The Alameda California Stock Option and Incentive Plan of Church Companies, Inc., is a company-wide benefit program offered to employees that aim to promote employee retention, engagement, and shareholder value. This plan is specifically designed to attract and reward talented individuals in Alameda, California, who contribute to Church Companies' success. The Alameda California Stock Option and Incentive Plan offers eligible employees the opportunity to purchase company stock at a predetermined price, often known as the exercise price or strike price. The plan typically includes a vesting schedule, which stipulates the length of time an employee must remain with the company before gaining full ownership of the stock options. By granting employees stock options, Church Companies aims to align their interests with those of the shareholders, increasing motivation and fostering a sense of ownership among employees. This plan signifies the company's commitment to recognizing and rewarding the hard work and dedication exhibited by its workforce. In terms of different types of Alameda California Stock Option and Incentive Plans offered by Church Companies, Inc., there can be a variety of plans tailored to different employee groups or specific roles within the organization. For instance, the plan may have separate provisions for executives, managers, or employees at different levels. This differentiation may be done to align the benefits with the individual contributions, responsibilities, and goals of specific employee categories. These customized plans might feature unique vesting schedules, granting options at different times or with differing terms. Additionally, certain plans might include performance-based criteria, tying the stock options to the achievement of specific company performance goals. This design encourages employees to drive the company's success and performance, thus aligning their personal interests with the company's overall strategic objectives. In conclusion, the Alameda California Stock Option and Incentive Plan offered by Church Companies, Inc., provide an enticing employee benefit package that includes stock options. These options allow employees to purchase company stock at a predetermined price, motivating them to contribute their best efforts and aligning their interests with the company's long-term success. By tailoring the plan to specific employee groups and incorporating performance-based criteria, Church Companies ensures that the program is effective and relevant to individual needs and aspirations.

Alameda California Stock Option and Incentive Plan of Hurco Companies, Inc.

Description

How to fill out Alameda California Stock Option And Incentive Plan Of Hurco Companies, Inc.?

