Cook Illinois is a Stock Option and Award Plan offered by Fresco, Inc., a prominent company in the financial services sector. This plan is designed to incentivize and reward employees by providing them with the opportunity to purchase company stocks at a predetermined price, known as the stock option price. Fresco, Inc. offers various types of stock options and award plans under the Cook Illinois scheme. These types include: 1. Non-Qualified Stock Options: Non-qualified stock options are a popular type of compensation plan, commonly granted to employees. They allow the employees to purchase company stocks at a specific price, usually lower than the prevailing market price. The key advantage of non-qualified stock options is their flexibility, as they are not bound by strict rules and regulations. 2. Incentive Stock Options: Incentive stock options are typically granted to key employees or executives. These options come with specific tax advantages, as they are subject to favorable tax treatment under the Internal Revenue Code. Employees who exercise their incentive stock options may be eligible for long-term capital gains treatment on the appreciation of the stock value if certain holding period requirements are met. 3. Restricted Stock Units (RSS): Restricted Stock Units are an alternative to stock options. Rather than granting the option to purchase company stocks, RSS award employees with actual shares of stock, subject to certain vesting conditions. RSS often have a vesting period during which the employee must remain employed with the company to receive the shares outright. 4. Performance-Based Stock Awards: Performance-based stock awards are another type of stock option within the Cook Illinois plan. They are granted based on predetermined performance goals, such as revenue targets or stock price milestones. If the performance goals are met, employees can receive additional stock awards as a form of recognition and reward for their contribution to the company's success. Fresco, Inc.'s Cook Illinois Stock Option and Award Plan has been established to attract and retain top talent, motivate employees, align their interests with that of the company, and foster a sense of ownership. By providing employees with the opportunity to purchase company stocks or receive stock-based awards, the plan encourages long-term commitment and dedication towards achieving the company's goals.

Cook Illinois Stock Option and Award Plan of Amresco, Inc.

Description

How to fill out Cook Illinois Stock Option And Award Plan Of Amresco, Inc.?

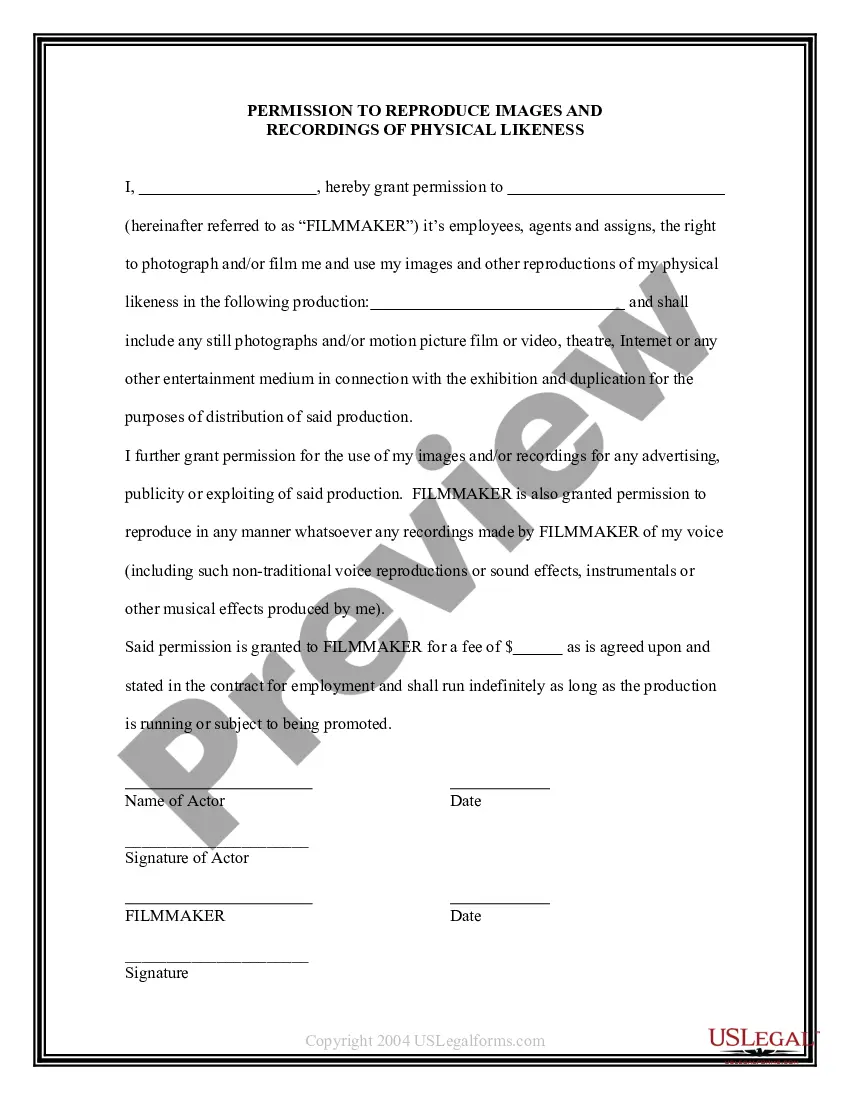

Creating paperwork, like Cook Stock Option and Award Plan of Amresco, Inc., to take care of your legal matters is a tough and time-consumming task. Many situations require an attorney’s involvement, which also makes this task not really affordable. However, you can consider your legal issues into your own hands and handle them yourself. US Legal Forms is here to save the day. Our website comes with over 85,000 legal documents created for a variety of scenarios and life situations. We make sure each document is compliant with the regulations of each state, so you don’t have to worry about potential legal problems associated with compliance.

If you're already familiar with our services and have a subscription with US, you know how straightforward it is to get the Cook Stock Option and Award Plan of Amresco, Inc. template. Go ahead and log in to your account, download the form, and personalize it to your requirements. Have you lost your document? No worries. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new customers is just as straightforward! Here’s what you need to do before downloading Cook Stock Option and Award Plan of Amresco, Inc.:

- Make sure that your template is specific to your state/county since the regulations for creating legal paperwork may vary from one state another.

- Discover more information about the form by previewing it or reading a brief description. If the Cook Stock Option and Award Plan of Amresco, Inc. isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Log in or create an account to start using our service and download the form.

- Everything looks good on your side? Hit the Buy now button and select the subscription option.

- Select the payment gateway and enter your payment details.

- Your form is good to go. You can go ahead and download it.

It’s easy to find and buy the appropriate template with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our rich collection. Subscribe to it now if you want to check what other perks you can get with US Legal Forms!