San Bernardino California Proposed Stock Option and Award Plan of Fresco, Inc. is a comprehensive employee benefit scheme introduced by Fresco, Inc. in San Bernardino, California. This plan aims to reward and motivate employees by providing them with the opportunity to own company stock and participate in various performance-based awards. The San Bernardino California Proposed Stock Option and Award Plan features multiple types of stock options and awards, tailored to suit the needs of different employees. These options and awards are designed to align the interests of employees with the long-term growth and success of Fresco, Inc. One type of stock option available under this proposed plan is the Non-Qualified Stock Option (NO). This option grants employees the right to purchase a predetermined number of shares at a specified price within a defined timeframe. Nests can be exercised after a vesting period, typically based on the tenure of the employee. Another type of stock option offered is the Incentive Stock Option (ISO). SOS are subject to specific tax regulations and provide employees with advantageous tax treatment compared to Nests. They also require individuals to hold the option for a specific period before exercising it. This encourages long-term commitment and loyalty among employees. Additionally, the San Bernardino California Proposed Stock Option and Award Plan includes various performance-based awards, which are granted based on predetermined performance criteria. These awards motivate employees to achieve specific targets while contributing to the overall growth and success of the company. Performance Share Units (Plus) are one type of award granted to employees. These units represent the right to receive a specific number of shares in the future, contingent upon achieving predetermined milestones. The performance goals can be based on financial performance, operational targets, or other key performance indicators (KPIs) relevant to Fresco, Inc. Restricted Stock Units (RSS) are also part of this proposed plan. RSS grant employees the right to receive company shares after a vesting period, typically dependent on an employee's continued service or the achievement of performance conditions. By offering a diverse range of stock options and awards, the San Bernardino California Proposed Stock Option and Award Plan of Fresco, Inc. provides employees in the San Bernardino, California region with valuable incentives to contribute to the company's growth, long-term sustainability, and overall success.

San Bernardino California Proposed Stock Option and Award Plan of Amresco, Inc.