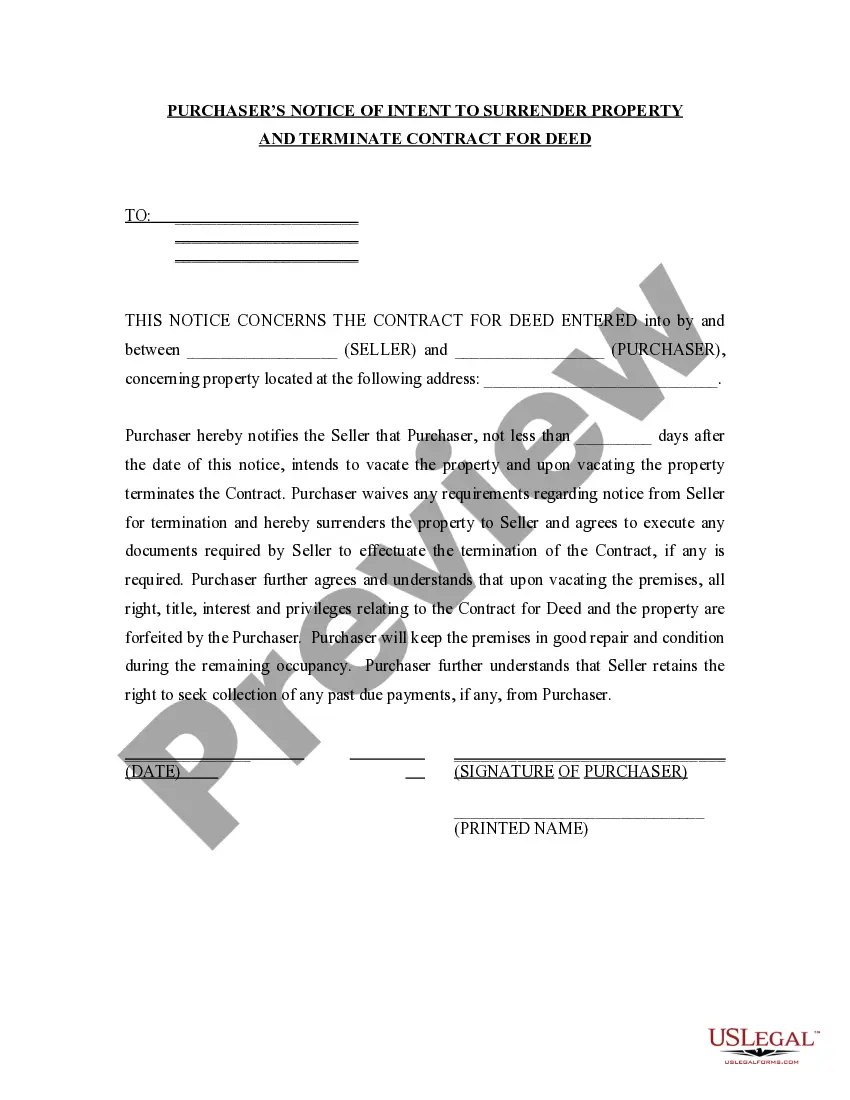

Are you looking to quickly create a legally-binding Alameda Stock Option and Incentive Plan of Hurco Companies, Inc. or maybe any other form to take control of your personal or business affairs? You can go with two options: contact a professional to draft a legal document for you or draft it entirely on your own. Luckily, there's another option - US Legal Forms. It will help you get neatly written legal papers without having to pay unreasonable fees for legal services.

US Legal Forms offers a huge catalog of more than 85,000 state-compliant form templates, including Alameda Stock Option and Incentive Plan of Hurco Companies, Inc. and form packages. We provide templates for a myriad of use cases: from divorce paperwork to real estate documents. We've been out there for more than 25 years and got a spotless reputation among our clients. Here's how you can become one of them and obtain the necessary template without extra troubles.

- To start with, carefully verify if the Alameda Stock Option and Incentive Plan of Hurco Companies, Inc. is tailored to your state's or county's regulations.

- In case the document has a desciption, make sure to verify what it's intended for.

- Start the search again if the template isn’t what you were looking for by utilizing the search bar in the header.

- Choose the subscription that best fits your needs and move forward to the payment.

- Select the format you would like to get your document in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, locate the Alameda Stock Option and Incentive Plan of Hurco Companies, Inc. template, and download it. To re-download the form, simply go to the My Forms tab.

It's stressless to buy and download legal forms if you use our catalog. In addition, the documents we provide are updated by industry experts, which gives you greater peace of mind when writing legal matters. Try US Legal Forms now and see for yourself!

Form popularity

FAQ

You will usually need to pay taxes when you exercise or sell stock options. What you pay will depend on what kind of options you have and how long you wait between exercising and selling.

On June 30, the SEC approved rules requiring shareholder approval of equity compensation plans, including stock option plans. The new rules will also require approval for repricings and material plan changes.

An ESOP will probably cost $80,000 to $250,000 to set up and run the first year and, for most companies with fewer than a few hundred employees, $20,000 to $30,000 annually.

An employee stock option is a plan that means you have the option to buy shares of the company's stock at a certain price for a given period of time. In doing so, it could increase how much money you bring in from your job.

Setting Up Your Employee Stock Option Plan Your company's mission and values should be a major factor in your stock option's plan design. Determine how much of the company you plan to share with early employees and employees that will join your company later. Regular stock grants are sold in shares of 100.

An employee stock option is a plan that means you have the option to buy shares of the company's stock at a certain price for a given period of time. In doing so, it could increase how much money you bring in from your job.

1: Setup Develop your philosophy. Your stock option plan is an expression of your company philosophy.Paper it. Adopt your stock plan and option agreements and get board and stockholder approval.Make it official. Work with your lawyers to obtain all relevant state permits for your option plan.

Options contracts usually represent 100 shares of the underlying security. The buyer pays a premium fee for each contract. 1 For example, if an option has a premium of 35 cents per contract, buying one option costs $35 ($0.35 x 100 = $35).

ESOPs are costly to set up ($80,000 to a few hundred thousand dollars), but less costly than the sale of the company to another buyer. Their ongoing costs are not a significant factor for the large majority of companies.