Clark Nevada Stock Option and Incentive Plan Overview: The Clark Nevada Stock Option and Incentive Plan is a program offered by Church Companies, Inc., a leading industrial technology company. This employee benefits initiative aims to reward and motivate employees by granting them stock options and incentives based on their performance and contributions to the company's growth. Keyword: Clark Nevada Stock Option and Incentive Plan Types of Clark Nevada Stock Option and Incentive Plans by Church Companies, Inc.: 1. Stock Option Plan: The Stock Option Plan allows eligible employees to purchase a specific number of company shares at a predetermined price, known as the exercise price. These options help align the interests of employees with shareholders and provide them with a potential financial gain if the company's stock value increases over time. 2. Incentive Plan: The Incentive Plan implemented by Church Companies, Inc. is designed to motivate and reward employees for achieving predetermined performance targets and goals. It may include various incentives such as cash bonuses, stock grants, performance-based awards, profit-sharing, and other valuable rewards, encouraging employees to excel in their roles and contribute to the company's success. 3. Performance-based Stock Option Plan: This type of stock option plan is specifically tied to the performance of the company, divisions, or individuals. It provides employees with the opportunity to obtain stock options based on their individual or team performance, improving their potential financial benefits as they contribute to the company's growth. 4. Executive Stock Option Plan: The Executive Stock Option Plan is designed exclusively for key executives within Church Companies, Inc. It provides them with additional incentives and benefits to align their interests with the long-term growth and success of the company. This plan often offers more significant stock options and rewards to top-level executives, reflecting their crucial roles in driving the company's strategic vision. 5. Restricted Stock Unit Plan: Church Companies, Inc. also offers a Restricted Stock Unit Plan as part of its Clark Nevada Stock Option and Incentive Plan. Under this plan, eligible employees receive a grant of company stock units as a reward for their performance and commitment to the organization. These units generally vest over a specific period, ensuring that employees stay with the company and contribute their expertise over the long term. 6. Employee Stock Purchase Plan: The Employee Stock Purchase Plan is an additional component of the Clark Nevada Stock Option and Incentive Plan. This plan permits eligible employees to purchase company shares at a discounted price, often through payroll deductions. It empowers employees to become shareholders, fostering a sense of ownership and pride in the company's success. In conclusion, the Clark Nevada Stock Option and Incentive Plan by Church Companies, Inc. offers various options and incentives to employees, including stock options, performance-based awards, and purchase plans. These plans aim to motivate employees, align their interests with shareholders, and foster a culture of performance and success within the company.

Clark Nevada Stock Option and Incentive Plan of Hurco Companies, Inc.

Description

How to fill out Clark Nevada Stock Option And Incentive Plan Of Hurco Companies, Inc.?

Laws and regulations in every sphere differ from state to state. If you're not an attorney, it's easy to get lost in countless norms when it comes to drafting legal documentation. To avoid pricey legal assistance when preparing the Clark Stock Option and Incentive Plan of Hurco Companies, Inc., you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal forms. It's a perfect solution for professionals and individuals looking for do-it-yourself templates for various life and business occasions. All the documents can be used multiple times: once you obtain a sample, it remains accessible in your profile for future use. Thus, when you have an account with a valid subscription, you can simply log in and re-download the Clark Stock Option and Incentive Plan of Hurco Companies, Inc. from the My Forms tab.

For new users, it's necessary to make a few more steps to get the Clark Stock Option and Incentive Plan of Hurco Companies, Inc.:

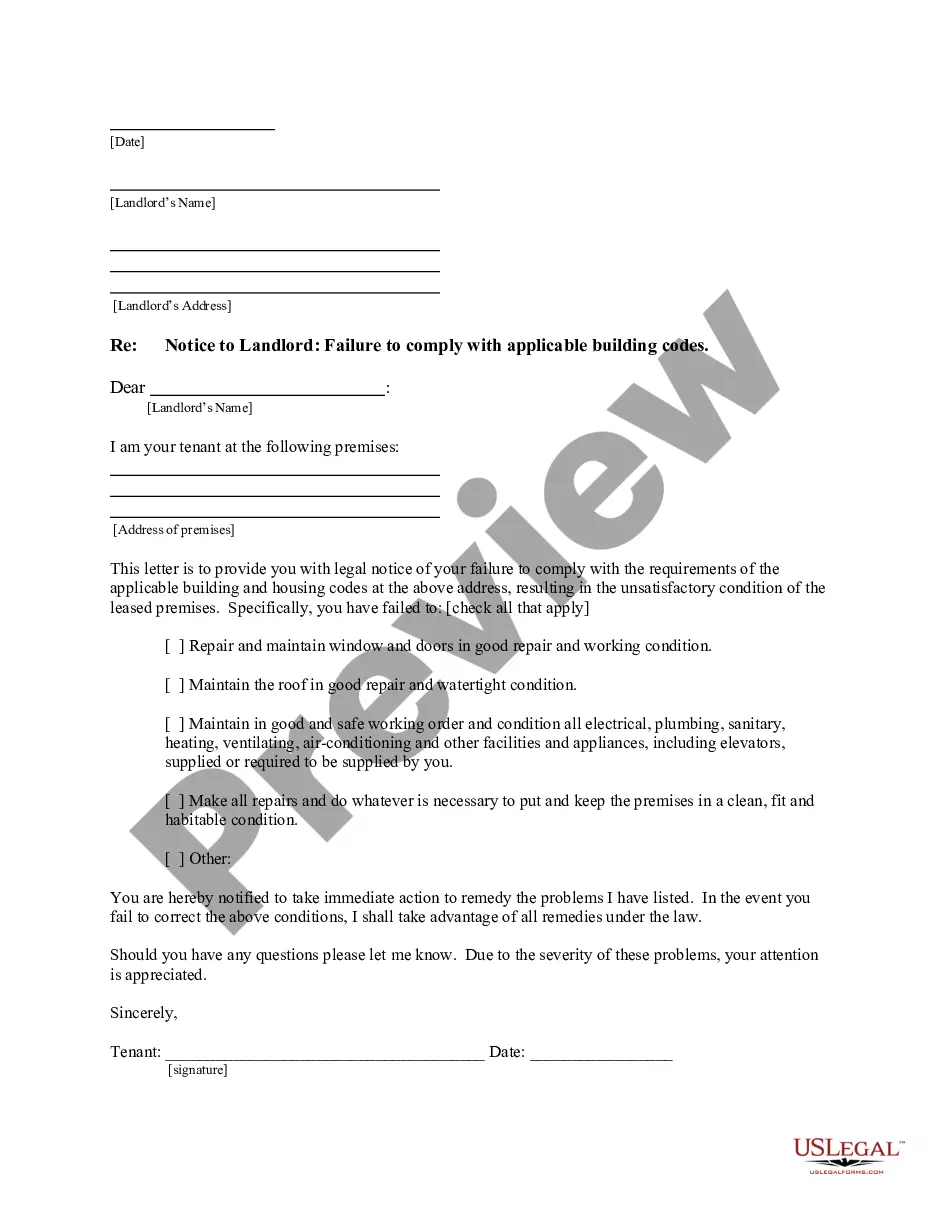

- Examine the page content to ensure you found the right sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to obtain the template once you find the correct one.

- Choose one of the subscription plans and log in or create an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Fill out and sign the template on paper after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!