Description

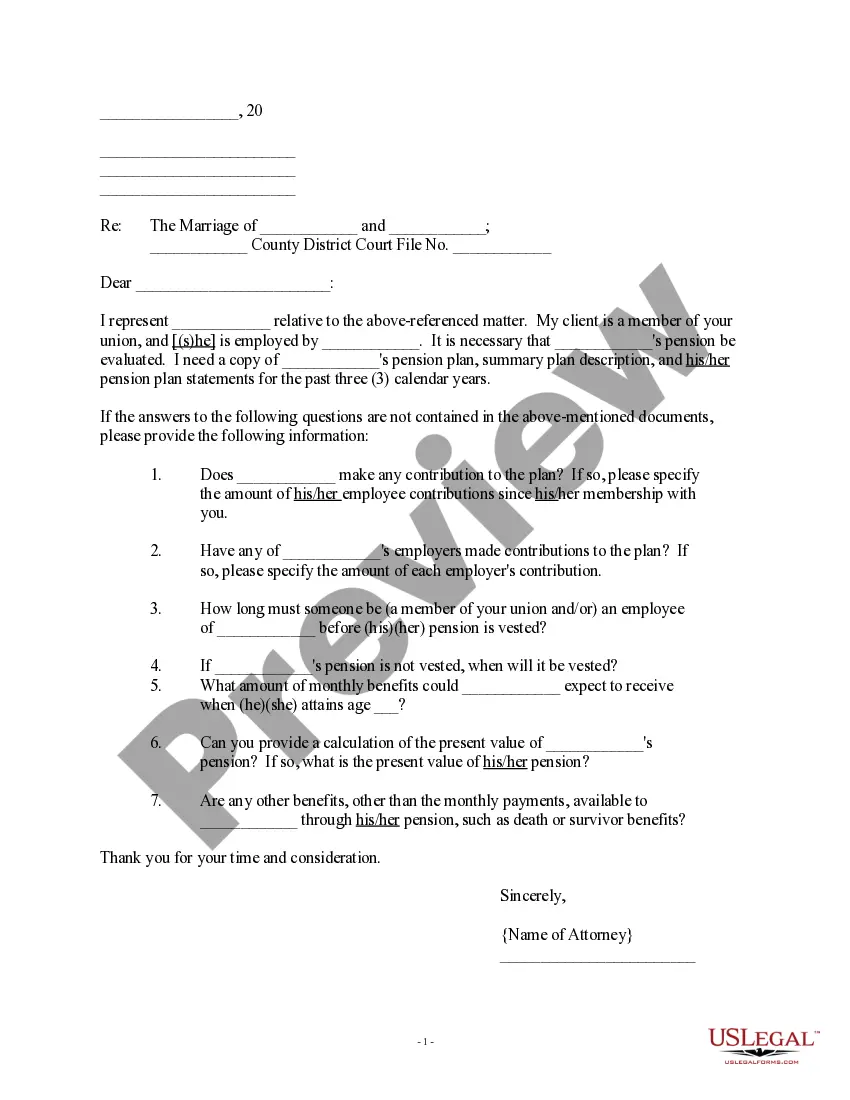

How to fill out San Bernardino California Proposed Stock Option And Award Plan Of Amresco, Inc.?

Laws and regulations in every area differ around the country. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal documents. To avoid costly legal assistance when preparing the San Bernardino Proposed Stock Option and Award Plan of Amresco, Inc., you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal forms. It's an excellent solution for professionals and individuals searching for do-it-yourself templates for various life and business occasions. All the forms can be used many times: once you pick a sample, it remains accessible in your profile for future use. Therefore, when you have an account with a valid subscription, you can just log in and re-download the San Bernardino Proposed Stock Option and Award Plan of Amresco, Inc. from the My Forms tab.

For new users, it's necessary to make a few more steps to get the San Bernardino Proposed Stock Option and Award Plan of Amresco, Inc.:

- Analyze the page content to ensure you found the right sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Use the Buy Now button to get the document when you find the appropriate one.

- Choose one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Complete and sign the document on paper after printing it or do it all electronically.

That's the easiest and most cost-effective way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your paperwork in order with the US Legal Forms!

Form popularity

FAQ

Restricted stock units are issued to employees through a vesting plan and distribution schedule after they achieve required performance milestones or upon remaining with their employer for a particular length of time. RSUs give employees interest in company stock but no tangible value until vesting is complete.

Stock options are only valuable if the market value of the stock is higher than the grant price at some point in the vesting period. Otherwise, you're paying more for the shares than you could in theory sell them for. RSUs, meanwhile, is pure gain, as you don't have to pay for them.

Restricted Stock Units Example Therefore, the company decides to offer him 600 restricted stock units as part of the company compensation, apart from giving him a substantial salary and other benefits. The shares of the company trade at a market price of $50 per share that makes 600 RSU worth more than $30,000.

You typically receive the shares after the vesting date. Only then do you have voting and dividend rights. Companies can and sometimes do pay dividend equivlent payouts for unvested RSUs.

Restricted stock units are a way an employer can grant company shares to employees. The grant is "restricted" because it is subject to a vesting schedule, which can be based on length of employment or on performance goals, and because it is governed by other limits on transfers or sales that your company can impose.

Each RSU will correspond to a certain number and value of employer stock. For example, suppose your RSU agreement states that one RSU corresponds to one share of company stock, which currently trades for $20 per share. If you're offered 100 RSUs, then your units are worth 100 shares of stock with a value of $2,000.

Options can be a better choice when you want to limit risk to a certain amount. Options can allow you to earn a stock-like return while investing less money, so they can be a way to limit your risk within certain bounds. Options can be a useful strategy when you're an advanced investor.

Options give management an incentive to take too much risk. Stock and stock options are also inefficient compensation because of their high discount rate. Employees undervalue stock and stock options because they are under- diversified. Employee capital gain, available on stock, is usually to be avoided.

If you believe in your company's future prospects, you may want to hold on to your options. If your company's share price rises, your options' worth will continue to grow while putting off any tax consequences. This optionality or flexibility for a longer time frame gives your options even more value.

An RSU is always worth something, unless the company goes bankrupt. An option is worth something only if the market price of the stock is above the strike price of your option. If Facebook is selling for, say, $100 but your stock option strike price is $101, your option is worthless, aka underwater.