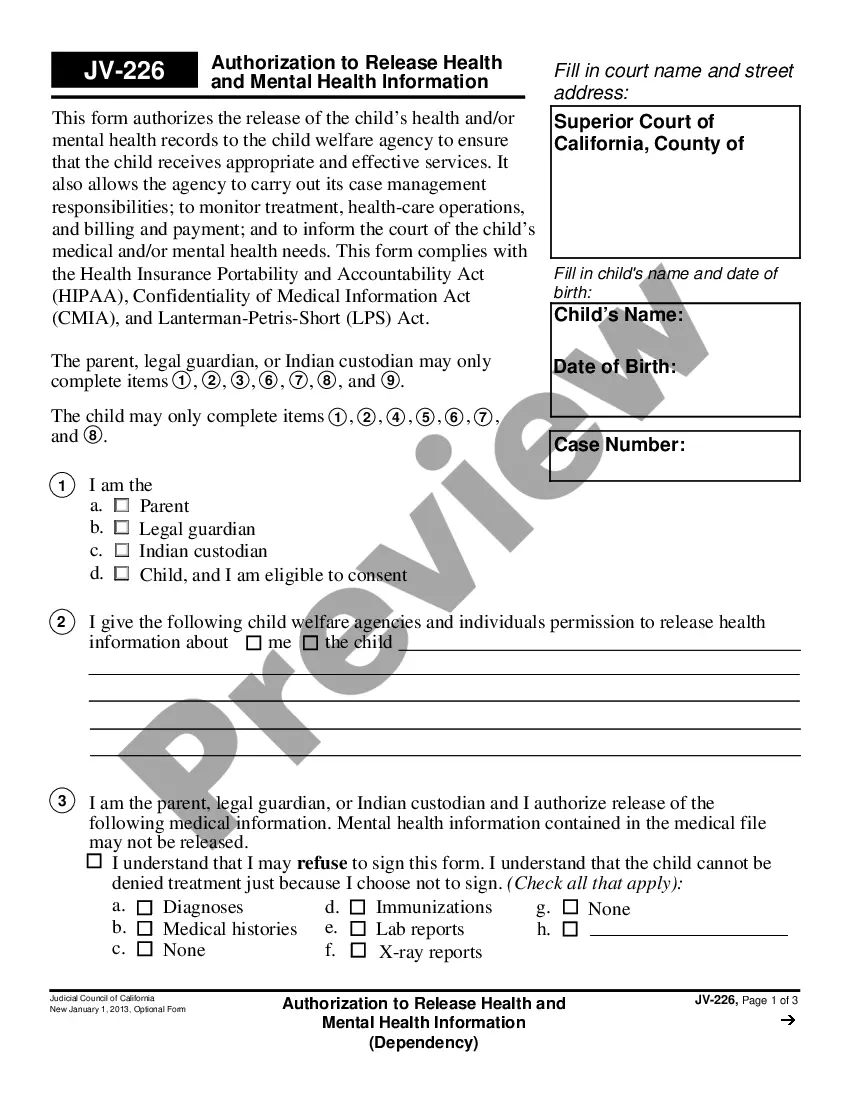

How to fill out Nassau New York Director Incentive Compensation Plan?

How much time does it normally take you to create a legal document? Since every state has its laws and regulations for every life scenario, locating a Nassau Director Incentive Compensation Plan meeting all local requirements can be stressful, and ordering it from a professional lawyer is often expensive. Numerous web services offer the most common state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive web collection of templates, grouped by states and areas of use. Aside from the Nassau Director Incentive Compensation Plan, here you can get any specific document to run your business or personal affairs, complying with your county requirements. Specialists check all samples for their validity, so you can be certain to prepare your documentation properly.

Using the service is remarkably straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the required sample, and download it. You can get the document in your profile at any moment later on. Otherwise, if you are new to the website, there will be some extra actions to complete before you obtain your Nassau Director Incentive Compensation Plan:

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Search for another document utilizing the related option in the header.

- Click Buy Now when you’re certain in the selected document.

- Choose the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Nassau Director Incentive Compensation Plan.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired document, you can locate all the samples you’ve ever saved in your profile by opening the My Forms tab. Give it a try!

Form popularity

FAQ

Directors Compensation means all or part of any board and committee retainer, and board and committee meeting fees payable to a Director in his or her capacity as a Director. Director's Compensation shall not include any expenses paid directly to the Director through reimbursement.

The director title usually refers to the first stage or lowest level in an executive team, though this may not always be the case. Some large businesses might have more than one level of director, such as having both an associate and senior director.

The average Sheriff/Police Chief salary in Nassau, NY is $124,778 as of , but the range typically falls between $117,813 and $132,358.

The average Director in the US makes $183,000. The average bonus for a Director is $38,000 which represents 21% of their salary, with 100% of people reporting that they receive a bonus each year.

What is a Good Bonus Percentage? A good bonus percentage for an office position is 10-20% of the base salary. Some Manager and Executive positions may offer a higher cash bonus, however this is less common.

Board members aren't paid by the hour. Instead, they receive a base retainer that averages around $25,000. On top of this, they also may be paid a fee for each annual board meeting and another fee for meeting by teleconference. At any given company, director pay may be set up differently.

A Director of Compensation and Benefits strategizes, plans, creates, and oversees every element of the organization's remuneration system. This includes the salary, bonuses, paid and sick leave, welfare benefits, and retirement plans.

As of , the average annual pay for a County Executive in New York is $82,489 a year. Just in case you need a simple salary calculator, that works out to be approximately $39.66 an hour. This is the equivalent of $1,586/week or $6,874/month.

The salary starts at $63,705 per year and goes up to $61,936 per year for the highest level of seniority.

Director and senior manager salaries vary by industry, your level of experience and the location in which you work. However, the average annual salary for directors is $84,937 per year . Senior managers earn an average annual salary of $119,020 per year .